MARA Holdings: Currently The Cheapest Bitcoin Miner, Huge Upside Ahead

Summary: Bitcoin miners like MARA are leveraging convertible bonds to increase BTC holdings, injecting stock volatility and...

News / Analytics / Reviews

Summary: Bitcoin miners like MARA are leveraging convertible bonds to increase BTC holdings, injecting stock volatility and...

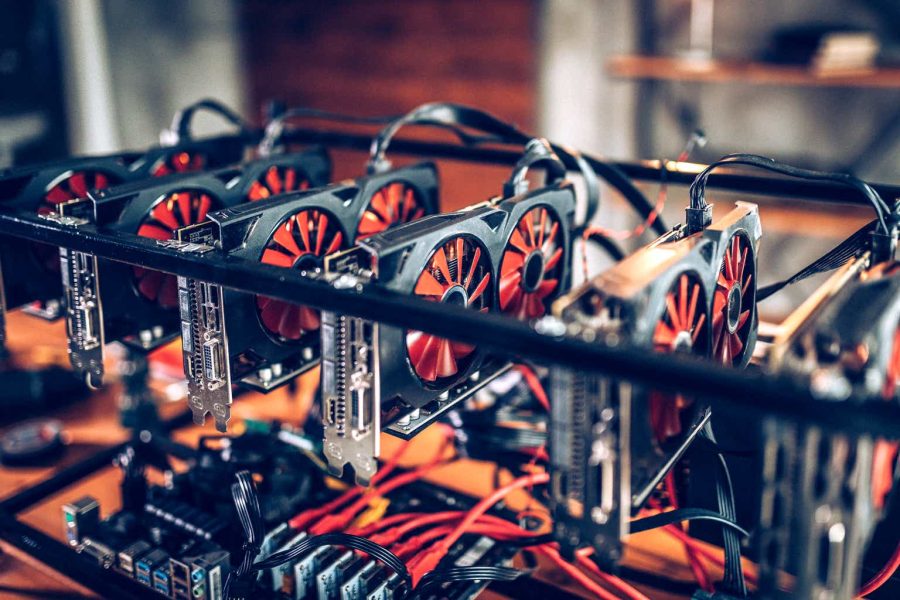

Summary: MARA Holdings leads in bitcoin mining and energy-efficient computing through advanced technologies and strategic...

Summary: MARA Holdings’ 1.5 GW capacity, with 65% owned, ensures unmatched cost control and scalability.Ohio data centers...

Summary: I support the CEO's decision to avoid independent AI/HPC hosting, reducing risks tied to low margins and rapid...

Summary: Marathon Digital's stock has been highly volatile but appears undervalued as it accumulates more Bitcoin and...

Summary: Despite previous skepticism, MARA Holdings' stock has held up well post-halving, prompting a reevaluation of its...

Summary: Marathon Digital's pivot to Kaspa mining has likely not yielded lasting profitability, as mining difficulty has...

Summary: MARA Holdings is diversifying beyond BTC mining, exploring data center cohosting, infrastructure integrations, and...

Summary: An ongoing mean reversion on Bitcoin miner valuations, potentially mispricing MARA based on a potential Bitcoin...

Summary: An ongoing mean reversion on Bitcoin miner valuations, potentially mispricing MARA based on a potential Bitcoin...