Summary:

- President Joe Biden pardoned all people with convictions for simple possession of marijuana. This is seen as a critical moment for the cannabis sector.

- There are rumors that this could potentially open up the door to the legalization of cannabis in the US.

- Meanwhile, Tilray reports lackluster fiscal Q1 2023 results, with a miss to both its top and bottom line.

- Also, Tilray increases its total number of shares by 17% y/y.

- With Tilray down nearly 60% in the past year, investors may be enticed to buy the dip.

LanaStock/iStock via Getty Images

Investment Thesis

Tilray Brands, Inc. (NASDAQ:TLRY) reported fiscal Q1 2023 results that missed on both its top line and bottom line. While at the same time, Tilray increased the total number of shares outstanding by 17% y/y. Is that key to this investment thesis?

No, I don’t believe it is. I believe that Tilray will over the coming few weeks be a story stock.

This stock is extremely speculative and investors getting involved here need to appropriately position Tilray to cause very little headache. Simply put, this stock should carry a label, investors be aware.

Recent Moves in Cannabis Sector

President Joe Biden pardons all people with convictions for simple possession of marijuana. This clearly has been seen by the investment community as a positive for cannabis stocks.

This is likely to see cannabis stocks getting downgraded from a Schedule 1 substance, and in the same category as LSD and heroin. This would potentially lead to a reduction in taxes that companies such as Tilray would have to pay, thereby dramatically improving the profitability of Tilray.

For many in the investment community, this move could perhaps be seen as the first step of many. Including the potential legalization of cannabis in the US.

Consequently, this would to a large extent disrupt the overall market and see legal cannabis as a competitor on both price and quality with illicit cannabis.

Next, let’s dig into Tilray’s fiscal Q1 2023 results.

TLRY Q1 2023 Results

Tilray’s net revenues were down 9% y/y. Does anyone care? I don’t believe so.

At this stage, investors are looking to seize upon any insights over which companies are going to have staying power and will be able to benefit from Biden’s administration’s likely pivot on its stance on cannabis.

For its part, Tilray holds roughly $640 million of debt on its balance sheet, which is offset by just under $500 million of cash and equivalents. Consequently, there’s roughly around $140 million of net debt.

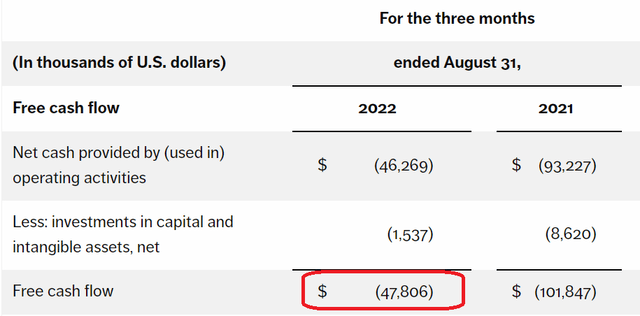

Given that Tilray’s free cash flow substantially improved y/y from negative $102 million to just negative $49 million, investors have a lot to cheer about this improvement in its free cash flow profile.

Not only does this reflect the improvement that Tilray has been attempting to make, to cut costs in its operations, but it also lends credence to its ambition of reaching positive free cash flow in its Operating Business Units by the time Tilray exits Q4 2023.

For their part, Tilray highlights for investors that this quarter marks its second-highest quarterly adjusted EBITDA figures. However, when we dig into its adjusted EBITDA figures, one figure stands out.

Tilray’s non-operating expenses figure of $33 million is a large add-back to its EBITDA. Tilray’s non-operating expenses are charges associated with its convertible debentures. As a reference point, this figure that is added back to Tilray’s EBITDA is approximately twice as big as the total EBITDA figure of $14 million reported in the quarter.

TLRY Stock Valuation — Very Difficult to Ascertain Fair Value

The one thing that has got investors positively interested in Tilray has been Biden’s pardoning yesterday. However, curiously, Tilray’s earnings statement does not contain one comment about this crucial turn of events.

For a stock that often appears to only move in one direction, and that is down, this absent commentary is interesting. Indeed, even putting aside the peak of 2018, just in the past year Tilray is down more than 60%.

And this inevitably forces the question, what’s the fair value for Tilray? Well, herein lies the difficulty. Investors are not holding their breath that Tilray will be able to positively impress them anytime soon.

On the other hand, as mentioned already, the stock is down so significantly, that it has been practically left for dead.

The Bottom Line

This stock is one for true speculators. For investors that know what they are getting themselves into. For example, back in fiscal Q1 2022, Tilray had approximately 433 million shares outstanding. Today, Tilray’s diluted shares have jumped to 506 million.

Consequently, we can see that Tilray isn’t shy about diluting its shareholders, with the total number of shares jumping 17% y/y, while revenues are down 9% y/y.

On the other side of the equation, there’s the argument that details don’t matter too much. As long as the ”story” is that Biden may open the door for the legalization of cannabis, that’s likely to put a floor on this stock. Clearly, this is an interesting turn of events.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.