Summary:

- Micron Technology is facing a deep crisis, losing over a billion dollars in free cash flow each quarter.

- The company’s revenue is expected to halve this year and take three years to recover.

- Valuation analysis indicates that the stock is overvalued, making it a “Sell” recommendation.

vzphotos

Investment thesis

Micron Technology (NASDAQ:MU) is in a deep crisis for external reasons. The company is losing more than a billion dollars in free cash flow every quarter in this fiscal year. MU faces harsh headwinds due to the end market weakness and geopolitical tensions between the U.S. and China. The company’s revenue is poised to half this year, and consensus estimates expect it will take the next three years to recover. At the same time, my valuation analysis indicates the stock is overvalued, meaning the market underestimates the depth of Micron’s crisis. To summarize, I believe the stock is a “Sell”.

Company information

Micron Technology provides memory solutions for computing, communications, consumer, and industrial applications and serves wireless and embedded applications.

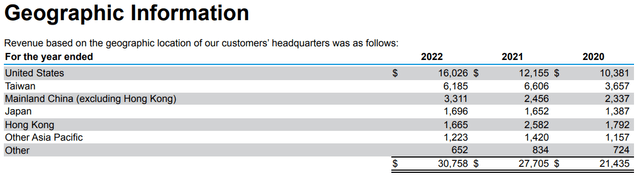

The company’s fiscal year ends on August 31. The business consists of four segments: Compute and Networking Business Unit [CNBU], Mobile Business Unit [MBU], Embedded Business Unit [EBU], and Storage Business Unit [SBU]. In FY 2022, the company generated about 72% of its revenue from DRAM technology. Micron generates a substantial part of its sales outside the U.S.

Financials

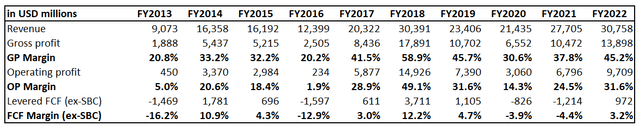

If we look at the company’s financial performance over the past decade, it seems stellar, with a 13% revenue CAGR and substantially improved profitability metrics. But if we look more carefully, we will see that the company’s best-ever fiscal year was five years ago, and since then, the financial performance has been volatile.

Micron’s revenue dropped sharply in 2019 due to the demand weakness and trade war pressures between the U.S. and China. That said, the company’s financial performance is significantly vulnerable to external factors, which is risky for investors. The rapid rebound to above $30 billion revenue might be a good sign, but I prefer looking deeper here. Despite the company’s revenue returning to FY 2018, profitability metrics narrowed notably. Substantial inflation in recent years is the reason for shrinking profitability ratios, meaning the company does not have much pricing power to adjust its pricing in line with cost increases.

Seeking Alpha

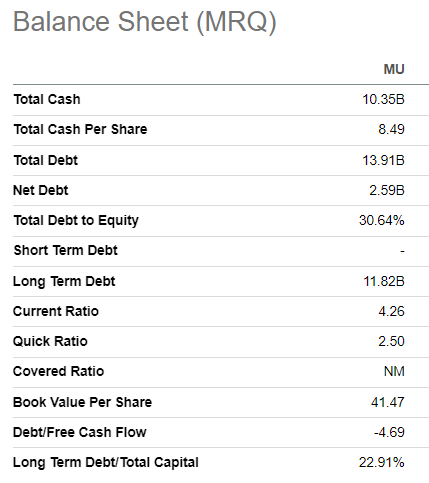

As of the latest reporting date, the company had a substantial $2.6 billion net debt position, though the overall leverage ratio looks low. I do not see a big risk in the company’s substantial net debt position since the major part of it is long-term. Liquidity metrics are robust as well. The strong balance sheet is vital for the company because it navigates through a harsh environment this year, which we see from quarterly earnings.

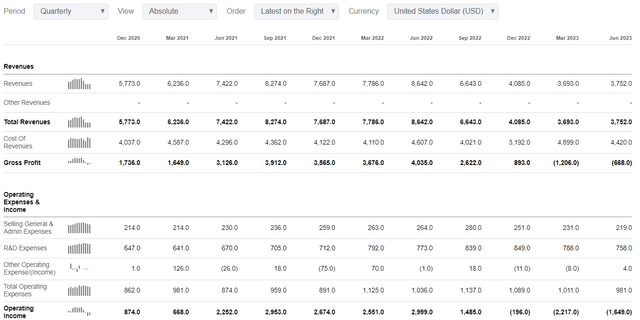

As you see, the company’s revenue has crashed this year, with about a 50% YoY decline in each quarter. The company faces a harsh environment caused by the end-market weakness and ongoing geopolitical tensions between the U.S. and China. Micron has been banned from selling memory chips to key domestic industries in China.

The latest quarterly earnings were released on June 28. The company demonstrated a 57% YoY revenue decline. That had a massive adverse effect on the company’s profitability. The gross and operating margins were negative, though they demonstrated improvement sequentially due to the management’s steps to cut costs. As a result of negative profitability metrics, the free cash flow [FCF] was minus one billion dollars.

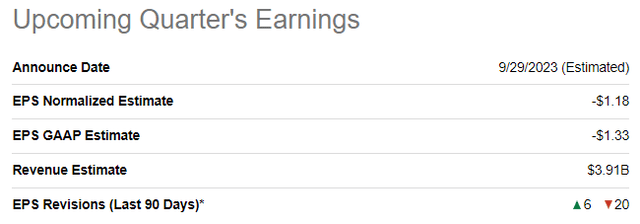

The upcoming quarter’s earnings are scheduled for release on September 29. Quarterly revenue is expected by consensus at $3.91 billion. This means another harsh quarter for MU, with a 58% YoY revenue drop. The adjusted EPS is expected to follow the topline and decline from $1.45 to -$1.18.

I think the company’s revenue will take multiple quarters to recover. The macro conditions are harsh in developed economies. The United States is in an environment with the highest interest rates since the beginning of this century, and credit crunch is looming. Leading European economies are steadily falling into recessions, and the biggest global geopolitical crisis since the Cuban Missile Crisis is still in place as well. All these factors are very unfavorable for Micron. The expected $15 billion revenue decline for the full fiscal year is a big crisis for the company and consensus estimates forecast the company’s revenue to recover to the $30 billion level only in FY 2026. In the current rapidly changing world, it means vast uncertainty regarding the actual timing of when the company’s financial performance will recover. Losing the next couple of years to struggle against the crisis also poses significant risks that the company might fail to be in line with the pace of technological advancements in the industry and fall behind the competition.

Valuation

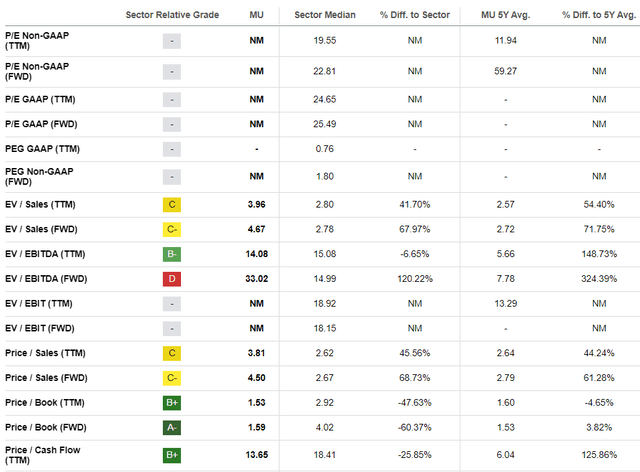

This year, the stock outperformed the broad market with a 29% year-to-date rally. Seeking Alpha Quant assigns the stock a low “D-” grade. Indeed, valuation ratios are mostly substantially higher than the sector median. A more warning sign to me is that current multiples of MU are also substantially higher than the company’s historical averages across the board.

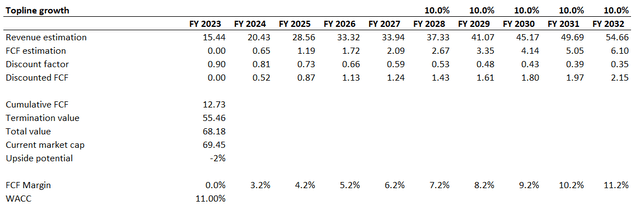

Now, let me move on to the discounted cash flow [DCF] simulation. I use an elevated 11% discount rate due to the inherent instability of the company’s financial performance in recent years. I have consensus revenue estimates up to FY 2027 and expect a 10% CAGR for the years beyond. I use zero for this fiscal year’s FCF margin due to harsh near-term headwinds. I expect the FCF to rebound next year to the FY2022 level and further expand by one percentage point yearly.

Based on the DCF, MU looks fairly valued, with the current market cap close to the cumulative discounted value of future cash flows. However, I would like to emphasize that MU is in a substantial $2.5 billion net debt position, meaning the stock is slightly overvalued.

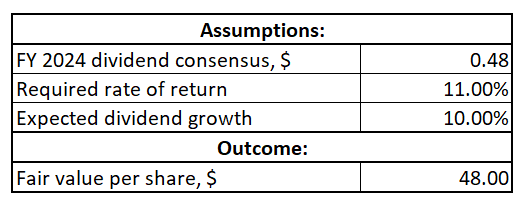

Micron pays dividends, and we can use the dividend discount model [DDM] as well to expand the valuation analysis. I use the same 11% discount rate for the DDM. Consensus dividend estimates forecast FY 2024 payout at $0.48. I use an optimistic 10% dividend CAGR.

Author’s calculations

According to DDM, with an optimistic dividend growth assumption, the stock’s fair price is $48. That said, the stock is substantially overvalued from the DDM perspective. All three valuation approaches suggest the MU stock is not attractively valued.

The major risk to my bearish thesis

The stock market has been very volatile and nervous since the beginning of 2022. We saw vast market overreactions to rumors indicating any potential good news for companies. For example, Micron might potentially be acquired by some of the big techs, and that will be a huge positive catalyst for the stock. Or, any slight indications of the improving relationships between China and the U.S. might also fuel a massive rally. That said, there is a substantial risk of good news, or even rumors, popping up suddenly for Micron.

Bottom line

To conclude, Micron’s stock is a “Sell”. My valuation analysis suggests that the stock is overvalued, especially given the depth of the crisis the company is experiencing. Headwinds are really harsh, and it will take multiple years for the company’s financial performance to recover. While struggling for survival Micron is likely to fall behind the pace of the rapidly evolving technological landscape.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.