Summary:

- Nvidia Corporation’s Q2 earnings results and guidance exceeded expectations, with sales up 101.6% and GAAP EPS up 854% YoY.

- The company has established a $25 billion buyback authorization, indicating confidence in its future growth and cash flow.

- Nvidia’s dominance in the AI chip market and potential for continued growth make it undervalued, with a fair value estimate of $510-$540 per share.

Ethan Miller

Last week, Nvidia Corporation (NASDAQ:NVDA) magically turned into one of the best values in the entire market.

It seems crazy to say that about a stock that has risen by nearly 250% on a year-to-date basis…but stick with me here; I promise I’ll provide a fundamental-based rationale for my NVDA bull case.

I say “magically” because frankly, the earnings results that they put up during the second quarter combined with their Q3 guidance is a thing of legend.

After NVDA’s first quarter results this year, I said it was the best quarter that I’ve ever seen and I doubted that I’d ever see another one like it.

Well, during Q2 Jen-Hsun Huang (Nvidia’s CEO) leaned back in that classic black leather motorcycle jacket and said, “Hold me beer.”

During the second quarter, NVDA’s sales came in at $13.5b, up 101.6%.

During Q1, their Q2 guidance of ~$11b in sales…those estimates blew analysts out of the water, and when the second quarter numbers were posted Nvidia, blew that prior guidance figure away.

During Q2, NVDA’ GAAP EPS was $2.48/share. That beat Wall Street’s estimate by $0.61/share.

And no wonder Wall Street was so wrong…that $2.48 GAAP number represented 854% growth on a y/y basis and 202% growth sequentially compared to Q1.

On a non-GAAP basis, NVDA’s EPS was $2.70, up 429% from the same quarter a year ago and up 148% sequentially.

Anyone predicting these types of results 3 months ago would have been called crazy, and yet, here we are today with NVDA printing cash.

They’re printing so much cash that they established a $25b buyback authorization.

Look, they’ve got to do something with these riches, right?

That’s not going to make a meaningful dent in the outstanding share count, but at the end of Q2 NVDA had just $1.2b of short-term debt and $8.5b of long-term debt on its books…compared to quarterly cash flow of $8.7b during the first half of 2023.

As a long-term shareholder, I’m not going to complain about management retiring shares…especially when I think they’re reasonably valued (more on this in a moment).

Before I talk about valuation, I want to shine a light of NVDA’s margin figures…which really hammer how this company’s dominance of the AI chip market.

During Q1, gross margins came in at 70.1% (on a GAAP basis).

That was up from 64.6% during Q1 and 43.5% during the second quarter one year ago.

On a non-GAAP basis gross margins were even higher, coming in 71.2%; up from 66.8% last quarter and 45.9% a year ago.

What’s even more fantastic for investors is the fact that NVDA expects to see its profit margins rise moving forward.

When providing Q3 guidance, they called for sales of ~$16b with gross margin arriving in a range of 71.5%-72.5%.

For comparison’s sake, during NVDA’s third quarter last year sales came in at $5.93b and non-GAAP gross margins were 56.1%.

I wouldn’t be surprised if NVDA beats expectations again during Q3…and ends up posting revenue that is 3x higher than it was a year ago.

It’s simply mind-boggling that this is a realistic possibility for this stock (or any stock, for that matter, with this sort of existing size/scale/and market share position).

Why do I think yet another big beat is possible?

Well, Nvidia is obviously selling these chips as fast as they can make them.

The world’s appetite for best-in-class AI chips is insatiable right now.

People are talking about a trillion-dollar sales opportunity in terms of the data center industry alone here…and NVDA is only a few quarters into the AI revolution.

And do you know what those margins tell me?

There’s little to no competition on the high-end of the AI/data center space right now and while I’m not an industry insider, from what I’ve read, this company is so far out in front of its peers right now, they’re likely to maintain this enormous market share (and reap the rewards of incredible margins) for years to come.

Honestly, if NVDA’s data center revenues alone come in above $80b next year I wouldn’t be surprised.

I think that segment of this business could justify the post-Q2 share prices (after the slight dip)… and that doesn’t even factor in areas like Gaming (which used to be NVDA’s crown jewel) and Automotive (which is also an area that benefits from secular tailwinds).

I know I sound overly enthusiastic here, but like I said, in my decade+ as an analyst, I’ve never seen quarters like these.

Unfortunately, I had a newsletter to finish up last week so I wasn’t able to start on this article right away.

It’s unfortunate because NVDA shares have been on a nice rally this week, up by more than 8% during the last 5 trading sessions.

Thankfully, our members got my real-time, post-earnings update on shares, but now that the newsletter has been published, I wanted to take the time to pen this piece because to me, NVDA continues to be one of the most misunderstood stocks in the entire market.

Although I didn’t have time to write a post-earnings report last week, I did purchase Nvidia shares as soon as they gave up their post-earnings gains because, to me, the stock was simply too cheap to ignore.

I added to my already overweight position at $459.13.

And I felt fine doing so because, at this point in time, I believe that NVDA is a must-own position for any long-term investor.

I’ve held NVDA shares for years. I began buying the stock back in 2017.

Here’s an article that I wrote on Seeking Alpha all those years ago introducing my original bullish thesis on the stock.

My cost basis on the original shares that I purchased is $27.64.

Since then I’ve added a few times at higher prices (including my most recent purchase) and today my cost basis sits at $54.97.

Throughout all of the volatility that this stock has experienced since I started buying, NVDA has always been a pretty easy long-term hold for me because of its leading position in so many high-growth areas of the chip space.

Huang is obviously a genius – the Wayne Gretzky of semiconductors, if you will – because under his leadership NVDA has consistently skated to where the puck is going, oftentimes taking first mover advantage, and establishing market-leading positions in the most envious areas of the tech space.

And with that in mind, I feel comfortable averaging up here.

Like I said, in the $460 area I viewed NVDA as a value stock, as crazy as that might sound.

Let me explain why.

There’s No Way That Nvidia is Only Worth $240/share

Before I get into my take on NVDA’s valuation, I want to touch upon some post-earnings commentary that I saw last week from “the Dean of Valuation” Aswath Damodaran.

In an interview with CNBC, Damodaran said that he thinks NVDA is worth $240.00/share.

In general, when Damodaran speaks, I listen.

Here’s the link if you want to dive into his rather bearish thesis.

Granted, after highlighting his $240 FV estimate, Damodaran also said that he’s holding onto his shares because there is a chance that Huang continues to thread the needle and grow his company at an extraordinarily rate.

I respect the man and I love his commentary of investor psychology, the importance of avoiding herd mentality, and his strict focus on underlying fundamentals.

But, that doesn’t mean that I agree with everything that comes out of his mouth.

I feel odd having a fair valuation that is so far off of Damodaran’s; however, I when I look at NVDA’s fundamentals I think shares are easily worth twice as much as he does.

And I don’t think I’m being outlandish here.

For what it’s worth, Wall Street agrees with this bullish sentiment; the high price target on Wall Street is $1,100.share, and according to Yahoo Finance, amongst the 44 analysts that follow NVDA shares, the average price target is $620.54.

I’m not quite that bullish…but looking at forward bottom-line expectations for Nvidia and the multiple that I’d be willing to pay for them, I think NVDA shares are worth $510-$540/share.

Breaking Down the Fundamentals

After its massive 2023 growth, NVDA shares are actually cheaper now (or at least they were a week or so ago) than they have been in quite some time (on a forward-looking basis).

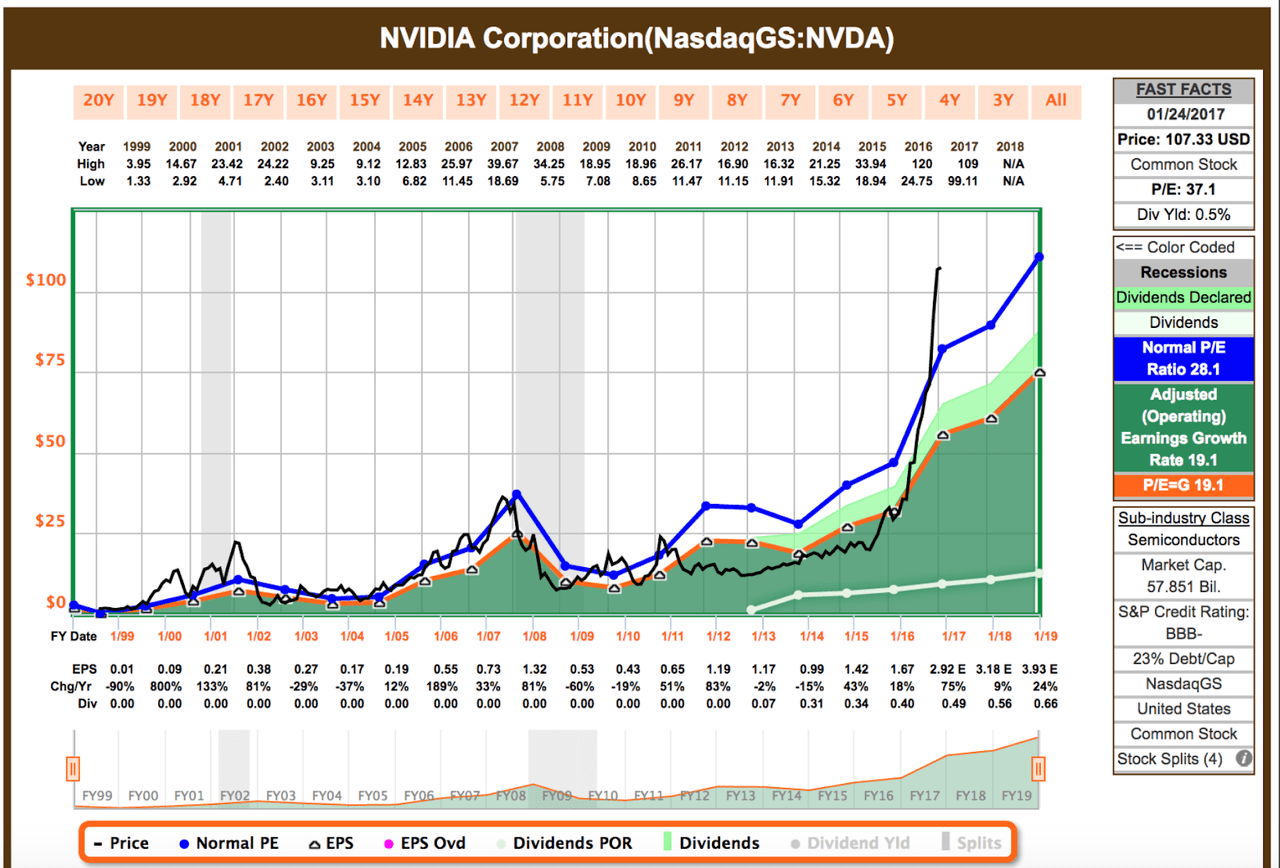

When I first wrote that article in 2017 about buying NVDA shares were trading for ~37x blended earnings.

Here’s the old FAST Graph from January 24, 2017 showing the stocks apparent “overvaluation.”

FAST Graphs (FAST Graphs )

Well, with the benefit of hindsight, shares were dirt cheap then (remember, NVDA had a 4-1 split in July of 2021 so that $107.33 price is really $26.83).

Shares are up nearly 1,700% since then.

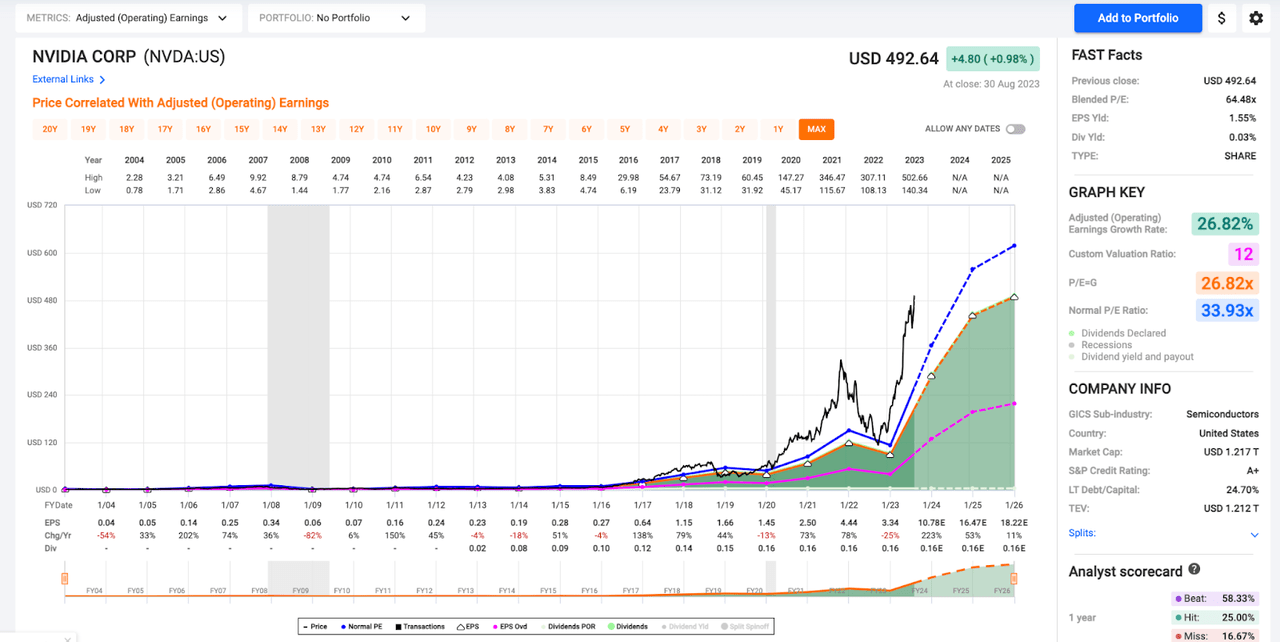

Today, NVDA trades with a blended P/E of ~65x. And if you look at the present-day FAST Graph, NVDA shares look just as expensive (if not more so).

FAST Graphs (FAST Graphs )

But…present day valuations here don’t matter when a stock is growing as rapidly as NVDA is.

These shares are (rightfully so) being priced based upon their future potential when it comes to cash flow generation.

When I bought shares at $459 last week, NVDA was trading for ~27.9x consensus earnings estimates for next year.

Using earnings estimates 2 years down the road, NVDA was trading for just 25x earnings.

How’d you like to buy shares of this company at 25x?

I think that’s the bargain of the year…and I’m more than happy to stick around for 2 years to see it through.

Looking at the current consensus estimates for 2023, 2024, and 2025, I think Wall Street is likely to be low (yet again).

NVDA has beaten the Street’s consensus quarter EPS estimate during 17 out of the last 20 quarters.

During Q2, analysts were way off…calling for EPS which ended up being 22.5% below the actual number.

Looking forward to the rest of 2023 and 2024, I wouldn’t be surprised to see NVDA post annual EPS of ~$11.50 and ~$17.00 and with that in mind, on a forward basis (looking at my 2024 EPS estimate) NVDA shares were trading with a 27x multiple when I added at $460.

That’s an incredibly cheap valuation for a company growing like NVDA is today.

What’s more, it’s well below the stock’s historic averages over the last 3, 5, 10, 15, and 20-year periods.

Looking at historical P/E ratios for Nvidia, we see:

- The 3-year average: 55.2x

- The 5-year average: 50.3x

- The 10-year average: 36.8x

- The 15-year average: 35.2x

- The 20-year average: 33.9x.

After posting its amazing Q2 results, the “P” in NVDA’s P/E ratio did not change.

Yet…the “E”…on a forward basis, shot up like a rocket.

When that occurred, NVDA shares suddenly became very cheap.

Getting back to Damodaran’s $240 fair value estimate…if consensus is right about next year’s EPS he’s talking about a ~14.6x forward multiple here.

If I’m right about next year’s EPS, we’re looking at a ~14x forward multiple.

With all due respect to the Dean of Valuation, there’s no way that NVDA shares should be trading with that sort of forward multiple attached – Intel (INTC) is currently trading for 20x consensus 2024 EPS estimates and there’s no way anyone is going to be to convince me that Intel is even in Nvidia’s league in terms of overall company quality and execution right now.

To me, NVDA’s forward looking growth prospects in 2023/2024 are just as strong (if not stronger) than they were at any point in time during the last 20 years and, therefore, the stock does not deserve to be trading at such a substantial discount to historical averages.

Sure, by using forward estimates to arrive at my ~27x multiple I’m required to have a bit of patience…but I have that in spades.

To me, this AI story is going to be the biggest growth phenomenon playing out in the tech sector over the next decade, and I’m sleeping well at night with a sizable position to the established leader (right now, NVDA is about the only company that I see that is showing the ability to actually monetize its AI products/services).

Like I told our members when I bought these shares, in 18-24 months, I think NVDA could easily be trading in the ~$600-$650 range.

And honestly, in a few years, I wouldn’t be surprised to see that some of the highest ($800-$1,100) price targets on the street end up being right.

Only time will tell. And I know…I know…NVDA looks expensive in the present. But, investors focusing on ttm or even blended multiples are missing the point here. But, over the long term, fundamentals dictate share price performance, and NVDA’s fundamentals are growing at an unprecedented rate for a company of this size.

Nvidia is growing at a triple-digit pace. That’s incredibly rare. And while that rate of growth isn’t sustainable for a very long period of time, the overall growth runway associated with the AI revolution remains incredibly long.

Every time I look at this company’s numbers, I find myself wanting to own more. With that in mind, if NVDA experiences any sort of significant dip from here, I’ll be a buyer once again.

Right now, this is my 5th largest equity position (behind Apple, Alphabet, Microsoft, and Broadcom). And although NVDA no longer pays a growing dividend, I’d feel comfortable taking my weighting up even higher…especially if I was able to buy shares in the sub-$450 area (well above Damodaran’s $240/share PT).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADC, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BMY, BN, BR, BTI, BX, CARR, CCI, CMCSA, CME, CMI, CNI, CPT, CRM, CSCO, CSL, DE, DEO, DHR, DIS, DLR, ECL, ENB, ESS, FRT, SPAXX, GOOGL, HD, HON, HRL, HSY, ICE, ITW, JNJ, KO, LHX, LMT, LOW, MA, MAA, MCD, MCO, MDT, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PFE, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, RY, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, WM, WPC, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.