Summary:

- The wireless carriers market is unattractive due to low profit margins and high capital expenditure.

- The race to develop 5G technology is intensifying competition among wireless carriers.

- Historical use of lead in telecom infrastructure has resurfaced as a potential hazard, with reports suggesting leakage into soil and water.

Justin Sullivan

Last April, AT&T (NYSE:T) CEO John Stankey grandly proclaimed that the wireless carrier is one of America’s top investors. Well, it’s not as we hadn’t noticed. Disappointing Free Cash Flow figures have sent the stock tumbling this year.

The advent of 5G and the ever-increasing demand for data sent companies racing to upgrade their infrastructure to remain relevant. However, there needs to be more clarity on how these carriers plan to monetize these hefty investments. Telecommunication service carries commodity-like characteristics, and the distinction in quality, especially between larger carriers like Verizon (NYSE:VZ) and AT&T, is narrow. These dynamics lead to price-based competition, thin margins, and an inability to capitalize on 5G trends. My service provider introduced 5G to my area a year and a half ago. I now pay less than on 4G.

Despite these challenges, many investors view VZ and T as solid investments. Operating within a triopoly market structure offers a unique advantage for investors: by diversifying their portfolio to include all three dominant carriers, investors can mitigate the risks associated with competition. If customers switch carriers, they likely join another you’ve invested in, minimizing potential fallout from competitive shifts. Additionally, the stability of revenue and attractive dividend yields further enhance the sector’s appeal.

Still, diversification doesn’t fix all problems. AT&T and VZ adopt different strategies and their financial performance is distinct. VZ has historically been better in execution and faster to adapt than AT&T, enjoying superior financial metrics compared to its peer.

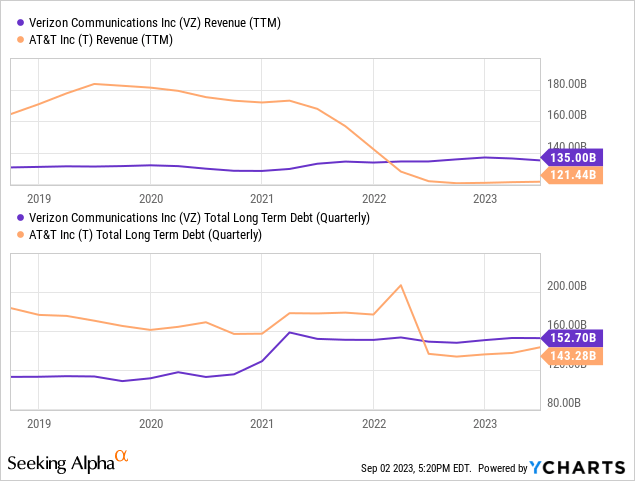

Debt

Companies often adopt different accounting methods to document their finances. Direct comparisons between two companies can only be accurate when accounting for these differences. At first glance, VZ’s interest expense seems much less than AT&T’s despite having slightly higher debt. However, closer examination reveals that both T and VZ capitalize some interest costs, particularly those tied to financing spectrum licenses. VZ capitalizes more of these interest expenses than AT&T, thus distorting the interest expense figures and, by extension, Interest Coverage and capital cost.

The first thing to do is to adjust for Capitalized Interest expense.

| Q2 2023 (Millions $) | AT&T | VZ |

| Interest | $1,608 | $1,285 |

| Capitalized Interest | $265 | $456 |

| Total Interest Expense | $1,873 | $1,741 |

When we account for Capitalized Interest, the disparity between the two companies narrows. While AT&T still pays slightly higher interest rates on a slightly lower debt, the difference is minor and can largely be attributed to its credit rating. VZ boasts a Baa1 rating, a notch higher than AT&T’s Baa2.

| Q2 2023 (Millions $) | AT&T | VZ |

| Total Interest Expense | $1,873 | $1,741 |

| Operating Income | $6,406 | $7,220 |

| Interest Coverage Ratio | 3.4x | 4.1x |

Given the table above, investors might lean towards VZ, which demonstrates a notably stronger interest coverage ratio, a critical metric for evaluating financial strength.

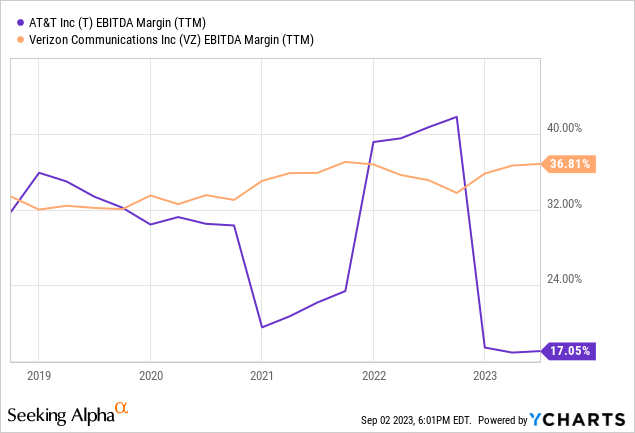

Restructuring

Over the last two years, both T and VZ have navigated major shifts, restructuring their portfolios in the face of substantial capital demands of 5G deployment. AT&T spun off WarnerMedia and divested 30% of DirectTV, while Verizon sold its media arm, including Yahoo and AOL. The two companies also continue to incur some costs related to the gradual shutdown of legacy network infrastructure, including 3G. Yet, VZ seems to have executed these changes more smoothly than T, a sentiment echoed by the comparative EBITDA margins below.

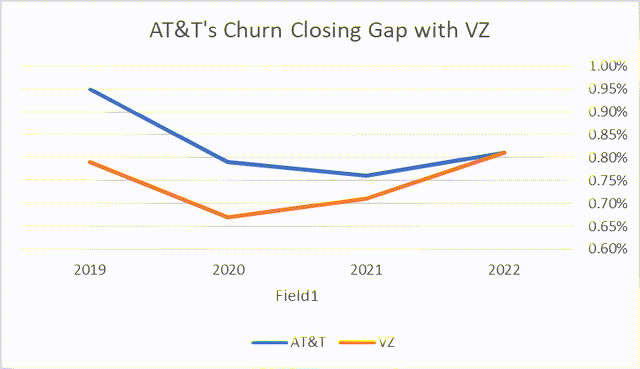

AT&T and VZ consistently register low churn rates, especially compared to T-Mobile (TMUS). Historically, VZ maintained a slight advantage in this realm. However, the gap has gradually diminished in recent years due to remarkable improvements taken by AT&T, and a minor decline of VZ’s side. This might explain why AT&T’s management is still holding to their jobs after disappointing financial results and disastrous stock performance while Verizon is undergoing a leadership transition.

SEC Filings

Cash Flows and CAPEX

VZ and AT&T diverge in their 5G deployment methods. VZ prioritized the high-band mmWave spectrum, providing high speeds but with a trade-off in range. To counter this limitation, VZ densely populated urban areas with cell sites. In contrast, AT&T pursued a diversified spectrum approach, balancing high-speed, short-range frequencies with slower, broader-coverage ones.

The FCC’s 2021 allocation of mid-band spectrum to the wireless sector brought significant cash inflows to the government but a significant expense for VZ and AT&T. VZ poured a record $45 billion into securing C-Band waves that balance speed and range. AT&T spent $23.5 billion in the same auction.

I believe that peak spending is behind us now. Both companies are exhausted, and shareholders are voting for higher FCF by their wallets. VZ is down 42% in the past three years, while AT&T is down 34%. VZ projects about $18.5 billion in capex spending this year, while AT&T expects a $24 billion outlay.

US rural migration is exposing the contrasting strategies of the two giants, which might explain AT&T’s higher capex requirements this year. AT&T leans on its fiber network, necessitating physical groundwork. VZ meanwhile banks on Fixed Wireless Access technology, a swifter, more flexible solution for remote regions.

Considering VZ’s upfront 5G investment and their less infrastructure-intensive rural strategy, they seem better positioned to streamline their balance sheet, putting it a step closer to the share repurchase plans they (and AT&T) are committed to.

Legal Challenges

AT&T and Verizon have deep histories rooted in the early days of the telecom sector. Historically, lead played a role in landline infrastructure, but its usage was discontinued decades ago due to associated health hazards. Recently, a WSJ report highlighted the existence of legacy cables leaking lead into the soil and water. In response, AT&T and VZ emphasized their commitment to adhering to standard protocols concerning these cables. However, there’s a notable lack of clear governmental guidance on this matter.

In the best-case scenario, compliance with these protocols will help VZ and AT&T in a criminal lawsuit brought by the government. Still it will not protect them in a tort lawsuit in a civil court by citizens claiming negligence. It is too early to assess the damage. The lead cables controversy will likely loom over the sector’s investment prospects for years to come as the case slowly works its way through the legal channels.

Summary

As the dust settles in the race for 5G dominance, both AT&T and Verizon have showcased their strategic strengths and weaknesses. While AT&T’s expansive investments and diversified spectrum approach underscore its commitment to a broader service, VZ’s focused strategy could be a strategic advantage as 5G applications grow. Both companies are wrestling with the challenge of monetizing massive investments in an environment of price-based competition. Yet, VZ’s superior financial metrics and strategic choices regarding rural coverage, 5G, and branding make it a better pick.

The lead cables controversy poses significant risks, casting a shadow over the sector’s investment outlook for the coming years. It’s too early to gauge the full impact on public health and finances.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.