Summary:

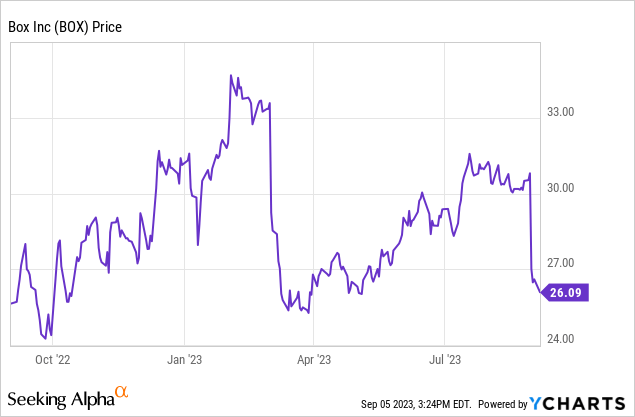

- Box stock slipped after Q2 earnings due to a cut in revenue expectations for this year, driving YTD losses to double digits.

- Despite the slight cut in growth, Box raised its pro forma EPS outlook and authorized an additional $100 million for its buyback program.

- Opex spend management and a margin-positive infrastructure shift to the public cloud have lifted Box’s operating margins to new highs and delivered double-digit profit gains.

- Box’s product portfolio expansion, multi-product strategy, founder-led management, enterprise focus, and growth plus profitability make it an attractive long-term investment.

tomeng/iStock Unreleased via Getty Images

It has been a difficult earnings quarter for most technology companies as they face weaker end-customer demand and slashed IT budgets. Added on top of that, growth stocks have had to contend with competition from rising interest rates, putting downward pressure on valuation. Amid this critical juncture in the markets, the key question investors should be asking is: What stocks should I be choosing for my equity portfolio now? While I am shrinking my stock allocation and increasing cash, within my equity positions, I’m rotating toward “growth at a valuable price” plays.

Enter Box, Inc. (NYSE:BOX), the cloud storage and collaboration company that has long been a value name in an expensive enterprise software sector. One of the few tech companies to be down this year (down roughly 15% YTD), and with losses picking up after the company’s recent Q2 earnings release, it’s a good time for investors to add this name to their portfolios or double down on an existing position.

FY24’s slight growth cut is offset by pro forma EPS boost and enlarged buyback plan

I was long on Box in the past and continue to be so, and I am happy to add to my position after the post-earnings fall.

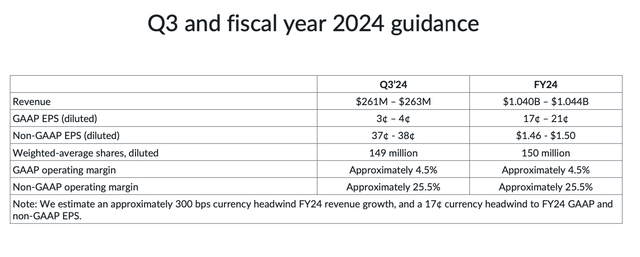

The cliff-notes version of why Box stock fell: The company saw both sharp deceleration in billings, driven by macro headwinds, and also slightly adjusted downward its revenue outlook for the year to $1.040-$1.044 billion, roughly $10 million lower (or 1 point of growth) for the full year.

Box outlook (Box Q2 shareholder deck)

I’m encouraged by the fact, however, that the company raised its pro forma EPS outlook to $1.46-$1.50 (from a prior view of $1.44-$1.50), indicating that, despite the minor revenue slowdown, the company is confident enough in its opex discipline to deliver an equivalent level of earnings.

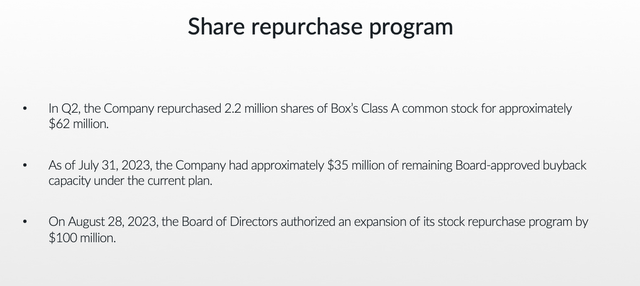

Adding on top of this, note as well that Box’s board authorized an additional $100 million for its buyback program, allowing Box to take advantage of lower share values. This updated authorization covers roughly 3% of Box’s current ~$4 billion market cap.

Box buyback plan (Box Q2 shareholder deck)

On top of this, I continue to believe in the core tenets of my bullish thesis for Box (for investors catching up, here it is below):

- Box’s product portfolio expansion has led to a $74 billion market. Despite competition, Box cites a massive $74 billion market across storage, content collaboration, and data security. That’s a big enough space for multiple incumbents and also suggests Box is only currently ~2% penetrated into this overall market. Recent portfolio additions like Box Sign have greatly expanded Box’s potential.

- Multi-product strategy is winning. More than two-thirds of Box’s new deal bookings come from Box Suites customers who are purchasing more than one Box product. Additions like Box Sign continue to pave the way for incremental revenue growth.

- Founder-led. Though many Silicon Valley startups have been passed over from their founders to professional CEOs, Box remains led by its co-founders Aaron Levie and Dylan Smith as CEO and CFO, respectively.

- Enterprise orientation. Of all of its well-known competitors, Box is the only company that is enterprise-focused. The company touts its security features plus advanced capabilities like Box Skills as key distinguishers versus the likes of Dropbox.

- Growth plus profitability in one package. Box touts “growth + FCF margin” as its key metric for balancing revenue and profitability, and this has marched steadily upward to 37% in FY23. Box hopes to hit 40-42% by FY25.

Stay long here and use the dip as a buying opportunity.

Q2 download

Let’s now go through Box’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

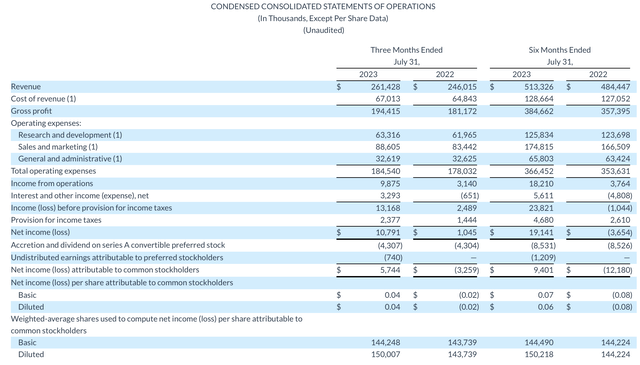

Box Q2 results (Box Q2 shareholder deck)

Box’s revenue grew 6% y/y to $261.4 million, essentially in line with Wall Street’s expectations of $261.3 million and holding pace versus last quarter’s 6% y/y growth rate. On a constant currency basis, meanwhile, revenue would have grown 9% y/y.

One of Box’s core challenges in the current environment is encouraging customers to expand. Expansion generally happens organically in a holistic platform like Box – as customers grow their headcount of Box users, so do their billings to Box, which prices on a per-seat basis.

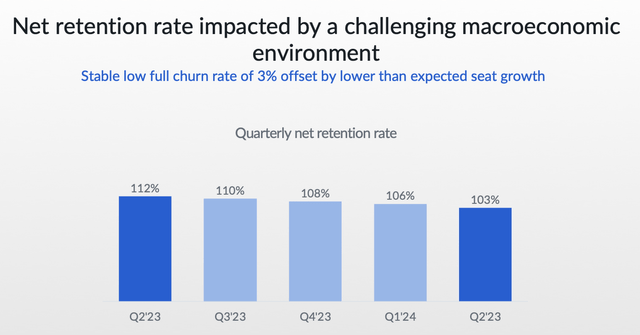

Box expansion trends (Box Q2 shareholder deck)

While Box reports that its churn rates have been stable at ~3%, more limited seat expansion (driven by the headline dynamics that are very prominent in today’s news: Company layoffs and slower hiring) has pushed down net retention rates to just 103%, three points lower than in Q1 and five points lower than in Q4.

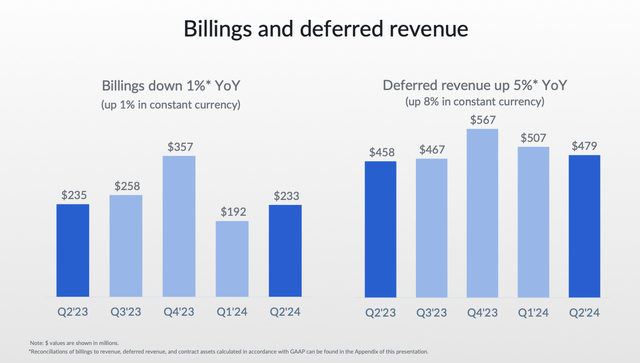

In turn, as well, billings declined -1% y/y in Q2 (+1% constant currency) versus 11% y/y growth in Q1.

Box billings (Box Q2 shareholder deck)

The company’s FY24 guidance reduction incorporates the more challenging seat expansion/billings dynamics in Q2 playing out through the remainder of the year. Per CFO Dylan Smith’s remarks on the Q2 earnings call:

However, in Q2, we continued to achieve year-over-year price per seat improvements driven by customers continuing to convert to Enterprise Plus. Additionally, our annualized full churn rate remains strong and stable at 3% demonstrating Box’ overall stickiness and criticality in our customers’ IT environments. We expect both our full churn rate and our net retention rate to remain roughly flat with our Q2 results throughout the back half of this year. As seat growth returns to more normalized levels, and as we continue driving pricing improvements, we’re confident that our best-in-class full churn rate and expanding our suite of innovative products will enable a higher net retention rate over time.

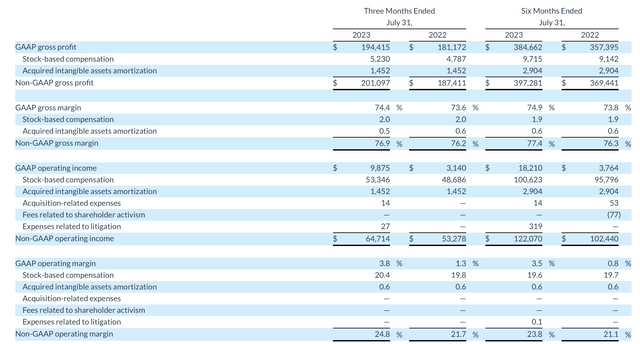

Box has been successful at offsetting slower topline dynamics, however, with strong earnings performance. Pro forma gross margin in Q2 rose 70bps to 76.9%, driven in large part by Box migrating its infrastructure to the public cloud – which will be fully complete in Q3. The company is confident that eliminating its own data center expenses will allow it to continue sequentially improving gross margins through the end of FY24.

Box pro forma margins (Box Q2 shareholder deck)

And as shown in the snapshot above, Box’s pro forma operating margins rose 310bps y/y to 24.8% (also a 200bps sequential improvement), driven by gross margin gains on top of operating leverage on the company’s sales and marketing expense. Pro forma EPS of $0.36 in the quarter also came in ahead of Wall Street’s $0.35 expectations.

Valuation and key takeaways

The core reason to invest in Box, of course, is that it’s cheap – and all of these fundamental risks of lower seat expansion and billings deceleration are more than well represented in its stock price. At current share prices just north of $26, Box trades at a $3.75 billion market cap. Netting off the $445.4 million of cash and $369.8 million of debt on Box’s most recent balance sheet gets us an enterprise value of $3.67 billion.

For next fiscal year, FY25, Wall Street analysts are expecting Box to generate $1.12 billion in revenue (+8% y/y) and $1.77 in pro forma EPS, which would represent 18% growth on the high end ($1.50) of Box’s guidance for this year. This puts the company’s valuation multiples at:

- 3.3x EV/FY25 revenue

- 14.7x FY25 P/E

I’m staying long here: There’s more than enough wiggle room on valuation, in my view, to incentivize me to hold on through several quarters of macro-related growth headwinds.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BOX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.