Boeing In Crisis: Possible DoJ Action, Airplane Deliveries Hit Low, And 777X Orders

Summary:

- Boeing is facing more pressure from the Department of Justice, an action which creates more uncertainty for the airplane manufacturer.

- Boeing’s airplane orders in April were weak, with only seven wide-body orders and 33 cancellations, reflecting the company’s ongoing crisis.

- Boeing’s airplane deliveries hit a low in April, with only 24 airplanes delivered, indicating the impact of the safety and quality crisis on the company’s operations.

Kristian1108

Boeing (NYSE:BA) is having a year that will go down in the history books, but not for the right reasons. Following the Alaska Airlines Boeing 737 MAX 9 accident, the company has significantly reduced production rates on the Boeing 737 MAX while supply chain issues forced a reduction on the Boeing 787 program. Whistleblowers have come forward with what they allege are potential manufacturing mishaps that could potentially compromise quality and safety. The Department of Justice has sent a letter to a judge alleging that Boeing potentially violated the terms of an earlier deferred prosecution agreement. In this report, we will briefly discuss the DoJ action as well as the orders and deliveries that Boeing booked in April, which also show the deep crisis that the company is in.

Boeing Is Back In DoJ Crosshairs

Boeing has news flow coming in almost every week or every other day, and most of the news is bad news. The latest on Boeing is the DoJ action. In 2021, Boeing reached a deferred prosecution agreement with the Department of Justice settling for a monetary amount of more than $2.5 billion. At the time, I analyzed the Boeing DPA and already concluded that the overall sum of $2.5 billion was a relatively low sum.

The Department of Justice did consider that Boeing implemented remedial measures:

- Creating a permanent aerospace safety committee of the Board of Directors to oversee Boeing’s policies and procedures governing safety and its interactions with the FAA and other government agencies and regulators;

- Creating a Product and Services Safety organization to strengthen and centralize the safety-related functions that were previously located across Boeing;

- Reorganizing Boeing’s engineering function to have all Boeing engineers, as well as Boeing’s Flight Technical Team, report through Boeing’s chief engineer rather than to the business units;

- Making structural changes to Boeing’s Flight Technical Team to increase the supervision, effectiveness, and professionalism of Boeing’s Flight Technical Pilots, including moving Boeing’s Flight Technical Team under the same organizational umbrella as Boeing’s Flight Test Team, and adopting new policies and procedures and conducting training to clarify expectations and requirements governing communications between Boeing’s Flight Technical Pilots and regulatory authorities, including specifically the FAA AEG. Boeing also made significant changes to its top leadership.

The Department of Justice has now determined that Boeing may have allegedly violated terms of the deferred prosecution agreement by failing to make promised changes. No later than the first week of July, the Department of Justice will tell the court whether it is going to move forward.

That’s a lot of uncertainty for Boeing, and Boeing is already facing an extremely uncertain year. Even if the DoJ decides to not prosecute, it remains to be seen whether the DPA remains in place. In the best-case scenario, which I deem unlikely, the DPA remains in place. In the worst-case scenario, the DPA no longer holds and that could lead to Boeing potentially being sued by family and heirs of the passengers on the fatal Boeing 737 MAX crashes, which could potentially result in hefty compensation.

It should, however, be noted that there’s no certainty that will occur. Boeing believes that it has not violated the terms of the deal made in 2021:

We believe that we have honored the terms of that agreement, and look forward to the opportunity to respond to the Department on this issue. As we do so, we will engage with the Department with the utmost transparency, as we have throughout the entire term of the agreement.

Boeing Airplane Orders: A Sobering Month

The Aerospace Forum

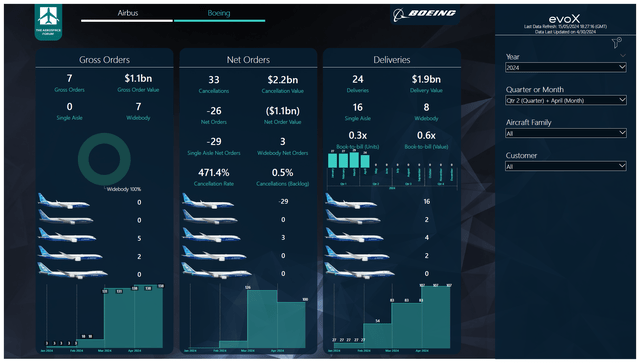

In April, Boeing booked orders for seven airplanes which were all wide bodies valued at $1.1 billion:

- El Al ordered three Boeing 787-9s

- Unidentified customers ordered two Boeing 777X airplanes and two Boeing 787-10s.

During the month, the following mutations were made to the order book:

- China Southern Airlines was identified as the customer for one Boeing 737 MAX and one Boeing 787-9.

- Air China and Shandong Airlines were identified as the customer for one Boeing 737 MAX each.

- All Nippon Airways (OTCPK:ALNPY) cancelled orders for two Boeing 777X and two Boeing 787-10s.

- Lynx Air cancelled orders for 29 Boeing 737 MAX airplanes.

During the month, Boeing received orders for seven airplanes while processing 33 cancellations, bringing the net orders for the month to -26 with a net order value of negative $1.1 billion. The absence of single aisle orders shows quite well that Boeing’s order pipeline is weakening amidst the fresh chapter of the crisis. I believe that no airline, at this point, would be extremely willing to sign up for airplanes that catch negative headlines as frequently as the MAX. Even more so, when they do not know when the airplanes they order will be delivered. All things considered, I don’t believe there’s a strong reason for airlines to be buying Boeing airplanes at this moment, and it would also be unwise for Boeing to announce a flurry of orders while it is facing public criticism on its quality and safety records.

In the same month last year, Boeing booked 34 gross orders, which is also not a huge number, but order inflow was almost equally divided between single aisle and wide body airplanes. There were 21 cancellations, bringing the net orders to 13 with a $2.3 billion net order value. So, we’re seeing lower orders, no single aisle orders and higher cancellations. It should be noted that the April 2024 net orders were affected by the Lynx Air cancellation. While the cancellation is for MAX airplanes, the reason for the cancellation is not the Boeing 737 MAX. Lynx Air ceased operations in February, and Boeing and Lynx Air agreed to terminate the order. At the same time, the orders from an unidentified customer for four airplanes can likely be attributed to All Nippon Airways, which cancelled airplane orders in the same amount. So, on net-basis that’s a neutral move.

Year-to-date numbers show that Boeing’s booked 138 gross orders valued at $12.1 billion and 38 cancellations, bringing the net orders to 100 airplanes valued at $9.4 billion. In the same period last year, there were 154 gross orders and 69 net orders after cancellations, valued at $8.7 billion. While month-over-month we see some indicators of weakness, the year-to-date numbers are down on gross order totals but up on net order and net order value.

ASC 606 adjustments which tally orders for which a purchase agreement exists, but other criteria to count the orders to the backlog not met declined by 29 units. This likely is driven by the cancellation of the Lynx Air order, for which Boeing likely already had indicated the additional criteria were not met. As the order was indeed cancelled, it reduced the adjustments by 29 units while one order was placed in the tally during the month for a net reduction of 28 units to the tally. Currently, up to 9% of the backlog does not meet the additional criteria and could be up for cancellation if the additional criteria are not met.

Boeing 777X Sales Are Picking Up

Boeing

The order for the Boeing 777X that Boeing logged in April was likely more of a housekeeping mutation. However, so far this year, we have seen some positive order inflow for the Boeing 777X with total gross orders of 28 units and 116 orders last year. So, while the Boeing 777X has an uncertain certification timeline, we do see that airlines, mostly those in the Middle East, are still committed to the Boeing 777X and are even ordering more airplanes. At the same time, airline executives appear frustrated with the ongoing delays and the uncertain timeline. While I don’t believe the Boeing 777X will be a huge sales or financial success for Boeing, it’s good to see that airlines are still ordering the airplane.

Boeing Airplane Deliveries Hit A Low

Boeing

While Boeing does not have much to celebrate, especially not in terms of deliveries, it has recently delivered the 1,500th Boeing 737 MAX airplane to its customer Ryanair (RYAAY). The figures for April, however, show how deep the impact of the current crisis is on Boeing’s delivery levels. During the month, the plane maker delivered 24 airplanes valued at $1.9 billion. Deliveries hit the lowest level since February 2022 when it delivered 22 airplanes.

The deliveries were as follows:

- There were 16 Boeing 737 MAX deliveries.

- Boeing delivered two Boeing 767-300Fs to UPS (UPS).

- Boeing delivered two Boeing 777Fs, one to EVA Air and one to Qatar Airways.

- Boeing delivered four Boeing 787 airplanes, consisting of two -9s and two -10s.

Year-on-year, deliveries decreased by two units, while the delivery value declined by $300 million. The reduction is not huge, but we should also take into account that Boeing should have been delivering at least 50 airplanes if it were able to stick to its initial production and delivery plans. So, what we’re seeing is the major impact the current safety and quality crisis has on Boeing’s deliveries, and that is going to translate to lower cash flow performance.

Whereas, we were seeing book-to-bill ratios above one which indicated strong demand but also the jet maker’s inability to increase its production levels to desired rates, April saw a book-to-bill ratio of 0.3x in terms of units and 0.6x in terms of value. So, the book-to-bill ratio also reflects the crisis. For the first four months, we still see those ratios at 1.3x and 1.6x, but it remains to be seen whether Boeing can maintain that.

Boeing CEO Resigns, But What’s Next?

Boeing is facing challenges on all most every level. Its operations are not smooth, nor are its financials, while Boeing reportedly intends to buy Spirit AeroSystems (SPR). Cash flows are falling short of initial expectations and the debt pile remains sky high. The problems don’t end there for Boeing, as the certification timeline for its in-development airplanes are unknown and Boeing has to select a new CEO in the next six months. In the aftermath of the Boeing 737 MAX 9 accident, Boeing saw some executives and board members resign and one of them is David Calhoun. He will be Boeing’s CEO until the end of the year, meaning that Boeing is also in the process of selecting a new CEO. It shows a company that’s unstable on almost every level, while the challenges for the company are growing by the day. I recently discussed what’s next for Boeing together with some fellow Seeking Alpha contributors in a special roundtable edition, and one thing is clear. The next CEO should be able to manage the integration of Spirit AeroSystems, put in place a robust safety and quality management system while increasing production rates in line with demand and work on making Boeing’s commercial airplanes’ product line more competitive.

Conclusion: Boeing Has A Lot To Deal With

It would be an understatement to say that there’s a lot going on at Boeing. We see challenges on many aspects of the business, and we even see the erosion in orders and deliveries. On a year-to-date basis, Boeing is not doing badly, but one can wonder whether it can capture any momentum in the remainder of the year. While this does not sound as an appealing stock to own, I do believe that eventually Boeing will get on top of things, which will unlock significant upside for the stock. Whether Boeing achieves its mid-decade targets is not of interest to me, I rather have the company miss or remove those targets and execute its business and practices in a way that make investors think in 5-10 years from now that Boeing is making great planes again, and they regret not buying any more stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.