Summary:

- Tilray’s acquisition of beverage and beer brands from Anheuser-Busch and Molson Coors solidifies its leadership in the cannabis industry.

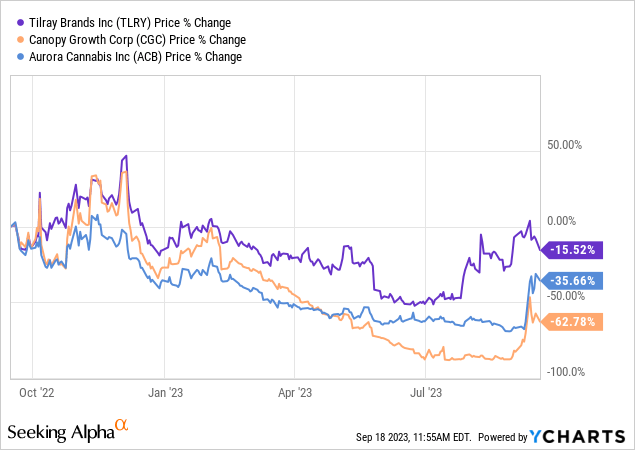

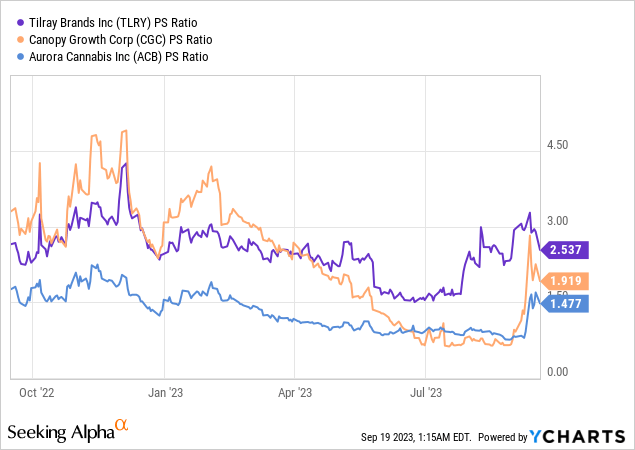

- Despite the struggling cannabis industry, Tilray has only experienced a 16% decline compared to its peers’ larger declines.

- Tilray’s focus on its beverage business is expected to overtake its revenue from cannabis, distribution, and wellness segments.

digidreamgrafix/iStock via Getty Images

Tilray (NASDAQ:TLRY) has always tried to stand out from its cannabis peers and its acquisition of a basket of beverage and beer brands from Anheuser-Busch (BUD) and Molson Coors Beverage (TAP) is its greatest move yet to further cement its distinction and leadership over its North American cannabis peers. The stakes are high with Canopy Growth (CGC) and Aurora Cannabis (ACB), the previous stalwarts, both facing material financial difficulty as the current global interest rate macro backdrop catalyzes a dearth of liquidity. That Tilray has been able to execute these buyouts for its beverages’ portfolio against a bleak capital backdrop for cannabis companies can be interpreted as a sign of its more astute management and a balance sheet somewhat flush with cash.

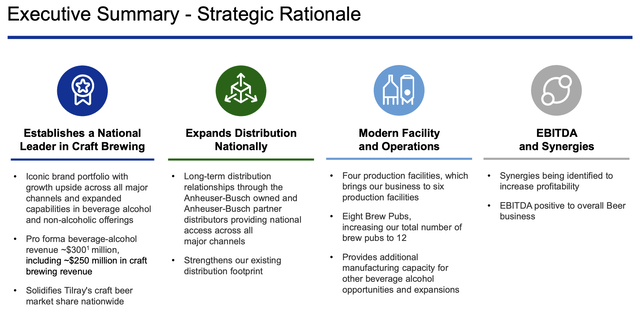

The industry is hurting but Tilray is only down by 16% versus a 36% decline for Aurora and an even larger 63% pullback for Canopy Growth over the last year. Critically, this outperformance is not by chance or by misplaced investor euphoria. Tilray’s growing beverages portfolio came backstopped with cash and equivalents of $448.5 million as of the end of its recently reported fiscal 2023 fourth quarter which ended May 31, 2023. Whilst the terms of the acquisition were not fully disclosed, Tilray will be acquiring eight beer brands from Anheuser-Busch including Breckenridge Brewery and Blue Point Brewing Company. These will in aggregate see its beer business triple in size from 4 million cases per year to 12 million cases.

On Becoming A Beverage Company

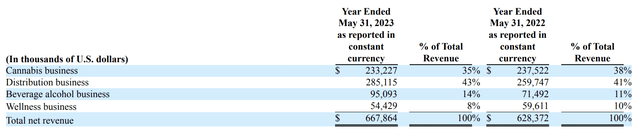

Tilray’s total revenue as of the end of its fourth quarter came in at $667.86 million of which around $95 million, or around 14% was formed from its alcoholic beverage business. This was up from $71.49 million, or around 11% of total revenue as of the end of the year-ago period. Bears would be right to flag that the 300 basis points year-over-year expansion seems broadly immaterial for a unit that has attracted so much enthusiasm from investors. However, the beverage segment generated the most growth for the company’s fourth quarter at 43% year-over-year with Tilray also stating pro forma revenue of around $300 million from its US beverage portfolio with the addition of the Anheuser-Busch beer brands.

Tilray Brands August 2023 Presentation

This is entirely transformative with beverage sales set to overtake their revenue from their cannabis, distribution, and wellness segments. To be clear, Tilray on a technicality is set to be a beverage alcohol company with a cannabis segment rather than a cannabis company with a beverage alcohol business. Whilst the combined revenue from cannabis, distribution, and wellness will still be in excess of beverages, the fast-growing unit is set to be immediately accretive to EBITDA. Tilray has followed up on the Anheuser-Busch acquisition with the buyout of the remaining 57.5% equity ownership of Truss Beverage, a cannabis-infused beverage company, from Molson Coors that it doesn’t own.

I flagged in an article in December last year that the growth of Tilray’s beverage brands will likely become the main driver of its stock returns in the years ahead on the back of tepid progress being made with US cannabis legalization and a brutally Darwinistic Canadian cannabis market. This still holds true with the bulk of this industry still reporting heavy losses and cash burn on the back of Canada’s high Cannabis tax burden and onerous regulation around the marketing and sales of cannabis.

Inverting Structural Unprofitability

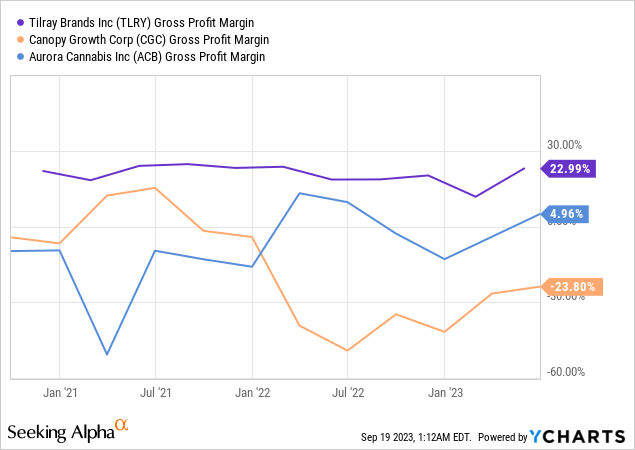

Tilray fell double digits in intraday trading following the publication of a bearish report that called the company structurally unprofitable. This ignores that Tilray’s gross profit margin is more than 5x Aurora’s and materially ahead of Canopy Growth. The company did record a gross profit margin of 37% for its fourth quarter against a net loss of $138.7 million. However, it recorded positive cash flow from its operating activities with this figure at $7.9 million for the full year.

Hence, even though Tilray seems overvalued compared to its peers, this is a well-deserved premium and the short call seems out of touch with the underlying outperformance of Tilray versus its peers. This valuation divergence is likely to open up more as Tilray moves to realize the synergies from the acquisition and as beverages continue to grow. The uncertainty now is whether the positive EBITDA set to be earned from all eight will provide investors with a decent enough return. It’s also important to note that the acquisitions should allow Tilray to build up a distribution network that it can tap into should the US legalize the sale of cannabis on a federal level. Tilray is now the standout cannabis ticker, but I’d wait until its earnings start to consistently report positive earnings and cash flows before considering a position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.