Summary:

- NVIDIA is facing major headwinds. Its near-term results will likely be pretty bad.

- NVIDIA has seen its shares rise 60% from the lows set this fall, despite no meaningful good news, and despite the earnings outlook worsening.

- This seems totally unjustified to me, and NVIDIA’s shares are now dangerously expensive, trading at a major premium compared to the historic norm.

Khosrork/iStock via Getty Images

Article Thesis

NVIDIA Corporation (NASDAQ:NVDA) is a quality company but faces considerable growth headwinds and had a pretty weak third quarter. And yet, shares have risen by a massive 60% from the recent lows already, despite the fact that earnings estimates continue to fall. Shares are now trading at a very elevated valuation again, which does not seem justified to me. While NVIDIA arguably was attractively priced at the lows seen this fall, they have now risen too much too fast, I believe.

NVIDIA Experiences Major Growth Problems

Not all semiconductor companies are created equal. Some have always been growing at a low pace and were focused on dividends, while others have always been cyclical, such as Micron (MU). NVIDIA was seen as a fast-growing company for a long time, but that is over, at least for now. The company has reported a deeply negative revenue comparison for the most recent quarter, and it’s likely that revenues will be down during the next two quarters as well, with forecasted sales declines in the 20%+ range.

That is attributable to several headwinds. First, the ongoing crypto winter hurts demands from Ethereum miners. While Bitcoin can’t be mined with GPUs efficiently, Ethereum and Ethereum-like cryptocurrencies can be mined with GPUs. While crypto prices were high, miners bought up GPUs from NVIDIA and others at a rapid pace, which was beneficial for NVIDIA’s sales volumes and its margins. With crypto prices standing where they are today, cryptocurrency mining has become a lot less profitable, and demand for new GPUs from miners has vanished. Even worse, some miners have started to sell the GPUs that they bought in the past, which adds additional supply to the market, thereby depressing prices further.

Since interest rates continue to climb, it seems unlikely to me that cryptocurrencies will rise a lot in the foreseeable future. Demand from cryptocurrency miners will thus likely not come back in a big way in the foreseeable future.

At the same time, NVIDIA is also facing headwinds from inflation and rising interest rates. Those pressure the disposable incomes of consumers, as they have to pay more for their mortgages and their needs, such as food, energy, and so on. They thus have less cash available to spend on wants, which includes new PCs and gaming equipment. With consumers’ pockets getting pinched, fewer consumers are willing to pay the very high prices for high-end graphic cards that NVIDIA was able to demand during the pandemic when consumers were flush with cash thanks to fiscal and monetary stimulus and when other ways of consumer spending, such as travel, were not possible. With consumers now either reducing their overall consumer spending on wants or diverting their spending towards experiences such as travel, concerts, etc. instead of “stay-at-home” spending such as gaming equipment, NVIDIA’s sales outlook in the consumer segment is being hurt.

Last but not least, NVIDIA is also being hurt by new regulations that hurt NVIDIA’s ability to sell high-end semiconductors to China. NVIDIA has stated in a filing that this regulation could block it from selling some of its newest AI chips, such as the A100 and H100 series, and that $400 million in booked orders were at risk. It seems likely to me that this will not be a one-time issue. Instead, it seems possible to likely that additional regulation will be coming in the foreseeable future, and that NVIDIA’s business in China could face even larger headwinds going forward. It should be noted that the same holds true for some of NVIDIA’s peers that will also be impacted by these rules.

Recent Results Were Bad, And The Next Two Quarters Will Likely Be Bad As Well

NVIDIA reported its most recent quarterly results in November. Sales dropped by a hefty 17% year over year, and profits were cut in half. That’s not really fitting for a company that is seen as a major growth player and that is trading at a pretty high valuation.

There were some positives in the report, such as NVIDIA’s strong data center sales. But even those weren’t sufficient to offset the headwinds that NVIDIA experienced in other business areas, such as gaming.

NVIDIA’s underperformance versus Advanced Micro Devices (AMD) was noteworthy, as the latter was able to push out a huge 29% revenue gain in its most recent quarter, despite also facing some of the headwinds that NVIDIA is suffering from. It looks like AMD is managing those a lot better, partially due to the fact that it isn’t as heavily impacted by the crypto winter relative to NVIDIA.

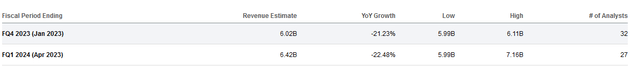

Even worse, NVIDIA looks like it will report even worse results for the next two quarters. Right now, analysts are forecasting that NVIDIA’s revenue decline rate will accelerate to more than 20% for the current quarter and the one after that, i.e. Q4 of fiscal 2023 and Q1 of fiscal 2024:

Sales declines of more than 20% are very hurtful, and not at all ordinary for a company like NVIDIA, which has had a pretty consistent revenue growth track record over the last couple of years, even during the pandemic. This is also in stark contrast to AMD’s expected performance, as AMD is forecasted to grow its sales by 5% over the next half year. Intel (INTC) is forecasted to see its sales drop by 20%+ in the next two quarters as well, but then again, that’s Intel – not a lot of growth is expected from Intel anyways, and the valuation accounts for weak results, with INTC trading for less than 14x forward earnings.

The fact that NVIDIA is expected to experience a quite harsh downturn while trading at a pretty high valuation should give investors pause. A company that is priced for massive growth shouldn’t experience large business downturns, and a company experiencing a large downturn shouldn’t be priced as if it was growing at a massive pace, I believe.

The Valuation Is Getting Ridiculously High

NVIDIA’s shares have underperformed in 2022, and rightfully so – growth was way weaker than expected, and growth forecasts for the next couple of years have taken a big hit. NVIDIA dropped to less than $110 at one point, where shares arguably were a very solid value, as the near-term headwinds seemed accounted for.

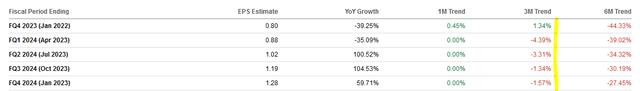

Somewhat surprisingly, however, NVIDIA has seen its shares rally by 60% since then. That’s a hefty gain for a company the size of NVIDIA, as this pencils out to a $150 billion market capitalization gain in just two months. Was this driven by improving earnings estimates, major upwards revisions to NVIDIA’s guidance, or waning macro headwinds? The contrary is true — macro headwinds such as high inflation, rising rates, and low crypto prices persist, regulation when it comes to AI chip sales to China remains a headwind, and earnings estimates aren’t falling. In fact, they have continued to weaken:

NVIDIA’s earnings per share estimates for the next five quarters have dropped massively over the last half-year, and EPS estimates for four out of those five quarters have also declined further over the last three months. It is surprising to see that NVIDIA’s share price has nevertheless risen so much in such a short period of time – to me, it seems rather ridiculous that the market is not caring for NVIDIA’s weak profit outlook.

Looking at expected full-year results, the picture isn’t prettier:

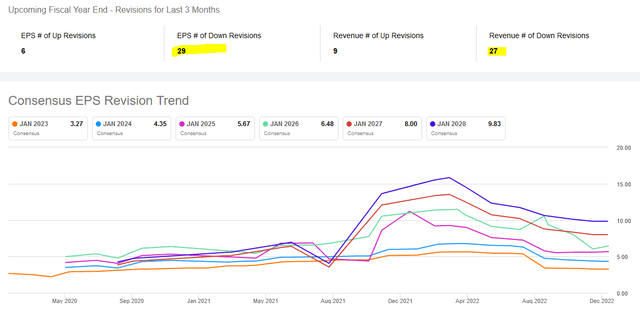

Over the last three months, there were 5x as many EPS downward revisions compared to EPS upward revisions, and the ratio isn’t much better when it comes to revenue estimates. In the chart below, we see the massive pullback in EPS estimates over the last year. While analysts were predicting that NVIDIA would earn way more than $10 per share by January 2026 (green line) not too long ago, not even the longest-dating estimates for January 2028 see NVIDIA breaching the $10 per share level.

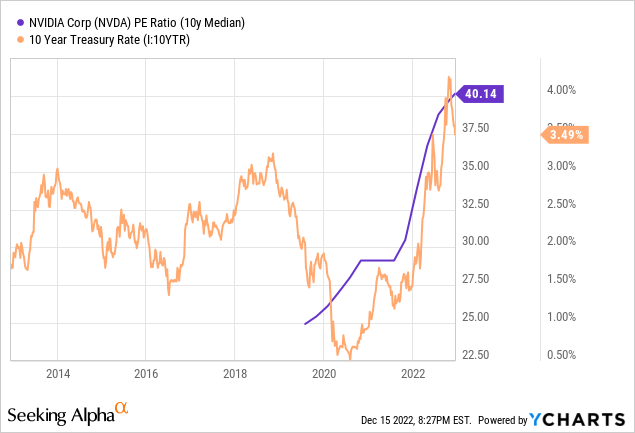

Based on current EPS estimates for this year, NVIDIA is trading at 52x forward earnings today. Let’s look at NVIDIA’s historic valuation to deduct whether that makes sense:

The 10-year median earnings multiple is 40, which means that NVIDIA trades at a 30% premium compared to the past average right now. At the same time, interest rates are massively higher today relative to the 10-year average, at 3.5% versus ~2% for the 10-year treasury rate. In theory, higher interest rates should result in lower equity valuations. But in NVIDIA’s case, the contrary is true – despite the fact that rates are way higher now, NVIDIA is way more expensive than it used to be.

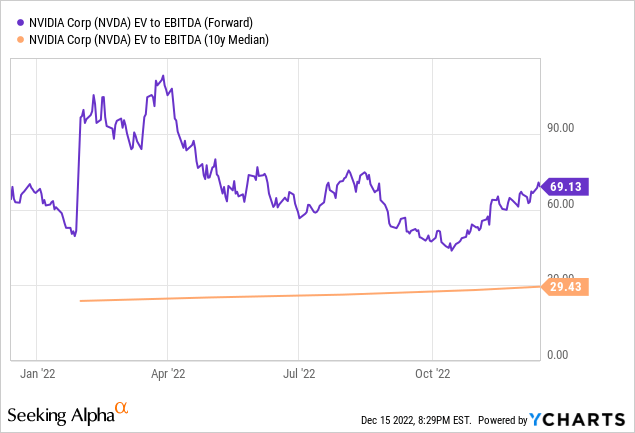

When we look at the company’s enterprise value to EBITDA multiple, which accounts for changes in debt usage, the premium is even more elevated:

Right now, based on current estimates, NVIDIA’s EV/EBITDA multiple is 140% higher than it was, on average, over the last decade. I do not see a good reason for a way higher valuation at a time when NVIDIA is facing considerable headwinds, when the economy is cooling and a recession becomes more likely, and when interest rates are at a 10-year-high, which should compress equity valuations, all else equal.

Takeaway

NVIDIA is not a bad company, but even good companies can be bad investments at the wrong price, as Cisco (CSCO) and Microsoft (MSFT) have proven during the dot.com bubble.

NVIDIA has rebounded massively from the lows seen this fall, and that seems way overblown to me. Right now, following this 60% rise in its share price, NVIDIA is trading at a substantial premium relative to its historic valuation, despite ongoing headwinds. I do not believe that this massive rally in NVIDIA’s shares is justified, and do not believe that chasing shares is a good idea as they are now historically expensive while results will likely be very weak for the next two quarters.

Disclosure: I/we have a beneficial long position in the shares of MSFT, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!