Summary:

- Adobe is an established software company that has created best-in-class tools for the creative industry. In addition, it owns the leading marketing automation software for enterprises (Marketo).

- The company reported solid financial results for the fourth quarter of fiscal year 2022, beating earnings expectations.

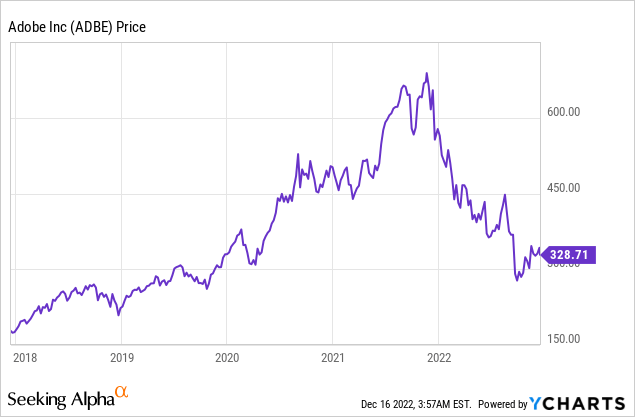

- Adobe stock is fairly valued intrinsically and undervalued relative to historic multiples.

ArtistGNDphotography/E+ via Getty Images

Adobe Inc. (NASDAQ:ADBE) is a leading software company that has created a plethora of world-renowned tools for the creative industry. From its flagship Adobe Photoshop to video editing and graphic design software, the company has consistently produced strong financial results for many decades. In true form, the company recently beat its earnings expectations for Q4 FY22. In this post, I’m going to break down the business model, financials, and valuation, let’s dive in.

Fourth Quarter Financials

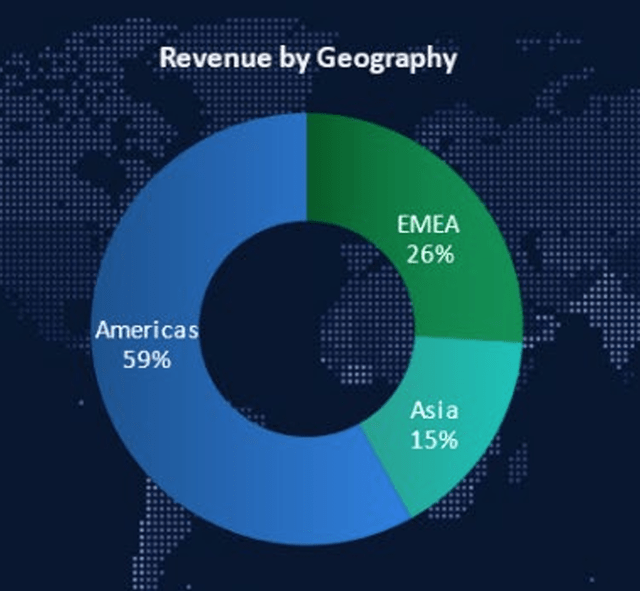

Adobe reported solid financial results for the full fiscal year 2022. Revenue was a record $17.61 billion, which increased by 15% year-over-year. In the fourth quarter, revenue was $4.53 billion which rose by 10% year over year, which was slightly (-$3.19 million) below analyst expectations. However, if we take into account unfavorable foreign exchange headwinds, Adobe actually increased its revenue by 14% year-over-year. As you can see from the graphic below, Adobe makes 59% of its revenue from the Americas. However, it makes 26% from EMEA and 15% of revenue from Asia, therefore, these markets are prone to exchange rate fluctuations.

Adobe International (Q3,FY22 report)

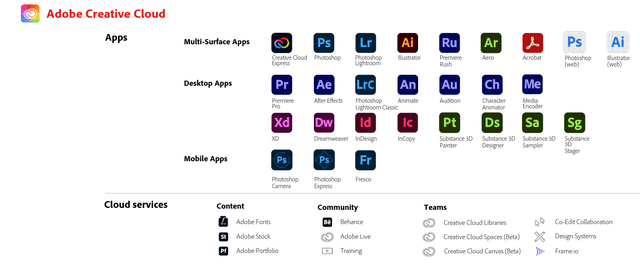

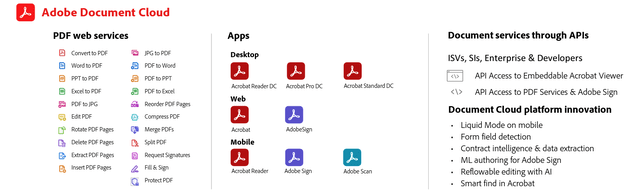

These results were driven by a record quarter for its Digital Media business, which generated $576 million in net new ARR. Adobe’s Digital Media business is the largest segment of the company and makes up 59% of revenue. This segment can be further divided into two parts, the “Creative Cloud” and the “Document Cloud.” The Creative Cloud business consists of Adobe’s family of Apps such as Photoshop, Premiere Pro for Video editing, etc. These platforms are known as the top-level software for professionals in the creative industry. In fact, Adobe’s website states that “over 90%” of the world’s creative professionals use Photoshop.

In Q4, FY22, Create Cloud revenue increased to $2.68 billion, up 8% year over year or 13% on a constant currency basis. Key growth drivers for the portion of this business included new user growth, which was a result of a series of advertising campaigns. In addition, there is strong adoption across customer segmentations from the individual to educational institutes and the enterprise. Adobe’s platform is usually taught in schools and Universities, therefore, the business has a first-mover advantage against other software packages.

Its Document Cloud business reported $619 million in revenue, which increased by 16% year over year or 19% on a constant currency basis. This was driven by growth in its “Acrobat Web” tools, which was driven by strong online searches for PDF converters. I personally have used Adobe’s online web tool to convert PDFs and found their sales strategy to be effective. The platform basically offers a couple of free conversions (with login) and then asks you to purchase. I have also compared its Word to PDF against free alternatives online and none seem to replicate the same quality which I required for a complex document with many graphics etc. However, if you wish to convert a simple plain text word document to a PDF, there are many free alternatives online. Adobe also reported strong demand by SMBs and its reseller channel for its platform, while its eSign product offered an easy upsell to customers.

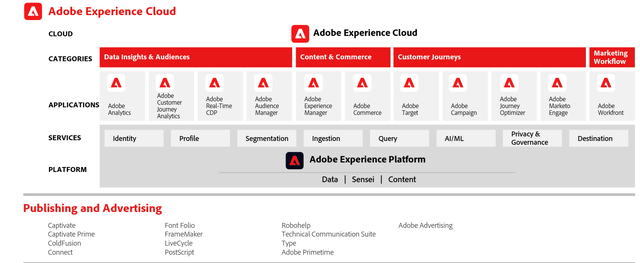

Adobe’s Digital Experience segment consists of its analytics platform, customer data platform (CDP), and even the Digital Marketing automation platform (Marketo). Marketo is known as the best-in-class tool for enterprise email marketing and was a true pioneer in the industry. Gigantic companies such as Amazon use this software. However, it does face competition from the Salesforce marketing cloud (Pardot). In the world of SMBs, HubSpot is a major player in this market.

Overall revenue for this segment was $1.15 billion, which increased by 14% year-over-year, or 16% on a constant currency basis. This segment was driven by a solid number of growth drivers in North America, which was driven by strength in its CDP platform with enterprises.

Adobe Experience Cloud (Adobe)

Profitability and Balance Sheet

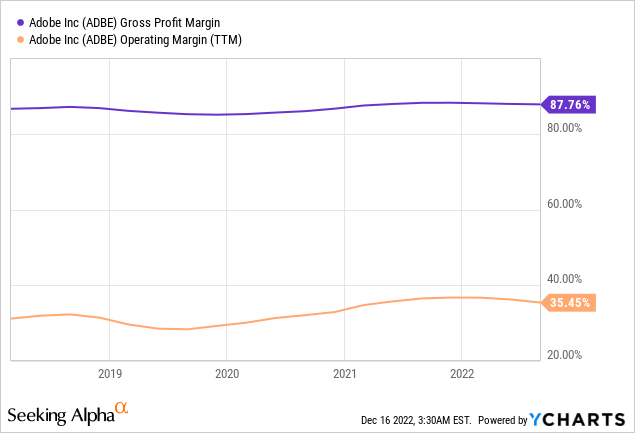

In Q4 22, Adobe reported earnings per share of $2.53, which beat analyst expectations by $0.05. Adobe primarily sells software packages and thus has high margins built into the business. Historically, the business has achieved a fantastic gross margin of over 87% and an operating margin of over 35%. In this quarter, its GAAP Tax rate was lower than expected due to lower-than-expected tax on foreign earnings.

Adobe has a solid balance sheet, with cash and short-term investments of $6.1 billion. The company does have a fairly high debt of $4.6 billion but just $500 of this is current debt of which the business plans to pay down in order to reduce its interest expenses in the fiscal year 2023. The business also executed $1.75 billion in share buybacks and has $6.55 billion left from its $15 billion authorization.

Advanced Valuation

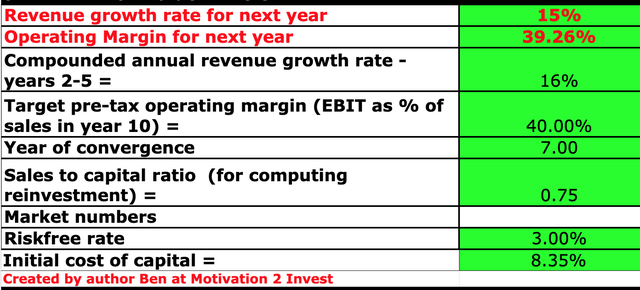

In order to value Adobe I have plugged the latest financials into my discounted cash flow (“DCF”) model. I have forecasted 15% revenue growth for next year, which is aligned with the full fiscal year 2022 results. In addition, in years 2 to 5, I have forecasted the company to increase its growth rate to 16%, as economic conditions improve. These estimates are all reported on a constant currency basis.

Adobe stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have also capitalized R&D expenses which have lifted net income. I have also increased its pre-tax operating margin to 40% over 7 years, as the business benefits from a greater number of upsells.

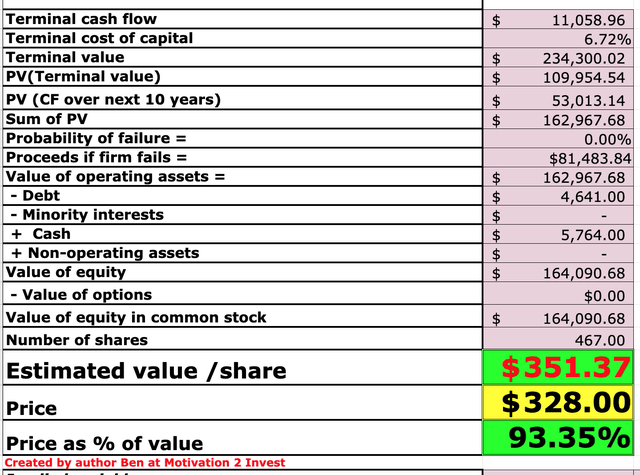

Adobe stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $351 per share, the share price at the time of $328 per share, and thus the stock is ~7% undervalued or “fairly valued” in my eyes.

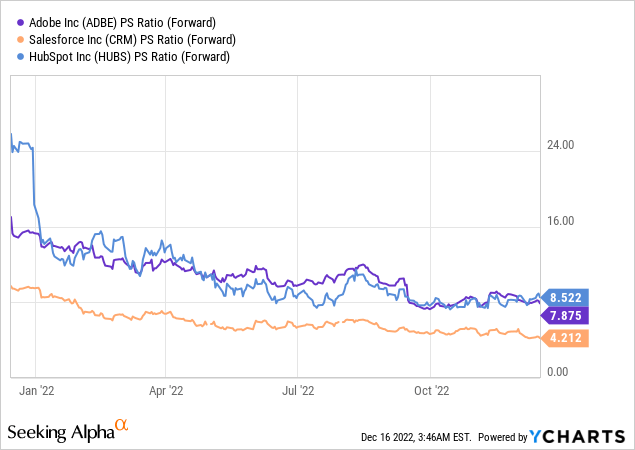

As an extra datapoint, Adobe trades at a price-to-earnings ratio = 34, which is 28% cheaper than its 5-year average. Whereas, its price to sales ratio = 9, which is 33% cheaper than its 5-year average. Below I have compared it to its Marketing automation competitors, and you can see it trades at a similar level, albeit more expensive than Salesforce (CRM).

Risks

Competition

Adobe used to be the undisputable king of creative software. However, these days, people have many more free or low-cost alternatives. For example, in the world of graphic design, we have Canva, a tool I personally use regularly. It is free to sign up for and easy to use. This company makes its money from upsells to its pro package. In the world of video editing with DaVinci Resolve, which is a free alternative to Adobe’s Final Cut video editing software. At a more advanced level, we also have Artificial Intelligence (AI) powered tools such as Chat GPT or DALL-E, which, despite being in the prototype phase, can generate AI images and save the need for hiring graphic designers.

Final Thoughts

Adobe Inc. is a tremendous company that offers a suite of best-in-class software. The company is still growing at a steady rate despite increasing competition in the industry. Adobe also has super-high margins and, at the time of writing, it is undervalued intrinsically and relative to historic multiples, which is a rarity in its history. Therefore, Adobe Inc. could be a great long-term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.