Summary:

- Tilray’s stock has rallied amidst renewed hopes for cannabis reform in the United States.

- The company’s latest acquisition of alcohol assets raises concerns about its pursuit of growth at any cost.

- TLRY’s high debt and low profitability may signal long-term pain ahead.

- I was wrong: I am downgrading the stock to strong sell.

boonstudio

Tilray (NASDAQ:TLRY) is once again in the spotlight amidst renewed hopes for cannabis reform in the United States. First there was news that the HHS sent a letter to the DEA recommending to reschedule the plant to schedule III. In recent days, SAFE banking passed a markup by a Senate committee. Long-time cannabis investors, however, may have grown wary of counting on potential legislative reform, but that has not stopped many cannabis stocks from rallying. I have been patient on waiting for profitability improvements – probably too patient – but the company’s latest acquisition of alcohol assets is the last straw. I’m concerned about the apparent “grow at any cost” strategy as it’s pressuring the already strained balance sheet. While there may still be hopes in the event of full legalization in the United States, I’m doubtful that shareholders will do well between now and then, if ever.

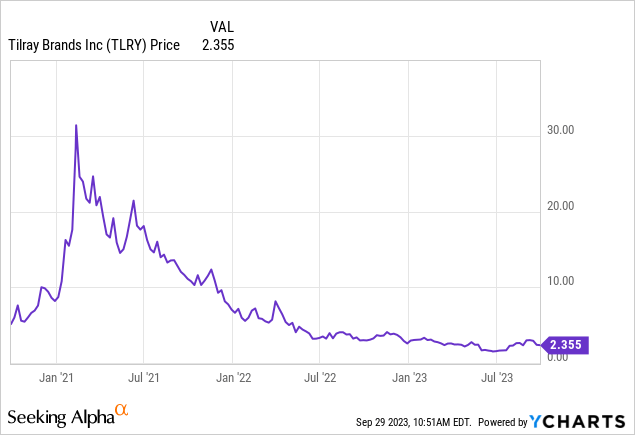

TLRY Stock Price

TLRY saw its stock jump from the lows upon renewed hopes for legislative reform, but that rally has done little in the grand scheme of things.

I have covered TLRY regularly over the years, most recently giving it a buy rating, but noting my preference for multi-state operators. In hindsight, I was being too “cute” and should have drawn a more critical view of the company sooner. Better late than never – the recent rally gives investors a good opportunity to exit before the company continues its dilutive and – potentially – financially detrimental pursuit of growth.

TLRY Stock Key Metrics

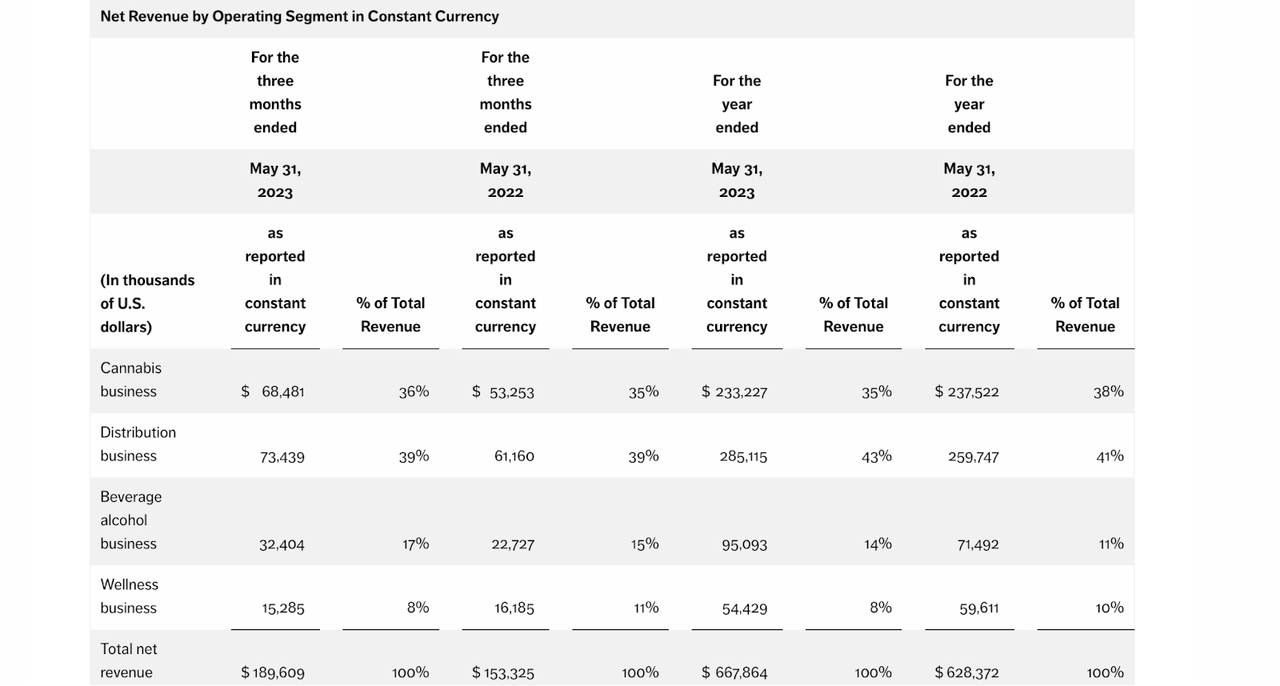

In its most recent quarter, TLRY generated more than 23% revenue growth (constant currency), led by strength in cannabis and alcohol sales. As I have highlighted in prior reports, while TLRY is most well known as a leading cannabis company from Canada, cannabis revenues make up just 36% of overall sales.

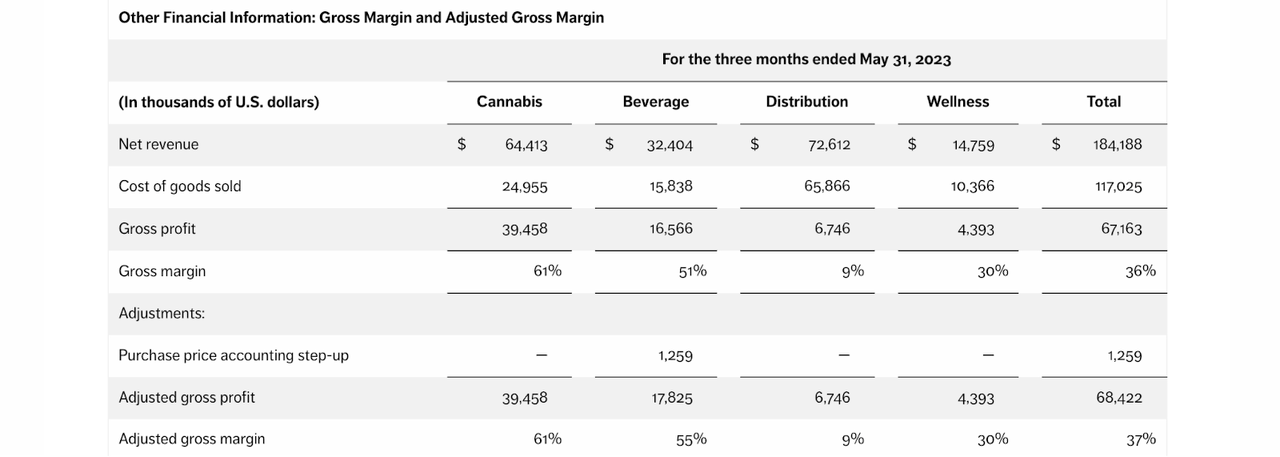

While cannabis revenues have come at a 61% gross margin, the rest of the businesses carry far lower unit-level margins, including just 9% gross margins for distribution revenues. The company’s expensive acquisitions in the distribution and other business lines should have been the clear red flag that the underlying strategy may be to grow at any cost.

For the full year, the company generated $1.4 billion in net losses, but on an adjusted basis that loss was $130 million. The company generated $61 million in adjusted EBITDA and generated some adjusted free cash flow (though I note that their list of adjustments is as long as any I have ever come across). TLRY ended the year with $450 million in cash vs. $579.8 million in debt.

Looking ahead, management expects to generate up to $78 million in adjusted EBITDA in the next year, representing up to 27% YoY growth. On the conference call, CEO Irwin Simon proudly stated:

When I first joined the Aphria team in 2018, Aphria was singularly a Canadian cannabis LP with approximately $50 million in annual revenue and minimal cash, now close to $630 million in revenue and almost $500 million in cash and marketable securities. Boy, have we come a long way.

That commentary is confusing, given that TLRY ended 2018 with around $111 million in net cash but ended the recent quarter with nearly $130 million in net debt, while seeing shares outstanding more than triple. Later on, I will discuss the compensation structure and how that may explain the capital allocation decisions of the past.

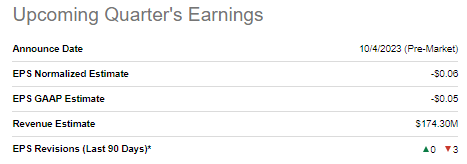

What To Expect From Tilray Earnings

TLRY will announce first quarter earnings on Oct. 4 before the market opens. Consensus estimates call for around $174.3 million in revenues, up from $153.2 million in the prior year.

Seeking Alpha

That estimate looks reasonable, though I expect analysts to instead focus more on the company’s efforts to increase adjusted EBITDA and deal with the balance sheet.

Is TLRY Stock A Buy, Sell or Hold?

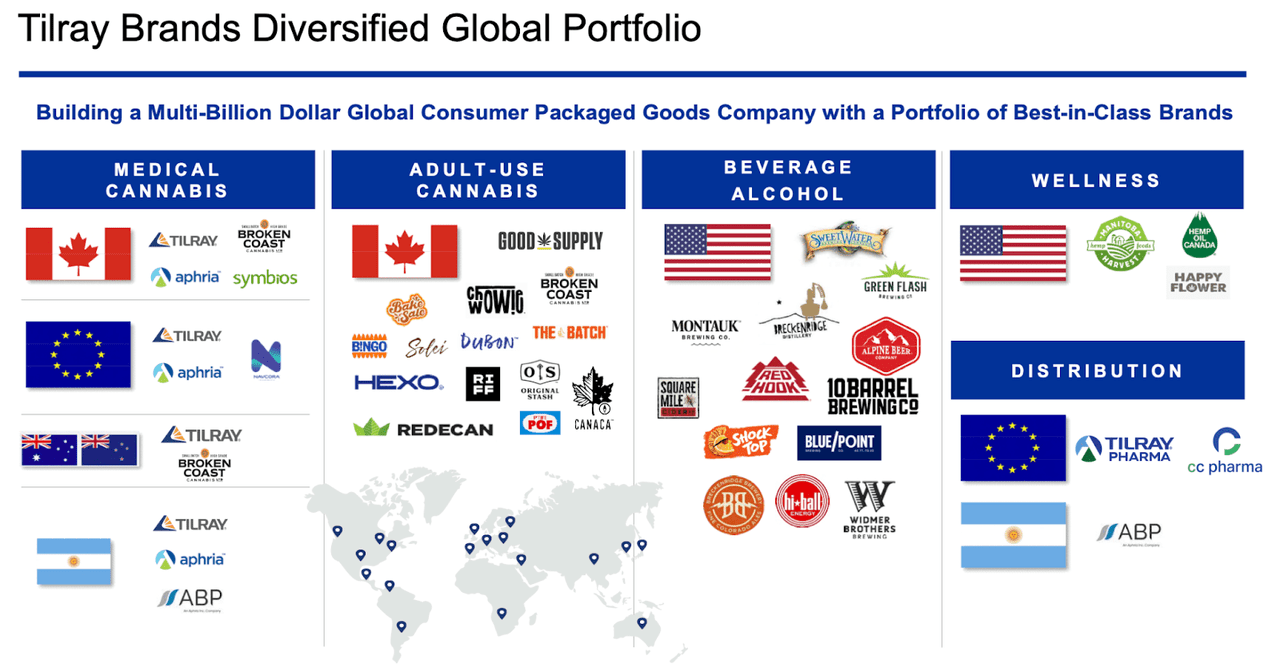

TLRY was once known as one of the giants in the global cannabis industry. Those days are gone, as TLRY has transformed itself into a “multi-billion dollar global consumer packaged goods company.”

TLRY still should benefit from legalization of cannabis in the United States through both its investment in MedMen (OTCQB:MMNFF) as well as the potential to ramp up production at its greenhouse facilities to export into the country. I was once quite optimistic that the stars were aligning for legalization of the plant in the country, but I no longer possess such optimism. I’m now of the view that full legalization may be a decade away, if not longer, as our politicians have made it clear that they still maintain reservations about full legalization.

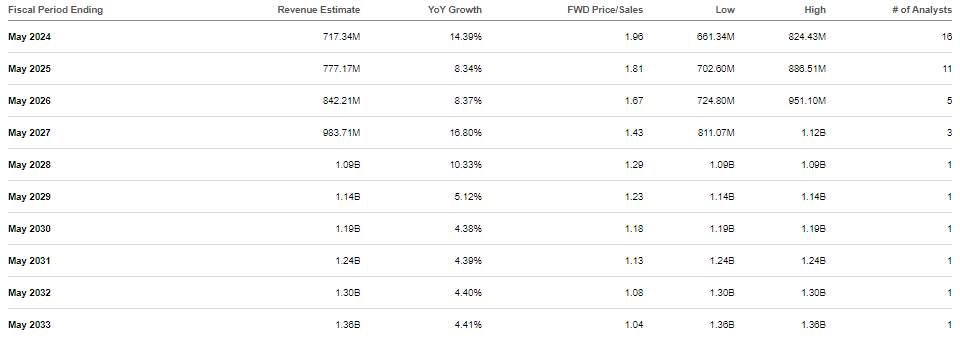

At recent prices, TLRY was trading at around 2x sales with consensus estimates calling for low double-digit growth in the coming years.

Seeking Alpha

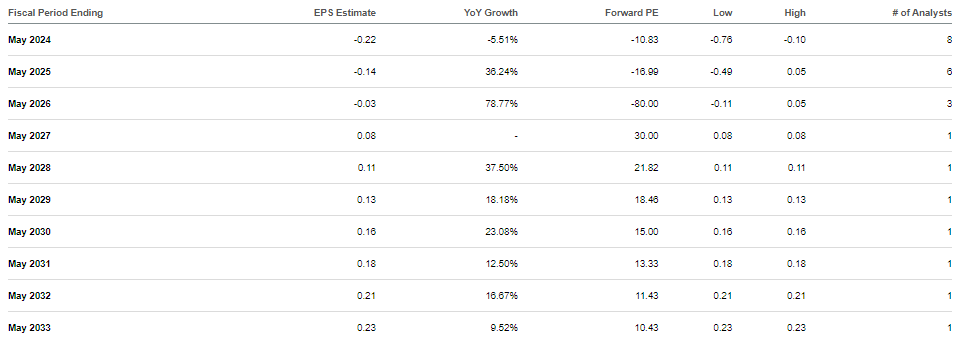

TLRY is expected to show strong operating leverage and start generating profits by 2027.

Seeking Alpha

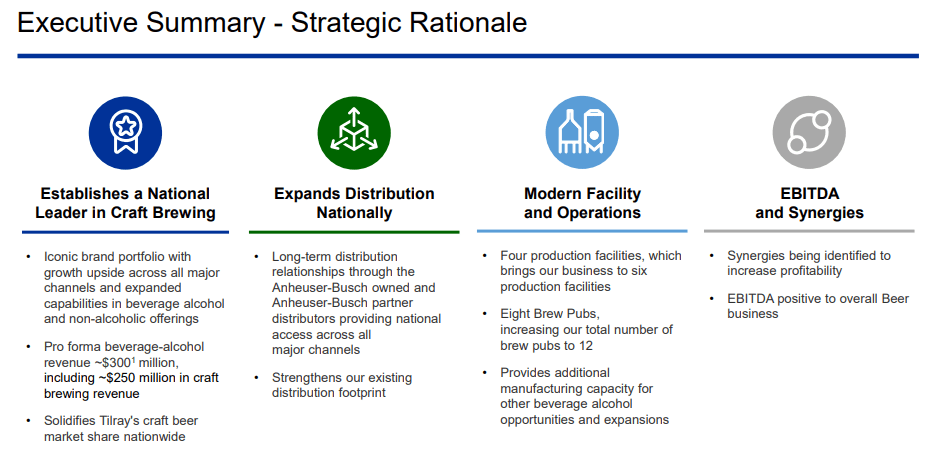

I find these consensus estimates to be too aggressive because outside of full legalization of cannabis in the United States I view operating leverage as being very unlikely given that the company is generating consolidated gross margins of just 37% (as of the latest quarter). I’m downgrading the stock to a strong sell in part due to the leveraged balance sheet and my view that the road to profitability is highly uncertain, as well as the company’s latest acquisition of eight brands from Anheuser-Busch (BUD). Terms of the deal were not disclosed and the company stated that synergies were “being identified.”

August 2023 Presentation

I previously stuck by a buy rating for the stock as a highly speculative pick for potential legislative reform of cannabis. Legislative reform took far longer than expected and the company has been aggressively growing its business lines at the expense of its balance sheet and shares outstanding without much to show for the growth in terms of profits.

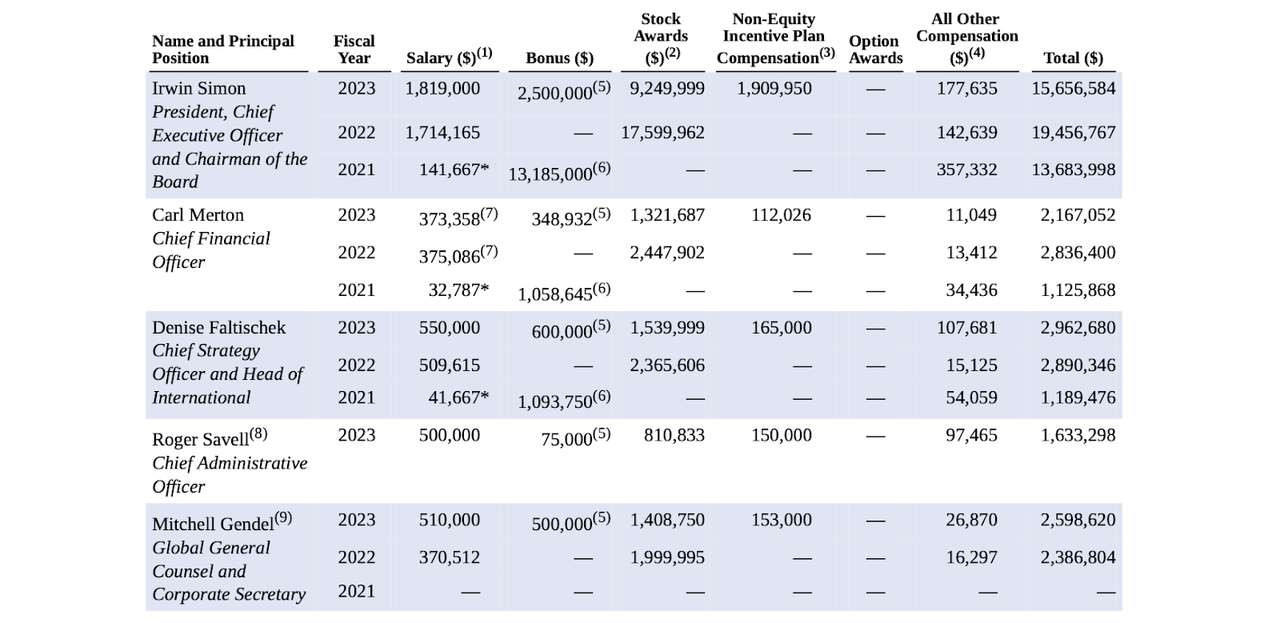

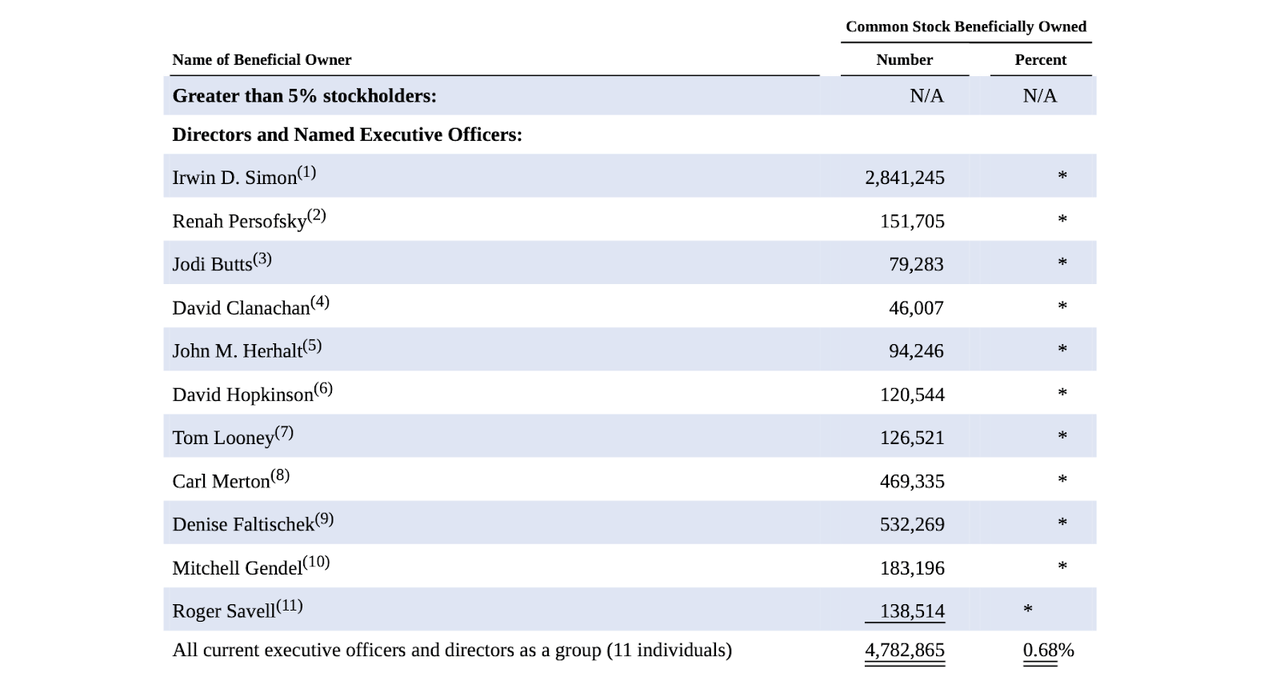

Investors can often find value by analyzing the compensation structure in the company’s financial statements. As stated in the 2023 proxy statement, the management team’s bonus payments in 2023 were paid out on terms where the “applicable consolidated net revenue target was $695 million and the Adjusted EBITDA target was $75 million for full bonus payments.” Notice that there was a lack of “per share” metrics for that payout which is typically what I look for to ensure that accretion is the goal.

That in turn led to the CEO getting paid more than $15 million in total compensation in the year – recall that the company generated $61 million in adjusted EBITDA for the full year.

Meanwhile, the management team apparently has very little “skin in the game,” with CEO Simon owning only 2.8 million shares, worth just under $7 million.

This analysis of the compensation structure and insider ownership makes it easier to understand the capital allocation strategy. While TLRY is indeed bigger than in years past, I’m of the view that the shift from a net cash to net debt balance sheet and the continued pressure on the bottom line are not sufficient rewards given the large amount of dilution taken place over the past several years. I expect the stock to trend lower over the long term as the company is generating insufficient cash flow to manage its highly leveraged balance sheet, let alone reward shareholders. I would not rule out more acquisitions in the future that put more pressure on the balance sheet and shares outstanding. I rate the stock a strong sell and again highly regretful that it has taken me this long to do so.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!