Summary:

- Tesla, Inc. is set to report Q3 earnings on October 18, 2023.

- Tesla’s historical stock performance reveals four key valuation leaps tied to strategic product launches.

- Tesla’s valuation challenges are based on total addressable markets.

- Megapack’s potential in the $42 trillion energy storage market is strong. Tesla’s energy business, particularly its Megapack product, could be the primary driver of future valuation growth.

Maurizio Fabbroni/iStock Editorial via Getty Images

Introduction

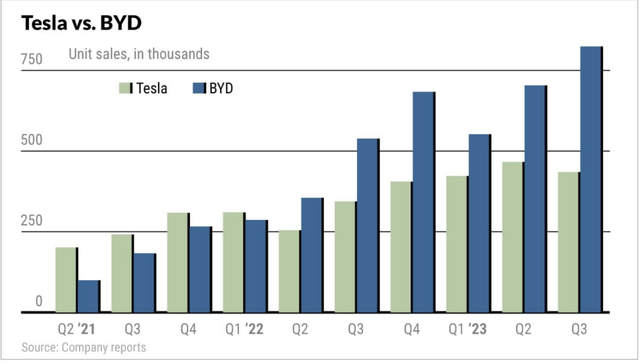

Tesla, Inc. (NASDAQ:TSLA) is set to report third-quarter earnings post-market on October 18, 2023. The company’s recently disclosed Q3 delivery figures disappointed some investors, as units grew annually but declined sequentially amid production delays. This lackluster growth contrasts with Chinese peer BYD Company Limited (OTCPK:BYDDF), which showed continued sequential expansion.

Despite Tesla maintaining full-year guidance, markets seemed unimpressed as the stock barely moved on the delivery news. With Tesla’s upcoming earnings on the horizon, looking back at its historical stock performance can provide perspective on the current opportunity. Though Q3 deliveries underwhelmed, examining how the stock has previously reacted to results can reframe how investors evaluate Tesla heading into the print.

Valuation Debate

With a market cap approaching $800 billion, Tesla’s valuation has long sparked debate. Prominent short-seller Jim Chanos, who unsuccessfully targeted Tesla in the past, remains steadfast in his skeptical view. Meanwhile, Morgan Stanley recently reiterated its bullish stand, arguing Tesla’s Dojo supercomputer could transform it from an automaker into a software powerhouse as autonomous driving advances. These competing views highlight differing perspectives on Tesla’s future. Bears believe the stock price far exceeds reasonable valuations for a car company. But new bulls see an upside if Tesla evolves beyond hardware into a leader in software and AI. At nearly $800 billion, Tesla provides fodder for both sides to make their case around its appropriate valuation.

4 Historical Valuation Leaps

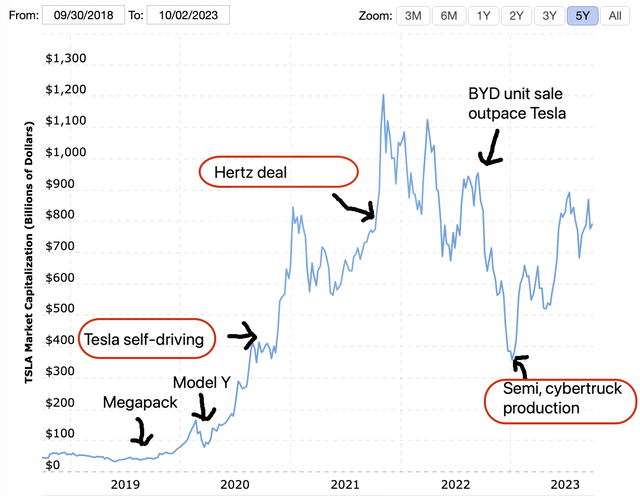

Looking back reveals four key valuation leaps tied to Tesla’s strategic product launches:

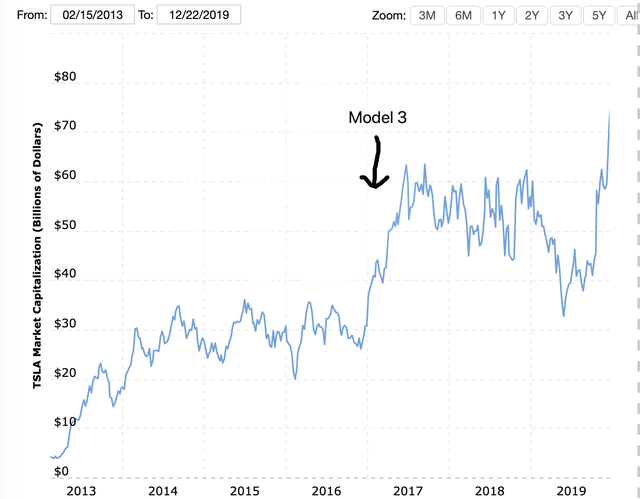

2013-2016: $20-$30 billion market cap valued Tesla as a luxury automaker based on high-priced Models S and X targeting the upper market. This positioned Tesla similarly to premium brands like BMW (OTCPK:BAMXF) and Mercedes (OTCPK:MBGAF) based on its focus on sleek, high-end electric sedans and SUVs during this period.

2017: Launching the mass market Model 3 in July 2017 marked a pivotal moment, fueling the first major jump in Tesla’s valuation. By demonstrating its ability to produce an affordable, mid-range electric vehicle, Tesla showed its potential to disrupt the broader auto market through electrification. The Model 3 opened Tesla up to a much wider audience beyond just luxury buyers.

Tesla market cap (Macrotrends)

March 2020: Introducing the mid-size Model Y SUV in early 2020 expanded Tesla’s addressable market, propelling a second steep valuation rise. Adding a more affordable electric SUV enabled Tesla to compete in the hugely lucrative crossover segment, the most popular vehicle type in the U.S. market. This moved Tesla beyond just cars into the leading product category. The Model Y helped push Tesla’s valuation to around $400 billion, surpassing the market cap of industry leader Toyota (TM), which was around $200 billion.

Sep 2020: The third major surge in Tesla’s valuation began in September 2020, as the company introduced its Full Self-Driving (“FSD”) beta test program and detailed plans for a robotaxi network. Bullish analysts like Morgan Stanley’s Adam Jonas propelled the stock higher by valuing Tesla’s software and services business, including the potential for an autonomous ridesharing platform, at nearly the same level as its automotive operations. This pushed Tesla’s market cap from around $400 billion up to $800 billion by late 2020. The prospect of Tesla evolving into a leader in autonomous taxi services, powered by AI and software, led many investors to significantly expand the company’s total addressable market and opportunity beyond just electric vehicles.

Our analysis below revealed that despite the FSD efforts’ modest success, they would not be able to maintain their $400 billion valuation boost.

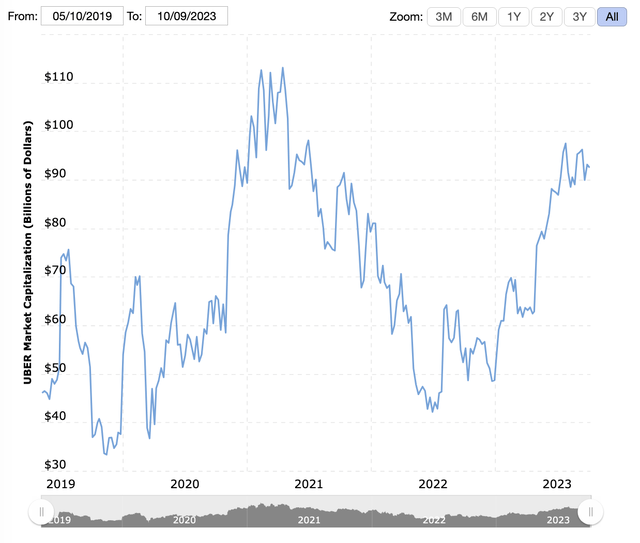

Tesla disclosed that 400,000 owners in the United States and Canada now have access to the FSD beta, representing high penetration among existing owners given Tesla has sold over 1.9 million vehicles globally. With around 400,000 customers in North America alone on the autonomous platform, Tesla has reached material scale in its installed base of FSD users. For context, Uber (UBER) had a market cap of $60-$100 billion at the time based on its ridesharing network. Tesla’s base of FSD beta users highlights the company’s leadership in autonomous driving technology among consumer vehicles.

However, gaps remain in justifying Tesla’s valuation based on its total addressable markets.

2021: Another surge occurred in August 2021 after the announcement of a 100,000-vehicle order from Hertz (HTZ). But the global rental car market is only around $100 billion, far below the over $1 trillion valuation Tesla reached. Even combining rental cars and the $200 billion heavy truck market, the combined total addressable market, or TAM, is dwarfed by Tesla’s peak $1 trillion valuation.

This helps explain Tesla’s 50%+ pullback from over $1 trillion to around $400 billion, as the upside from autonomous driving, rental cars, trucks, etc. could not sustain such an elevated valuation. The upper limit of Tesla’s immediately addressable markets remains well below its recent valuation highs.

Energy Business Potential

In our previous article, we discussed how Tesla’s energy business, specifically its Megapack product, could be the primary driver of future valuation growth.

According to the International Energy Agency (IEA) 2019 World Energy Balances, the global primary energy supply is 165 PWh/ year, and total fossil fuel supply is 134PWh/year. 37% (61PWh) is consumed before making it to the end consumer. This includes the fossil fuel industries’ self-consumption during extraction/refining, and transformation losses during electricity generation. Another 27% (44PWh) is lost by inefficient end-uses such as internal combustion engine vehicles and natural gas furnaces. In total, only 36% (59PWh) of the primary energy supply produces useful work or heat for the economy. Analysis from Lawrence Livermore National Lab shows similar levels of inefficiency for the global and US energy supply2,3.

Our $4.2 trillion total addressable market estimate for Tesla Energy is based on simple assumptions around global energy storage needs. According to Tesla, the global energy market is 165,000 terawatt-hours (TWh) per year. If we assume only 5% of this capacity will need storage long-term, that equates to 8,250 TWh of storage required.

Tesla’s Megapacks have a capacity of 3.9 megawatt-hours (MWh). So to store 8,250 TWh would require around 2.1 million Megapacks at $2 million each – resulting in a $4.2 trillion market opportunity. With the massive $42 trillion addressable market for energy storage, this segment offers far more upside potential than Tesla’s car business or even full self-driving capabilities.

Huawei’s Insight: The projected energy storage needs for data centers

While the 5% energy storage assumption is subjective, the math illustrates the sheer magnitude of storage investments needed to support grid reliability and renewables growth. Energy storage may potentially be in higher demand, for example, in data centers as AI develops.

According to Huawei’s report, energy storage is becoming essential for data centers to reduce costs through peak shaving and valley filling. Electricity is 60-70% of data center operating costs, so facilities utilize storage to arbitrage cheaper off-peak power.

Operators are also connecting edge data centers to provide low latency, localized computing at the network edge. Per Huawei, over 10,000 mobile edge computing nodes will be deployed by 2030. This brings content closer to users, reduces latency, and enables localized data processing.

Additionally, clean energy usage will rise as data centers target 100% green power by 2030. Wind, solar and other renewables will displace fossil fuels.

Megapack’s Recent Progress

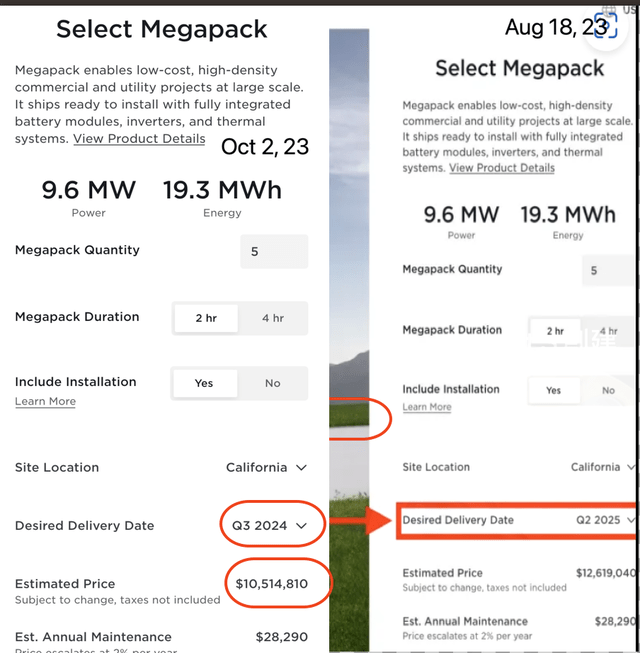

As the Megapack is key to realizing the energy storage opportunity, we wanted to check in on recent progress as a potential indicator ahead of Tesla’s Q3 earnings. We uncovered data points around Megapack pricing and delivery timelines that are worth monitoring as possible signs of slowing demand, though they could alternatively reflect supply ramping up.

On August 18, 2023, Electrek reported the earliest Megapack delivery date available on Tesla’s website was Q2 2025, with pricing set at $12 million for a 5-megapack system. When we checked the website on October 2, 2023, the earliest delivery date had moved up to Q3 2024, while pricing had dropped to $10 million.

Lower pricing and faster delivery could point to weaker demand. However, Tesla has a history of cutting prices as production scales, so this could also stem from the manufacturing ramp allowing cost reductions and shorter lead times.

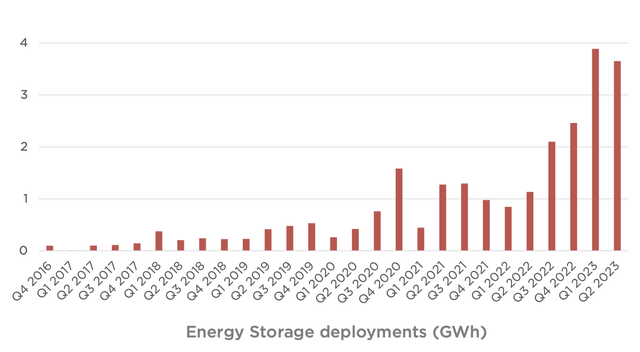

In Tesla’s Q2 shareholder letter, the company noted its dedicated Megapack factory in Lathrop, CA had successfully scaled production, though still with room to reach full capacity. Energy storage deployments grew 222% annually but did see some sequential slowing “due to project timing.”

Energy storage deployments increased by 222% YoY in Q2 to 3.7 GWh, another strong quarter due to the ongoing ramp of our first dedicated Megapack factory (Megafactory) in Lathrop, CA. The ramp of this 40 GWh Megafactory – the first of many – has been successful with still more room to reach full capacity. While the energy storage deployment rate can be volatile due to project timing, the production rate improved further sequentially in Q2.

This ramp-up seemed to support the case that accelerated delivery timelines and lower costs reflect expanding supply rather than weakening demand. And in June and July 2023, Tesla continued landing major Megapack orders like a $500 million Belgium project and $413 million deal in Massachusetts.

Conclusion

As Tesla gets set to report Q3 results, progress on the Megapack rollout remains an important catalyst for investors to watch. Strong continued growth in deployments and orders would reinforce Tesla’s long-term energy storage upside. But any signs of slowing traction could raise concerns about realizing its immense potential in this critical market. We will be closely monitoring energy segment metrics this earnings season for the latest Megapack demand signals. We keep our buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.