A. O. Smith: A Decent Buying Opportunity For This SWAN Stock

Summary:

- A. O. Smith’s adjusted diluted EPS and free cash flow payout ratios are both going to be very safe in 2023.

- The company’s net sales were almost flat in the first half, but its adjusted diluted EPS soared by 22% during the period.

- A. O. Smith’s interest coverage ratio was above 45 through the first two quarters of this year.

- My assumptions for the dividend discount model show the stock to be about 4% undervalued.

- A. O. Smith could be a buy for dividend growth investors.

A person working on their finances. staticnak1983/E+ via Getty Images

By its nature, there is uncertainty associated with investing. Is a global recession imminent or can it be avoided? Everybody has their opinion, but nobody can be certain.

This is why it is best to simply have a sound investment strategy and stick with it. As evidenced by the 100-plus dividend stocks that I own, my approach to investing is to be invested in most sectors throughout the global economy.

The water heater, water boiler, and water treatment company A. O. Smith (NYSE:AOS) is one stock within my portfolio. For the first time in over four years, I will revisit what I like about this business and why I am maintaining a buy rating.

The Dividend Aristocrat Can Keep Flooding Shareholders With Dividends

A. O. Smith has raised its dividend for 30 consecutive years, which puts it in the company of less than six dozen other Dividend Aristocrats. Logging a five-year annual dividend growth rate of 12% versus the industrials sector median of 7%, the business isn’t just barely upping its payout, either. That is why Seeking Alpha’s Quant system awards an A+ dividend growth grade to A. O. Smith.

Along with a 1.8% dividend yield that is moderately above the sector median of 1.6%, the company provides a nice mix of growth potential and starting income.

Best of all, this growth can persist: Analysts anticipate that A. O. Smith’s adjusted diluted EPS will climb by 10% annually for the next three- to five years. This is because the company operates as the clear leader in a $30 billion global water heater industry as of 2022 that could top $46 billion by 2032.

Not to mention that A. O. Smith’s adjusted diluted EPS and free cash flow payout ratios are poised to be quite low in 2023. The company is going to pay $1.20 in dividends per share during the year. Against the $3.60 in adjusted diluted EPS that analysts are projecting, this is a 33.3% adjusted diluted EPS payout ratio. Management believes that it will generate $575 million ($550 million to $600 million) in midpoint free cash flow in 2023. Relative to the roughly $185 million in dividends that are going to be paid including share buybacks, that is a free cash flow payout ratio of around 32% (estimate from page 32 of 81 of A. O. Smith 10-K filing). For these reasons, I believe A. O. Smith’s dividend will grow by 8.25% annually in the long run.

Strong Results And Guidance

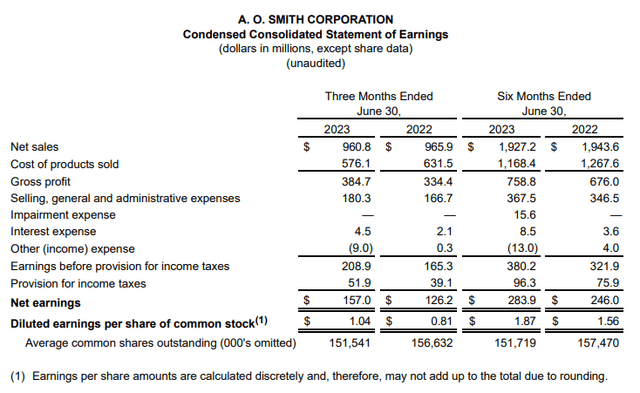

A. O. Smith Q2 2023 Earnings Press Release

A. O. Smith’s net sales edged 0.8% lower over the year-ago period to $1.9 billion in the first half ended June 30, 2023. Demand for residential and commercial water heaters remained steady in the first half of the year. This is why the company thinks that its residential water heater volume will be flat to up 2% over 2022. Commercial water heater volumes are also expected to increase at a mid-teens rate compared to 2022, according to Chairman and CEO Kevin Wheeler.

But strength in the sales of these products was slightly more than offset by a downturn in its boiler business. A. O. Smith forecasts that the outlook for this business has deteriorated from up mid-single digits this year to being down high-single digits compared to last year. This is due to elevated inventory levels of residential and commercial boilers heading into the year.

A. O. Smith’s adjusted diluted EPS surged 22% year over year to $1.94 during the first half of 2023. Lower steel costs and high demand for its water heaters contributed to these results, as well as a lower share count from share repurchases.

Looking at the full year, A. O. Smith is guiding for approximately $3.8 billion in midpoint net sales. This would be 1% topline growth at the midpoint. As a result of improved profitability, the company’s adjusted diluted EPS is expected to grow by 12.3% over 2022 to a midpoint of $3.525.

A. O. Smith’s interest coverage ratio through the first six months of 2023 was a blistering 45.7. If that wasn’t enough, the company also had a $204 million net cash position as of June 30. If A. O. Smith so desired, it could eliminate its $196 million in long-term debt instantly (details according to A. O. Smith Q2 2023 earnings press release and A. O. Smith Q2 2023 Earnings Presentation).

Risks To Consider

A. O. Smith is a wonderful business with solid near-term and long-term growth potential. Even so, the company still has its share of risks.

If a global recession plays out that is worse than currently expected, demand for A. O. Smith’s products could temporarily decline. This would hurt net sales and adjusted diluted EPS in the short term.

Because almost a quarter of A. O. Smith’s sales were generated in China, the fortunes of the company are partially linked to the country. That means any unfavorable economic or regulatory conditions in China could somewhat harm A. O. Smith (more risks can be found on pages 7-12 of 81 of A. O. Smith’s 10-K filing).

The Recent Rally Hasn’t Made Shares Too Expensive

Shares of A. O. Smith have performed exceptionally great in the past 12 months, gaining 30% during that time. However, my valuation model shows the valuation remains within reason.

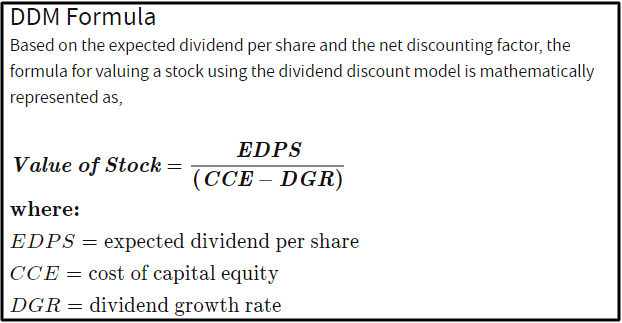

Investopedia

The valuation model that I’ll be using to value A. O. Smith’s shares is the dividend discount model or DDM. This consists of three inputs.

The first input for the DDM is the expected dividend per share. This is simply the annualized dividend per share, which is $1.20 for A. O. Smith.

The next input into the DDM is the cost of capital equity, which is another term for the annual total return rate. I will use 10% since that is what I target for annual total returns.

The final input for the DDM is the annual dividend growth rate. Considering A. O. Smith’s low payout ratios and healthy growth prospects, I believe 8.25% is a sensible expectation.

Plugging these inputs into the DDM, I get a fair value of $68.57 a share. This suggests that shares of A. O. Smith are trading at a 3.7% discount to fair value and offer a 3.8% upside from the current price of $66.05 a share (as of October 2, 2023).

Summary: Now Is An Okay Time To Buy A. O. Smith

A. O. Smith is a top-notch dividend growth stock. The company appears to have many more years of dividend growth left in the tank as well. A. O. Smith may not be a screaming buy, but it’s not a bad pick for dividend growth investors in the mid- $60 share price range.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.