Summary:

- Algonquin Power & Utilities Corp. has faced challenges due to high debt and poor capital allocation policy.

- Valuation entered a buy-zone in the last few days.

- We go over expected returns and tell you why the 9.6% yield on the preferred shares can be an attractive alternative.

Billionaire Is Not Too Thrilled With What He Sees Eric Francis

Algonquin Power & Utilities Corp. (NYSE:AQN) (TSX:AQN:CA) has been on the receiving end of a rather rough period in the markets. It has gone headfirst into troubles stemming from both a high debt load and from a poor capital allocation policy. The go-go days of 2018-2021 were great for buying assets with zero regard for long-term value creation. Unfortunately, higher interest rates brought forth the famous billionaire quote in action.

Only when the tide goes out do you learn who has been swimming naked.

Source: Warren Buffett – Billionaire

It is safe to say that the tide’s out. But underneath this rubble, we are seeing glimpses of value. We tell you why that is and why we are upgrading this to a buy. We also tell you why we are buying the 10% yielding preferred shares.

The Bull Case

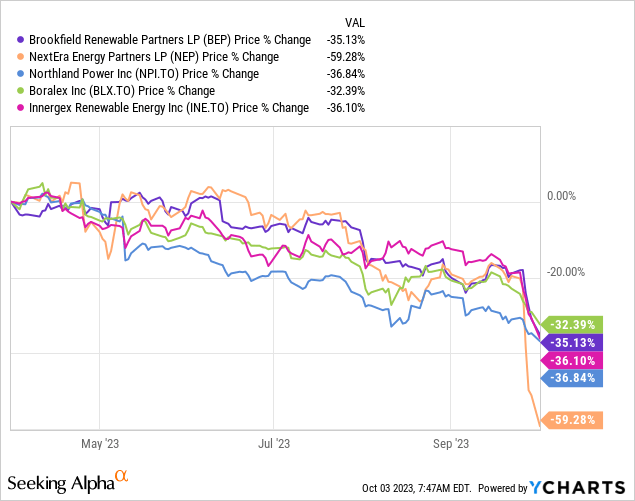

While a stock may occasionally bottom and bounce on announcing a dividend cut, most tend to go further into the abyss. AQN fell into the latter category, and it was even more painful for the dividend investors, who once again took their cues from “what management said”. The end result is one where a stock goes back to having a large, well-covered dividend yield, after the dividend cut. Currently, AQN yields 7.6%, and that results in a 75% payout ratio. Amongst regulated utilities on both sides of the border, this is the highest we can find. AQN is of course not a pure regulated utility and its renewable power assets, are their valuation, are likely coming under scrutiny these days. AQN plans to divest this, though it may be difficult to get that elusive 11-12X EV to EBITDA multiple which would make such a sale accretive. In case you have a more optimistic bent, here are the charts for Brookfield Renewable Partners L.P. (BEP), NextEra Energy Partners, LP (NEP), Northland Power Inc. (NPI:CA), Boralex Inc. (BLX:CA), and Innergex Renewable Energy Inc. (INE:CA).

So that offload may have to wait, but even discounting that timeline or perhaps a lower price, the stock is looking attractive. We are now approaching 10.5X EV to EBITDA for 2024 estimates. Yes, interest rates are a headwind for AQN as they are for all utilities, but AQN has a BBB rating, and you are getting a good debt maturity profile for AQN. Fitch is not worried either, though they are watching the evolving situation with the renewable asset sale and making sure that there is no silliness like dialing up leverage in the process.

Fitch Ratings has placed the ‘BBB’ Long-Term Issuer Default Rating and the ‘F2’ Short-Term IDR of Algonquin Power Co (APCo) as well as issue-level rating on Rating Watch Evolving following its parent Algonquin Power & Utilities Corp.’s (APUC) announcement of the plan to sell its renewable subsidiary APCo. Fitch expects to resolve the Rating Watch when the company provides more details on the transaction, including the buyer, capitalization post sale, and whether any of the proceeds will be used to paydown current outstanding debts at APCo.

Successful execution of the renewable business sale, including APUC’s ownership in Atlantica Sustainable Infrastructure (AY) and APCo should lead to further leverage improvement, as the proceeds from asset sales offset some of the financing needs and lower parent level debt. Fitch expects APUC should be able to execute renewable asset divestiture, as the demand for those assets remains relatively strong. Higher cash flow contribution following several rate case filings should provide additional improvement in leverage in 2025

Source: Fitch

What Kind OF Returns Can You Expect?

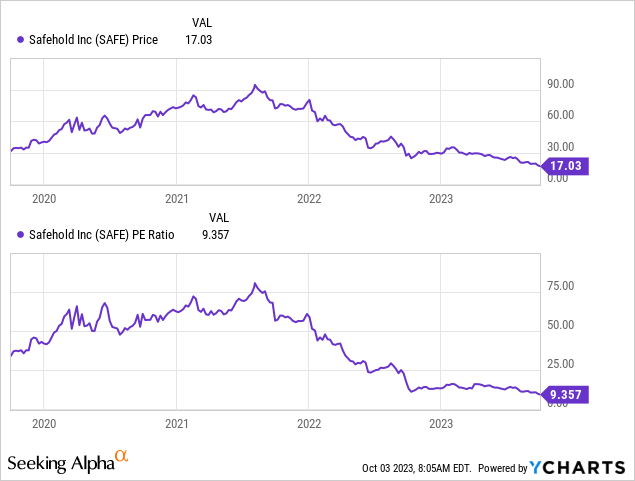

When valuations get compressed, you tend to get solid returns even when things don’t go your way. We are not quite at that extreme level with AQN but close enough that we can make an educated guess. The dividend here looks quite sustainable, so right off you have that 7.6% yield. Growth will be difficult as higher interest rates offset some base rate increases. But even then, 2% growth rates look like a shoe in. The final point of your return profile that most investors ignore, is the change in valuation. This is the reason that even stocks that “grow” can be such poor investments. Safehold (SAFE) our favorite case study for our upcoming book, “Bubbles- And Why You Are Poor” illustrates this. Earnings expanded but valuation contracted and you got your 80% drop.

With AQN, our worst case here is a flat multiple over the next 5-7 years. In other words, the valuation might not help, but likely won’t hurt. So you can get about 9.5% annual returns from here and that certainly makes this a competitive proposition. If we see a valuation expansion, even a modest one, you could see 12%-13% compounded returns from here.

Verdict

No matter how we looked at AQN, we always saw it as a replica of AltaGas (ALA:CA) from the 2017-2018 timeframe. The same unbridled spending was seen in both. Analysts were gushing over the “growth mantra” in both cases. Everyone forgot that these were boring utility assets and you cannot pile up debt to the sky. In fact, when we wrote about these utilities in late 2022, predicting that AQN was going to butcher the dividend, we also had a specific price in mind for AQN’s bottom (you know the one you spot when the tide goes out).

Post that, a bounce 20% higher looks probable. For a longer term trajectory, we take direction from AltaGas. Note below, where the bottom came.

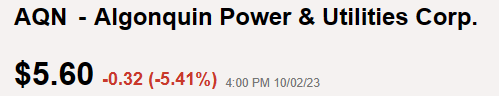

Identical dates not withstanding (that cut came on December 13, 2018), we think a 60% drawdown from the 2022 starting price looks likely. That puts us closer to $5.60 for a final bottom. Watch for the dividend cut announcement which we think is two shoes in for 2023.

Source: Discounted Utilities With Ominous Similarities

And here we are.

Seeking Alpha

In all likelihood, we will be wrong on it bottoming right here, and it probably will go lower, but it is hard to be negative at this valuation. We are hence upgrading this to a buy and will likely initiate some covered call positions for the portfolio.

The Preferred Shares

While we are likely to do the defensive covered call approach, on the TSX side, the preferred shares are looking modestly attractive as well. Algonquin Power & Utilities Corp. PFD SER A (TSX:AQN.PR.A:CA) is a Canadian standard 5-year resetting preferred issue and will reset on December 31, 2023 at 5-year Government of Canada i.e. GOC-5, yield plus 2.94%. The actual reset announcement comes a bit sooner, and that should let you know the yield is locked in. At current interest rates, the preferred shares will yield about 7.24% on par, and that works out to about 9.65% on the current price of $18.75 CAD. This is a solid yield and is currently at an effective 5.3% spread to GOC-5. So this appears to us as a competitive purchase.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We might buy AQN via a Covered Call position or establish a long position in the preferred shares.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

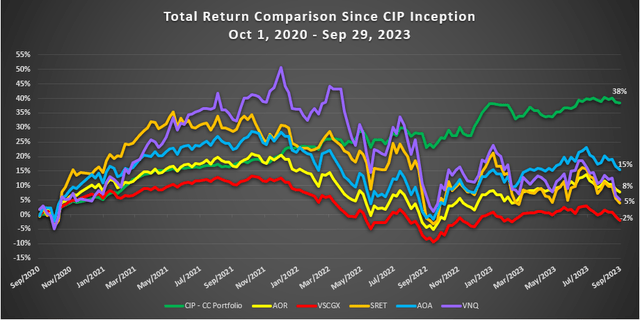

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.