Summary:

- Tilray Brands’ quarterly revenue growth is driven by acquisitions, not organic growth, leading to the company just spinning their wheels.

- Tilray’s shift from cannabis to wellness and beverage alcohol has not solved the issues in the cannabis business.

- The acquisition of craft beer brands is expected to boost reported sales, but past acquisitions have not led to organic growth.

- TLRY stock trades at ~22x adjusted EBITDA targets leading to a Neutral rating.

syahrir maulana

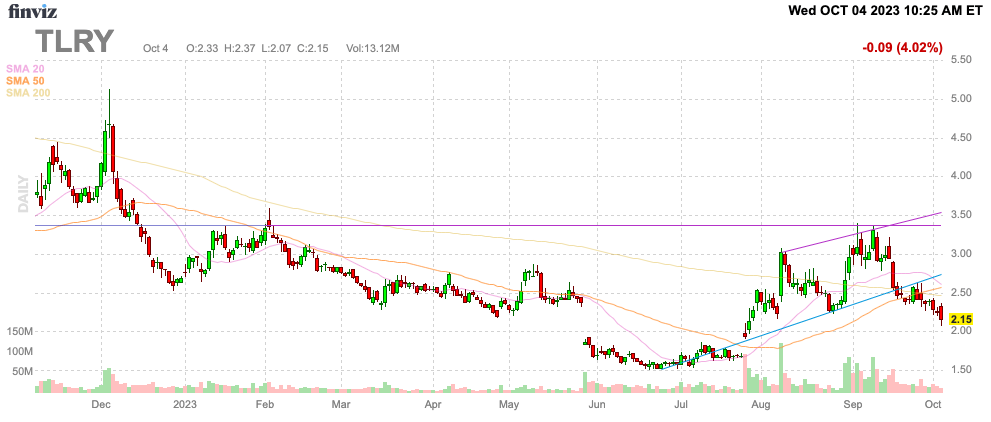

The biggest frustration with Tilray Brands, Inc. (NASDAQ:TLRY) is the company constantly shifting the business around via acquisitions, but the Canadian cannabis company doesn’t appear to ever make a lot of progress organically growing the business. Tilray just reported FQ1 results and the initial excitement over quarterly growth was quickly subdued due to sequential revenue dips. My investment thesis remains Neutral on the stock, as the business appears stable, but Tilray is still spinning their wheels, limiting any potential upside.

Source: Finviz

Acquisitions To Nowhere

Tilray reported FQ1’24 revenue of $177 million for growth of 15.5% over last FQ1. Revenues beat analyst estimates by $3 million, but the numbers have a big hiccup.

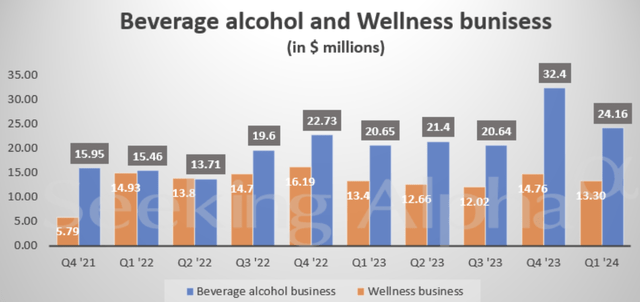

The cannabis company reported FQ4’23 revenue of $184 million. Sales were actually down $7 million sequentially due largely to weakness in the Beverage alcohol business that reported sales down $8 million from FQ4.

The Beverage alcohol business is a key segment to watch due to Tilray just closing the deal to buy 8 craft beer brands from Anheuser-Busch (BUD). The company has a history of buying brands and watching sales slump following the deal close.

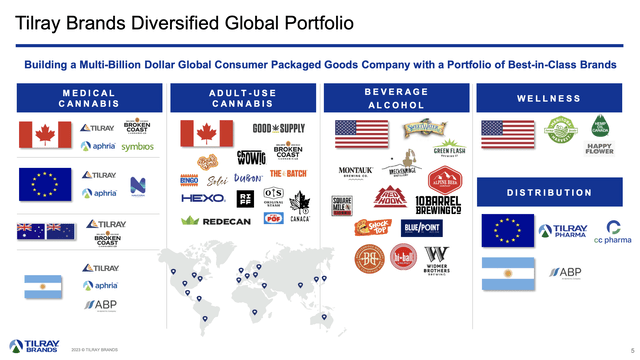

The issue here is a constant frustration with Tilray in the shift of the business from cannabis to Wellness and Beverage Alcohol while never solving the cannabis business. In general, the company now has so many brands in global locations that the company appears very difficult to manage.

Source: Tilray Craft Beer presentation

Investors need to realize all of the YoY revenue growth in FQ1 was due to the closing of mergers for HEXO in June and Truss Beverage Co. in August while the craft beer brands deal was finalized in October and will impact the FQ2 results with 2 months of results.

Cannabis revenues were $70 million, up 20% from $59 million last FQ1. HEXO reported FQ3’23 revenues of $16 million, though revenue was collapsing heading into the merger with Tilray. Again, sales growth was entirely derived via an acquisition and not internal growth.

Now, investors will have to watch the progress of the beverage business listed as the fifth largest craft beer brewer in the U.S. with a market share of 5%. In theory, the reason for such a deal would be the ability of the company to grow market share and end up with a 10% share in a few years, but past acquisitions haven’t led to any growth at all.

Tilray already owned a large set of beverage brands, including SweetWater Brewing Company, Montauk Brewing Company, Alpine Beer Company, and Green Flash Brewing Company. The company now projects the craft beer business goes from 4 million cases of beer to $250 million and 12 million cases of beer.

Executives had promoted a beverage business reaching $300 million when the deal was announced just back in August, so the numbers aren’t clear whether this amount remains the target. With the closing of the Truss Beverage deal in August and those results partially included in the FQ1 results, Tilray makes it very difficult to compare results and derive where the impact on forecasts.

In theory, the Canadian cannabis company is adding ~$200 million in annual craft beer revenue, or around $50 million per quarter. FQ2 sales will jump accordingly based on 2 months of sales.

Tilray’s Depressed Margins

Tilray continues to report depressed adjusted gross margins of just 28% in FQ1, partly due to the low margins of the distribution business. Also, the cannabis revenues were apparently propped up by a wholesale transaction for $3.1 million in cash at a low margin to reduce inventory levels.

As usual with Tilray, the company closes acquisition after acquisition and the numbers just spin around. The adjusted EBITDA in the quarter was $11.4 million, down from last years level of $13.5 million.

The company guided to the previous adjusted EBITDA goal of $68 to $78 million for FY24. After only $11 million during FQ1, Tilray will need to produce over $20 million per quarter the rest of the year due apparently to the craft beer deal being EBITDA accretive.

The stock has a market cap of $1.6 billion placing the valuation at ~21.5x EBITDA targets. The valuation isn’t attractively here, hence the Neutral rating, but Tilray might pop when the company reports FQ2 revenue growth from the craft beer deal.

As mentioned above, Tilray now has pro-forma revenues in the $227 million range. The FQ2 results will only include 2 months of craft beer revenues, but the reported higher sales will likely provide a short-term pop in the stock until the market realizes organic revenues aren’t actually growing.

Takeaway

The key investor takeaway is that Tilray Brands, Inc. is still just spinning their wheels with sales growing due to acquisitions and not organic growth. The stock might get a pop as reported revenues “grow” over the next couple of quarters, but investors shouldn’t chase the stock, as an eventual outcome is likely weaker than expected results with the company failing to juggle all of the businesses in the process.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.