Summary:

- I usually do not bet with Wall Street. But in the case of PayPal, I think Wall Street gets it right this time.

- I see strong fundamentals and catalysts afoot both in the near term and long term to deliver favorable returns.

- Near-term catalysts include its new leadership, ongoing cost-saving initiatives, and new offerings.

- Long-term catalysts include its superb return on capital employed and capital allocation flexibility.

- Despite all the above, the stocktrades around 12x P/E.

lucky-photographer

Thesis

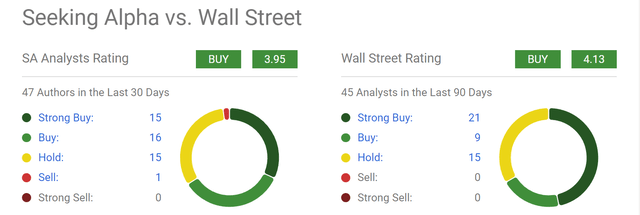

Most investors are familiar with the various limitations associated with Wall Street ratings: near-term focus, herd thinking, and a bias toward the bullish end. But in the case of PayPal (NASDAQ:PYPL), I think Wall Street’s bullish enthusiasm is well justified. As you can see from the following chart, many Seeking Alpha authors have written about this stock. To wit, a total of 47 of them wrote on the stock in the past 30 days, and 31 of them rated the stock as either BUY or STRONG BUY. The ratings from Wall Street are even stronger, with an average rating of 4.13 (vs. 3.95 from Seeking Alpha authors).

In the remainder of this article, I will detail my thoughts on siding with Wall Street on this one. And my main arguments will consist of the fundamental catalysts and the cheap valuation. In my view, this combination generates an upward bias in its price movement both in the near term and long term. In the near term, the key catalysts in my view are the new leadership, its ongoing cost-saving initiatives, and also new initiatives such as Venmo and cryptocurrency offerings. In the long term, its robust return on capital employed, capital allocation flexibility, and strong brand recognition all help to maintain its wide moat and spur growth.

Near-term catalysts

Currently, the stock trades at a price of around $58 per share and a P/E of around 11.8x on an FWD basis. I see several catalysts that could push the stock prices upward in the near term.

To start, the recent appointment of its new CEO, Alex Chriss can act as a positive catalyst for several reasons. First, I view the appointment (which is backed by the unanimous support of the Board and its CEO search committee) as a relief of an overhang among investors regarding the company’s leadership. Chriss’ tenure as both CEO and President will start effective on September 27. Second, Chriss brings a combination of external views and a deep understanding of technology’s role in the payment world, critical to the revitalization of PYPL’s offerings. Chriss, age 46, came from Intuit and had extensive experience in technology and product development. At Intuit, he led the Small Business and Self-Employed Group, which accounted for more than half of Intuit’s revenue. Besides the new leadership, PYPL also has ongoing cost-saving initiatives and capital allocation plans, which are very likely to lead to earnings recovery and/or growth this year. Finally, PYPL has several initiatives afoot to boast avenues. To name a few, its ‘‘Buy Now, Pay Later,’’ Venmo (recently made available to all U.S. Amazon customers), and cryptocurrency offerings, are promising ideas to leverage the company’s strong brand recognition and global reach and create new growth areas.

Long-term prospects

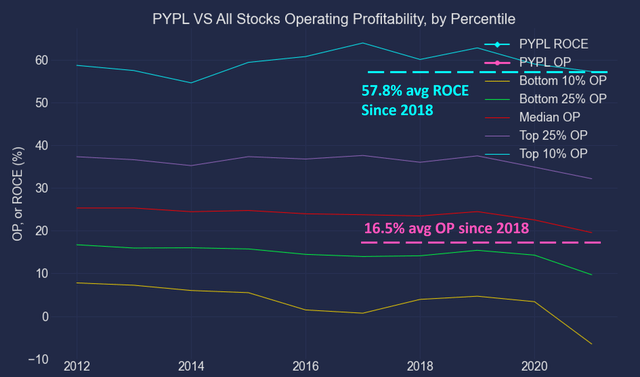

Furthermore, I see excellent prospects for long-term returns as well, with an entry P/E of ~12x. The long-term growth rate of the earning power for a given business is governed mainly by the interplay of two forces: profitability and reinvestment rate. As detailed in my blog article, our preferred metric for profitability is ROCE (return on capital employed) PYPL’s ROCE has been averaging 57.8% in recent years as seen in the chart below, far superior to the average economy.

Source: author based on Seeking Alpha data

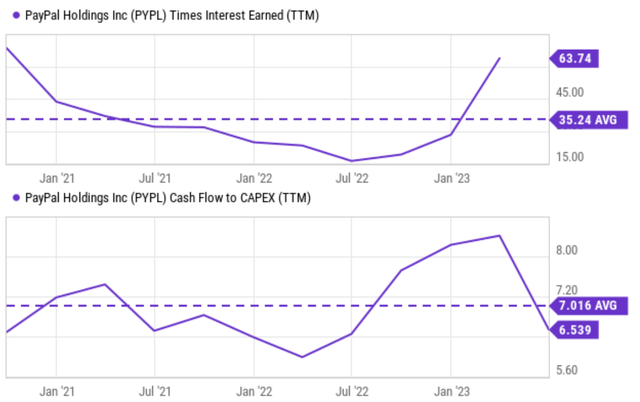

In terms of reinvestment rate, PYPL enjoys tremendous capital allocation flexibility. The business is essentially debt-free. As seen in the top panel of the next chart, its interest coverage ratio is currently 64x (to provide a reference, the ratio for the overall economy is about 6x). In the meantime, it’s a CAPEX-light business also.

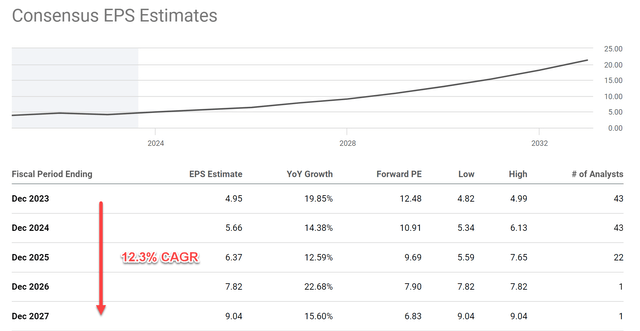

As seen in the bottom panel of the next chart, it has been using on average only ~14% (inverse of 6.53) of its operating cash flow as CAPEX. Therefore, as a result, the majority of its earnings can be allocated freely. My conservative estimate for its growth reinvestment rate is about 10% (more details are provided in my earlier article). With the combination of a 57.8% ROCE and 10% RR, it can sustain ~5.8% organic growth (57.8% ROCE * 10% RR = 5.8%). Consensus estimates are projecting even higher growth rates in the double-digits.

If you think as a long-term business owner, your long-term rate of return would be the sum of A) your owner’s earning yield when you bought the business and B) the organic growth rate. In PYPL’s case, both Part A (about 8% by my estimation) and Part B (5.8% by my estimation and 12.3% base consensus estimates) would be far above market averages because of its low P/E, superb ROCE, and excellent growth prospects as analyzed above.

Source: Seeking Alpha data Source: author based on Seeking Alpha data

Other risks and final thoughts

There are several other risks, both in the downside and upside directions, which are worth mentioning. Uncertain macroeconomic and geopolitical conditions, combined with operational challenges, have resulted in mixed quarterly financial results lately. And these quarterly fluctuations have caused large stock price volatilities in the past 1~2 years. These factors could keep causing uncertainties in its Total Payment Volume (“TPV”) and margins. The company’s initiatives on the crypto front remain in an early stage. On the positive front, its “Buy Now, Pay Later” feature and Venmo are gaining traction and seeing good customer demand.

All told, I see the positives easily outweigh the negatives. The gist of my bull thesis is that it is a catalyst-rich stock for sale at a cheap valuation. As a result, the stock offers favorable odds both for the near and long term. In the near term, immediate catalysts such as new leadership, cost-saving initiatives, and new offerings could push its price upward substantially. In the long term, the combination of low P/E, superb ROCE, and excellent growth prospects can provide annual returns in the mid-teens based on my estimates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

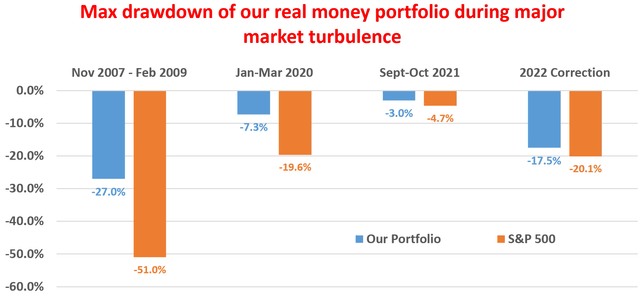

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.