Summary:

- Netflix aims to convert over 100 million non-paying viewers into paying subscribers through a crackdown on password sharing.

- The company’s measures to address password sharing have led to better retention rates and increased paid memberships.

- Netflix’s entry into the advertising market is part of its strategy to diversify revenue streams and reduce reliance on subscription fees.

- Based on our DCF model, Netflix’s fair value hovers around $500, implying a 33% upside from current levels.

Pascal Le Segretain

Investment Thesis

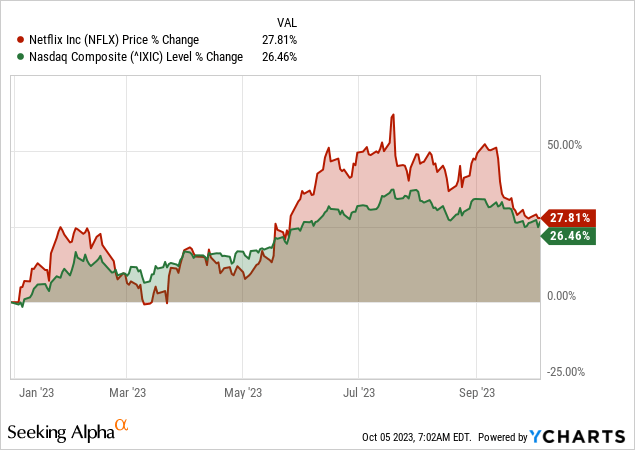

In the ever-evolving landscape of entertainment streaming, Netflix, Inc. (NASDAQ:NFLX) has embarked on a bold mission to convert over 100 million viewers into paying subscribers, a sizable market compared to the current 238.4 million paying subscribers. As the world’s leading streaming giant, Netflix recognized a vast, untapped potential lying within its reach, and it’s not simply about cracking down on password sharing; it’s about unlocking a future where revenue and value potentially soar to new heights, leading to a buy rating.

Converting 100 Million Non-Paying Viewers into Paying Subscribers

Netflix’s decision to address the issue of password sharing is driven by the need to convert non-paying viewers into paying subscribers. Over 100 million borrowers accessed Netflix content without contributing to the company’s revenue. This massive potential user base offered an opportunity for significant revenue and value growth in the long term.

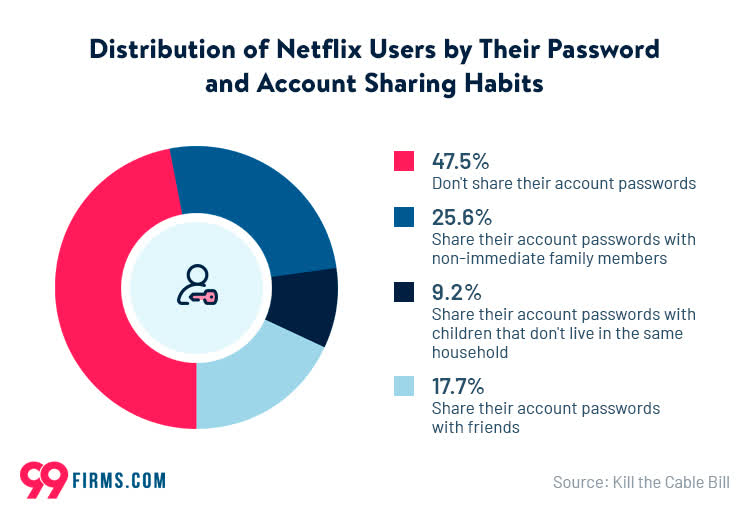

According to 99firms, approximately 41% of Netflix users watch the service without paying. Many Netflix users share passwords or accounts, resulting in non-paying viewers. Additionally, a recent survey in the article found that about 52.5% of Netflix consumers share their passwords with other households. This sharing behavior contributes to many users accessing Netflix content without contributing to the company’s revenue.

By implementing measures that make it more intuitive and user-friendly for members to manage their accounts and subscriptions, Netflix has successfully mitigated the risk of a widespread cancellation of memberships. This approach may not only retain existing members but has also led to better retention rates.

The initial response from members to the crackdown has been relatively muted, with no significant spikes in cancellations reported. This is a positive sign that members understand and accept the need for a crackdown on password sharing. The result is an increase in paid memberships, both individual and extra, contributing to revenue growth.

99firms.com

As Netflix continues to roll out these measures across more than 100 countries, covering over 80% of its revenue base, the company is poised to tap into a vast pool of potential paying subscribers. Netflix’s password-sharing crackdown may produce a healthy mix of sign-ups across different pricing tiers. While individual accounts are encouraged, the company also recognizes the importance of accommodating extra household members.

In terms of pricing tiers, Netflix offers both ad-supported and ad-free options. While the ad-supported tier accounts for a minority of subscriptions, it still contributes to the company’s revenue. Notably, the crackdown on password sharing may show a slight shift towards ad-free subscriptions among spin-off accounts based on users’ preferences for an uninterrupted viewing experience.

Notably, the rollout of measures to crack down on password sharing is not a one-time event but a gradual process that unfolds over multiple quarters. Netflix has adopted a phased approach to the rollout, addressing different aspects of the issue over time.

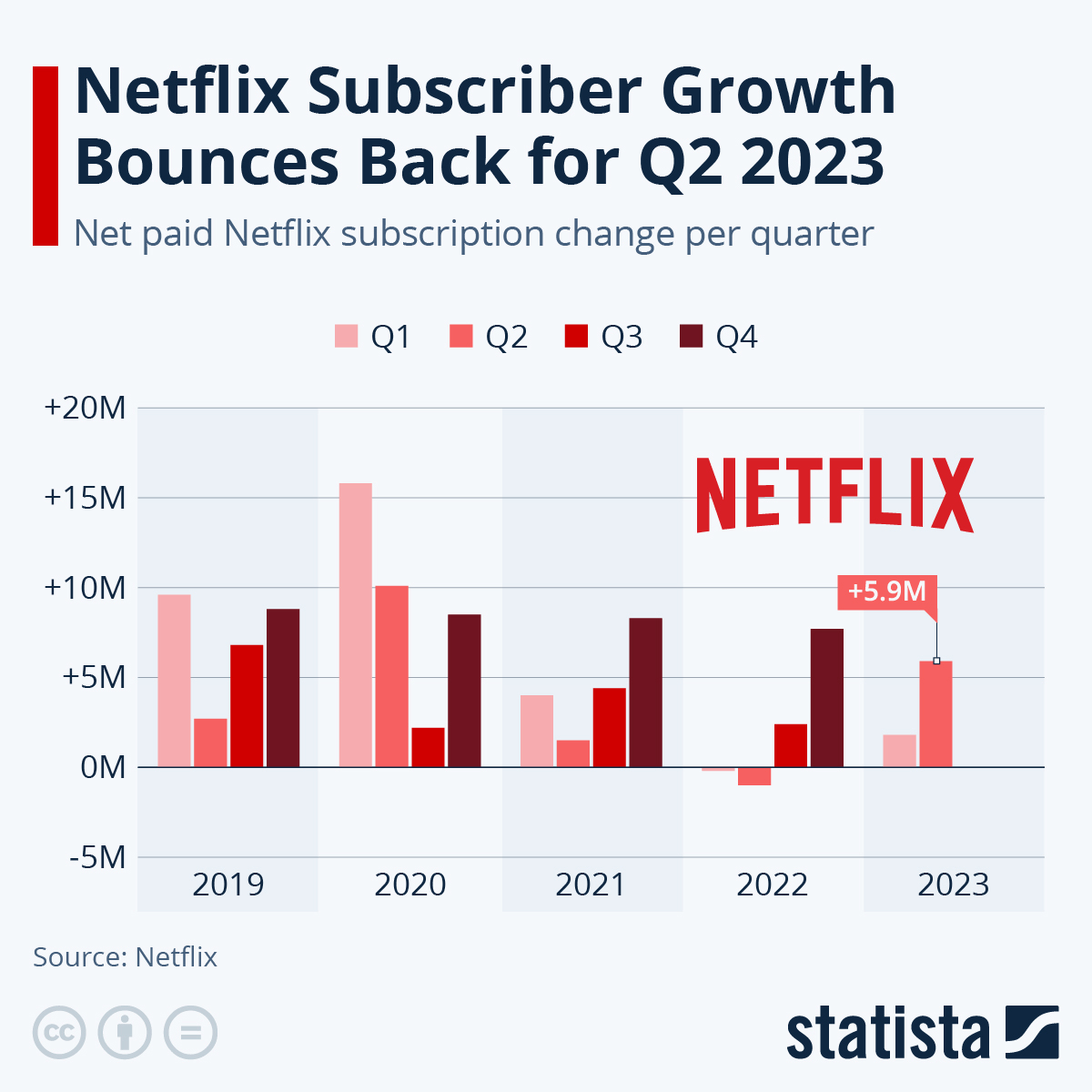

For instance, Netflix achieved paid net additions of 5.9 million in Q2 2023, a significant difference from a year ago when they had -1.0 million. This is attributed to the successful launch of paid sharing. The password-sharing crackdown has been a crucial driver of this positive growth. Therefore, this gradual implementation allows the company to fine-tune its strategy and adapt to member behavior.

statista.com

One of the unexpected benefits of the crackdown on password sharing is improved member retention. New subscribers who sign up due to the crackdown tend to be long-time Netflix viewers familiar with the platform. They exhibit behaviors and retention characteristics similar to those of higher-tenure subscribers. This means these new subscribers are more likely to stay with Netflix for an extended period. This improved retention rate translates into a more stable subscriber base, reducing churn and ensuring a steady revenue stream.

Furthermore, Netflix is offering consumers access to a range of price points. For instance, it dropped the basic plan in Canada and later in the US and UK ($5.99 in Canada, $6.99 in the US, and £4.99 in the UK). This shift allows consumers to choose from ads, no ads, video quality, and simultaneous streams.

These pricing adjustments cater to different consumer preferences and increase the average revenue per member (ARM). It’s important to note that these changes have been well-received, with entry prices in the US, UK, and Canada offering excellent value to consumers. As more subscribers opt for higher-priced plans, it directly impacts Netflix’s revenue.

Overall, the crackdown’s impact may not be immediately apparent regarding revenue growth, as it takes time for the changes to resonate with users and lead to increased paid memberships. The nature of the rollout is such that it is front-loaded, meaning that the impact is more pronounced in the early stages but continues to build over time.

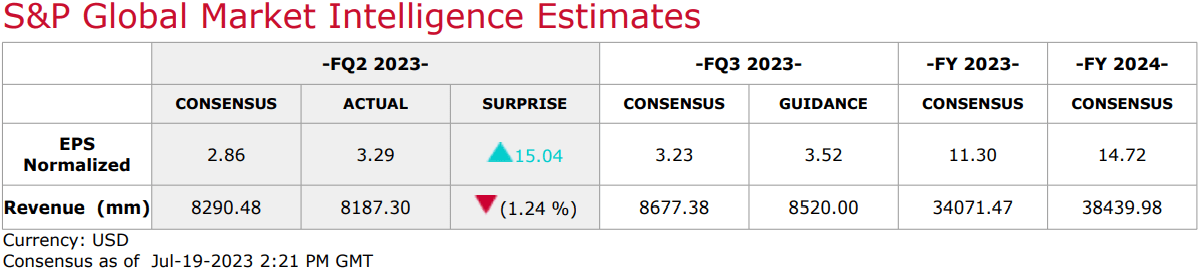

Netflix has emphasized that the initial focus of the crackdown is on increasing paid memberships rather than immediately affecting ARM. Thus, Netflix expects revenue and EPS to accelerate in the coming years, with a full-year impact in 2024 compared to partial-year impacts in 2023.

Q2 2023 Earnings Call

Dual Strategy: Unleashing the Power of Advertising

As a vital note, in addition to the crackdown on password sharing, Netflix is venturing into the advertising market. While still in its early stages, this move can significantly contribute to the company’s long-term revenue growth. By leveraging its extensive user data and viewing habits, Netflix may provide advertisers with valuable targeting capabilities.

The entry into the advertising market is part of Netflix’s broader strategy to diversify its revenue streams and reduce its reliance on subscription fees. Over the long term, this strategy can provide a buffer against potential market saturation and offer additional avenues for revenue growth.

This advertising factor will be a balancing factor against the estimation error in quantifying the fundamental impact on value through the crackdown. In simple words, the advantage of the advertising move is not considered during the computation of the valuation impact on Netflix’s stock price during the crackdown. However, the ad move may benefit Netflix so that the benefit may be integrated into the stock price by the efficient market simultaneously with the benefit from the password-sharing crackdown.

In Q3 2023, Netflix is forecasted to attain a YoY revenue growth of 7.5%. However, on a long-term basis, ARM growth has decelerated during past financial years to below 1% YoY growth in 2022 (vs. 2021). Therefore, in the DCF model, decelerating ARM, membership, and revenue growth have been taken into account to quantify the fair value with a gradual enhancement of paid sharing.

Interestingly, during Q2, the ARM declined by 3% YoY, primarily due to limited price increases in the past year and the rollout of paid sharing. While this might seem counterintuitive, it’s part of a strategic plan. Netflix paused price adjustments during the paid sharing rollout, but in the long term, they expect ARM to benefit from both price adjustments and the impact of paid sharing.

Unlocking Netflix’s Future: DCF Valuation Scenario

Additions from the crackdown remain a long-term process; therefore, three conservative scenarios (with decelerating growth projected forward until 2027 and zero terminal growth) are used for Netflix’s valuation. The following assumptions have been accounted for in the DCF model:

- First, the annual revenue, average monthly revenue per paying membership, and average paying membership figures have been used from Netflix’s SEC filings (10-K) for 2022, 2021, and 2020 to derive Netflix’s growth rates (CAGR).

- Then, we assumed an even conversion over five years of the 100 million non-paying subscribers based on the following scenarios:

- Optimistic: 80% additions over five years

- Base: 40% additions over five years

- Pessimistic: 20% additions over five years.

- We estimated the additional revenue to be generated evenly across five years and derived the total projected revenue for the firm.

- Then, we applied a levered free cash flow margin of 58.5% (5-year average) to derive the annual levered free cash flow.

- We applied a cost of equity of 11% to discount the levered free cash flows.

- The present values for each scenario have been divided by the number of outstanding diluted shares, which is around 451,572,000 as of Q2 2023.

- Finally, we arrive at Netflix’s estimated fair value of $503, suggesting a 33% upside from current levels.

| DCF Summary | Conversion | Target | Probability | Estimated Value |

| Optimistic | 80% | $554 | 25% | $138 |

| Base | 40% | $495 | 50% | $248 |

| Pessimistic | 20% | $466 | 25% | $117 |

| Current share price | $377 | $503 |

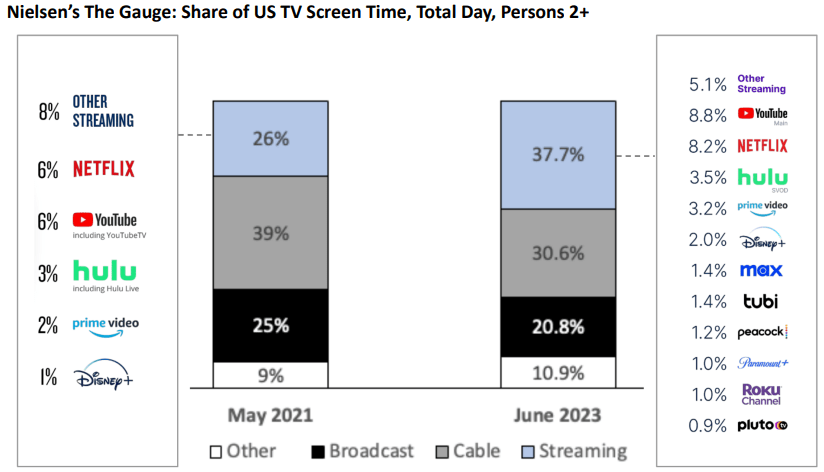

Netflix Faces Fierce Competition

Netflix operates in an intensely competitive market against legacy entertainment giants like Disney (DIS), Comcast (CMCSA), Paramount (PARA), and Warner Bros. Discovery (WBD). It is also in direct competition with big tech players such as Apple (AAPL), Amazon (AMZN), and Alphabet’s (GOOG) (GOOGL) YouTube. This competition has intensified as these companies invest heavily in their streaming services.

Finally, Netflix has historically relied on subscriber growth to drive revenue and project content spending. However, there’s a reasonable cap on how many subscribers it can acquire, especially in mature markets. Therefore, as the company saturates its user base, it may struggle to maintain the same level of revenue growth.

Q2-23-Shareholder-Letter

Takeaway

In conclusion, Netflix’s aggressive password-sharing approach may be a game-changing strategy. Netflix may accelerate sustained growth by targeting the massive pool of non-paying users, implementing user-friendly measures, and diversifying into the advertising market.

While the impact may not be immediate, the gradual rollout is expected to bolster revenue and valuation in the long term. With improved member retention and pricing adjustments also in play, Netflix is set to maintain its dominance in the streaming industry and offer investors promising upside potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.