Summary:

- Carnival Corporation’s stock is up 64% this year, but recent turbulence following its third-quarter earnings report has dampened investor sentiment.

- Rising fuel costs have presented a challenge to Carnival’s financial performance and post-pandemic recovery.

- I am impressed by some of the recent strategic decisions taken to manage Carnival’s massive debt load effectively.

- My investment thesis is centered around the improving odds for sustainable long-term earnings growth.

SeregaSibTravel

When the Covid market crash in March 2020 wreaked havoc, I was quick to pounce on Carnival Corporation (NYSE:CCL) as I thought the market reaction was exaggerated. I booked a handsome profit when I exited my position a year later in 2021, but to be fair, I realized Mr. Market was not as irrational as I thought when it punished Carnival during the Covid crash. In May 2022, I thought another opportunity was brewing to invest in Carnival but I did not invest in the company as CCL did not seem to fit my portfolio at that time. Since then, I have had a hold rating on Carnival, but after digesting the company’s third-quarter earnings, I have decided to upgrade my rating despite the mixed short-term outlook for the company. This rating upgrade comes on the back of my belief that Carnival, through recent strategic decisions, is improving the odds of sustainable earnings growth in the long run.

Rising Fuel Costs

Carnival stock is up 64% this year, but this impressive performance has been met with recent turbulence following the company’s third-quarter earnings report. While Carnival managed to achieve positive net income for the first time since the onset of the pandemic, investor sentiment was dampened by the sobering reality of its substantial debt burden and the persistent volatility in oil prices, which cast a shadow over the company’s path to recovery. Moreover, management’s less-than-optimistic profit guidance for both the upcoming quarter and the full fiscal year contributed to the sell-off, raising questions about the cruise giant’s ability to navigate the challenges ahead.

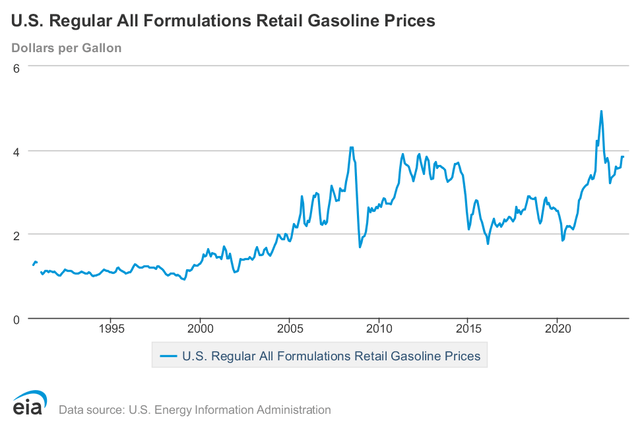

The surge in gasoline prices, as indicated by data from the U.S. Energy Information Administration, has presented a formidable challenge to Carnival. August witnessed a notable escalation in gasoline costs with prices reaching a peak of $3.984 per gallon during the third week of the month. Gasoline prices remained elevated at $3.798 as of October 2.

Exhibit 1: Gasoline prices

As revealed during the earnings call, Carnival’s management observed a substantial 20% surge in oil prices when compared to levels observed in June. This unanticipated escalation in both oil prices and the strength of the U.S. dollar has translated into a substantial financial burden for the company, with an estimated additional cost of $130 million in the upcoming fourth quarter. This financial impact erases a significant portion of the company’s earlier $200 million outperformance excluding fuel and currency factors, in comparison to the original guidance provided in June.

Josh Weinstein, CEO of Carnival, said during the call:

We still expect our 2023 adjusted EBITDA to be $4.1 billion or more, which is well within our prior guidance range, and we’re raising our net income expectations for the year.

Carnival follows a unique approach to managing fuel costs, distinct from some of its industry counterparts, which involves refraining from hedging against oil price volatility. During Q&A, CEO Weinstein highlighted the company’s cautious approach to hedging. While some investors may advocate for hedging as a means to mitigate wild earnings swings and enhance long-term investment appeal, Weinstein highlights the selective nature of the company’s approach. He suggests that hedging involves making wagers contingent on market conditions, and empirical studies they’ve conducted reveal that the benefits may be overshadowed by costs. Mr. Weinstein emphasized that the long-term value of Carnival, factoring in aspects such as cash flow generation and discounting, remains largely unaffected by hedging.

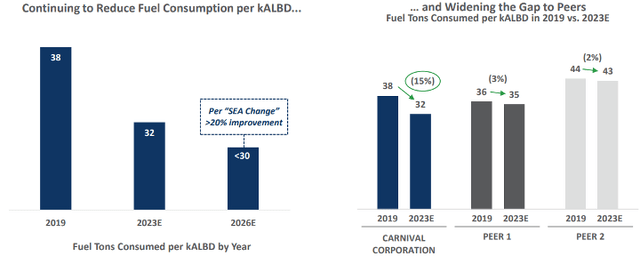

In place of hedging, the company has placed a strategic emphasis on fuel optimization technologies and continuous enhancement of fleet fuel efficiency. Carnival’s management asserted its position as an industry leader in fuel efficiency, boasting a remarkable 16% reduction in fuel consumption per available lower berth day (ALBD) compared to pre-pandemic levels in 2019. This concerted effort has yielded substantial savings of $375 million for the company this year, underscoring the effectiveness of its approach in mitigating the impact of volatile fuel prices and reaffirming its commitment to sustainability and cost management.

Exhibit 2: Carnival’s fuel consumption trends

Carnival does not have a say over global fuel prices but the company, in my opinion, has proven its efficiency in the face of rising prices so far this year. This resilience, in turn, has boosted my confidence in its ability to weather future macroeconomic headwinds better than it did in the past.

The Debt Burden

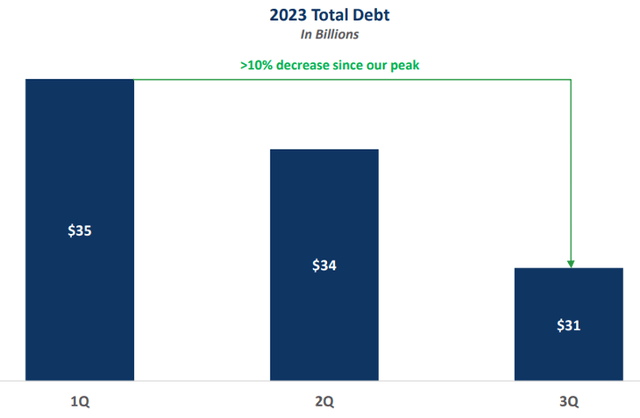

The challenges faced by the cruise industry in its recovery from the pandemic are reflected in the financial performance of Carnival Corporation. Unlike some sectors that received substantial government support, cruise operators turned to financial markets, accumulating significant debt to weather the storm. Carnival’s towering debt load, surpassing $30 billion, remains a cause for concern among investors, particularly in light of high interest rates.

Carnival is actively working to reduce this debt burden. Strategic refinancing measures, including the retirement of high-cost debt and accelerated repayment efforts, have started to yield results. Over the past six months, the company has successfully reduced its debt balance by over 10%, representing a substantial reduction of nearly $4 billion since the first quarter of 2023. This proactive approach aims to bring the debt burden below $31 billion by the end of the year.

Exhibit 3: Total debt

The company’s adept management of its debt maturity profile by extending the bulk of maturities to 2025 and beyond and thereby dealing with a relatively manageable debt profile today, coupled with a debt portfolio primarily consisting of fixed rates, provides a degree of financial stability. However, 2024 presents a unique set of challenges. The increase in dry dock days, up 18% from the previous year, along with the acquisition of three new ships, will impact year-over-year cost comparisons and potentially limit the free cash flow available for debt reduction. Nevertheless, management anticipates a more favorable debt paydown trajectory in subsequent years, with fewer ship acquisitions on the horizon, providing a potential opportunity for accelerated debt reduction.

David Bernstein, Chief Financial Officer of Carnival, said during the Q&A session with analysts:

Remember that in 2024, we do have three ships for delivery. And so, that probably will be less debt reduction in ’24 than in ’25 and ’26, where in ’25, we only have one ship. And in ’26, we don’t have any ships on order.

He further highlighted that dry dock days are anticipated to add between three-quarters of a percentage point to one percentage point to the company’s overall cost structure. However, there is optimism stemming from the increased efficiency of new ships compared to the existing fleet, potentially resulting in a 1% reduction in operating costs due to economies of scale. Despite this, the extent of this effect may be influenced by ongoing optimization efforts within the existing fleet. Carnival is in the process of evaluating these variables, and a more definitive outlook is expected in the coming months.

The Soaring Demand

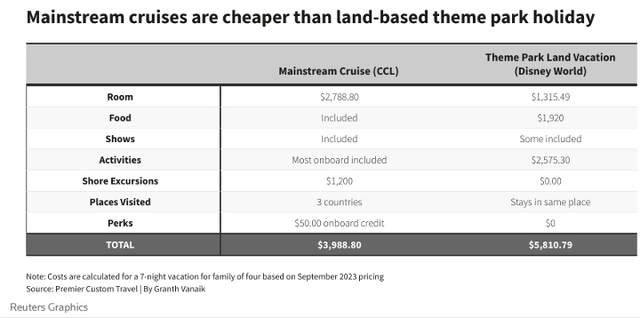

Cruise operators, including Carnival, are currently navigating a favorable landscape marked by robust demand and pricing power. Carnival management’s revelation of advanced bookings for the full year 2024, exceeding historical levels and commanding higher prices, signals an encouraging trajectory. Post-pandemic pent-up travel demand and cost advantages compared to leisure hotels have bolstered the cruise industry. Cruise pricing currently offers a cost advantage of 35% to 40% compared to prices at leisure hotels and resorts.

Exhibit 4: A comparison of costs associated with a cruise holiday and a Disney World vacation

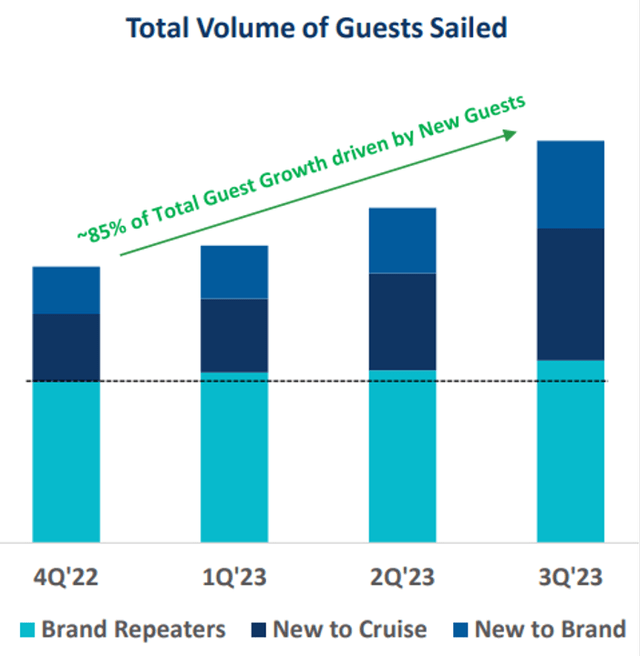

Given this favorable landscape, Carnival’s booking volumes surged in Q3, reaching almost 20% above Q3 2019 levels, with an impressive 170% increase in first-time cruisers compared to 2021. This surge in demand translated into record quarterly revenues and the restoration of occupancy rates to pre-pandemic norms. Management expressed confidence in the company’s booked position but acknowledged the potential for booking volumes to taper as inventory saturation looms.

Exhibit 5: Total volume of guests

Carnival’s revenue base exhibits a recurring and predictable nature, with over half of its guests being repeat cruisers. Over 50% of the next 12 months are booked at any given time, while 40% of onboard revenues are now generated through pre-cruise sales – a notable 11-point increase from 2019. The company anticipates a 5% capacity increase for 2024, poised for strong net yield improvement compared to 2023, with occupancy levels expected to return to historical norms. Despite this capacity increase, the company possesses less remaining inventory to sell than in the prior year, further reinforcing the potential for higher pricing.

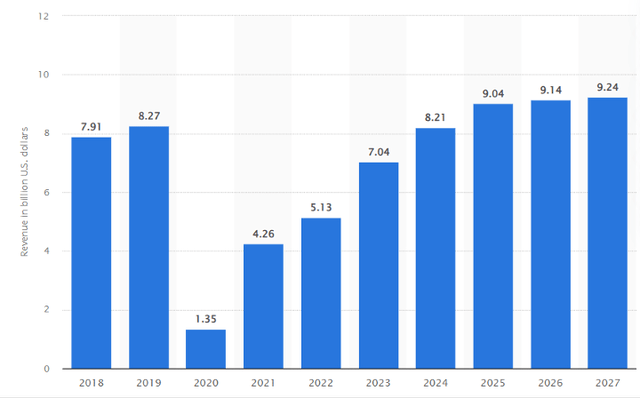

Additionally, in Europe, Carnival’s brands have displayed resilience, with occupancy levels closely approaching 2019 figures. Specifically, Costa and AIDA brands achieved a remarkable 119% occupancy rate in August. The overall European market for cruises appears promising, as indicated by Statista’s report of significant revenue growth in the cruises segment of the travel and tourism market. The anticipated continuous increase in revenue between 2023 and 2027, amounting to a 31% growth, underscores the positive prospects for the European cruise industry.

Exhibit 6: Revenue of the European cruise sector

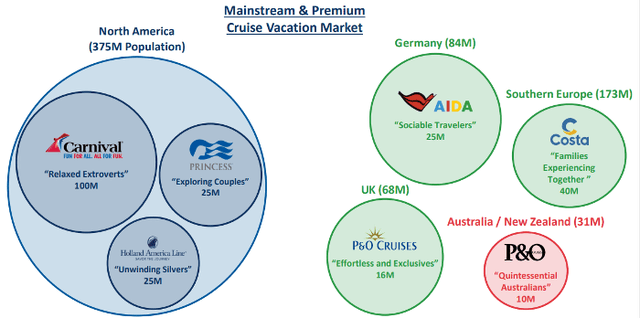

Carnival’s strategic segmentation approach identifies differentiated target segments across key regions, each with substantial market potential. In North America, Carnival, Princess, and Holland America Line cater to distinct groups such as relaxed extroverts, exploring couples, and unwinding silvers, representing a combined potential reach of 150 million. In Germany, AIDA focuses on sociable travelers, tapping into a market of 25 million in a country with a population of 84 million. Southern Europe, with its 173 million inhabitants, sees Costa targeting families experiencing together, potentially reaching 40 million. In the UK, P&O Cruises addresses effortless and exclusive categories, appealing to 16 million in a country with a population of 68 million. Lastly, in Australia and New Zealand, P&O Cruises targets quintessential Australians among a population of 31 million, presenting a potential market of 10 million. This segmented approach strategically positions Carnival to cater to diverse customer preferences across regions, maximizing market penetration and revenue potential.

Exhibit 7: Carnival’s segmented approach

While prices are expected to be upwardly revised as occupancy nears pre-pandemic levels, the cruise industry’s strategy of lowering prices initially to attract passengers, coupled with record onboard spending, has proven effective. The noteworthy shift toward higher ticket prices, accompanied by a steady level of onboard spending, underlines the industry’s adaptability and passengers’ willingness to invest in onboard experiences. The ability to pull forward a significant portion of onboard spending can be seen as a promising trend, offering potential for further growth in this area. This balanced approach between ticket prices and onboard spending contributes to the company’s overall revenue stability and growth.

Takeaway

An evaluation of Carnival’s prospects reveals a mixed outlook for the company. While the company grapples with a substantial debt load that can delay de-leveraging efforts when faced with unexpected cost increases, there is substantial potential for upside in the stock if oil prices stabilize. Management’s cautious approach to providing precise cost projections, as they diligently assess plans across the company’s diverse brands for 2024, reflects a prudent stance in the face of evolving market dynamics. Despite short-term challenges, Carnival is showing resilience and adaptability in the post-pandemic cruise world. Rising ticket prices and a steady level of onboard spending underscore the company’s ability to maintain revenue stability and growth. At a forward price-to-sales ratio of less than 1, I believe Carnival is cheaply valued given its potential to dominate the cruise industry in the long run, attracting premium valuation multiple.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CCL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!