Abercrombie & Fitch: Limited Margin Of Safety At Current Levels

Summary:

- Abercrombie & Fitch has massively outperformed the retail sector, with its stock up over 200% year-to-date.

- The company reported strong Q2 results, beating sales estimates and raising its full-year outlook, with its incredible performance making its FY2025 targets look very achievable.

- However, ANF is now looking close to fully valued short-term & the stock is showing signs it might be getting close to topping out after what’s been an incredible run.

jetcityimage

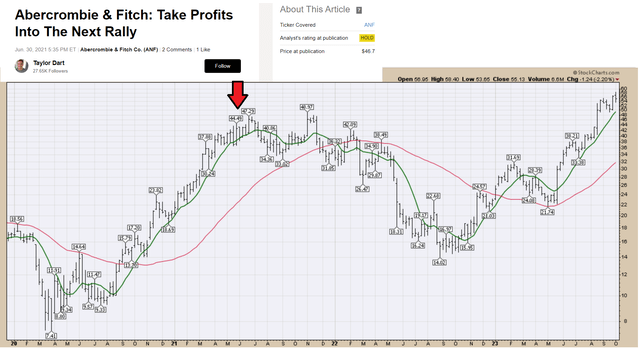

While it’s been a massacre the past few months for the Retail Sector (XRT) with several large-cap names plunging over 50% from their highs, Abercrombie & Fitch (NYSE:ANF) has been one of the few outperformers, and it has led massively. This is evidenced by the stock outperforming previous sector leaders like Dollar General (DG) by over 200% year-to-date, an incredible performance considering the worsening macro backdrop that’s made it more difficult for companies to grow sales and deliver on their projections. However, while ANF has trounced its peers with ease and just came off another strong Q2 report, the stock is showing signs it could be topping out short-term, similar to when I warned on the stock at $46.00 in June 2021 before a violent 70% decline. Let’s take a closer look below:

Abercrombie Weekly Chart & June 2021 Article Update – StockCharts.com, Seeking Alpha PRO

Recent Results & Industry-Wide Trends

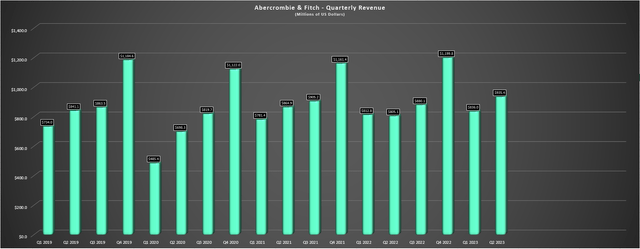

Abercrombie & Fitch (“Abercrombie”) released its Q2 results in late August, surprising the market with a double-digit beat on sales estimates, with revenue soaring to $935.4 million (16% year-over-year), its best Q2 performance in years. This prompted the company to raise its full-year outlook to 10% sales growth while also guiding its operating margin higher to 8-9% vs. a previous outlook of 5-6%. Not surprisingly, this massive beat with significant sales leverage and the benefit of lower freight costs helped the company to deliver strong earnings growth, with quarterly earnings per share soaring to $1.10 and FY2023 annual EPS estimates are now sitting at $4.40. Given this significant beat, the stock has tacked on another 15% gain since its results were reported, a massive divergence vs. the Retail Sector which has slid roughly 6% after an already brutal August.

Abercrombie – Quarterly Revenue – Company Filings & Author’s Chart

Digging into the results a little closer, Abercrombie noted that its strong margin performance was driven by average unit retail gains combined with lower freight costs, with operating margins of 9.6% in the period, just shy of its long-term 10% target. Meanwhile, its inventory was down 30% year-over-year, marking another impressive statistic, given that several retailers like Nike (NKE), Foot Locker (FL) have struggled to keep inventories down in the softer macro backdrop. And those that have shed inventory have done so at promotional prices with accelerated liquidation, like The Children’s Place (PLCE). Finally, while ANF’s consolidated sales performance was impressive with the Americas region leading with 19% growth, its performance at Abercrombie was even more impressive, up 26% year-over-year, while Hollister came in at 8% with the company noting that “efforts to evolve the brand’s positioning and assortment are paying off”.

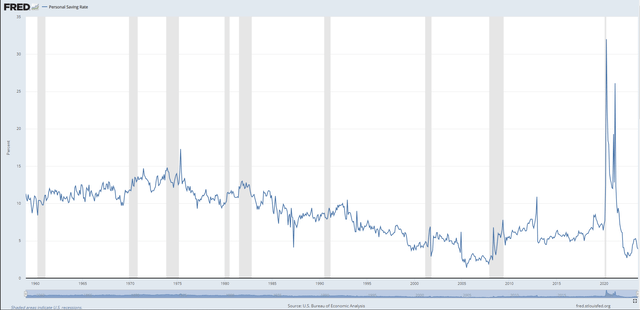

Following the impressive results, Abercrombie’s ambitious FY2025 targets outlined in last year’s Investor Day targets are looking much more attainable, with FY2023 revenue set to come in north of $4.0 billion, just shy of the top end of its FY2025 goal of $4.3 billion. In fact, its long-term target of $5.0 billion is also looking much more achievable as well if the company can continue to fire on all cylinders and win some market share, and the company has made major strides from its low point last decade on allegations of discrimination, with it being awarded the designation of one of the best places to work in retail by Fortune in 2021. That said, the company does have its work cut out for it given the difficult macro backdrop even if it’s making impressive headway on its long-term goals, with personal savings rates continuing to hang out near multi-year lows below 4.0% and set to dip lower with gas prices on the rise and mortgage/rent costs not getting any cheaper.

Personal Savings Rate – FRED, BLS

Given the difficult macro backdrop; a mediocre start to the Q3 reporting season from Nike; plus warnings of some check management in sensitive industries like restaurants (in addition to traffic declines), I think it’s tough to be overly optimistic about another beat in fiscal Q4, even if Abercrombie has trounced estimates to date. In addition, the company is in the unfavorable position of now having to lap difficult comparisons in FY2024 against what could be an even more challenging macro backdrop as credit card balances hit an all-time high of ~$107 billion in Q2 2023 in Canada and over $1.0 trillion in the United States, suggesting things are getting tighter for the average consumer. So, given this setup of difficult comparisons and a foggy outlook over the next year in regard to consumer demand, I think investors should demand a larger margin of safety, especially when the risk-free rate is the highest it’s been in well over a decade.

Unfortunately, as ANF’s valuation shows, this isn’t the case, with the stock up ~300% off its lows and no longer trading at a deep discount to fair value. In fact, the stock is now sitting at closer to full value even if it meets upgraded estimates and sentiment surrounding the stock is overly positive, which could lead to a sharp decline in the stock if it can’t keep up its pace of regular beats each quarter which has buoyed the stock over the past several months. Let’s take a look at the valuation and technical picture below:

Valuation & Technical Picture

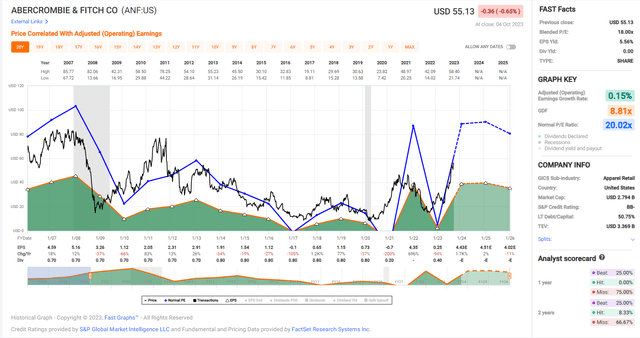

Based on ~52 million fully diluted shares and a share price of $55.00, Abercrombie trades at a market cap of ~$2.85 billion and an enterprise value of ~$3.40 billion, leaving it towering over other most other apparel companies like Boot Barn (BOOT), Buckle (BKE), and The Children’s Place which have massively underperformed ANF over the past year. However, ANF is hitting the point where its relative value has become much less compelling on a relative and absolute basis above $55.00. This is because the stock has now soared from a valuation of barely 7x forward free cash flow to over 16x free cash flow on an EV/FCF basis using FY2024 estimates, a valuation that offers minimal margin of safety for new investors, especially if the macro situation worsens, with this not priced into ANF in the slightest after its ~300% rally.

Abercrombie – Historical Earnings Multiple – FASTGraphs.com

Meanwhile, if we look at the stock from an earnings standpoint, ANF is now trading at ~12.4x FY2024 earnings estimates, and I would argue that a more conservative earnings multiple for the stock is 13.0x earnings in the current rate environment where we’ve seen significant multiple compression across nearly all sectors. If we assume FY2024 earnings estimates of $4.50, this points to a fair value for Abercrombie of $58.50, translating to just a 5% upside from current levels. And while this might interest some investors, I’m looking for a minimum 30% discount to fair value for mid-cap stocks and ideally closer to 35%, suggesting that the stock’s low-risk buy zone is significantly lower at $38.00, providing a very margin of safety for new investors here.

Obviously, I could be wrong, and ANF has certainly defied gravity this year, being one of the few retail names to charge to new 52-week and multi-year highs. However, the stock’s rally looks to be getting long in the tooth here with the stock trying to make new highs this week and show follow-through above short-term resistance but immediately reversing on above-average weekly volume. So, with the stock extended short-term, beginning to show a minor change of character from a negative standpoint and being miles above its 250-week moving average at $25.00, I see far more attractive reward/risk bets elsewhere in the market today. One name that stands out is B2Gold (BTG), which trades at just ~6.0x FY2025 free cash flow estimates with a ~5.6% dividend yield, making it a rare mix of growth and value as it brings as new high-grade gold mine online in Nunavut.

Summary

Abercrombie & Fitch has enjoyed an incredible rally off its 2022 lows, trouncing the performance of its peer group and continuing to exceed most investors’ expectations. Meanwhile, the company did a decent job of buying back additional shares during 2022, and is one of the few apparel retailers that has seen a significant increase in annual EPS vs. FY2019 levels. That said, I prefer to buy stocks when they’re hated and trading near double-digit free cash flow yields and while ANF has executed near flawlessly over the past year; the stock is neither hated nor cheap here after its near parabolic rally. So, while the stock could certainly head higher, it would not surprise me to see some rotation into more beaten-up names with the easy money having been made already in ANF.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.