Summary:

- Tesla Inc. boasts industry-leading profitability margins, which are set to expand as the adoption of electric vehicles advances and market leaders emerge following the price war.

- I anticipate Tesla will maintain its EV market leadership, projecting a 38% annualized sales growth over the next decade, coupled with diversification into other clean energy ventures.

- Today, Tesla is trading at a discount compared to its 5-year historical valuation averages, with a Fair Value of $324, indicating a 29% discount.

Justin Sullivan

Investment Thesis

Just before COVID-19 swept across the world in January 2020, I had an intense discussion with a friend of mine who is an investor himself. During our conversation, we placed a bet on Tesla, Inc. (NASDAQ:TSLA).

In Q3 2019, Tesla reported its first quarterly profit of $143 million, marking the beginning of its exceptional performance in the stock market.

At that time, Tesla was on a hot streak for over two quarters with the stock price reaching a high of $450, prior to all the stock splits. I bet against the possibility of the stock surpassing $700 by the end of Q1 2020, citing the significantly elevated valuation and defying logic of market gravity.

Looking back, I was completely wrong. Tesla peaked just shy of $1,000 that quarter, with my failing to realize its potential.

Even a legend like Warren Buffett acknowledged that he doesn’t want to compete with Tesla CEO Elon Musk and Tesla, leading him to divest from BYD Company Limited (OTCPK:BYDDF).

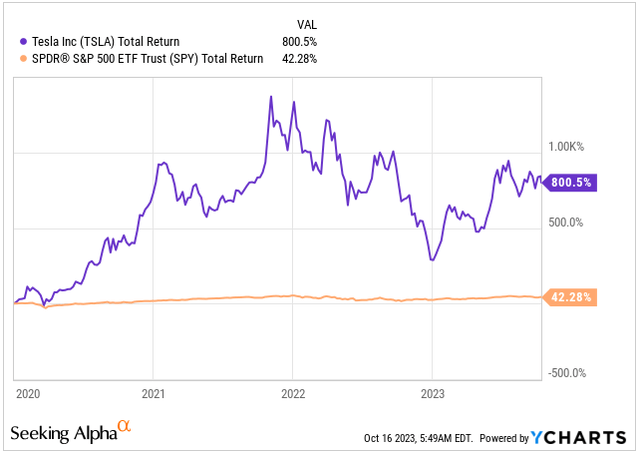

It’s needless to say since then, Tesla has embarked on a remarkable journey and has become a highly profitable business, delivering outstanding returns to its investors, well above the market returns (SPY).

Sometimes, the ability to adjust your strategies and think innovatively, even if it challenges your established principles, is crucial for making well-informed and successful investment decisions.

Let me show you why I like Tesla here, before the Q3 announcement tomorrow post-market on October 18th.

From Zero to Hero and Beyond

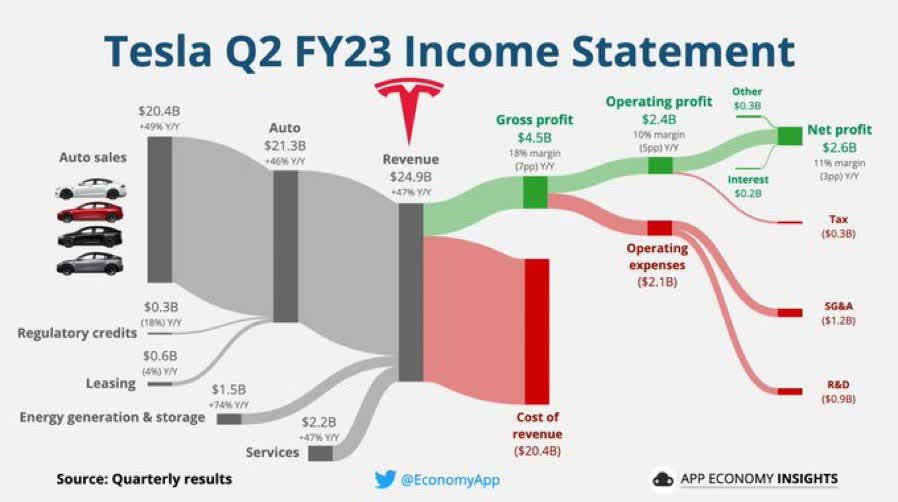

As of Q2 FY23, the majority of Tesla’s $21.3 billion revenue has come from its personal electric vehicle (“EV”) business. Tesla has achieved remarkable growth, with a revenue increase of 3.946% since 2013. This translates to an extraordinary annual growth rate of 395%.

Income Statement (App Economy Insights)

From its inception, Tesla struggled as a highly unprofitable venture, heavily reliant on government subsidies. At a critical juncture in 2008, the company narrowly dodged bankruptcy, nearly running out of cash, as disclosed by CEO Elon Musk.

This stark reality underscores the immense risks early-stage businesses face, serving as a reminder that regardless of a company’s potential or quality, any business is susceptible to going underwater.

Despite these challenges, the company persevered. Tesla has shifted from years of negative profits to an impressive operating income of over $13.7 billion by the close of 2022. At the end of 2022 its Operating Margin stood at 16.8%, leading the auto industry.

Naturally, as EVs are still a relatively new market, they are experiencing explosive growth. In 2020, EVs accounted for only 2.2% of the total car market in the U.S. By the end of 2022, this figure had risen to 6.1%, and it is projected to reach 8.5% by the end of 2023.

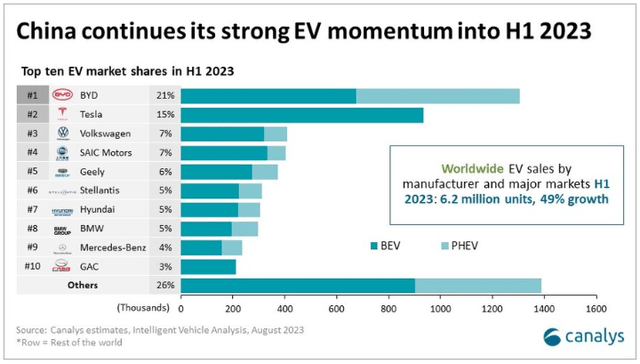

While the percentage of EVs in the total car market is an important metric, it’s even more crucial to consider the fact that in H1 2023, 16% of global light vehicle sales were EVs. This represents a 49% growth from the previous year, and this trend is expected to accelerate further as countries intensify their efforts to restrict sales of conventional combustion vehicles.

In recent years, the EV market has become significantly more competitive, with major players like Volkswagen (OTCPK:VWAGY), Ford (F), Stellantis (STLA), BMW (OTCPK:BMWYY), and Mercedes-Benz (OTCPK:MBGAF) entering the race alongside many other companies.

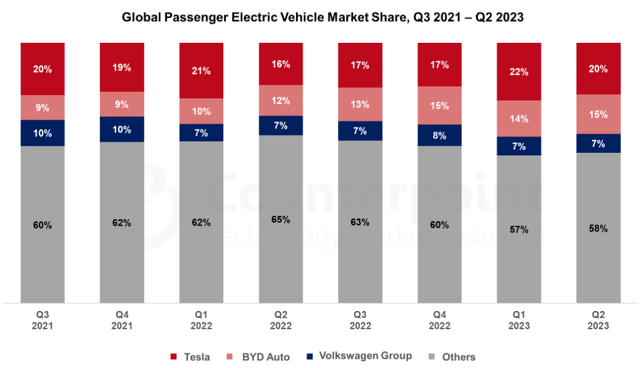

While Tesla currently boasts the largest market share at 20%, this figure is actually lower than the market share of 22% in Q1 2023. The intensifying competition has sparked a price war among manufacturers, leading to a race to the bottom, where companies prioritize gaining or retaining market share over maximizing profitability.

EV Market Share (Counterpoint)

Just consider the fact that in the U.S. alone, Tesla’s Model 3 is the best-selling EV. Its transaction price fell by 21% in August YoY, with other models following suit.

Tesla’s advantage lies in its direct-to-consumer sales approach, bypassing dealerships and other intermediaries. This strategy grants them better control over pricing and eliminates additional expenses, making them more agile vs. the competitors.

This phenomenon underscores Tesla’s ability to maintain its market share. However, as Elon Musk himself has stated, the company is focusing on boosting sales over profits, with the hope that Tesla’s elusive full self-driving (“FSD”) software will eventually bolster profit margins.

While this strategy of prioritizing consumer adoption over immediate profitability is a clever move, it hasn’t resonated well with investors, even though historically Elon Musk has been known to take bold risks.

The battle for market share is particularly prominent in China, a country that is spearheading the transition accounting for 55% of global EV sales, closely followed by Europe, the second largest market.

What is somewhat concerning is that during H1 2023, BYD’s vehicles accounted for the majority of EV sales at 21%, with Tesla following closely behind at 15%.

Indeed, the intense competition in the market is a cause for concern. However, it’s crucial to remember that Tesla was a pioneer in the industry, granting it substantial competitive advantages over the later entrants:

-

Cutting-Edge EV Technology: Tesla leads in EV tech, offering impressive range, fast charging, and high performance due to heavy investments in battery innovations.

-

Efficient Vertical Integration: Tesla’s control over its supply chain, especially battery production, ensures cost efficiency and quality. This integration also enables quick design iterations, enhancing efficiency and reducing production costs.

-

Autonomous Driving Expertise: Tesla excels in autonomous driving with advanced driver-assistance systems and data-driven algorithms, positioning it as a frontrunner in the future of self-driving vehicles.

-

Global Supercharger Network: Tesla’s extensive Supercharger network addresses charging concerns, making its EVs more attractive to buyers and bolstering the company’s market appeal.

However, even though Tesla currently relies almost exclusively on the sales of its EVs, the company recognizes the threat of competition and is diversifying into other areas of business, a move I find very appealing given its technological superiority.

While it’s not yet clear what impact these projects will have on Tesla’s sales, the market potential is enormous, especially with the urgent need to transition to clean energy.

Tesla is making significant investments in solar energy solutions, including solar panels and solar roofs technology.

Simultaneously, leveraging its industry-leading battery technology, the company is venturing into energy storage solutions such as the Powerwall and Powerpack.

These products allow consumers to rely on clean energy during power interruptions or while off-grid, ensuring a stable energy supply.

29% Discount to Fair Value with Robust Growth Ahead

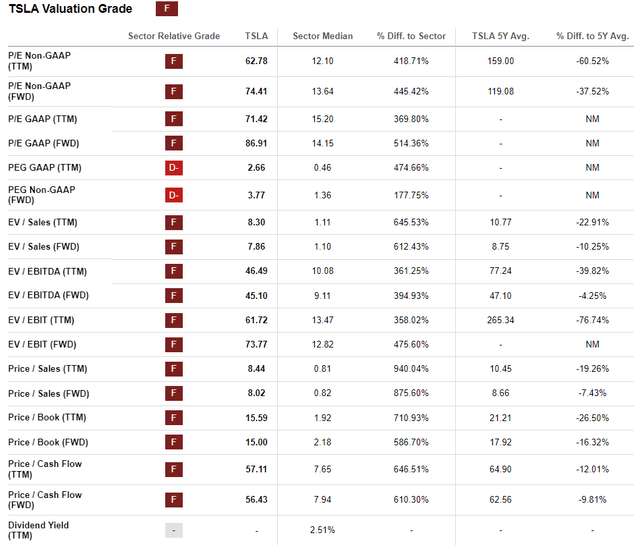

Some people might wonder how I can consider Tesla undervalued given its current high valuation in relative terms.

Naturally, a company trading at a Forward P/E of 74.41x its FY24 earnings raises concerns for most investors.

However, to truly grasp Tesla’s valuation, it’s essential to contextualize it within its historical averages and the anticipated robust growth.

While I don’t anticipate Tesla achieving the exceptional 300%+ annual growth it experienced in the last decade, the company is still poised for significant expansion.

Let’s first consider that Tesla’s 5-year average Forward P/E stands at 119x, indicating a 37.52% discount compared to today’s valuation.

Additionally, the Forward EV/EBITDA ratio is 45.10x, slightly below the 5-year average of 47.10x, implying a 5% discount.

Valuation Grade (Seeking Alpha)

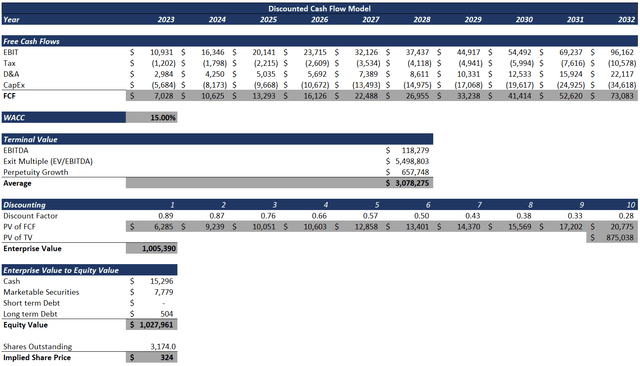

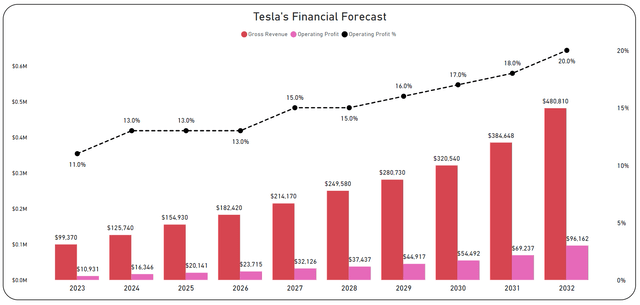

It’s worth noting that my expectations account for a drop in Tesla’s full-year 2023 EBIT below 2022 level due to the ongoing price war among EVs.

However, I anticipate EBIT to recover to similar levels as 2022 by 2024. This projection is based on the assumption that the market will stabilize somewhat, allowing margins to recover, yet still stay below 2022 level.

The decline in EBIT is driven by the margin pressures. However, Tesla has demonstrated its ability to achieve industry-leading margins, and I anticipate this trend will persist. I expect the EBIT margin to grow from an estimated 11% by the end of 2023 to 20% by 2032, a projection that appears entirely feasible given its market position and efficient manufacturing.

In my discounted cash flow (“DCF”) model, I have incorporated analysts’ expectations as disclosed on Seeking Alpha. Sales are projected to reach $480 billion by 2032, indicating an annualized growth rate of 38%. By 2032, I am expecting the EBIT to reach $96 billion.

Financial Forecast (Author’s Graph)

Other assumptions I am using for the DCF model:

- Tax 11%

- D&A and CAPEX at 24% and 25% of EBIT respectively

- EV/EBITDA 46.49x

- Perpetuity Growth 3.5%.

Given these robust growth projections, the estimated Fair Value for the company today stands at $324, indicating a substantial undervaluation of approximately 29% compared to the current price of $253.

Although there might be some volatility, especially with Tesla’s upcoming earnings announcement on October 18th after the market closes, I remain confident in my investment strategy.

I am adding to my existing position at these undervalued levels. Regardless of minor fluctuations in the stock price, I firmly believe Tesla remains one of the best investment opportunities available today for investors with a long-term horizon.

Conclusion

Tesla has embarked on a remarkable journey in its relatively short history. The company not only managed to escape bankruptcy in 2008 but also emerged as a trailblazer in EV technology, thriving with a remarkable 3.946% revenue growth over the last decade.

Although Tesla achieved profitability relatively recently, it has already begun generating substantial free cash flow, a crucial indicator I consider when evaluating investment opportunities.

The current EV market is undergoing a significant boom, attracting a slew of new competitors and sparking a price war. This battle will ultimately shape the industry’s leaders for years to come.

In my view, Tesla, with its industry-leading EV software, advanced battery technology, and expansive charging network, is well-positioned to maintain its market share and achieve robust growth. Additionally, the company’s diversification into other areas related to clean energy strengthens its position further.

Considering the current stock price, which represents a 29% discount to its Fair Value, and despite the looming clouds of fierce competition, I am optimistic about Tesla Inc.’s future. I am heavily investing in their shares, confident in the bright prospects ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.