NextEra Energy: Upgrading To Strong Buy

Summary:

- NextEra Energy stock has been beaten down in the last month or so with the company finally showing its vulnerabilities in the face of rising interest rates.

- To evaluate the prospects for NextEra Energy, investors need to understand the risks posed by higher interest rates. There are four ways high interest rates make life difficult for NextEra.

- To evaluate what lies ahead for the company, I will analyze the prospects for both the regulated utility business and the renewable energy business.

- I used a dividend discount model to estimate the intrinsic value of NextEra Energy, and my findings suggest the company is attractively valued today.

pidjoe

Mr. Market, at times, can be irrational. This is not a bad outcome by any stretch of the imagination unless you are a day trader trying to time the market. Every now and then, great companies are beaten down irrationally, presenting long-term-oriented investors with opportunities to capitalize on. Today, the renewable energy sector is feeling the wrath of rising interest rates, finally. After holding their ground amid persistently high interest rates, this sector is now showing vulnerabilities, as many analysts predicted. NextEra Energy, Inc. (NYSE:NEE), one of the world’s largest clean energy companies, has come under pressure in recent weeks with its subsidiary NextEra Energy Partners (NEP) slashing limited partner distribution per unit growth target to 6% through 2026 from a midpoint of 13.5% as recently as July. CEO John Ketchum highlighted that tight monetary policy conditions along with higher interest rates are capping the company’s earnings growth. The outlook for NextEra Energy is not rosy with its key subsidiary halving growth expectations, but I believe the current valuation does not accurately reflect the promising long-term outlook for the company. This anomaly has created an opportunity for contrarian investors to invest in NextEra Energy at an attractive valuation.

Understanding The Interest Rate Challenge

Without a good understanding of the challenges posed by high interest rates, investing in NextEra is nothing short of a walk in the dark. A good place to start this analysis, therefore, is by evaluating how NextEra is affected by higher-for-longer interest rates.

First, NextEra Energy, similar to any utilities company, takes on substantial amounts of debt to finance new infrastructure projects, and higher rates increase financing costs. Some of these new projects include building plants, upgrading distribution networks, and expanding into new renewable energy sources. For NextEra, higher rates will result in lower profit margins.

Second, NextEra Energy is a favorite among income investors, and its dividend yield has become less attractive amid higher interest rates. Although its current dividend yield of 3.4% makes for good income, it is no longer as attractive as it used to be with the 10-year Treasury yield already surpassing 4.7%. Because NextEra is considered a dividend stock, persistently high rates are likely to hurt the company’s valuation.

Third, in a rising-rate environment, NextEra’s profitability will hinge on its ability to convince regulators to adjust rates, and this reliance on regulatory decisions makes it a less attractive investment choice for long-term-oriented investors. Regulatory processes can also be lengthy and may not guarantee full recovery of higher interest expenses. This can put additional pressure on the company’s financial performance.

Fourth, higher interest rates can make certain capital projects less economically viable. Utilities often engage in long-term planning and capital budgeting for infrastructure investments. A significant increase in interest rates can lead to the reassessment or postponement of projects, which can affect growth and capacity expansion plans.

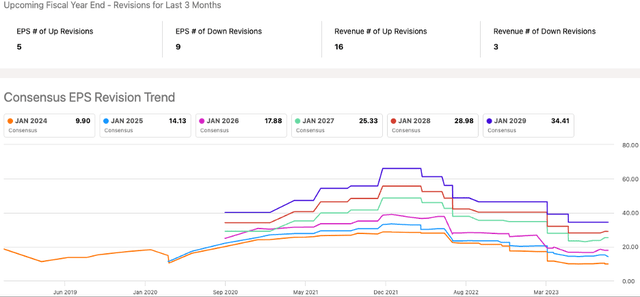

With NextEra Energy now grappling with higher interest rates, Wall Street analysts are likely to adopt a more conservative approach to earnings projections. Right on cue, earnings estimates for the upcoming Fiscal year have been slashed nine times in the last three months compared to five upward revisions. Of late, we have seen a series of negative earnings revisions.

Exhibit 1: EPS revision trend

With many analysts continuing to cast shadows over NextEra’s short-term financial performance, I would not be surprised if consensus EPS estimates for the next couple of years see more negative revisions, deteriorating the investor sentiment toward the company further.

With a good understanding of how rising interest rates adversely impact NextEra Energy, we can now move on to discuss the long-term outlook for the company.

The Long-Term Outlook Is Promising

As an investor with an extensive investment time horizon, I am hardly bothered by short-term market fluctuations unless I am trying to take advantage of irrational volatility in the market. Although high interest rates will be a massive challenge for NextEra Energy in the next few quarters, I believe this challenge does not pose a permanent threat to the company’s prospects. To evaluate what lies ahead for the company, we need to analyze the prospects for both the regulated utility business of the company (Florida Power & Light) and the renewable energy business (NextEra Energy Resources).

FPL is expected to invest significantly in infrastructure, including solar generation, storm-hardening, and transmission, which should support a 9% rate of base growth according to the company. FPL has a well-established capital investment plan that provides clear visibility through 2025. This plan focuses on strategic investments in various areas, including renewable energy, transmission, and distribution infrastructure. FPL is actively investing in renewable energy as well, with a strong emphasis on solar power. The company has been adding solar generation capacity to its portfolio, and it has plans to continue doing so. Solar is considered a cost-effective and clean energy source that allows FPL to serve customer demand while reducing reliance on fossil fuels. FPL has placed a significant focus on solar investments, with plans to add thousands of megawatts of solar generation capacity through 2025. Solar investments not only support clean energy goals but also provide long-term cost stability and reduced reliance on volatile fuel costs.

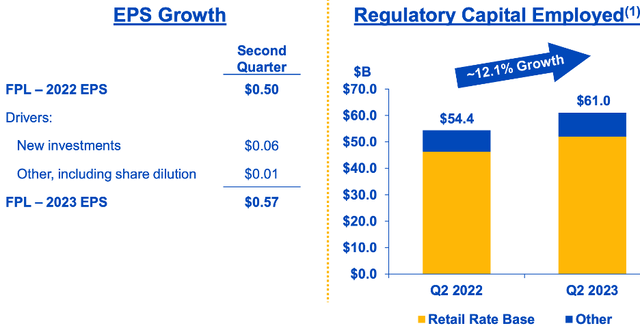

As illustrated below, in the second quarter, new investments drove EPS growth, highlighting the importance of these strategic investments.

Exhibit 2: EPS drivers of FPL in Q2

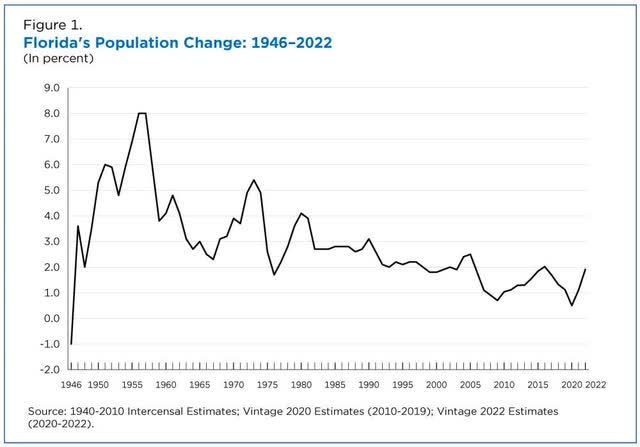

Population growth in Florida will be a key driver of the demand for electricity in the coming years, and FPL is well-positioned to serve this demand through conventional and renewable sources of energy. According to data from the Census Bureau, in 2022, Florida became the fastest-growing state for the first time since 1957 with population increasing by 1.9% to 22,244,823. Idaho was the fastest-growing state back in 2021.

Exhibit 3: Florida’s population growth rate

Recent energy consumption data in Florida shows an uptick in energy usage that coincides with the growing population in the state. Florida is the second-largest electricity producer in the nation behind Texas and is also the third-largest electricity consumer behind Texas and California. With the government aggressively promoting renewable energy sources, I believe FPL will have growth opportunities in both the old and new spectrum of energy for many years to come.

Let us now turn to the renewable energy business.

NextEra Energy Resources, the company’s competitive energy business, is a leader in renewable energy. The company has secured desirable wind and solar generation sites with long-term contracts, giving it a competitive advantage in the renewable energy sector. The company is shifting its focus to solar and energy storage, which aligns with the growing demand for renewable energy. NextEra Renewable Energy has a strong track record of originating, developing, constructing, and operating renewable energy projects, which makes it a leading player in the global energy transition.

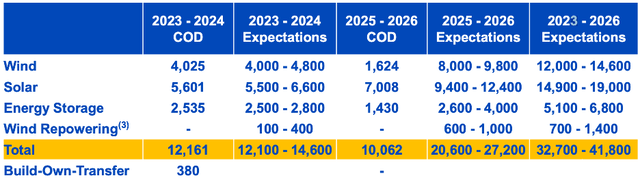

The company is seeing solid demand for renewables and energy storage solutions. Despite challenges such as supply chain disruptions and trade policy risks, the company remains confident in its ability to meet this demand. The addition of new renewables and storage projects to the backlog supports the company’s growth expectations. The company boasts a significant backlog of renewable energy and storage projects, totaling roughly 20 gigawatts. This backlog provides visibility into the company’s future earnings growth potential through 2026. In the second quarter, the company added 1,665 MW of new renewables and storage to its backlog.

Exhibit 4: Energy Resources Development Program

NextEra, commendably, is expanding into green hydrogen as well. The company believes that hydrogen can be thought of as another renewables customer class, and it is advocating for a smart hydrogen policy to establish a robust green hydrogen market. This presents a potential avenue for future growth.

In summary, NextEra Renewable Energy is well-positioned for continued growth in the renewable energy sector. Its strong backlog, focus on solar investments, and exploration of green hydrogen opportunities reflect a commitment to sustainability and long-term value creation.

The Valuation Makes NEE A Steal

NextEra Energy, in recent times, has never been valued this cheap. In Mr. Market’s defense, interest rates have hardly been this high in recent times as well, so an investor cannot come to a reasonable conclusion purely based on historical valuation levels. For this reason, I used a dividend discount model to estimate the intrinsic value of the company. The rationale behind using a DDM model for NextEra is simple; the company has a dividend growth track record of 27 years, and this growth has been fairly consistent.

To allow me to have more wiggle room in my calculations, I prefer to use an adjusted dividend model whenever I use a DDM model to estimate the intrinsic value of a company. The first step in this process is to find the excess income retained by the company last year after accounting for the required retained income to fund future growth. Below is an illustration of my calculation of excess retained income per share.

- Net income = $8.099 billion

- Cash dividends paid = $3.557 billion

- Retained income = $4.542 billion

- Required retention ratio (estimate by author) = 12%

- Required income retention = $972 million

- Excess retained cash = $3.57 billion ($4.542 billion – $972 million)

- Outstanding shares = 2.0237 billion

- Excess retained income per share = $1.76

To find the adjusted dividend per share, we will now take the sum of excess retained income per share ($1.76) and the actual dividend per share paid last year ($1.76), which comes to $3.52.

Using a long-term growth rate of 5.5% (5-year dividend growth rate is 11.13%) and a cost of capital of 10%, the intrinsic value estimate for NextEra Energy comes to $82.57 per share, which implies an upside of just over 51% from the current market price.

NextEra Energy is cheaply valued from an earnings multiple basis today, whether it be from a TTM P/E basis or forward P/E basis, and the findings of my DDM model confirm the undervalued status of the company. Because the estimated intrinsic value is substantially above the current market price, I feel comfortable investing in the company today even amid rising interest rates.

Takeaway

NextEra Energy is finally feeling the wrath of persistently high interest rates. The company, unarguably, will find it difficult to grow in the next few quarters, but its long-term prospects remain intact aided by favorable macroeconomic expectations, demographic trends, and policy support. At the current valuation level, NextEra Energy seems like a great bargain for long-term-oriented investors with an investment time horizon of more than five years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!