Summary:

- Wegovy/Ozempic/Mounjaro seem to be driving adoption for ABT’s glucose monitoring equipment, Libre, with 5M of global users by October 2023 (+11.1% YoY) and nearly 2M in the US.

- Its financial performance over the past few quarters in the Diabetes Medical Devices and Nutrition segments has also concurred with the CEO’s promising commentary.

- ABT’s other segments have similarly suggested a profitable growth trend, demonstrating why the stock deserves its premium valuation compared to the sector median.

- Its income investment thesis remains decent as well, with a forward dividend yield of 2.14% against its 4Y average dividend yield of 1.57% and sector median of 1.53%.

- As a result of the dual-pronged prospects through capital appreciation and dividend income, we are rating ABT as a Buy here, with a long-term price target of $111.46.

Diy13/iStock via Getty Images

The Conventional Diabetes Care Investment Thesis Remains Robust

For now, Mr. Market has been relatively concerned about the impact of Novo Nordisk’s (NVO) Wegovy/Ozempic and Eli Lilly and Company’s (LLY) Mounjaro on the prospects of multiple kidney related companies and food retailers.

The same has been observed with Abbott Laboratories (NYSE:ABT), with the CEO having to step out with this commentary in the recent FQ3’23 earnings call:

A recent analysis of our U.S. user base showed that a growing number of Libre users are using Libre in combination with GLP-1 medications as part of a companion therapy approach for managing their diabetes. On average, those using both Libre and a GLP-1 exhibited a higher rate of use for both products, wearing Libre sensors more often and taking GLP-1 medication more frequently compared to other users.

This increase in use or better compliance is a positive sign that these users are taking an even more active role in managing their diabetes. While we traditionally think of therapy choices as having to compete against one another, this is a good example of a complementary relationship between two products that both help optimize the treatment of diabetes. (Seeking Alpha)

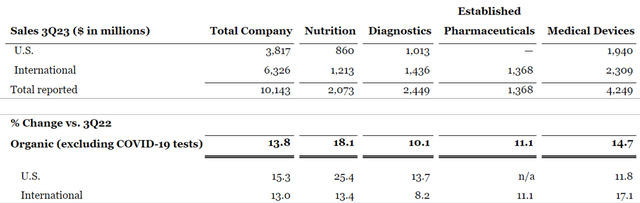

It is unsurprising that the ABT CEO has had to offer this particular statement, since Diabetes Medical Devices comprise the equivalent 14.4% (+0.2 points QoQ/+3.3 points YoY) of its overall FQ3’23 topline of $10.14B (+1.7% QoQ/-2.5% YoY).

For now, we concur with the management’s early observation, with the company already reporting 5M global Libre users by October 2023 (+11.1% YoY) with nearly 2M concentrated in the US, suggesting a high adoption trend for its glucose monitoring equipment.

For context, due to production issues, Wegovy/Ozempic was only widely available from December 2022 onwards, despite being launched in mid-2021. Mounjaro is also only approved by the US FDA in May 2022, with commercialization occurring from FQ3’22 onwards.

Based on a similar timeline, ABT’s Diabetes Medical Device segment top-line has definitely shown promising signs of demand acceleration. This is based on the FQ4’22 sales of $1.27B (+9.4% QoQ/+8.6% YoY), FQ1’23 sales of $1.31B (+3.1% QoQ/+16.6% YoY), FQ2’23 sales of $1.42B (+8.3% QoQ/+19.4% YoY), and FQ3’23 sales of $1.47B (+3.5% QoQ/+26.2% YoY).

The same trend has also been observed in its Nutrition segment, albeit at a slower rate, with FQ4’22 sales of $1.81B (+1.1% QoQ/-11.1% YoY), FQ1’23 sales of $1.96B (+8.2% QoQ/+3.8% YoY), FQ2’23 sales of $2.07B (+5.6% QoQ/+6.3% YoY), and FQ3’23 sales of $2.07B (inline QoQ/+15.5% YoY).

Based on these numbers, it appears that ABT is in no immediate danger for now, with its prospects still excellent moving forward, especially since Wegovy/Ozempic/Mounjaro are no miracle one-time drugs, with weight gain/diabetes usually rebounding with vengeance after a year of stopping.

This is on top of the unknown health risks and side effects, making a long-term adoption an uncertainty.

ABT’s Multiple Growth Drivers

In addition, ABT still has multiple growth drivers in its arsenal, with the Nutrition segment boasting a YoY growth of +18.1% YoY in FQ3’23, thanks to its market-leading share in the US infant formula business, with an impressive +25% YoY growth in the pediatric nutrition.

While its Diagnostic segment has suffered from a tougher YoY comparison, attributed to the moderating sales for COVID testing kits, the segment’s organic sales still indicate an organic growth of +10.1%. This is particularly led by the “double-digit organic sales growth in respiratory tests in anticipation of the upcoming flu season.”

Lastly, ABT still records a strong performance in its Established Pharmaceuticals segment, with a sales growth of +11% in the latest quarter. As a result of its well-diversified offerings, we believe that the company remains well-positioned for growth moving forward.

So, Is ABT Stock A Buy, Sell, Or Hold?

ABT Valuations

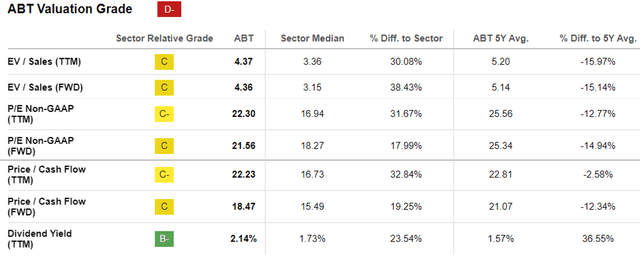

As a result of these developments, we believe that the growth premium embedded in ABT’s valuation is well deserved.

While the stock seems to trade at an impacted FWD P/E valuation of 21.56x compared to its 1Y mean of 22.30x and 5Y means of 25.34x, we must also highlight that the stock’s valuations have only normalized to its pre-pandemic P/E means of 21.46x, down from the hyper-pandemic peak of 32.66x.

The Consensus Forward Estimates

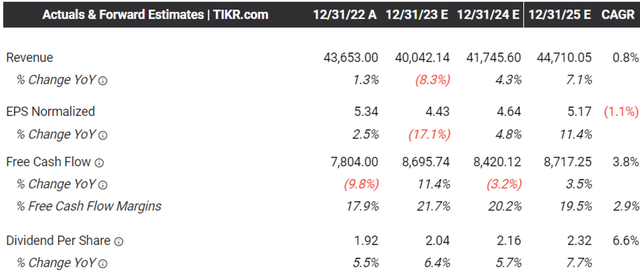

On the one hand, it appears that ABT has pulled forward much of its growth during the hyper-pandemic period, with the consensus estimating a top and bottom line CAGR of +0.8% and -1.1% through FY2025.

These numbers are naturally lower compared to its historical CAGR of +13.1% and +15.9% between FY2016 and FY2022, respectively.

On the other hand, we are not overly concerned, since ABT is still expected to expand its FCF margins to 19.5% by FY2025, compared to FY2022 levels of 17.9% and FY2019 levels of 14.1%.

The sustained expansion in its FCF profitability over the past few years has directly resulted in the company’s excellent 5Y Dividend Growth Rate of +12.74%, compared to its 5Y average of +11.06% and sector median of +6.30%.

This is on top of the sustained share repurchases since FY2019, with 33M of shares already retired since then.

The expanded cash flow has also contributed to ABT’s lower net debts of $6.55B (-13.1% YoY) by FQ2’23 (the FQ3’23 10-K has yet to be released), compared to its FY2019 levels of $12.52B (-18% YoY).

The management’s rate swaps have also triggered the company’s lower annualized net interest expenses of $431M (-21.4% sequentially) by the LTM, compared to its FY2019 levels of $670M (-18.8% YoY).

As a result of ABT management’s excellent execution over the past few years, we believe that the stock naturally deserves its premium valuations, with it also trading near its fair value of $95.72. This is based on the raised FY2023 adj EPS guidance of $4.44 at the midpoint (-16.8% YoY) and its FWD P/E of 21.56x.

Based on the consensus FY2025 adj EPS estimates of $5.17, there appears to be a decent upside potential of +15.1% to our long-term price target of $111.46 from current levels.

Its income investment thesis remains decent as well, with a forward dividend yield of 2.14% against its 4Y average dividend yield of 1.57% and sector median of 1.53%.

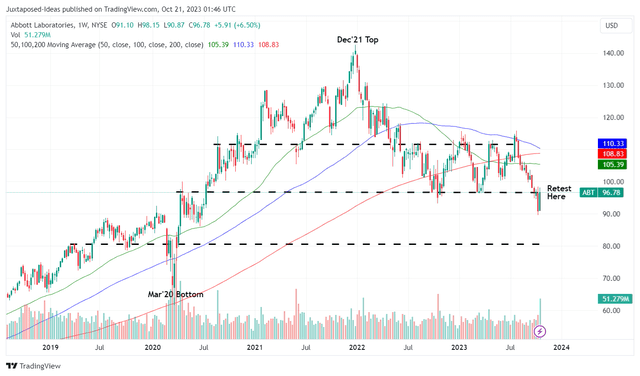

ABT 5Y Stock Price

As a result of the dual-pronged returns through capital appreciation and dividend income, we are rating ABT as a Buy.

Then again, this rating does not come with a specific entry point since it depends on individual investors’ dollar cost average.

On the one hand, based on ABT’s quick rebound from the October 21, 2023 bottom, we believe that the stock has a convincing bullish support at current levels of $96s.

On the other hand, it remains to be seen if the same support may materialize again if the company’s profit margins continue to decline. For example, its gross margin has declined to 54.8% (-0.3 points QoQ/-1 YoY) by FQ3’23, compared to FY2019 levels of 58.5% (inline YoY).

For now, the management has attempted to control costs with moderate success, resulting in stable operating margins of 15.9% (-0.8 points QoQ/-1.1 YoY), compared to FY2019 levels of 14.9% (+2.3 points YoY).

However, it is uncertain if ABT may return to the pre-pandemic gross margins after lapping up the uncertain global supply chain issues, potentially impacting its Free Cash Flow generation and consequently, its deleveraging process and dividend growth in the intermediate term.

As a result, investors may want to monitor the situation for a little longer, while sizing their portfolios according to their risk appetite.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.