Summary:

- MMM has had a drastic correction in its valuations and stock prices, resulting from the normalizing of top and bottom lines after the hyper-pandemic growth.

- Part of the headwind is likely attributed to the expensive legal settlements, with FQ2’23 and FQ3’23 bringing on an eye-watering write-downs of $14.5B.

- However, with these already behind us, we believe that things may lift from FQ4’23 onwards, significantly aided by the management’s raised FY2023 adj EPS guidance.

- Combined with the inherent improvement in its balance sheet, we believe that MMM remains oversold, with these depressed levels likely to offer a great rebound story.

Gearstd

The MMM Investment Thesis Appears To Be Tempting Here, Thanks To Its Oversold Status

3M (NYSE:MMM) is a stock that requires no introductions, with its offerings often found in many homes including ours, such as the Scotch-Brite scrubbing pads, the Nexcare Adhesive Wound Dressings, the Post-It Sticky Notes, and the Scotch adhesive tapes.

With the pandemic just over, we reckon that most readers may have also used one of 3M’s surgical masks and hand antiseptics over the past three years.

And it is for this reason that we believe that MMM commands a pretty robust pricing power, with its gross margins of 44.9% (+0.2 points QoQ/ -0.2 YoY) by the latest quarter only impacted by the uncertain global supply chain, compared to the FY2019 levels of 46.9% (-2.3 points YoY).

On the one hand, it appears that the hyper-pandemic boom is already over, with the COVID-19 top-line contribution behind us, as the company reverts to its pre-pandemic stagnant growth cadence.

This is demonstrated by MMM’s annualized FQ3’23 revenues of $33.24B (inline QoQ/ -3.6% YoY) being moderated, compared to its peak FY2021 levels of $35.35B (+9.9% YoY).

On the other hand, the management has been able to generate a robust Free Cash Flow of $4.85B (+25.3% sequentially) while expanding its FCF margins to 14.8% over the LTM (+3.7 points sequentially), though still lagging behind FY2019 margins of 16.7% (+1.9 points YoY).

Investors may want to note that it is more accurate to refer to the company’s LTM FCF generation, due to the timing/ seasonality of its capital expenditure.

For now, the robust FCF has directly resulted in MMM’s much healthier balance sheet with a net debt situation of $7.66B (-11.3% QoQ from $8.64B/ -26.2% from $10.38) by the latest quarter, compared to $15.06B in FY2019.

The management has also put great emphasis on shareholder returns, with -28.4M shares retired since FY2019 and consistent dividends paid out over the last few years, albeit with a minimal 3Y Dividend Growth Rate of +0.79% compared to the sector median of +8.14%.

These imply that the MMM management has been relatively shareholder-friendly, while competently deleveraging at a time of elevated interest rate environment.

MMM’s Impacted Valuations/ Stock Prices Are Mostly Attributed To Its Minimal Growth Trend & Legal Issues

MMM Valuations

Seeking Alpha

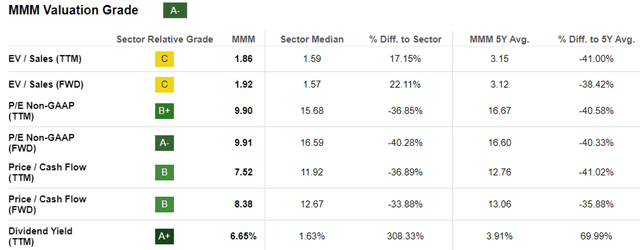

Then again, MMM still trades at impacted FWD EV/ Sales of 1.92x and P/E valuation of 9.91x, compared to its 5Y mean of 3.12x/ 16.60x, pre-pandemic mean of 3.91x/ 18.13x, and sector median of 1.57x/ 16.59x, respectively.

Perhaps part of the headwind is attributed to the lower forward consensus estimates, with a top and bottom line CAGR of -0.5% and +1.4% through FY2025, compared to its historical CAGR of +2.2% and +3.6% between FY2016 and FY2022, respectively.

This is on top of the ongoing legal headwinds, with the company also expected to pay $6B in legal settlements for the combat earplugs and $10.3B for the PFAS water pollution issue, worsened by the ongoing masks/ respirators lawsuits since the peak filings in 2003.

Nonetheless, we believe that the pessimism embedded in the MMM stock has been overly done, since the two former lawsuits have been settled and pre-tax charges related to the proposed settlements already recorded in its income statements at $10.3B in FQ2’32 and $4.2B in FQ3’23.

We believe that the masks/ respirators lawsuits are unlikely to be a major headwind as well, based on the excellent precedent with “the Company prevailing in fifteen of the sixteen cases tried to a jury over the past twenty plus years.”

MMM 15Y Stock Price

TradingView

On the one hand, long-term MMM shareholders may have been disheartened by the stock’s sustained decline of -55.8% since the May 2021 top of $202.45, with the dividend income unlikely to make up for the immense capital losses thus far.

Since then, the stock’s lower highs and lower lows have also hinted at a lack of bullish support and an elusive floor, with the current movement signaling a potential retracement to the next support levels of $70, suggesting a downside of -21.6% from current levels.

MMM’s pessimistic trend is not promising indeed, with us similarly downgrading another impacted stock, Verizon (VZ), with a Hold rating after multiple buy ratings, worsened by the potentially immense legal rectification works worth nearly $60B for the lead-lined issues.

On the other hand, here is where the similarities end, since MMM has a much-improved balance sheet, with FQ4’23 to bring forth a fresh start. With the legal headwinds mostly concluded as discussed above, we believe that the bottom may be near, with a reset in sentiments more than warranted.

Investors May Want To Note The Risks Ahead

On the one hand, while the MMM management has already attempted to optimize costs through multiple spin-offs and restructurings, it remains to be seen when we may see growth materialize, with the macroeconomic outlook still uncertain.

While the management has highlighted strength in the automotive industry, it appears that things may be reversing quickly, with multiple automakers opting to decelerate their EV production ramp-up thanks to the elevated borrowing costs.

With MMM looking to spin off the Health Care segment in 2024, it remains to be seen if we may see a revitalized company moving forward.

On the one hand, it appears that consumer and electronics demand may pick up moving forward, based on Taiwan Semiconductor Manufacturing Company’s promising commentary in the recent earnings call, with “early signs of demand stabilization in PC and smartphone end markets.

As a result of its mixed prospects, investors may want to temper their near-term expectations.

So, Is MMM Stock A Buy, Sell, or Hold?

For now, the MMM management has raised its adj EPS guidance to $9.05 at the midpoint (-10.3% YoY), up by +2.2% from the previous estimate of $8.85 (-12.3% YoY). Based on the raised guidance and its FWD P/E valuation of 9.91x, it appears that the stock is also trading near its fair value of $89.68.

Thanks to the drastic correction thus far, its forward dividend yields have also expanded to 6.66%, compared to its 5Y average of 3.94% and sector median of 1.67%.

MMM’s income investment thesis remains decent, with its dividend still safe, thanks to the somewhat stable TTM Free Cash Flow Yield to Dividend Yield Ratio of 1.46%, compared to the 5Y average of 1.61%, with the recent moderation only attributed to the hefty one-time legal settlements, as discussed above.

As a result of the dual-pronged returns through capital appreciation and dividend income, we are cautiously rating the MMM stock as a Buy, despite the risks as discussed above.

This is based on the excellent upside potential of +95.5% to our long-term price target of $174.79, from the consensus FY2025 adj EPS estimate of $10.53 and its normalized P/E valuation of 16.60x.

Naturally, due to the immense pessimism embedded in MMM’s valuations and the uncertain macroeconomic outlook, the stock is only suitable for investors with higher risk appetite and long-term investing trajectory, since its recovery may be prolonged depending on when bullish support materializes.

In addition, investors may want to monitor the stock movement for a little longer before adding once a floor is observed, for an improved margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.