Medtronic Stock Is Simply Too Cheap To Ignore

Summary:

- Medtronic is a global medical technology company specializing in various medical devices.

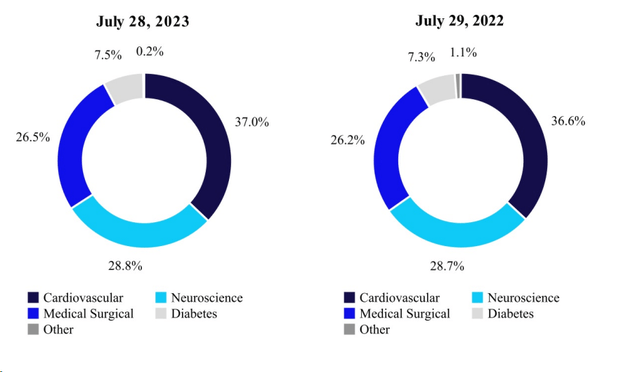

- The company’s revenues are well distributed among different segments, with cardiovascular being the largest segment.

- Medtronic expects further growth in its cardiovascular and neuroscience segments, driven by product launches and the adoption of integrated solutions.

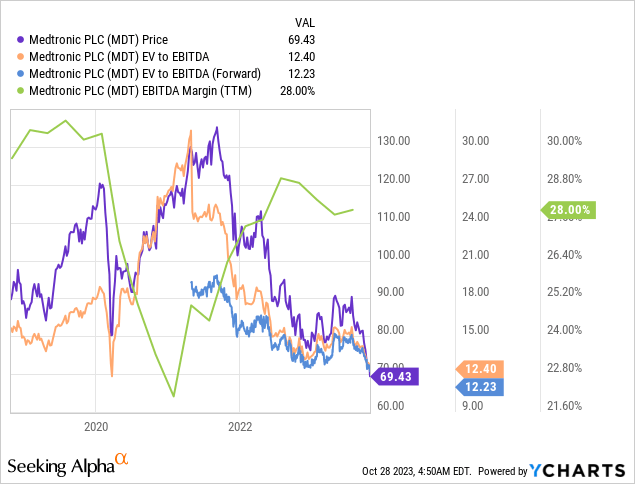

- The current EV/EBITDA multiple of just 12-13x and a growing dividend yield of over 4% provide a good starting point to enter a long position today.

Monty Rakusen/DigitalVision via Getty Images

The Company

Medtronic (NYSE:MDT) is a major global medical technology company based in Minnesota. They specialize in various medical devices, including those for cardiac rhythm management, spinal and surgical navigation, diabetes and neurological treatments, vascular therapies, and cardiac surgery.

The company’s revenues are pretty well distributed among different segments and end markets. There are 5 of them in total, but if you exclude the smallest segment (“Other”), 4 revenue segments are the most important:

-

Cardiovascular is the company’s largest segment. It includes products for the diagnosis and treatment of heart rhythm disorders, heart failure, and vascular diseases. Key products include pacemakers, implantable cardioverter defibrillators (ICDs), stents, and balloons.

-

Diabetes includes products for the management of diabetes, such as insulin pumps, continuous glucose monitoring systems, and blood glucose meters.

-

Medical Surgical includes products for a variety of surgical procedures, such as staplers, energy devices, and instruments. It also includes products for the treatment of respiratory, gastrointestinal, and renal disorders.

-

Neuroscience includes products for the treatment of neurological disorders, such as spinal cord stimulators, deep brain stimulators, and pumps for the delivery of medication to the central nervous system.

MDT’s latest 10-Q

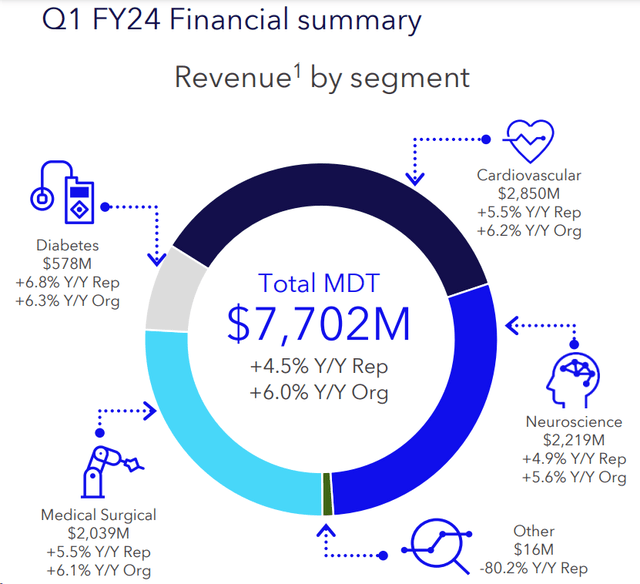

In Q1 FY2024, MDT achieved mid-single-digit organic revenue growth, with all 4 of its business segments delivering 6% growth. As the management noted during the earnings call, this growth was attributed to execution, innovation, and improved underlying fundamentals in the markets and supply chain.

MDT’s IR materials

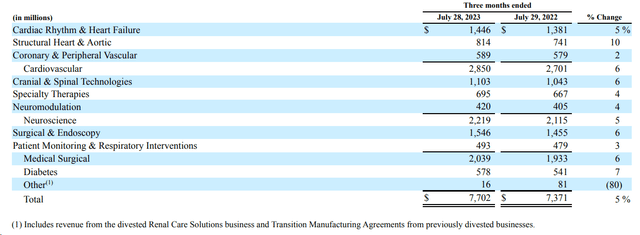

To better understand the driving force behind the company’s sales growth, I think it is necessary to take a closer look at its structure because MDT’s 4 segments are in turn made up of their own sub-segments, each of which is developing in its own way.

MDT’s 10-Q

As you can see above, the Cardiac Rhythm and Heart Failure sub-segment (CRHF) experienced a 5% increase in net sales, primarily due to the continued adoption of Micra, including the launch of Micra AV2 and Micra VR2 in the U.S., as well as growth from CRT-Ds, transvenous pacemakers, and Arctic Front cryoablation catheters.

Structural Heart & Aortic (SHA) saw a 10% increase in net sales, driven by growth in TAVR, including the recent U.S. and Japan launch of Evolut FX TAVR system, and in Cardiac Surgery driven by growth in Cannula and Perfusion, particularly in the U.S.

Coronary and Peripheral Vascular (CPV) net sales increased by 2%, attributed to the launch of Onyx Frontier and growth in guide catheters, drug-coated balloons, and the performance of vascular embolization and superficial venous products, including the VenaSeal system.

Looking ahead, Medtronic expects further growth in its Cardiovascular segment. The ongoing adoption of Micra transcatheter pacing systems, expansion of Azure pacing systems, growth of the Cobalt and Crome portfolio, and continued development and acceptance of various product lines such as CoreValve Evolut, Onyx Frontier DES, and VenaSeal Closure System, as well as the successful commercialization of pipeline products like the Symplicity Spyral Multi-Electrode Renal Denervation Catheter, Pulse Field Ablation, and Aurora Extravascular ICD, should contribute to the growth.

Let’s get to the Neuroscience segment. The Cranial and Spinal Technologies (CST) sub-segment reported a 6% increase in net sales, primarily fueled by strong adoption of the Aible spinal ecosystem and robust growth in Spine & Biologics products in the U.S. Additionally, increased sales of StealthStation Navigation and O-arm Imaging Systems contributed to the growth, according to MDT’s 10-Q. In the Specialty Therapies sub-segment, net sales increased by 4%, with growth in ENT and hemorrhagic stroke flow diversion products, though Pelvic Health experienced slight net sales declines due to competitive launches. The Neuromodulation (NM) segment also saw a 4% increase in net sales, driven by growth in Pain Stim, Targeted Drug Delivery, and Brain Modulation, although this was partially offset by a decline in Interventional due to competitive pressures.

Looking ahead, the Neuroscience division is expected to be influenced by the continued adoption and growth of integrated solutions via the Aible offering, which combines spinal implants with enabling technologies, Mazor robotics, and AI-driven technology for surgical planning. During the latest Well Fargo Healthcare conference, MDT’s CEO Geoff Martha emphasized their focus on AI and the development of AI platforms that can scale across the company. They have also hired a head of technology to drive a more efficient AI platform, so MDT may have a new lever for growth on this front.

Now a few words about the next segment – Medical Surgical. The Surgical and Endoscopy (SE) sub-segment reported a 6% increase in net sales, primarily attributed to growth in Advanced Energy and Barrx driven by improved supply, as well as continued growth in GI Genius and PillCam. Meanwhile, the Patient Monitoring and Respiratory Interventions (PMRI) sub-segment saw a 3% increase in net sales, largely due to growth in airways and monitors. Looking ahead, the Medical Surgical division is expected to undergo a significant change with the pending separation of the combined Patient Monitoring and Respiratory Interventions businesses from the Medical Surgical Portfolio, set to be completed in 1H FY2025. The company is focused on promoting minimally invasive surgery techniques and tools, expanding its presence in open surgery markets, and optimizing open-to-MIS transitions.

The last MDT’s segment in focus – Diabetes – reported net sales of $578 million in Q1 FY2024, marking a 7% increase YoY, fueled by strong international expansion, with the MiniMed 780G insulin pump system and integrated CGM driving international sales. Looking ahead, the Diabetes segment expects to continue its success with the MiniMed 780G insulin pump system, featuring SmartGuard technology and meal detection capabilities. Global adoption of sensor-augmented insulin pump systems has led to robust sensor attachment rates [according to the 10-Q commentary], and the U.S. FDA approval of the MiniMed 780G insulin pump system with the Guardian 4 Sensor further supports its growth prospects.

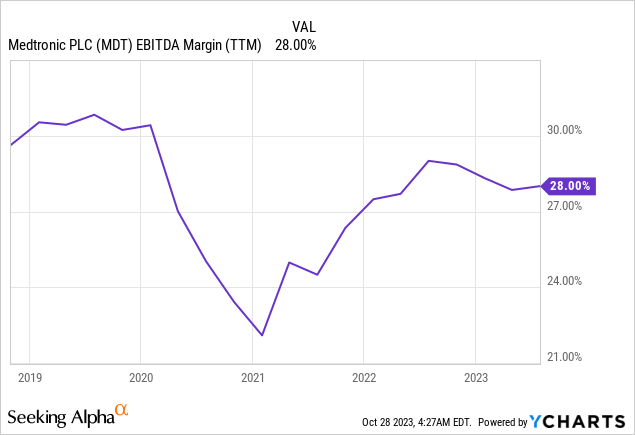

In general, thanks to the cumulative growth of the sub-segments as well as the improvement of the situation on the supply chain front, MDT has shown normalization of EBITDA margins in the last quarters (almost fully normalized after the COVID period):

During BofA’s Healthcare conference, CEO Geoff Martha said that pricing is set to stabilize beyond inflation because they have successfully maintained flat pricing even in challenging years. Their pricing strategy has proven resilient, allowing them to offset factors like China’s Volume-Based Procurement (VBP) and other price pressures. Despite short-term challenges related to anti-corruption measures and geopolitical factors, Medtronic expects the China market to rebound as pricing stabilizes. Martha said that the government has expressed interest in healthcare cooperation with foreign companies, offering opportunities for collaboration, so I think MDT still has the opportunity to expand its margins.

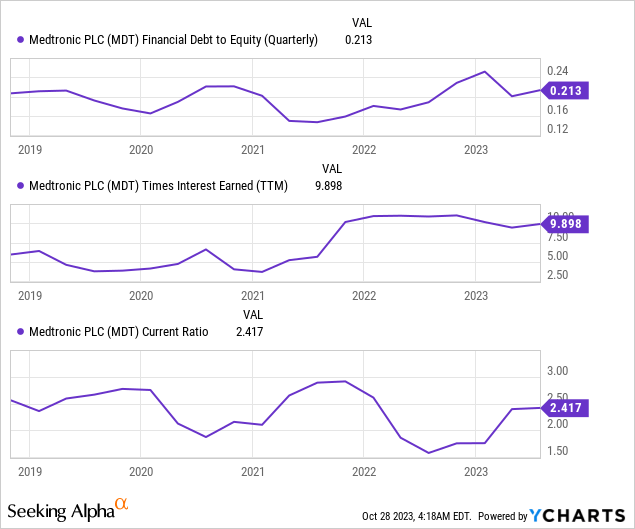

Regarding the quality of the company’s financial position, I think MDT is quite resilient from both a liquidity and credit risk perspective. The company’s current ratio is above 2.4, while its debt-to-equity ratio, while increasing slightly, is still well below 1. At the same time, MDT can cover its interest costs almost 10 times through its operating profit:

As far as I can tell, MDT seems to be a pretty stable company in a stable industry. This is a classic “boomer stock,” as it would probably be classified by the analysts at Bank of America, who recently published a research paper suggesting investing in such stocks instead of “millennial stocks”.

![BofA [October 2023, proprietary source]](https://static.seekingalpha.com/uploads/2023/10/28/49513514-1698482736709717.png)

BofA [October 2023, proprietary source]

It is unlikely that this trend will be interrupted in the foreseeable future, which creates a very favorable environment for MDT to further expand its top line, in my view.

But what about MDT’s current valuation?

The Valuation

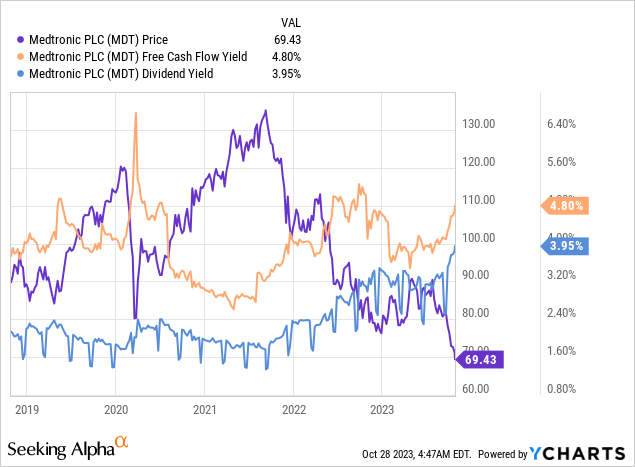

Over the past 5 years, the par value of MDT’s stock (ex-dividend) has declined nearly 23%, and since then the dividend and FCF yields managed to increase to 4.8% and 3.95%, respectively:

I already wrote above that MDT’s EBITDA margin continues to recover after COVID-19 and has almost fully recovered from the 2020-2021 decline in recent quarters. But at the same time, MDT’s EV/EBITDA for next year is now 12.23x (almost on par with TTM), which is extremely low.

The last time MDT had a valuation like this was when the EBITDA margin started to decline and the market expected that decline to continue. Today, I don’t think we’ll see anything like that soon – the industry conditions and supply chains are incomparably better and easier than they were then.

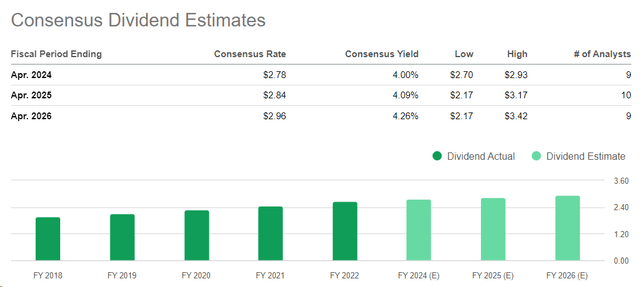

Analysts are projecting a dividend yield growth CAGR of 2.1% over the next 3 years, with the dividend yield reaching 4.26% in 3 years (at today’s price) – historically very good results for MDT.

Seeking Alpha

Part of this MDT’s new high in yield can be attributed to the expectation of a “higher for longer” interest rate environment, but if the Fed changes policy in the next few years, which I have no doubt it will, then this explanation will lose its meaning.

The Bottom Line

Even though Medtronic is a diversified medical device company and exhibits a strong financial track record, it’s still exposed to notable risks that should be considered. First off, competition from major medical device firms, such as Johnson & Johnson (JNJ), Abbott Laboratories (ABT), and Boston Scientific (BSX), may impact pricing and margins. Secondly, changes in reimbursement rates or policies pose a risk to revenue and profitability. Thirdly, with a significant debt load, Medtronic could be sensitive to economic downturns or rising interest rates. Additionally, specific business segments, such as Cardiovascular and Diabetes, confront unique challenges and competition.

But despite the existing risks the company seems to be poised for substantial growth, benefiting from existing and upcoming products, and already holds a robust market presence in various healthcare end markets.

The current EV/EBITDA multiple of just 12-13x and a growing dividend yield of over 4% provide a good starting point to enter a long position today, in my opinion. For this reason, I rate MDT a “Buy.”

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MDT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!