Summary:

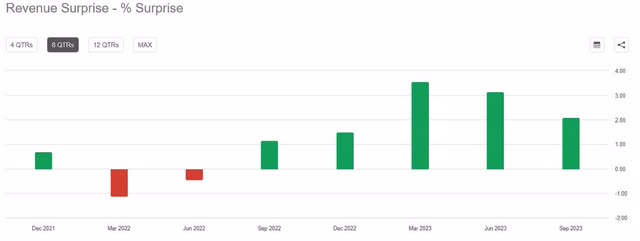

- Meta Platforms’ Q3 2023 revenue grew 23% YoY to $34.14 billion, beating analysts’ expectations.

- CEO Mark Zuckerberg highlights Artificial Intelligence and the Metaverse as key initiatives for long-term growth.

- Reality Labs’ release of Quest 3 mixed reality headset positions Meta as a leader in a growing market.

Justin Sullivan

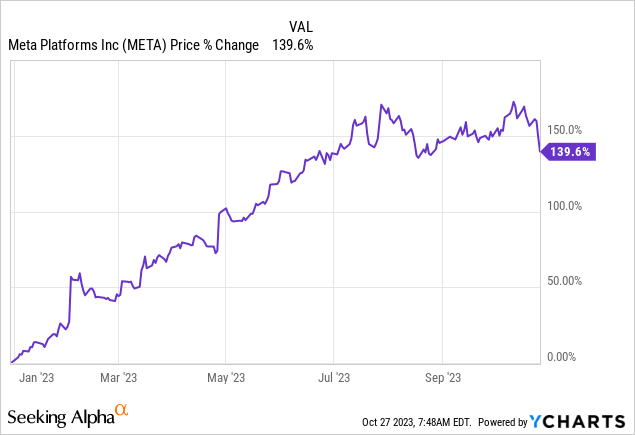

What a difference a year makes. In a slowing economy and slumping digital ad market, Meta Platforms (NASDAQ:META) third-quarter revenue in 2022 sank 4%. Additionally, investors worried about TikTok grabbing social media market share among younger users with its short-form video format — everything looked bleak for Meta Platforms. However, its fortunes changed in 2023. When the company recently released its third quarter 2023 earnings report, it confirmed why investors bid the stock up around 140% at the time I started writing this article.

In the third quarter of 2023, the company’s revenue grew 23% over the previous year’s comparable quarter to $34.14 billion, and it generated a diluted earnings-per-share of $4.39, beating analysts’ top and bottom-line estimates, just as it has throughout 2023.

In addition to producing excellent third-quarter results, Chief Executive Officer (“CEO”) Mark Zuckerberg highlighted during the earnings call a few of the ways the company plans to continue achieving long-term growth. His two main initiatives are Artificial Intelligence (“AI”) and the Metaverse. If these areas pan out, I believe Meta’s potential upside could be massive and a reason for aggressive growth investors to invest in the company today despite the triple-digit stock rise so far this year.

Reality Labs has the potential for remarkable things

Reality Labs, Meta’s division responsible for building the Metaverse, lost $3.74 billion in the third quarter and $13.72 billion in 2022. Some investors hate the idea of the company pouring huge sums into the idea of the Metaverse, as the concept is a vague idea that some think is a bad idea. Still, even if Zuckerberg’s vision of the Metaverse never fully works out, several of the things that Reality Labs is working on can potentially become massive revenue-generating profitable products. For instance, the primary way Meta intends for users to access the Metaverse is through Virtual Reality (“VR”), Augmented Reality (“AR”), and Mixed Reality (“MR”) hardware. Market research company Statista predicts the market for this hardware will grow from $29.26 billion at the end of 2022 at a compound annual growth rate of 36% to $100 billion by 2026. Meta has positioned itself to be a leader in that market.

While there are many companies out there that have toyed with MR technology, they have yet to gain much traction. Meta believes it will finally gain user momentum with its latest MR release, Quest 3. The company began accepting pre-orders for its latest MR technology on September 27, 2023, and it became available for purchase at various online stores on October 10. The company calls Quest 3 “The world’s first mass-market mixed reality headset.” Meta priced the headset at $499.99 for the 128 GB version and $649.99 for a larger storage capacity of 512 GB.

Meanwhile, Microsoft (MSFT) appears to have dropped out of the game of building MR headsets in 2022. Alphabet (GOOGL)(GOOG) has yet to make an official announcement about MR headsets, but rumors say that it could introduce the technology in 2024. The only major technology company that is close to seriously competing is Apple (AAPL), which plans on introducing a mixed-reality headset in early 2024 for $3,499 in the U.S. If you believe early reviews, Quest 3 gives the most bang for the buck for those interested in entering an alternative reality.

CEO Zuckerberg talked about Quest 3 on the earnings call:

The most important breakthrough for Quest 3 is that it’s the first mainstream mixed reality device. And that means that when you put on the device, you see your physical room around you, and you can bring digital objects and games into your physical space, whether that’s a ping pong table, your workstation, a big screen TV to play Xbox games on, or your friends as holograms. The early reviews have been great, and it’s been fun to see how people respond to this.

Source: Meta Platforms third quarter 2023 earnings call transcript

The fact that Apple is building mixed reality products indicates these headsets have high potential value outside the Metaverse, or else it would not bother investing in the idea. Apple CEO Tim Cook is a notorious non-believer in Zuckerberg’s vision of the Metaverse. So, suppose Quest 3 does take off; Meta will have established itself as a leader in MR technology, regardless of whether people become interested in the Metaverse.

Reality Labs is also building a software platform for Zuckerberg’s concept of the Metaverse called Horizon Worlds. On the third quarter 2023 earnings call, Zuckerberg announced the addition of new “worlds” called Super Rumble, an arena-style shooter game, and Citadel, an adventure game. The company seems to be trying to make the Metaverse popular through games like Roblox (RBLX) has done with its platform. So, even if the Metaverse doesn’t work out, this software has solid potential as a gaming platform. Zuckerberg said on the earnings call that the company is testing Horizon Worlds on multiple devices, including phones, tablets, and PCs.

Lastly, the company also announced the release of the next-generation Ray-Ban Meta smart glasses. Meta made these traditional-looking smart glasses in collaboration with EssilorLuxottica (OTCPK:ESLOY). Of all the products that Reality Labs is working on, smart glasses may have the highest upside potential if you believe Mark Zuckerberg’s past comments about smart glasses replacing smartphones by 2030. Verified Market Research projected the smart glasses market to grow from $4.8 billion at the end of 2022 to $10 billion in 2030. Market Research Future projects the smartphone market to reach $978.2 billion by 2030. Suppose smart glasses only capture 25% of the smartphone market share by 2030; it could grow appreciably faster than Verified Market Research’s projected $10 billion and reach around $245 billion by 2030. Although smart glasses have yet to gain traction, many of the largest technology companies are working on the technology, along with a whole slew of startups.

Meta is an AI leader

How does Meta plan to differentiate its Reality Labs hardware and software products from competitors? The answer is AI. While companies like Microsoft and Alphabet have grabbed more headlines about AI recently, Meta’s expertise and knowledge of the latest AI techniques are on par with those two technology giants in my view. After all, it hired Yann LeCun, who many consider an AI pioneer, back in 2013 and built what some believe is the fastest AI supercomputer in the world in 2022.

While some people have heavily invested in debating which company is a generative AI leader, Yann LeCun has given recent speeches stating that generative AI “don’t work that well” and is “nothing new.” Meta is already working on more advanced AI technologies like Joint Embedding Predictive Architecture (I-JEPA), which LeCun believes can surpass the capabilities of generative AI. So, before anyone thinks Alphabet or Microsoft is “way ahead” in AI, they might want to carefully look at what Meta Platforms is doing first.

Meta may be the first to install generative AI in its smart glasses. Zuckerberg announced on the third quarter earnings call that the Ray-Ban Meta smart glasses will have Meta AI built in. Meta AI is the company’s answer to OpenAI’s ChatGPT and Alphabet’s Bard. Here is what Mark Zuckerberg said about Meta AI within its smart glasses:

So you can ask your glasses questions throughout the day. It’ll answer them right in your ear. And in many ways, glasses are the ideal form factor for an AI device because they enable your AI assistant to see what you see and hear what you hear. Again, it’s good to see the early reviews, they’re so positive, and I’m looking forward to this space evolving quickly over the coming years.

Source: Meta Platforms third quarter earnings call transcript

Although almost every tech company under the sun is building its own generative AI chatbot, Meta AI differentiates by building not just one chatbot but multiple chatbots complete with different personalities, avatars, and social profiles on Instagram and Facebook. It already has 28 chatbots in beta testing that users can interact with on WhatsApp, Instagram, and smart glasses.

Meta also uses AI to do more than create fancy generative AI chatbots. It also uses sophisticated AI algorithms to grade what content is relevant and exciting to each user, and it surfaces that content in that person’s Facebook or Instagram Feed, Reels, and Stories. As a result, the company is seeing an increase in user engagement. Mark Zuckerberg said on Meta’s third-quarter earnings call, “This year alone, we’ve seen a 7% increase in time spent on Facebook and a 6% increase on Instagram as a result of recommendation improvements.”

Lastly, well before OpenAI made ChatGPT famous and drew the world’s attention to generative AI, Meta rolled out a product called Advantage+ shopping campaigns (“ASC”) in August 2022 to automate ad campaign creation using sophisticated AI models. ASC has since become one of the company’s fastest-growing ad products because of its effectiveness for advertisers. Chris Saniga, Head of Canada, Meta’s Global Business Group, wrote the following about ASC:

Take design-forward, luggage brand Monos as an example. Founded in Vancouver, the company tested a Meta Advantage+ shopping campaign against its more complex usual ad campaign set up and saw a 58% decrease in incremental cost per purchase using the Advantage+ shopping campaign. Monos also saw a 35% increase in incremental return on ad spend with their Advantage+ shopping campaign, compared to a usual campaign setup.

Source: Meta Blog

Now that generative AI has exploded onto the scene; Meta has added that technology into ASC, too. On the earnings call, Zuckerberg claimed that ASC has already exceeded a $10 billion run rate with advertisers, and over half of the platforms’ advertisers presently use its AI-powered creative tools to design ads.

There are several risks to monitor

Despite Meta’s excellent third-quarter results, the stock closed 4% lower the day after the company released the report. Investors didn’t like when Chief Financial Officer (“CFO”) Susan Li said during the earnings call, “We have observed softer ad spend in the beginning of the fourth quarter,” implying the conflict in Israel and the Middle East, while not directly impacting the business, could lower advertisers’ appetite to place ads. That comment was a reminder that the macro economy is still a massive short-term risk.

Over the longer term, investors need to monitor potential legal and regulatory actions from government regulators globally, especially from the U.S. and the European Union (“EU”). Of note is the Federal Trade Commission’s (“FTC”) attempt to modify a 2020 privacy consent order. The FTC alleges that Meta has not met its privacy promises for younger users. As a result, the FTC wants to modify the 2020 order to restrict the company from profiting from the data it collects from users under 18. CFO Li said the following about the FTC’s proposed changes during the earnings call:

Of note, the Federal Trade Commission is seeking to substantially modify our existing consent order and impose additional restrictions on our ability to operate. We are contesting this matter, but if we are unsuccessful it would have an adverse impact on our business.

Source: Meta Platforms third quarter 2023 earnings call transcript

The EU fined Meta €1.2 billion earlier this year for disobeying the General Data Protection Regulation, or GDPR. More recently, a Norway court ruled against Meta for privacy violations.

Another significant risk investors should monitor is the threat that TikTok could disrupt Meta’s social media empire. However, although TikTok remains a threat to Meta’s dominance, worries about Meta’s ability to compete against the Chinese social media app have declined in 2023. Reels, the short-form video platform that Meta created to compete with TikTok, has gained traction with users. While it still has a lower engagement than TikTok, Instagram Reels now has a higher watch rate, according to a Social Insider blog. Additionally, the TikTok threat has yet to dent Meta’s Family of Apps engagement rate seriously.

The company has robust engagement

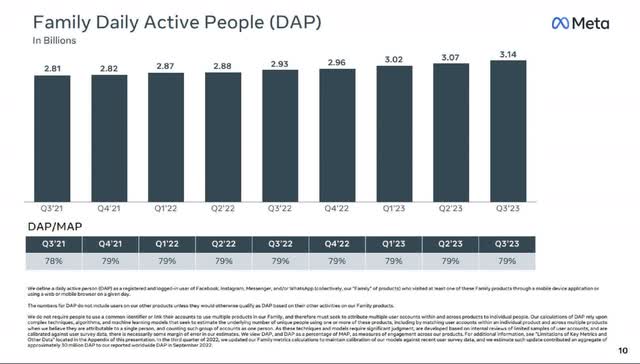

Meta reported that in the third quarter, Family of Apps daily active people (“DAP”) reached 3.14 billion, higher than analysts’ expectations of 3.09B. Family monthly active people (“MAP”) rose to 3.96 billion compared to analysts’ expectations of 3.88 billion. The DAP/MAP ratio was around 79%.

Meta Platforms Third Quarter 2023 Slide Presentation

The DAP/MAP ratio is similar to the daily active users (“DAU”)/monthly active users (“MAU”) ratio popularized by Facebook to measure app engagement. According to Andrew Chen, a partner at Andreessen Horowitz, “Usually apps [with a DAU/MAU ratio] over 20% are said to be good, and 50%+ is world class.” Engagement ratios are vital to social media companies that monetize users through advertising. Very often, the higher an app or platform’s engagement ratio, the greater the ability to charge advertisers higher rates. Meta’s massive audience and “world class” engagement ratio is why it is still the “King of Social Media.”

Third-quarter ad impressions, another essential engagement metric, rose 31%, compared to analysts’ expectations for a 29.6% gain. This metric measures how many people are clicking on its ads. The higher the ad impressions, the greater Meta’s ability to charge advertisers higher rates. However, its average price per ad fell 6% due to the company’s rapid expansion into areas of the world that monetize less than the U.S. Analysts expected this metric to fall 9%, so Meta was able to maintain ad pricing better than expected.

Valuation

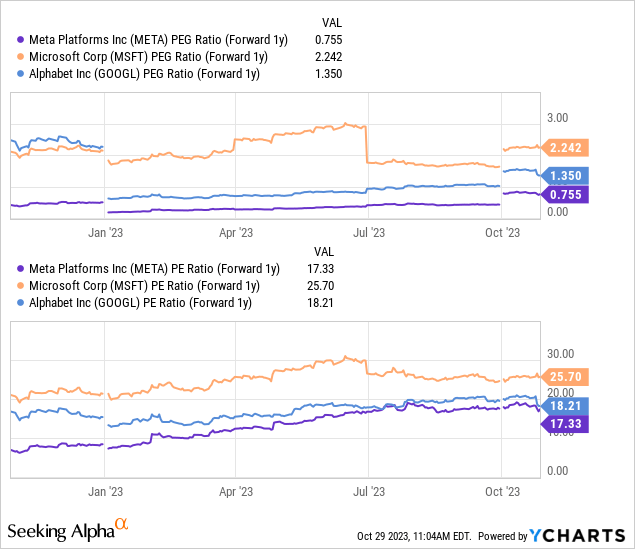

The chart below shows a comparison of Meta, Alphabet, and Microsoft’s one-year forward Price-to-Earnings-to-Growth (“PEG”) ratio and a one-year forward Price-to-Earnings (P/E) ratio. Meta has a one-year forward PEG ratio of 0.755 and a one-year forward P/E ratio of 17.33. When the market assigns a company a forward PEG ratio below one, its forward P/E ratio is lower than its future growth rate — a sign that the market may be undervaluing the stock.

Microsoft has the highest valuation, likely because it primarily generates revenue from its cloud business. This business has slightly less risk of provoking government regulators to start antitrust litigation than Alphabet and Meta’s advertising businesses. In addition, investors look at cloud providers as the engine of generative AI — an area experts expect to boom. Alphabet has the next highest valuation, likely because investors value Google’s search advertising revenue more than Meta’s social media advertising revenue. Some people may perceive that various privacy initiatives by companies and governments hurt search advertising less than social media advertising. For instance, Google’s Search advertising barely felt the results of Apple’s privacy changes on its revenue in 2021 and 2022, but it heavily impacted Meta. Investors are probably still wary of how much privacy initiatives like GDPR and Google’s plan to phase out cookies in 2024 might hurt Meta’s social media ad business. In addition, Alphabet has a cloud business, something Meta lacks.

However, whatever the reason for the difference between these companies’ valuations, I believe Meta’s forward PEG ratio is far too low. According to Seeking Alpha, analysts forecast Meta to have the fastest earnings growth in the company’s next fiscal period at 19.54%. Analysts predict Alphabet to generate earnings growth of 16.85%, and Microsoft comes in last at 14.32% in its next fiscal year. Meta conservatively deserves a forward PEG ratio of at least one, which is a forward P/E ratio that matches its estimated 19.54% forward earnings growth rate. At a forward PEG ratio of one, the price target is $334.52, around 13% higher than the October 27 closing price. However, as seen in the chart below, the average analyst’s one-year price target of $370.96 is much more optimistic about Meta’s prospects.

Although Seeking Alpha Quant grades Meta’s valuation as a D+, I believe the market modestly undervalues the stock, especially considering its potential upside in AI and the Metaverse.

Should you buy it?

Despite a market cap exceeding $750 billion, Meta has massive potential growth if its AI and Metaverse gambits work out favorably. If you are an aggressive growth investor looking for a stock with promising upside, consider buying it today at current prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, RBLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.