Summary:

- Textron’s quarterly results showed revenue growth and outperformed analyst estimates despite supply chain challenges.

- The company increased its guidance for the year and expects adjusted earnings per share to be higher than previously projected.

- Textron stock is a good buy, with potential upside in the coming years and positive prospects for revenue and margins.

Textron Aviaton Business Jet

passion4nature/iStock Editorial via Getty Images

In April 2023, I covered Textron (NYSE:TXT) for the last time and I reiterated my buy rating for the stock. And it has paid off, returning more than 10% on a market that was more or less flat showcasing the outperforming nature of aerospace names. In this report, I will be discussing the most recent quarterly results and more importantly I will be discussing the valuation and any upside potential for Textron stock.

Textron Navigates Supply Chain Challenges

Textron

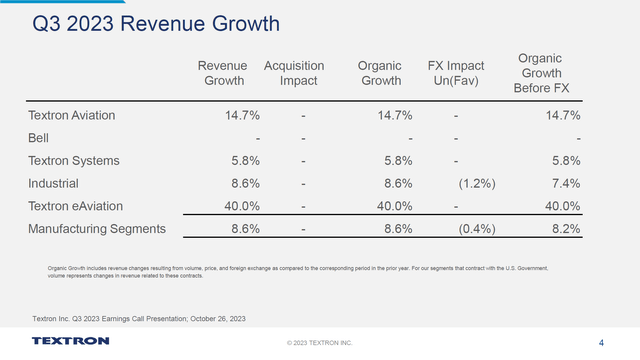

During the quarter, Textron Aviation revenues rose 14.7% to $1.362 billion driven by higher pricing, better mix and higher volumes on turboprop deliveries while jet sales remained flat year-over-year. Segment profit was $160 million indicating a 9.5% margin compared to a $131 million profit and a 11.2% margin last year. The margin erosion can be explained by $33 million related to supply chain challenges and labor inefficiencies. Absent, this pressure the margins would stand strong at 14.2%.

Bell saw revenues being flat, driven by helicopters deliveries reducing in the commercial market from 49 to 23 driven by supply chain challenges partially offset by higher military revenues including the revenue ramp up for the FLRAA program. The segment profit was $77 million, indicating a 10.2% margin, slightly higher than the 9.8% margin from last year.

Textron Systems saw a 5.8% increase in revenues reflecting higher volume while the segment’s $41 million profit indicated a 13.3% margin compared to 10.6% which can be attributed to $8 million in positive performance impact.

Textron eAviation saw 40% growth in revenues which seems huge but was just a $2 million increase from $5 million to $7 million while the loss in the segment expanded from $7 million to $19 million, reflecting higher research and development costs.

Overall, revenue increased 8.6% to $3.34 billion, missing analyst estimates by $132.2 million while income from operations increased nearly 20%, outpacing revenue growth and earnings per share of $1.49 beat expectations by $0.21.

Despite the supply chain disruptions, the company did manage to beat analyst estimates and increased its guidance for the year. Full year adjusted earnings per share are expected to be in a range of $5.45 to $5.55, up from a prior range of $5.20 to $5.30 with manufacturing cash flow before pension contributions of $900 million to $1 billion.

Is Textron Stock A Good Buy?

The Aerospace Forum

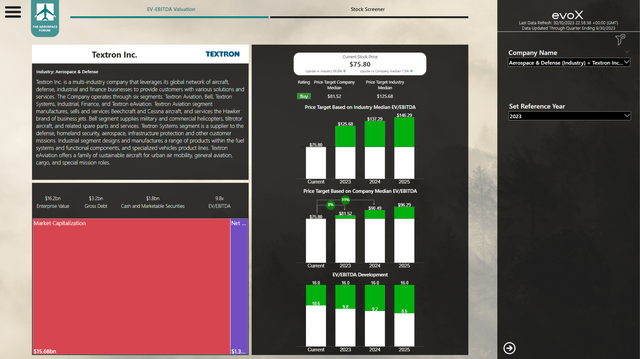

The quarterly earnings showed rather good results given the supply chain pressure. I tend to listen to earnings calls, read transcripts and have a look at the presentation slides. What’s rather clear is that Textron is not too bothered to put together a comprehensive slide deck, which perhaps is not a bad thing. Wall Street and investors have an obsession judging a company or stock on its quarterly results, and while I do think quarterly results are important, the aerospace development and business timelines are so long-term focused that the emphasis should not be on quarterly results.

With 2023 earnings in mind, Textron stock has 8% upside to $81.50 and with 2024 earnings in mind, the stock has 19% upside to $90.50. As a result, I am marking the stock a buy.

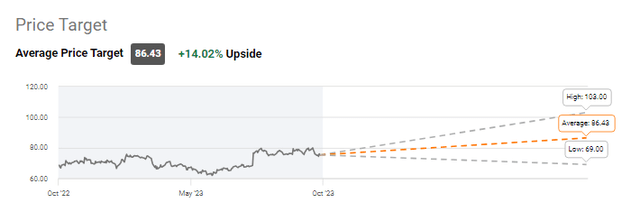

Seeking Alpha

Wall Street analysts have a $86.43 average price target representing 14% upside from current levels. The high side of the estimate seemingly factors in 2025 earnings on the rich side while the low side of the range does not quite reflect any fundamental valuation for the stock.

Conclusion: Textron Stock Is A Buy

In my view Textron stock is a buy. The company is dealing with some supply chain issues which keep the results at Bell flat, but with the FLRAA ramping up we should see revenue contributions increase and I would expect that to come with some margins as well, because much of the R&D that Textron had to fund has already happened before the contract award as Textron and its competitors build demonstrators. Initially those margins will be low, but they will increase as the program matures.

Focusing on business jets, Textron continues to see strength in orders which also bodes well for companies such as Bombardier, which I analyzed recently.

So, overall the company is navigating nicely and it has quite a nice streamlined debt profile allowing for continued shareholder returns and burn off the excess cash on hand compared to historic levels. By that time I would expect the company to see further free cash flow growth that will allow it to return its full free cash flow to shareholders in the form of robust buyback programs and a modest quarterly dividend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.