Summary:

- The COVID-19 pandemic caused major disruptions in the cruise line sector, leading to plummeting volumes and sales, and the incursion of a lot of debt.

- Carnival, the market leader, in particular, has accumulated substantial debt to stay afloat during the pandemic, raising concerns about its financial stability.

- The cruise line industry’s high capital expenditures, modest growth prospects, and lack of cash flow make it an unattractive investment.

dimarik

Introduction

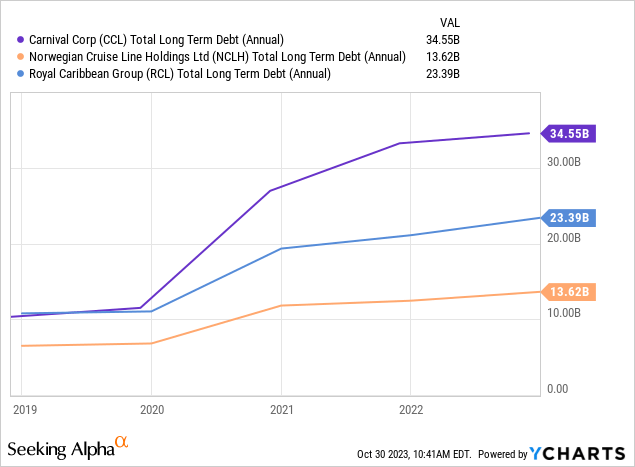

The devastating onset of the COVID-19 pandemic triggered unparalleled disruptions globally, forcing stringent policies that brought the travel industry, especially the cruise line sector, to an abrupt standstill. Major players like Carnival (NYSE:CCL), Norwegian Cruise Line (NCLH), and Royal Caribbean Cruises (RCL) found themselves grappling with plummeting volumes and sales, all while operational costs persisted. In a desperate bid to weather the storm, these companies resorted to accumulating substantial debt, a strategy that kept them afloat but raised alarming concerns about their financial stability.

As the pandemic begins to fade into history, a wave of optimism has washed over several affected industries, including the cruise lines. Ships are sailing again, passengers are returning with a zeal that partly surpasses pre-pandemic levels, and revenue is flowing again as well. Despite this apparent resurgence, reflected also somewhat by a recovery in the stock prices, I believe that there is a serious reason for caution. While some voices also on Seeking Alpha presently tout cruise line stocks as an attractive investment, this analysis takes a divergent, more critical perspective.

Cruise Line stock performance YoY (Google Stocks)

This piece aims to explore the implications of the enormous debt burdens shouldered by cruise line companies during the pandemic. To justify my headline, I am going to specifically focus on Carnival, the market leader in terms of market share.

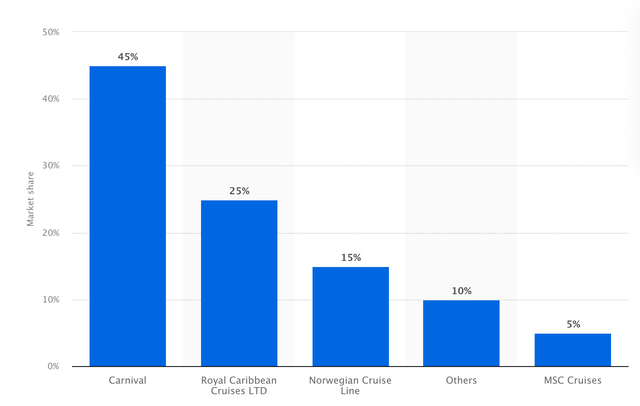

Worldwide market share of leading cruise companies in 2021 (Statista.com)

This analysis will delve into the company’s ability to manage its debt, raising significant concerns about its capacity to repay it. Moreover, my critique extends beyond Carnival, probing the very foundation of the cruise line business model and why I refrain from investing in this sector at all.

Cruise Line Business Model/Market Overview

Cruise lines focus on offering more than just transportation and lodging in the mass tourism market. They create experiences, providing various entertainment options on board, effectively turning their ships into floating resorts.

The cruise line market is primarily controlled by a few major players, with Carnival being a dominant force. Despite the impressive experiences they offer, cruise ship operators present challenges for investors.

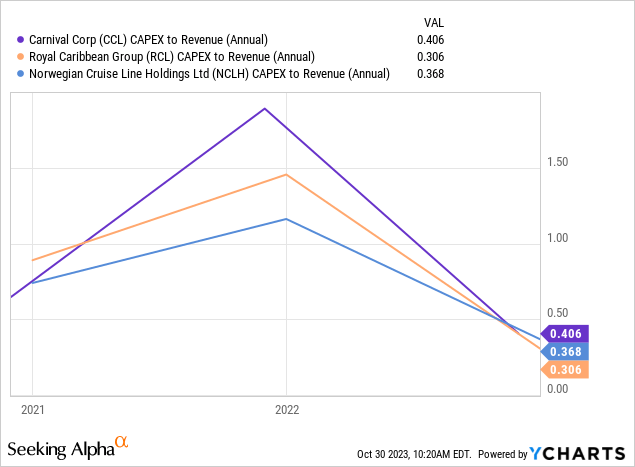

From an investor’s standpoint, the significant costs involved in setting up and running cruise lines are a concern. These businesses require substantial and ongoing investments, and they must continuously impress customers and stay ahead in terms of innovation and features. While the industry’s average profit margins are around 17%, however, looking at their Cash Flows reveals a different financial reality.

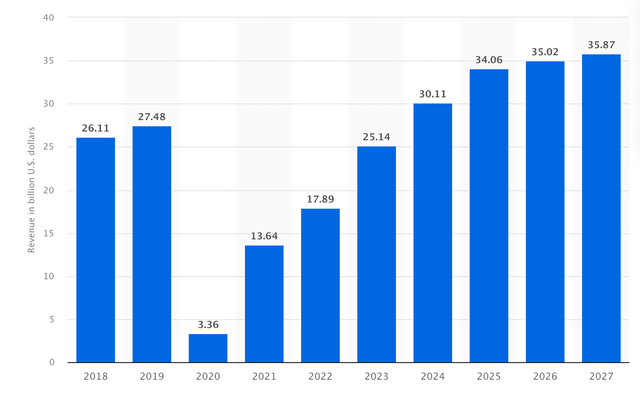

Moreover, forecasts for the overall industry suggest only modest growth, adding to the investment challenges.

Revenue of the cruises market worldwide from 2018 to 2027 (Statista.com)

High Capital Expenditures emphasize the capital-intensive nature of these businesses. These expenses impact the Free Cash Flow, reflecting the financial difficulties faced by cruise line companies.

In summary, cruise line businesses are financially demanding and inflexible, which doesn’t align with my preferred investment criteria, especially given the modest growth projections for the industry.

Worrying Debt Burden/Lack of (Free) Cash Flow

Cruise operators must contend with the colossal debt accumulated in recent years. Presenting a metaphor, it’s almost akin to loading these cruise vessels with large rocks, making them incredibly vulnerable to even minor impacts like a small iceberg striking the ship’s bow. The COVID-19 crisis was one such iceberg, freezing the entire business for a substantial period while costs remained high. However, even if we assume no future crises or major incidents affecting cruise line volumes – considering potential future government policies increasing costs for carbon-intensive industries like cruise lines, thereby squeezing their margins and volumes – the debt levels become particularly worrying.

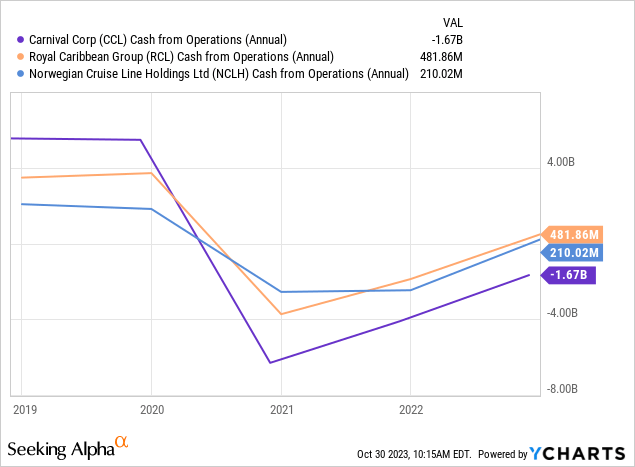

As stated, the reopening did lead to a partial rebound in volumes and revenues for the industry. Yet, while Norwegian Cruise Line and Royal Caribbean are expected to generate significant profits and Cash Flow, allowing them to repay their debt, the outlook is different for Carnival. Carnival is expected to incur losses on an operating cash flow basis as displayed in the Cash Flow chart earlier. This leads to a lack of cash flow from operating activities needed to help repay their debt.

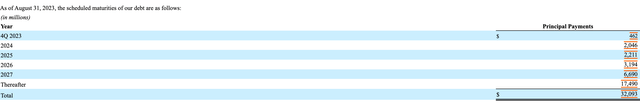

Carnival Debt & Maturities (SEC filing)

This has forced them to deplete their cash balance, which plummeted from about $4 billion reported in FY 22 to approximately $2.8 billion presently, just within a few quarters.

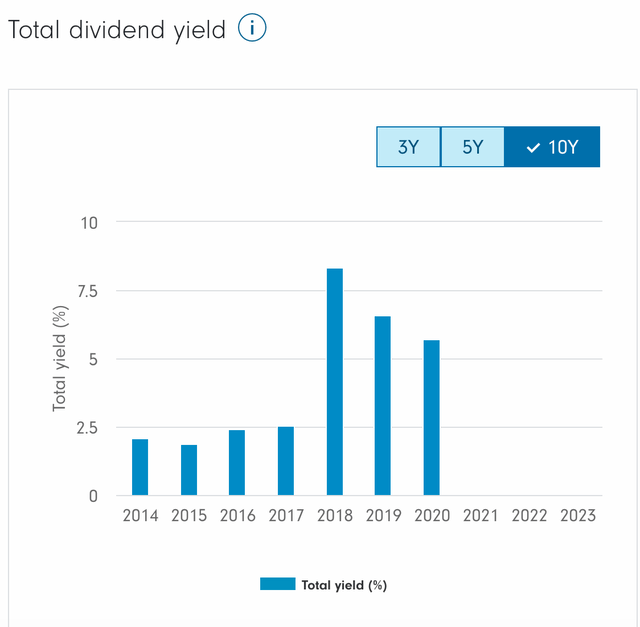

The situation wouldn’t be so alarming if there was a clear path to debt repayment from Cash Flow generation. However, their only viable option appears to be a dilutive capital increase, as well as refinancing which would both be unfavorable; especially the latter due to higher interest rates. Furthermore, Carnival, known for its dividend payments in the past, appears unlikely to resume them in the foreseeable future.

Carnival Dividend History (Fideilty.com)

Even if they manage to generate a bottom-line free cash flow by reducing investment activities, they would need significant margin hikes or top-line growth. Unfortunately, industry data doesn’t suggest extraordinary growth, and envisioning how they could substantially improve margins remains elusive.

The stark reality is that Carnival’s financial outlook is severely bleak, with a troubling debt burden and a lack of viable options for repayment, making it an unattractive prospect for investors.

Risks to My Thesis

While my analysis points to a concerning financial outlook for Carnival, it’s essential to acknowledge even the most improbable scenarios that could potentially brighten the company’s future and cause me to be more optimistic about an investment accordingly. One such possibility, although a distant possibility in my view, could be an unexpected intervention by the Federal Reserve, involving a sharp reduction in interest rates. This intervention could enable Carnival, even though most of their long-term debt is at fixed rates, to refinance it in the future at more favorable conditions. While this scenario seems highly unlikely given the Federal Reserve’s traditionally cautious approach, it’s one of the few avenues that could significantly alleviate Carnival’s financial strain.

Furthermore, the cruise industry could experience unexpected and sustained growth, surpassing current projections and leading to higher revenues for Carnival.

Final Thoughts

The cruise line industry, plagued by high debt and modest growth prospects, presents an unattractive investment landscape. Carnival, facing a significant debt burden and limited options for repayment, stands out as particularly vulnerable. The challenges faced by Carnival underscore the industry’s precarious financial situation, making it a risky prospect for investors. As it stands, caution should prevail for those considering investments in the cruise line sector, with Carnival serving as a stark example of the industry’s financial fragility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.