Summary:

- Mastercard has been performing extremely well over the last decade.

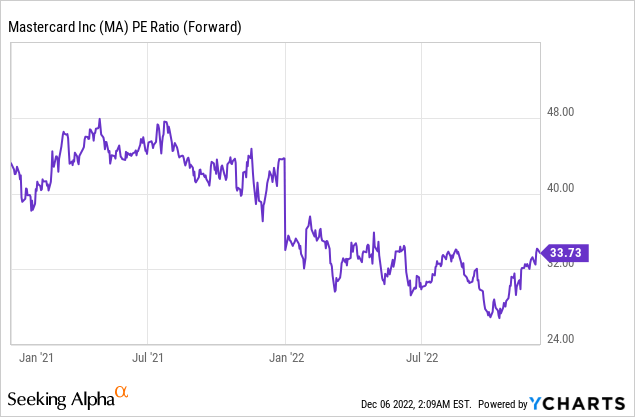

- Share of Mastercard are trading for more than 30 times earnings.

- With the higher uncertainty level today, investors should have Mastercard on their watchlist.

jbk_photography

Introduction

As a dividend growth investor, I seek additional opportunities to increase my dividend income. I focus my analysis on income-producing assets, mainly stocks. I add to existing positions in my portfolio and start new positions in companies to diversify my holdings further and gain exposure to new sectors and industries. The current market volatility may be an excellent opportunity to increase my dividend income for fewer funds.

Some stocks are more elusive than others. Most of the stocks that eluded me were stocks in the information technology sector. I acquired stock in that sector during a dip: Visa (V). Another stock that I am watching is its peer, Mastercard (NYSE:MA). Both are the leading payment scheme when using credit cards. In this article, I will look into Mastercard.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Mastercard Incorporated, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. It facilitates processing payment transactions, including authorization, clearing, and settlement, and delivers other payment-related products and services. The company offers integrated products and value-added services for account holders, merchants, financial institutions, businesses, governments, and other organizations.

Fundamentals

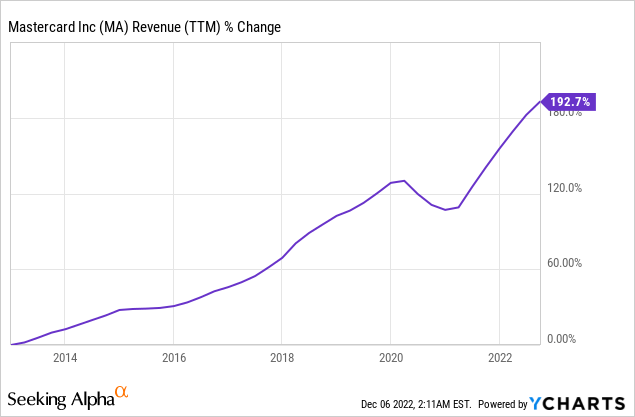

Revenues are up almost 200% over the last decade. Mastercard has shown swift growth as it tripled its earnings. Most of its development can be attributed to organic growth, as the company enjoyed increased credit card payments. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Mastercard to keep growing sales at an annual rate of ~15% in the medium term.

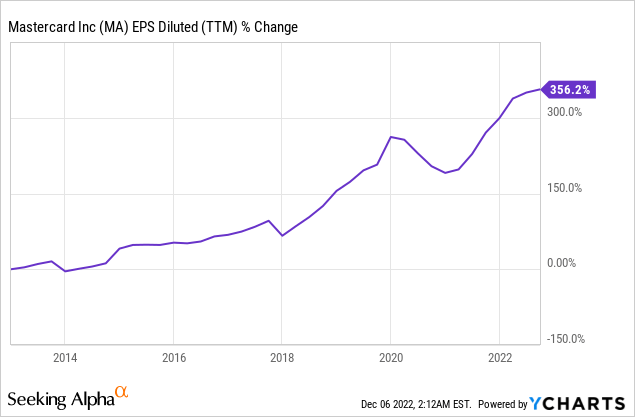

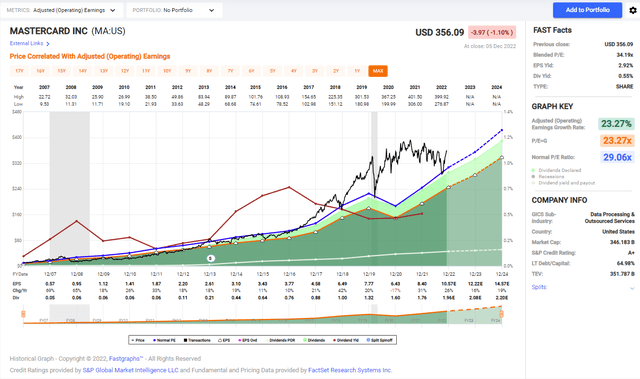

EPS (earnings per share) has grown at an even faster rate. Over the last decade, the EPS increased by 356%. During that decade, the company maintained stable margins. The EPS improvement results from higher sales and fewer outstanding shares. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Mastercard to keep growing EPS at an annual rate of ~20% in the medium term.

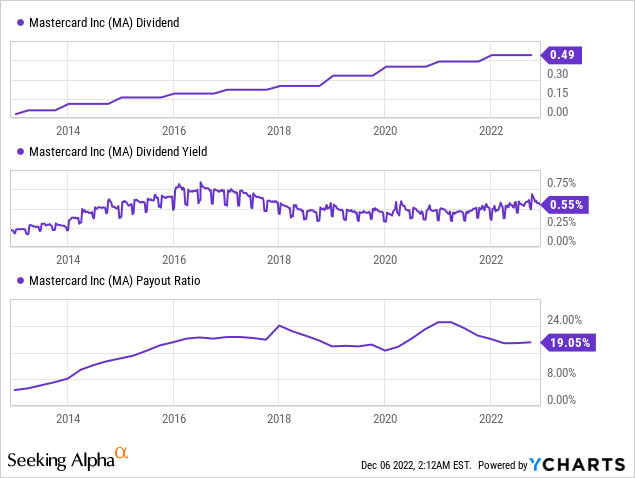

The dividend is one of the company’s most promising metrics. The company has increased the dividend for more than a decade and has never reduced it since its initiation fifteen years ago. The average dividend increase over the last five years was 17%, and at a payout ratio below 20%, the dividend seems safe. The downside is that the current yield is not very attractive at 0.55, yet long-term investors should focus on dividend growth.

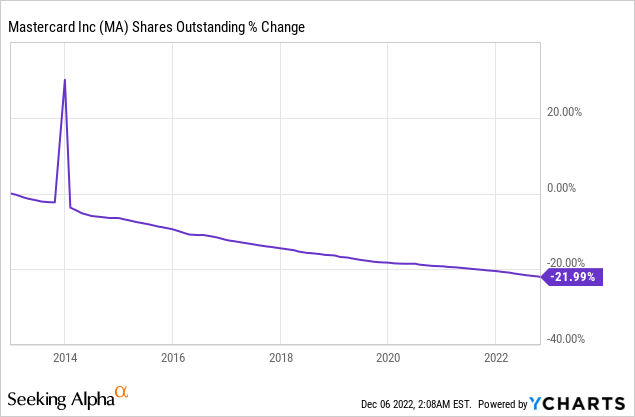

In addition to dividends, companies return capital to shareholders via buybacks. Share repurchase plans support EPS growth as they lower the number of shares outstanding. Over the last decade, shares decreased by 22%, keeping the fast EPS growth. Buybacks are most effective when the valuation is attractive. Thus it makes sense that Mastercard will focus less on buybacks at the current valuation.

Valuation

The P/E (price to earnings) of Mastercard, when taking into account the 2022 estimated earnings, is almost 34. The P/E ratio has declined substantially over the last twelve months. At some points, it almost reached 50 before starting to fall. However, the current P/E ratio is still high in this business environment. Mastercard grows fast, but this valuation seems rich, with interest rates going up.

The graph below from FAST Graphs emphasizes how Mastercard is still expensive despite the change over the last twelve months. Since its IPO, Mastercard has grown its EPS at an annual rate of 23%, which aligns with the current medium-term forecast. However, the valuation today is much higher than the average valuation. The average P/E over that time was 29, and the company is not expected to grow much faster to justify the premium.

FAST Graphs

To conclude, there are few companies with excellent fundamentals like Mastercard. Fast sales growth and an even faster EPS growth lead to dividend growth and buybacks. However, this fantastic package comes at a high cost, as the company’s valuation is very high. Despite the valuation decline in the last year, it will still be hard for the company to justify that.

Opportunities

The first growth opportunity for Mastercard is the fact that it is a part of an expanding duopoly. Together, Visa and Mastercard control the payment market as they own the largest and most comprehensive payment schemes. These two schemes will continue to expand as both companies reach new markets in Africa and Asia, and more and more businesses accept credit cards as their default payment option.

The megatrends of digitalization and the increase in e-commerce contribute to Mastercard significantly. The company not only expands into new regions and businesses but also enjoys the trend of e-commerce and digital consumption. People shift their spending from in-person spending, where cash is also used, to e-commerce and other digital channels where credit cards are the most prominent payment option. Therefore, Mastercard will enjoy more users and more spending per user.

Another opportunity for Mastercard is that credit card issuers compete very hard for clients, primarily banks. They offer very high bonuses and incentives for clients to use their cards and hopefully take loans. Mastercard is enjoying the fact that clients need to use the card more, resulting in higher payment volume. Therefore, several catalysts can have a positive effect on the usage of credit cards by clients.

Risks

A possible long-term risk for Mastercard is the increased usage of A2A (account-to-account) transfers. Banks have been building their payment schemes. We see Zelle in the United States and the EPI (European payments initiative) in the European Union. Both allow for real-time money transfers and can threaten Mastercard and Visa as they may become competing schemes.

Another risk for Mastercard is alternative non-scheme payment methods. In Africa, where both Visa and Mastercard want to expand, M-Pesa allows people to transfer money and pay quickly without cards. Even within the United States, companies like Block (SQ) and PayPal (PYPL) allow payments without needing cards. It may slow Mastercard’s growth pace in the long term as it won’t be a duopoly anymore.

The last risk is the fear of recession in the global economy. The company achieves significant operating margins of around ~54%. If the economy continues to slow down, the company may have to offer more rebates and incentives to its partners. Moreover, a recession is likely to harm consumer spending. The higher interest rates also make credit cards less attractive, decreasing the size of each purchase as consumers try to avoid interest.

Conclusions

Mastercard is a superb company with a robust business model. Its scale allows it to become almost integral to the global payment system. Therefore, it is not surprising that it has such excellent fundamentals with growth across the board. Thus, the company focuses on rewarding its shareholders and sharing their wealth. When looking at the growth opportunities, it seems that the megatrends that support its growth are here to stay.

On the other hand, the company trades for an extremely high valuation, almost 20% higher than its average valuation. There are risks to the business models, mainly from new companies that try to challenge the duopoly. Therefore, the current valuation may not be justified. However, we are in volatile times, and prices of stock fluctuate. Accordingly, investors should have the company on their watchlist. If the company reaches a P/E ratio below 29, it may be a decent time to buy. We had a short period in October, and it may return sooner than we think.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.