Summary:

- Apple wants to become cash neutral.

- To do so, it is returning excess cash through buybacks and dividends.

- In this article, we will understand what will happen to shareholder returns once the goal is achieved.

Maria Vonotna

Introduction

One of the issues Apple (NASDAQ:AAPL) has to face may actually seem a non-existent one: the company has long had more cash, after funding its operations and its investments, than it knows what to do with. What kind of problem is this, one may ask? Well, by sitting on idle mass of liquidity that isn’t used is actually a cost both in terms of management and in terms of loss of purchasing power due to inflation. In addition, Apple had most of its cash outside the U.S. in its foreign subsidiaries and it kept it there in order to avoid repatriation taxes. When the tax reform was approved with the 15.5% repatriation tax rate, Apple started to repatriate $250 billion. This was reported in early 2018. Soon thereafter, Apple disclosed that it would become a cash neutral company.

In this article, I would like to go over the idea of cash neutrality for those who haven’t yet heard of it and I would like to link this strategy to see how, once it is achieved, it will impact the company’s huge buybacks.

What is cash neutrality?

During the Q1 2018 earnings call, Luca Maestri, Apple’s CFO, first announced that the company was targeting cash neutrality. These are his words:

Tax reform will allow us to pursue a more optimal capital structure for our company. Our current net cash position is $163 billion. And given the increased financial and operational flexibility from the access to our foreign cash, we are targeting to become approximately net cash neutral over time. We will provide an update to our specific capital allocation plans when we report results for our second fiscal quarter, consistent with the timing of updates that we have provided in the past.

Though the idea is very simple, not everyone participating in the earnings call seemed to understand it well and this led Tim Cook to a further explanation:

What Luca is saying is not cash equals zero. He’s saying there’s an equal amount cash and debt, and that they balance to zero. Just for clarity.

Now it is clear: cash neutrality means that the net debt position is equal to zero, where cash and debt balance each other. If a company has excess cash, it can reach cash neutrality in two ways: it either lowers its available cash or it raises debt.

Of course, Apple saw the tax reform as a big opportunity that gave new flexibility thanks to the access to the foreign cash. Before the reform, in fact, Apple used to raise debt to have more available cash in the U.S. as the majority of the cash was overseas. At the beginning of 2018, Apple had $285 billion of cash and $122 billion of debt for a net cash position of $163 billion. Since then the company has been able to deploy this capital. Luca Maestri explained how the company would be in no rush to use all this new available cash at one:

We will do that overtime, because the amount is very large. As I said earlier, we will be discussing capital allocation plans when we review our March quarter results. And when you look at our track record of what we’ve done over the last several years, you’ve seen that effectively we were returning to our investors essentially about 100% of our free cash flow. And so that is the approach that we’re going to be taking. We’re going to be very thoughtful and deliberate about it. Obviously, we want to make the right decisions in the best interest of our long-term shareholders.

However, one thing was clear: excess cash will be returned to the shareholders. It is actually what we learn in business school: only cash that can’t be deployed at a high rate of return should be returned to the shareholders in order to make them decide how to deploy it.

In the following earnings call for Q2 2018, Luca Maestri addressed once again what Apple was thinking about its use of capital:

The biggest priorities for our cash have not changed over the years. We want to maintain the cash we need to fund our day-to-day operations, to invest in our future, and to provide flexibility so that we can respond effectively to the strategic opportunities we encounter along the way. As we said 90 days ago, the new tax legislation enacted in December gives us increased financial and operational flexibility from the access to our global cash. It allows us to invest for growth in the United States more efficiently and it also provides us the opportunity to work towards a more optimal capital structure. As we said in February, our goal is to become approximately net cash neutral over time.

In this way, he made it clear that Apple will keep for itself all the cash it needs not only to operate but also to invest and keep on growing. Let’s put it in another way: Apple will fund its operations with its own cash, without using a lot of debt. From these words it is now clearer that Apple will reach cash neutrality mostly by lowering its cash rather than increasing its debt.

The company could actually raise more debt without many problems because it could simultaneously make some investments that could return an interest income able to completely offset debt interest. However, this doesn’t seem the way Apple wants to take.

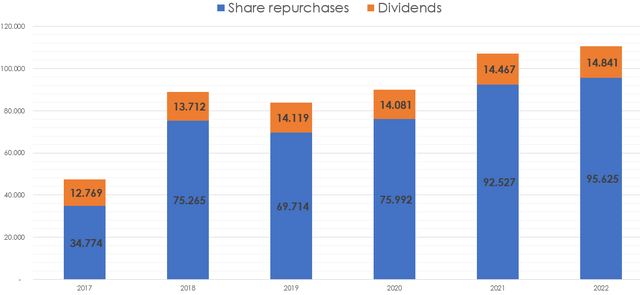

So, how has Apple used its excess cash in these years? The answer is quite simple: share repurchases have been the preferred use of cash, followed by the dividend. In the graph below I wanted to show this starting from 2017, the year before Apple announced its strategy.

Author, with data from Seeking Alpha

As we can see, Apple more than doubles its share repurchases moving up from $34.77 billion in 2017 to $75.27 billion in 2018. Since then, the company has spent $409 billion just to repurchase its outstanding shares. This has allowed the company to be rather flat in the amount of dividends it is paying. As we can see, in 2018 the company spent $13.71 billion, in 2019 it spent $14.12 billion and in the past year it was just at $14.84. However, Apple’s five-year dividend growth rate is above 8% and this is thanks to the massive share repurchases the company has done.

Concerns

Some investors are concerned that once Apple will have achieved cash neutrality, its share repurchase program will end or will significantly decrease, causing downward pressure on the stock. However, who fears this forgets that Apple generates an in-pouring flow of free cash flow that is actually growing at a very fast pace actually doubling in the past five years ($41 billion in 2017, $92 billion in 2022).

When Apple reaches cash neutrality, it will have to increase buybacks once again

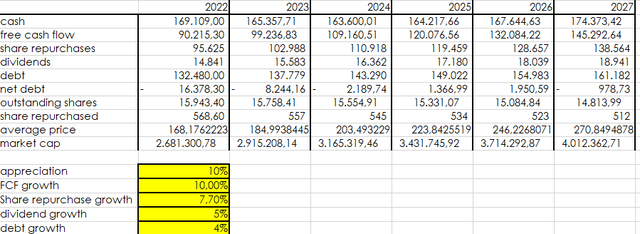

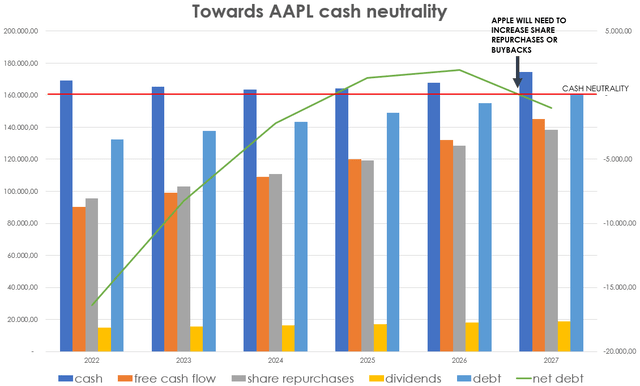

I ran a simulation which assumes that in the next five years, Apple will grow its free cash flow by 10% and will increase its share repurchases by 7.7% annually. In the meantime, it will increase its dividend growth by 5% and will increase its debt by 4%. Based on these assumptions, Apple should reach a positive net debt position between 2025 and 2026. However, take a look at what happens in 2027. I also assumed that shares will appreciate 10% annually in order to estimate how many outstanding shares the company will be able to repurchase through its buybacks.

Let’s use a graph instead a table. We see that at this pace, Apple will reach cash neutrality in 2025 but in just two years it will be heading back to where it came from: excess cash.

So, what will the company have to do in order to keep its cash neutral position? According to its culture, it will have to increase once again share repurchases and its dividends.

The reason is simple: Apple’s free cash flow is massive and it can really grow by 10% a year. This will keep on creating a massive amount of liquidity that Apple has to return to its shareholders, which will happily receive it.

Of course, these are estimates based on many assumptions. But I think the trajectory is quite clear and foreseeable.

This is why I am not worried, but I am actually pleased by the endeavor Apple has undertaken to reach cash neutrality. It is, in my opinion, another sign of how highly efficient this company is, making it a true cornerstone of my portfolio.

Conclusion

This article ideally follows another one I recently published to show how Apple is managing its balance sheet with carefulness and attention, making it more efficient than other big tech companies such as Google (GOOG) (GOOGL). For those interested in reading why I started looking at Apple’s buyback, I suggest reading this article “The Issue That Google Has And Apple Doesn’t“. I think it is very helpful for investors to understand whether or not they are holding a well-managed company because a strong balance sheet is a fortress against any downturns.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.