Summary:

- Although Mastercard sports a rich valuation, investors looking to buy should pull the trigger rather than wait for a lower entry point.

- After doubling its revenue and net income since 2017, the business looks set to continue growing on the continued transition to cashless payments globally.

- The stock has outperformed the S&P 500 by as much as 3 times in the past five years and is likely to continue doing so, thanks to business performance.

- Mastercard is generating high levels of cash, has low debt levels, pays a generous dividend and is aggressively buying back stock.

- Its high P/E reflects its strong earnings potential and it is likely that the stock will get more expensive and reward investors who pay the justified premium today in my opinion.

istanbulimage

Mastercard Incorporated (NYSE:MA) is a pricey stock that trades at a rich P/E (‘FWD’) of 35.41x vs the S&P 500’s P/E (‘FWD’) of 19.78x. A stock usually trades at a high multiple for one of two possible reasons: either investors’ expectations are too lofty and disconnected from reality, in which case a correction could be inevitable, or the underlying business’s future earnings potential is highly promising and warrants a rich price tag. In the case of MA, the latter scenario is more likely the case in my view.

This means that MA’s rich multiple could get richer, making it a potential buy at current levels for investors looking for capital gains. To get a sense of MA’s future earnings potential and why it’s a promising stock despite the current rich valuation, it’s first important to look at historical business performance to appreciate the incredible momentum the company has garnered in recent years.

Doubling the business in five years

One of the best explainers of how MA makes money can be found in this investopedia article. The payments technology company, which operates the Mastercard, Maestro, and Cirrus brands, generates revenue by charging fees on payment transactions processed on its network. These fees are usually charged to its customers – which include many of the world’s largest banks and financial institutions – rather than cardholders.

It’s important to clarify that MA does not issue cards, extend credit or determine interest rates and other fees charged to account holders by card issuers (in most cases a bank or other financial institution). It also does not determine the fees that merchants pay to their banks (referred to as ‘acquirer’ in payments industry parlance).

Analysts expect MA’s revenue for FY2022 to come in at $22.18 billion and grow further to $25.16 billion in FY2023. If you compare these numbers to FY2017 when the company raked in $12.50 billion, it’s clear that the business has doubled in five years against the backdrop of a pandemic, geopolitical shocks in Europe, and other macroeconomic challenges such as inflation and interest rate hikes. This is no mean feat for a business with the scale and international reach of MA.

The most impressive bit about MA’s growth story is that it is a highly profitable company that generates a ton of positive cash flow. Its net income grew from $3.91 billion in FY2017 to $8.68 billion in FY2021 while cash from operations grew from $5.66 billion to $9.46 billion over the same period. FY2022 is expected to be another banner year.

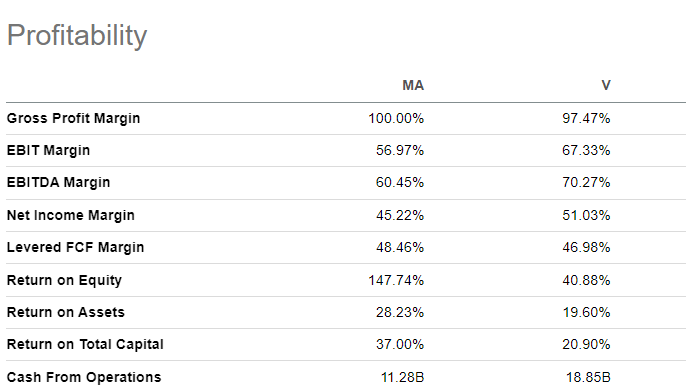

These numbers are possible because MA enjoys insanely high margins, which are likely to remain elevated given the industry it operates in is essentially a duopoly. Its peer, Visa (V), has similarly high margins as the illustration below shows.

MA and V both enjoy high margins typical of the duopolistic industry (Seeking Alpha)

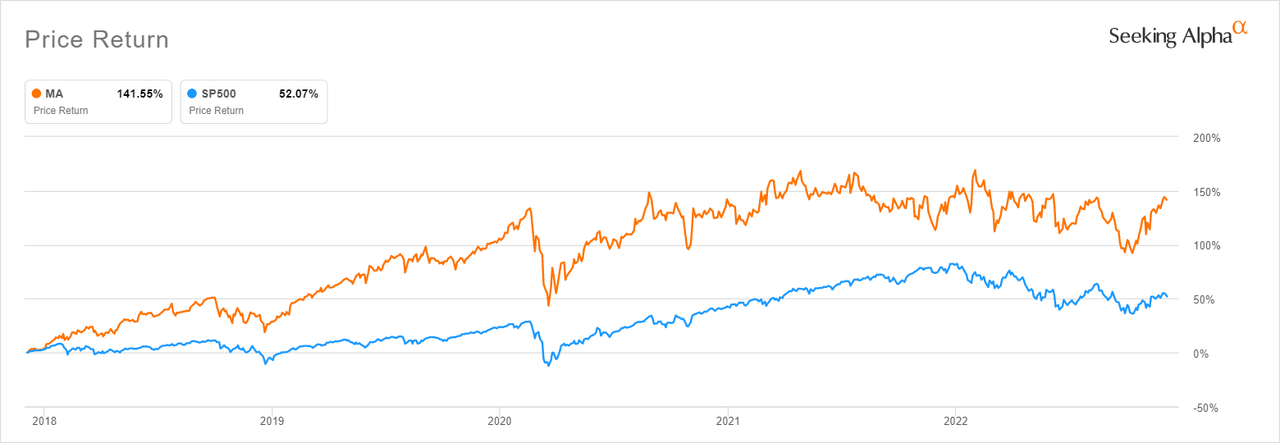

A fast growing business that consistently produces positive cash flow should over time outperform the index. This is the case with MA, which has in the past five years returned around 141% vs the S&P 500’s 52%.

MA’s 5 year return is almost 3x the S&P 500’s (Seeking Alpha)

The question for investors is: can MA maintain this outperformance given how high its P/E is today? We believe it can as the future earnings potential is highly promising.

Room for growth and innovation

One of the reliable signs that a company is firmly in growth mode is its tendency to surprise to the upside on earnings. This is evidently the case with MA. From the first quarter of 2018 to the latest third quarter of 2022, MA has missed quarterly revenue and EPS estimates just once.

The company clearly has strong execution, meaning its management team can consistently deliver on growth ambitions in different economic and market environments. Importantly, it is executing strongly in an industry that is still in expansion mode.

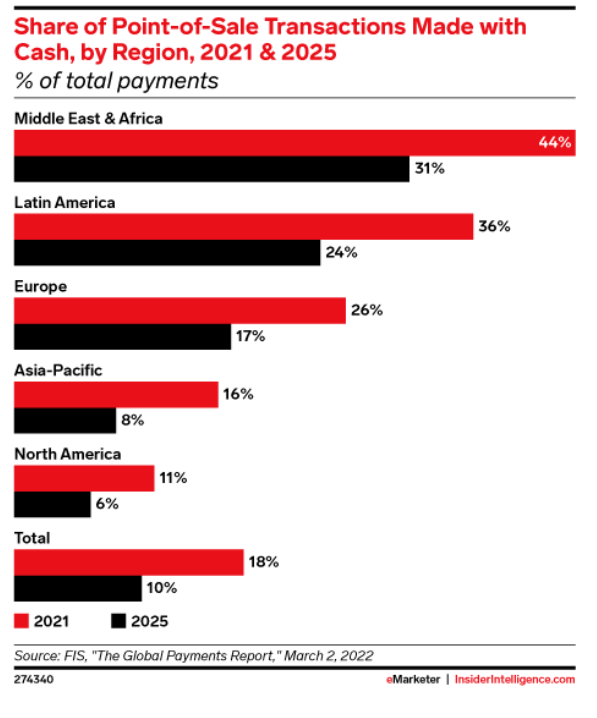

The main competitor for MA is not V, but is actually cash. When you look at the value of cash transactions in many countries, it is still high and the migration to cashless forms of payment is likely to continue for the foreseeable future. The chart below, retrieved from a bullish piece on MA by Seeking Alpha contributor Dividend Sensei, illustrates this ongoing migration to cashless payments. In total, the share of point of sale transactions globally made with cash will reduce by close to half from 18% in 2021 to 10% in 2025.

Global cash transactions could reduce to 10% by 2025 (FIS)

The shift to cashless is being driven by secular tailwinds such e-commerce and increased digitization of business processes. These are highly durable trends. There are also a lot of new opportunities in digital payments that MA can capture, including but not limited to crypto, cyber security, AI driven data analytics among many others. The range of customers is also expanding from traditional banks to fintechs and even governments, which are tinkering with digital currencies and other digital payment solutions. MA has the expertise and cash to capitalize on these new innovations, including through mergers and acquisitions.

Shareholder friendly company with fortress balance sheet

MA makes for a good investment not only because of its future growth prospects and ability to generate cash, but also because of how it deploys its cash to reward shareholders. It pays one of the most reliable dividends that is unlikely to get cut even in the face of a possible recession.

While the yield is admittedly low, this is mainly because of the high stock price. MA has a generous payout ratio of 18.94%. Its 5 year growth rate for its dividend is 17.37% and it has grown its dividend for the past 11 years.

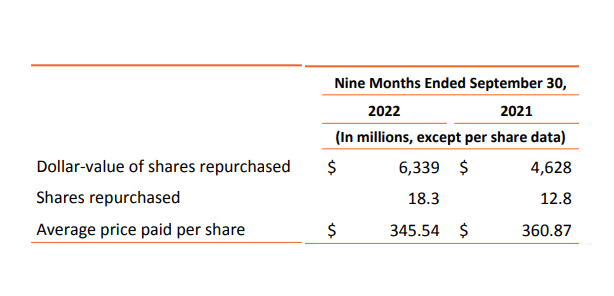

Its strong cash generation has also enabled it to return capital to investors through buybacks. The dollar value of shares repurchased grew by 36% year on year in the first nine months of 2022 to $6.33 billion as the screenshot below from its latest 10Q shows.

MA is aggressively buying back its stock (MA 10Q)

The company can afford these stock repurchases, which boost EPS and dividend per share. Its balance sheet is strong and it has a favorable rating from all the credit ratings agencies. Its last reported net debt was $6.1 billion vs total debt of $14.53 billion, reflecting its strong cash position. Its net interest expense for the trailing twelve months is barely half a billion, which is pocket change in relation to the cash it generates from its operations.

Conclusion

When you are buying the stock of a company like MA that is profitable, high growth, low debt and generates healthy levels of cash in a high interest rate environment, you should expect to pay a premium. And if you wait longer to buy in the hope of a bargain, it is likely that you will end up paying an even higher price. A high P/E can be an indication of a good quality stock with strong earnings potential. MA is a prime example and long-term investors who look past the current valuation will be rewarded in my opinion.

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.