Summary:

- Apple’s Services segment was one of the brightest spots in a relatively in-line November earnings report, topping an $85 billion run rate as growth jumped back to the high-double digits.

- Services growth has been broad-based, with new revenue records across a range of different offerings, and the segment has multiple growth outlets, including paid subscribers, AI, and price hikes.

- Should Services continue to grow in the teens for the next five years, such as at a 14% 5-year CAGR through FY28, it would be generating $164 billion in revenue.

ozgurdonmaz

Apple’s (NASDAQ:AAPL) Services segment was one of the brightest spots in a relatively in-line earnings report at the beginning of November, topping an $85 billion run rate as growth jumped back to the high double-digits after a string of single-digit growth. Services demonstrated that its growth flywheel continues to strengthen with multiple outlets of opportunity in sight — from AI to further growth in the installed base, to price hikes across different Services bundles.

Services Growth Outpaces iPhone, Apple

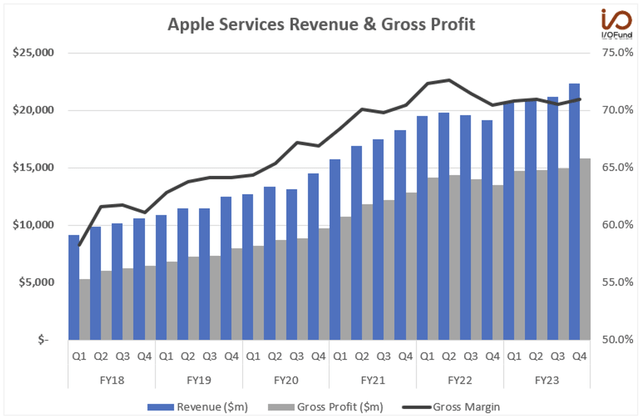

Since fiscal 2018, Services has become increasingly important to both the top and bottom lines for Apple. The segment has seen its share of revenue rise from under 15% five years ago to 22.2% at the end of September. Since then, Services has seen its annual run rate increase from ~$40 billion to over $85 billion, on track to surpass a $100 billion run rate potentially as early as the second half FY24.

FY21 was a breakout year for Services – the segment recorded greater than 24% YoY growth and generated more than $10 billion in gross profit each quarter, as its gross margin neared 70%. Gross margin has continued to stay above the 70% range, rising as high as 72.6% in Q2 FY22.

FY23 ending in September saw a full-year growth rate of 7.1% YoY for $85.2 billion outpacing both iPhone and company-wide growth, with Q4 being the strongest quarter of the fiscal year with a growth rate of 16.3% YoY.

Since FY18, Apple has grown revenue at a 7.6% CAGR, meanwhile, Apple’s company-wide gross profit has grown at a 10.1% CAGR over the same period with profits partly impacted by Services’ rising contribution and expanding margin.

Compared to Apple, Services is seeing revenue and gross profit grow at much quicker rates – more than 9 percentage points higher for both metrics. Since FY18, Services revenue has grown at a 16.5% CAGR, outpacing Apple’s 7.6% growth rate as well as the iPhone’s 4.0% CAGR, due to the unevenness in revenue in between upgrade cycles – iPhone delivered YoY revenue declines in FY19, FY20, and FY23.

Services’ gross profit has expanded at a 20.1% CAGR, rising around 150% since FY18, from $24.2 billion to $60.3 billion as gross margin has expanded 10 percentage points, from 60.8% to 70.8%. This strong revenue and gross profit growth over the past five years has seen Services gain importance to Apple’s margins and its bottom line.

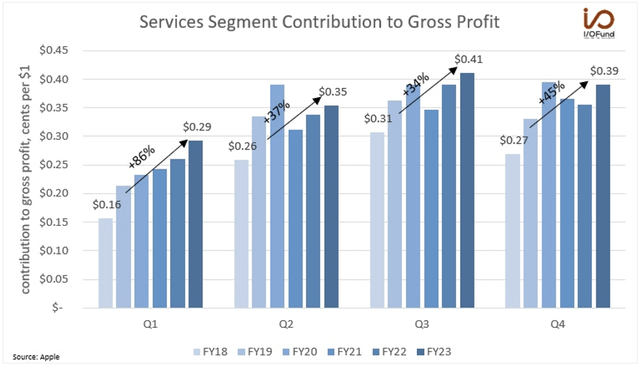

In FY18, Services contributed 23.7% of Apple’s gross profit, whereas today, Services contributes 36% of gross profit.

The breakdown looks like this:

As Services’ share of revenue rose from 15% to 22.2%, it helped pull Apple’s gross margin ~580 bp higher in just five years. Product gross margin – iPhone, Mac, iPad, etc. – increased just 210 bp, meaning this expansion in gross margin is primarily coming from Services.

FY21 was a breakout year for Apple’s gross margin, expanding from 38% to more than 42% because of that growth in Services. Apple is guiding for gross margin to expand further in fiscal Q1 next year, to the 45% to 46% range – an expansion of 200 to 300 bp YoY, with Services’ growth rate forecast to be in the high-teens again.

Services Seeing Multiple Growth Outlets

Services growth has been broad-based, with new revenue records across a range of different offerings, and the segment has multiple growth outlets to lever in the future, from growth in paid subscribers, AI, and price hikes.

CEO Tim Cook explained on Apple’s Q4 earnings call that the Services segment “achieved all-time revenue records across App Store, advertising, AppleCare, iCloud, payment services, and video, as well as the September quarter revenue record in Apple Music.” CFO Luca Maestri added that Services “reached all-time revenue records in the Americas, Europe and rest of Asia-Pacific and a September quarter record in Greater China.”

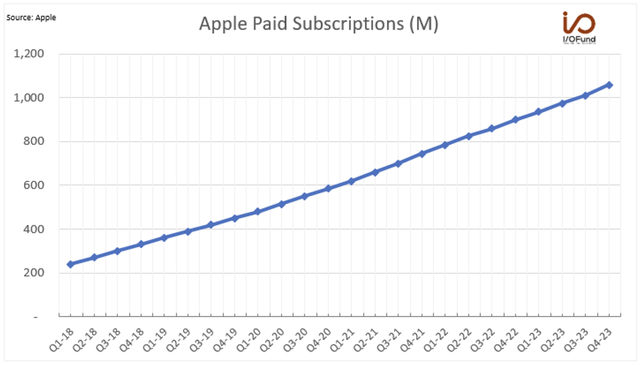

What is driving these record levels across multiple Services offerings and in every geography worldwide is solid growth in active devices and strong growth in paid subscriptions. Paid subscriptions have risen by more than 27% annually over the past five years to 1 billion by the end of FY23.

Apple has surpassed 2 billion installed devices, and “continues to grow at a nice pace and establishes a solid foundation for the future expansion of the ecosystem.” Thus, the organic growth flywheel for Services remains soundly intact – growth in installed devices driving growth in paid and transacting accounts at a higher degree.

At the start of FY18, Apple reported that it had an installed active device base of 1.3 billion devices, meaning it had a ratio of about 0.18 paid subscriptions per 1 active device. Since then, installed devices have grown more than +50% to over 2 billion, while paid subscriptions have grown nearly +360% to almost 1.1 billion, or a ratio of about 0.5 paid subscriptions per active device.

Reaching new all-time highs in its installed device base signals further growth lies ahead for Services, especially as the ratio of paid subscriptions per active device continues to rise. Other outlets of growth arise from Apple’s recent price hikes and potential monetization opportunities from AI.

Additional Levers

Apple recently enacted some price hikes for News+, Arcade, and its One bundles, with the hikes ranging from $2/mo to $5/mo. As a whole, the price hikes could generate an additional ~$5 billion in annual revenue with just a 15% attach rate to Apple’s more than 1 billion paid subscriptions — however, the price hikes could incur a small amount of churn, among more price-sensitive consumers.

In terms of AI, Apple is not releasing any details about projects in development, though it is rumored that some of the AI products Apple is working on would improve Siri and Messages’ capabilities, or add features to Keynote, Pages, and Apple Music. Apple’s large language model ‘Apple GPT’ is reportedly under development, but a commercialization route is still undetermined. The next generation of Apple’s software, iOS 18, macOS 15, and watchOS 11, are poised to bring AI features to Apple’s devices next year, as it works to catch up in the generative AI deployment race against OpenAI and Google.

For any of its AI products, there are three routes that could boost Services revenue – adding AI features for free in an aim to boost engagement across offerings, charging a subscription fee for AI features, or increasing prices of current bundles that incorporate AI. For example, if Apple charged for a stand-alone AI subscription at a $2.99/mo price point, it could rake in ~$10.8 billion in annual revenue at a 15% attach rate to its more than 2 billion active devices; boosting the prices of all of its subscription bundles by $0.99/mo could also add more than $10 billion annually.

In a previous Forbes article “AI Could Be Apple’s Next Chapter,” my firm pointed out that:

Although Apple is tight-lipped about the progress of its AI projects, the so-called Apple GPT chatbot is rumored to be more powerful than Open AI’s GPT 3.5 model, according to The Verge. Apple is spending millions of dollars a day training the large language model Ajax on more than 200 billion parameters.”

iPhone Demand Uncertain, China Risks Remain

Analysts have expressed concern over the holiday launch trajectory of Apple’s new iPhone 15, hinting that supply shortages, lower levels of consumer spending, and shorter wait times suggest weaker demand. The iPhone remains Apple’s main source of revenue, and a conservative fiscal Q1 guide from the company along with heightened concerns over iPhone 15 demand add to risks that iPhone revenue growth in the near term will remain depressed, after growing just +2.6% YoY in Q4.

Other concerns arise from Apple’s concentration in China, in regard to its iPhone supply base. Bank of America warned that Apple’s iPhone “supplier base remains largely in China,” which could “create many headwinds including around production, demand, [and] competition,” given that it is “hard to move all elements out of China.”

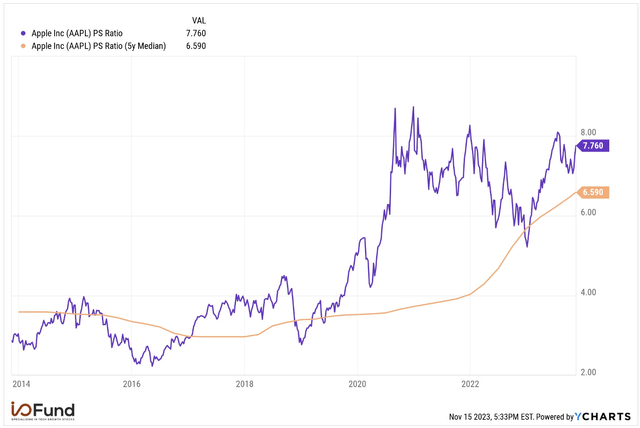

Services remains strong and a segment to watch, but we need the iPhone to participate and come in strong too, with a lingering risk to watch around China. Without the iPhone participating, Services is not enough to carry Apple’s stock alone, especially given its current valuation trading at levels hard to sustain.

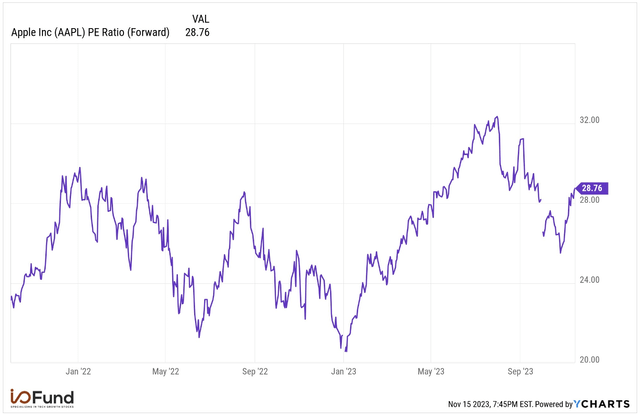

Apple is currently trading at a 7.76x P/S ratio, above its 5-year median P/S ratio of 6.59x, with the 8.0x a level that Apple has struggled to hold on to since spiking to it in 2020. Apple is also trading at a nearly 28.8x forward P/E ratio, again another valuation level that it has struggled to hold on to – since late 2021, Apple has generally pulled back to below 24x forward P/E after trading above the 28 range.

However, another risk to watch is Alphabet’s (GOOG) (GOOGL) antitrust trial, as it could have direct implications for Apple in the event of a negative ruling. Alphabet’s multi-billion dollar payments to Apple for Google to be the primary search engine on Safari across Apple’s devices are at the center of the trial, and that payment is rumored to be ~$19 billion this year – a key witness mentioned during the trial that Google is paying Apple 36% of search advertising revenue it generates via Safari. Should the scale of those payments constitute monopolization of the search market, Apple could be set to lose on a lucrative Services revenue stream.

Conclusion

Services is rapidly becoming one of Apple’s most important top-line segments, and arguably is the most important for Apple’s bottom line, given its outsized role in boosting Apple’s gross margin. Organic growth has been a strong driver of Services’ +16.5% 5-year revenue CAGR and its +20.1% 5-year gross profit CAGR, both of which outpace Apple’s growth rates by more than 9 percentage points.

Should Services continue to grow in the teens for the next five years, such as at a 14% 5-year CAGR through FY28, it would be generating approximately $164 billion in revenue or slightly more than 30% of Apple’s projected $538.6 billion in revenue. Price hikes, introduction of AI features, or finding ways to increase engagement and boost the ratio of paid subscriptions per active device all support this long-term revenue growth outlook for the segment.

Damien Robbins, Equity Analyst, contributed to this article.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.