Summary:

- Thermo Fisher Scientific is facing temporary revenue headwinds due to reduced COVID-19-related sales and cautious customer spending.

- The company’s organic revenues are expected to bottom in FY24 and see a reacceleration in growth from FY25 onwards which can help the stock re-rate.

- TMO’s valuation is cheap compared to historical averages and peers, offering a good buying opportunity.

JHVEPhoto

Investment Thesis

While Thermo Fisher Scientific Inc. (NYSE:TMO) is facing near-term revenue headwinds due to reduced COVID-19-related sales and cautious customer spending, these headwinds are temporary and the company’s organic revenues should bottom in FY24. The company continues to outperform its end markets even during this downturn, and once the end markets start recovering it can see a good revenue growth reacceleration from FY25 onwards.

On the margin front, the company’s pricing actions and productivity improvement initiatives along with easing comps should drive Y/Y improvement in margins in the near term. Further, once revenue returns to growth, it should also benefit from operating leverage in the medium to long run. The company’s valuation also looks cheap when compared with its 5-year historical averages as well as its peers. I believe the stock can see a re-rating in its valuation multiple once the organic growth accelerates. Hence, the stock offers a good buying opportunity as its organic sales approach the bottom.

Revenue Analysis and Outlook

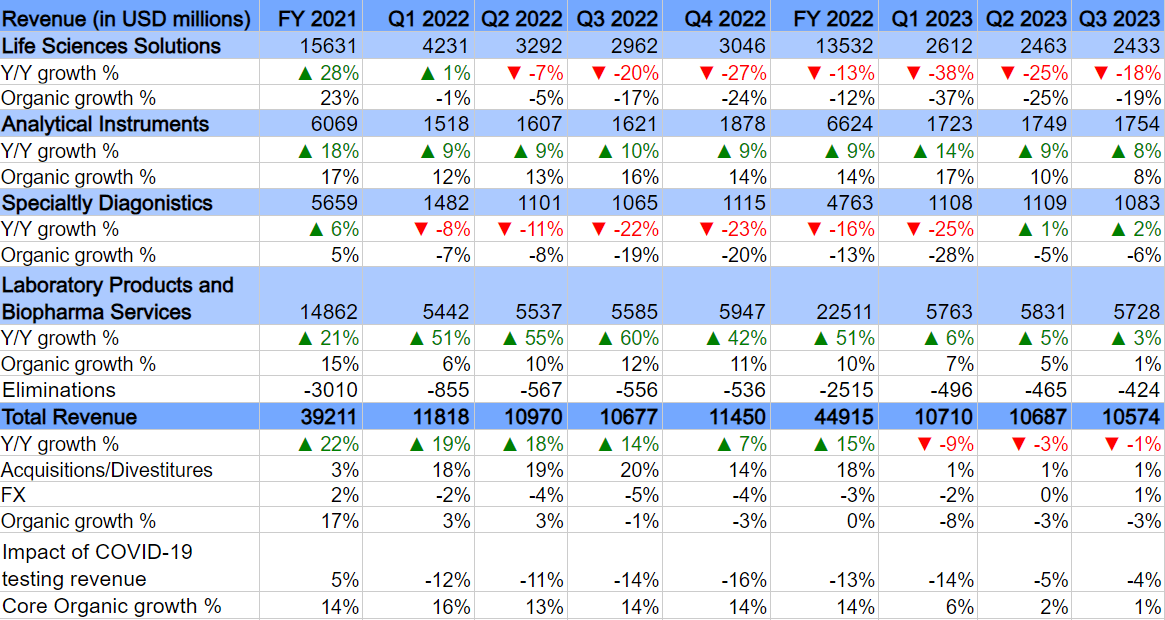

After seeing strong organic growth in FY20 and FY21 helped by Covid-19-related revenues and strong end-market demand, the company’s revenue growth has turned negative in the last few quarters due to moderation in Covid-19-related revenues and slowing end-market demand. In the third quarter of 2023, TMO’s revenue growth was negatively impacted by the decline in COVID-19-related revenues, resulting in a 1% Y/Y decline in total revenue to $10.574 billion. However, core organic revenues, which exclude the impacts of COVID-19 testing revenue, acquisitions, and currency translation, were up 1% Y/Y.

In the Life Sciences Solutions segment, revenues declined 18% Y/Y and 19% Y/Y organically due to lower COVID-19-related revenues. Within the Specialty Diagnostics segment, organic revenue decreased by 6% Y/Y due to lower revenues from products addressing the diagnosis of COVID-19, partially offset by growth in the immunodiagnostics, microbiology, and transplant diagnostics businesses, a 6% contribution from the Binding Site and CorEvitas acquisitions and a 1% favorable impact of FX translation. The Analytical Instruments segment’s revenue increased 8% Y/Y organically attributed to increased sales in its electron microscopy business. In the Laboratory Products and Biopharma Services segment, revenue increased 3% Y/Y with an organic growth of 1% Y/Y led by higher sales in the pharma services and clinical research businesses.

TMO’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, I believe we are approaching the bottom in terms of organic revenues in FY24 and the company’s organic growth rate should meaningfully accelerate from FY25.

The impact of COVID-related revenue runoff, which has been a big headwind for the company in the past several quarters, is sequentially reducing. In FY22 and Q1 23, the company saw a low-teen percentage impact from COVID-19 related testing and other sales going away. This headwind reduced to mid-single digit in Q2 23 and Q3 23. According to management, the pandemic-related revenues for both testing and total vaccines and therapies are likely to be around $300 mn in FY24 versus an estimated $1.6 bn in FY23. So, this would be a $1.3 bn or ~3 percentage point headwind in the next year, and from FY25 onwards it would not be material (less than 1%.) This should help in organic revenue bottoming in FY24 and then resuming growth from FY25 onwards.

In terms of core organic revenue excluding COVID-related sales, the company is facing headwinds from cautious customer spending, weak macros and regulatory headwinds in China, and muted bioprocessing demand as the customers are working through excess inventory. Despite this, the company was able to outperform the end market and post slightly positive Y/Y core organic sales thanks to its excellent execution and share gains. One notable pillar of the company’s market share gains is high-impact innovations and the company continues to launch new products. In line with this, the company launched its new mass spectrometry instrument Thermo Scientific Astral in June which has seen very strong demand and quick adoption by customers for their protein discovery research. The company also launched EXTENT Solution in Europe last quarter which complements its leading portfolio of assays to diagnose and monitor blood protein abnormalities related to multiple myeloma and other disorders. In the bioproduction business, the company introduced the Gibco CTS Detachable Dynabeads, its next-generation Dynabeads platform, and in the electron microscopy business, the company launched the Thermo Scientific Hydro Bio Plasma focused ion beam, providing high-resolution imaging along with a simplified workflow for cell biologists.

The company’s focus on innovation coupled with its industry-leading position and trusted partner status with customers should help the company drive continued outperformance versus the end market growth. Management expects the company’s end market to grow between 4% to 6% annually in the long term, and the company to outperform these end markets by 200 to 300 bps annually resulting in high single-digit long-term core organic growth for the company.

While the growth has slowed of late, most of the headwinds the company is facing in its end markets are temporary. The high interest rate and tight funding environment which is resulting in cautious customer spending should likely reverse over the next couple of years. There have been some positive data points with inflation trending in the right direction and analysts at Deutsche Bank recently commented that they see interest rate cuts starting June 2024. The inventory destocking headwind also can’t continue forever and should end over the next few quarters leading to an improved order rate. In China, the government’s anti-corruption crackdown on healthcare providers has resulted in some customers temporarily pausing orders and this has impacted all Med Tech companies in recent quarters. However, there has been some improvement of late and this should continue as more clarity emerges in the coming months. Further, as discussed before, the COVID-related sales rundown headwind should reduce to low single digits in FY24 and should not be material (<1%) from FY25 onwards.

So, I believe FY24 should mark the bottom of organic sales and it should start seeing a good acceleration from FY25 onwards.

Margin Analysis and Outlook

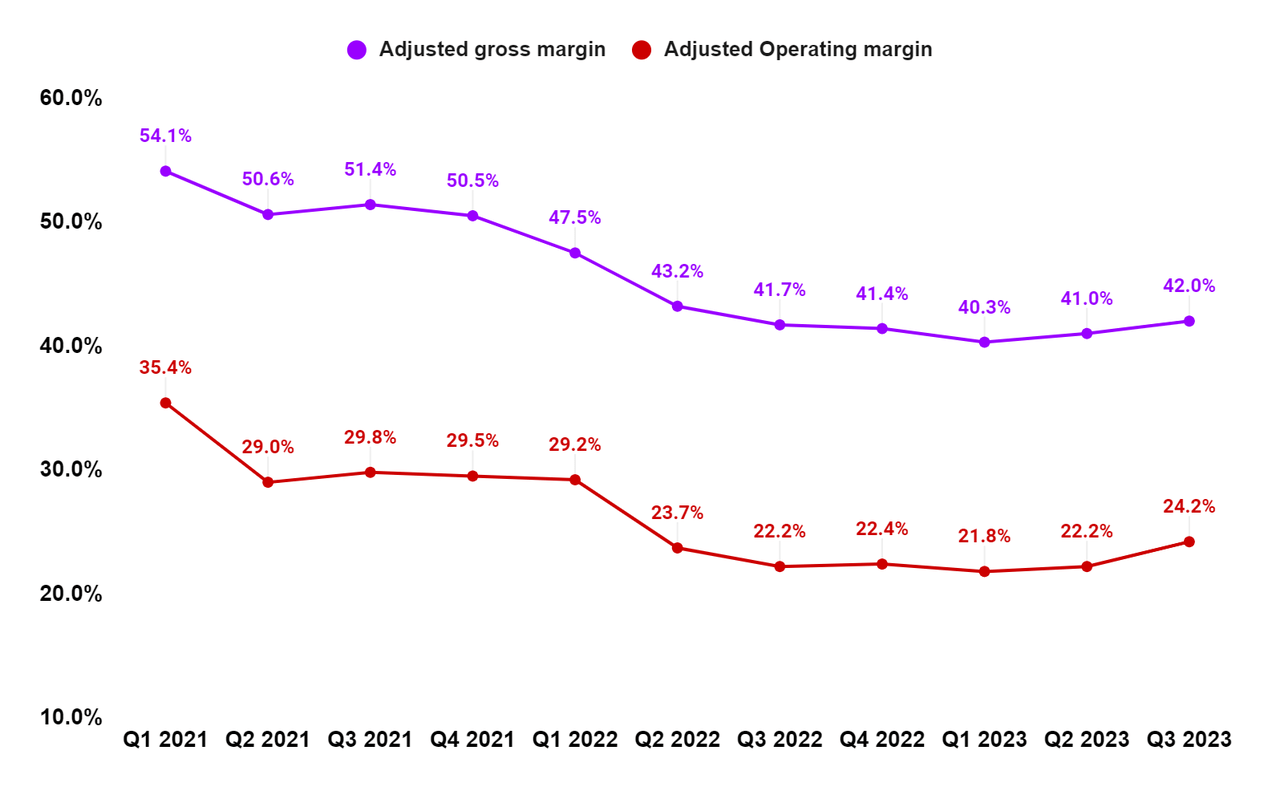

In Q3 2023, the company’s margin growth benefitted from strong productivity improvements and good price realization thanks to its Practical Process Improvement [PPI] Business System. This helped the company effectively offset the negative impact of lower COVID-19-related revenue, continued strategic investments, and unfavorable FX translation. As a result, the company saw a 200 bps Y/Y expansion in adjusted operating margin to 24.2% and a 30 bps Y/Y increase in adjusted gross margin to 42%.

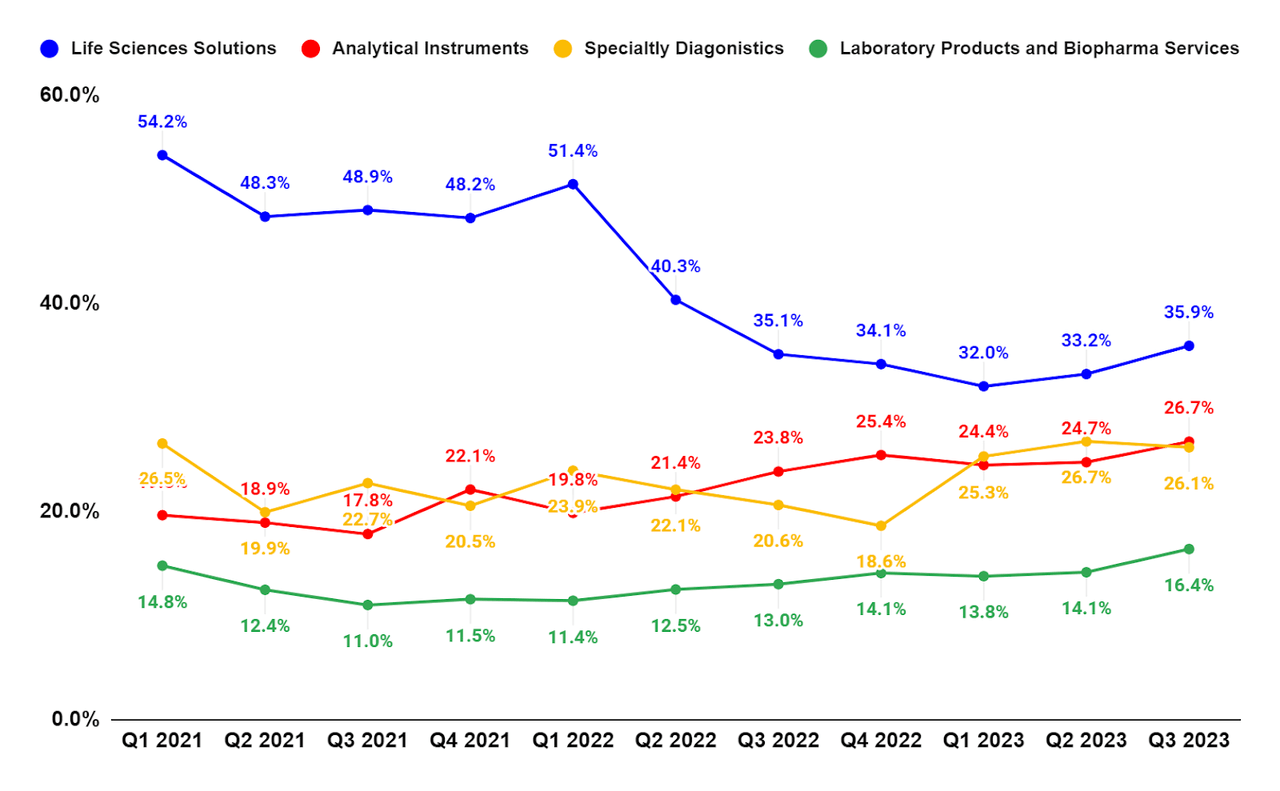

On a segment basis, the operating margin improved by 80 bps Y/Y in Life Sciences Solutions, 290 bps Y/Y in Analytical Instruments, 550 bps Y/Y in Specialty Diagnostics, and 340 bps Y/Y in Laboratory Products and Biopharma Services segments.

TMO’s Adjusted Gross Margin and Adjusted Operating Margin (Company Data, GS Analytics Research)

TMO’s Segment-Wise Operating Margin (Company Data, GS Analytics Research)

Looking forward, the company’s pricing action as well as productivity initiatives should continue to help it offset the organic revenue-related headwinds in the coming quarters. So, I expect margins to continue recovering sequentially. Also, margin comparisons are comparatively easier in the coming quarters as Q1 2023 marked the bottom of the company’s margins in this cycle. This should help the company post good Y/Y improvement in margins in the coming quarters. Once organic sales growth starts to accelerate again, the company should also benefit from operating leverage helping margins. So, I am optimistic about the company’s near as well as medium-term margin growth prospects.

Valuation and Conclusion

TMO is currently trading at 22.30x FY24 consensus EPS estimates and 20.02x FY25 consensus EPS estimates, which is at a discount versus the company’s average forward P/E of 24x over the last 5 years. The stock is also trading at a discount versus its other healthcare equipment and services peers like Danaher Corporation (DHR) trading at 28.31x FY24 consensus EPS estimates, Mettler-Toledo International Inc. (MTD) trading at 27.86x FY24 consensus EPS estimates, and Boston Scientific Corporation (BSX) trading at 25.08x FY24 consensus EPS estimates.

The company’s organic revenue growth has slowed in recent years resulting in it trading at a discount to its historical levels. However, the headwinds it is facing are transient, and I believe the sales should bottom in FY24 with the company returning to growth from FY25 onwards. Further, the company’s focus on high-impact innovation and product launches combined with its industry-leading positions and trusted partner status with clients should help it to outperform the end-market growth despite the near-term slowdown. The margin growth should also improve with the help of the company’s pricing action and productivity initiatives and easier comps.

I believe as the end markets recover and sales growth accelerates in FY25, the company’s valuation multiple can re-rate. This coupled with healthy earnings growth can provide a good upside for medium to long-term investors. Hence, I have a buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.