Summary:

- Texas Instruments’ stock has declined by 12.32% due to lower Q3 earnings and a significant drop in free cash flow.

- The company’s capital expenditure plan has increased by 40% until 2026, potentially leading to a constrained situation.

- Texas Instruments’ free cash flow conversion and inventory turnover are at historic lows, but the management remains optimistic about long-term growth.

kuriputosu

Investment Thesis

Preview

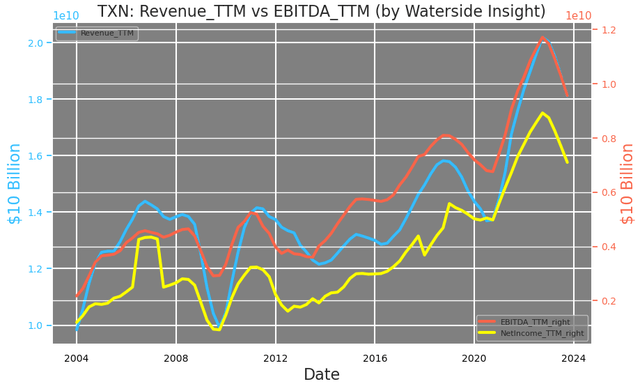

We first covered Texas Instruments in June this year in “Texas Instruments: Near-Term Slowdown Visible With Strong Long-Term Growth Drivers “. At the time, Texas Instruments was a tad below our bearish estimates, but we expected more slowdown ahead and recommended a “hold” instead of a “buy”. Since then, the stock has declined by 12.32%, due to Q3 earnings reporting a lower revenue, and its net income and EBITDA were both impacted by a similar proportion.

Texas Instruments: Revenue vs EBITDA (Calculated and Charted by Waterside Insight with data from company)

Updates

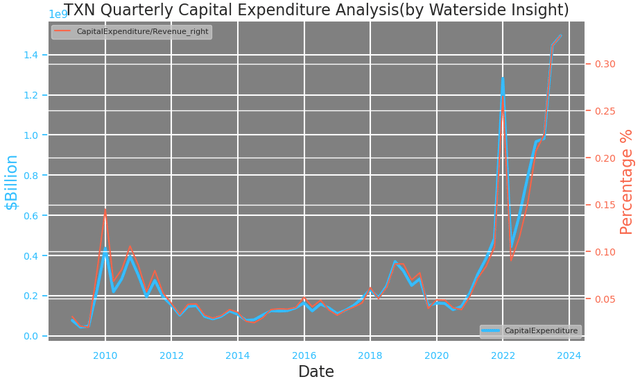

From our last article, we concluded that the focus for Texas Instruments was mostly on its inventory and capital expenditure. Mostly as a result of these two factors, its free cash flow has experienced the steepest decline since then.

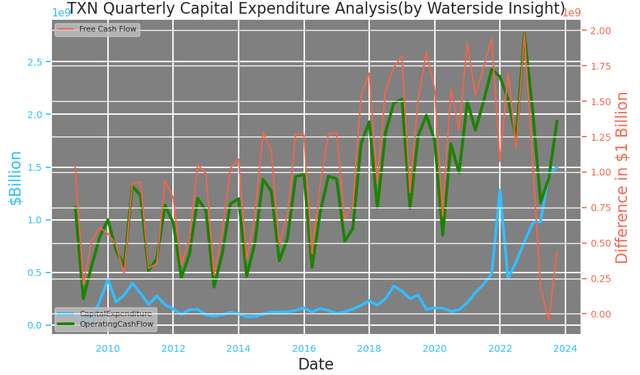

Texas Instruments has a set agenda for its capital expenditure -$5 billion/year from ’23-’26, and 10% -15% of revenue for ’26 and beyond. The period from now till ’26 has increased by 40% from its original CapEx spending plan set in 2022. By the same measurement, CapEx is at about 30% of its revenue currently and could be at or above this percentage level until 2026 if the plan stays as is.

Texas Instruments: Quarterly Capital Expenditure Analysis (Calculated and Charted by Waterside Insight with data from company)

So when TI’s operating cash flow only declined from the highs to the average levels in the past twenty years, its free cash flow dropped significantly. The company is setting itself up for a constrained situation – there is no room for operating cash flow to fall.

Texas Instruments: Capital Expenditure Analysis (Calculated and Charted by Waterside Insight with data from company)

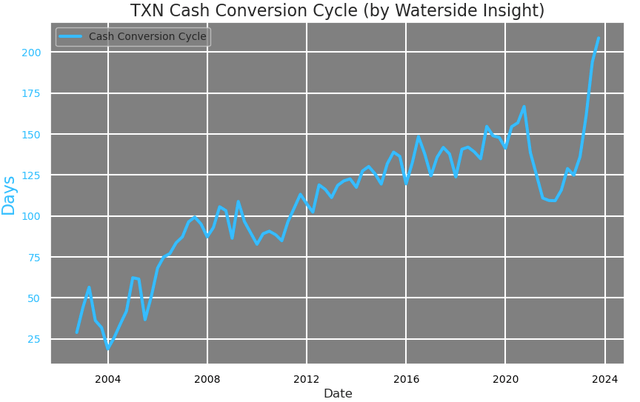

The lower operating cash flow was mainly due to lower net income and higher inventory for the quarter. On a YoY basis, its net income was lower by 24.2% while its inventory was up by 233%. Its days of inventory were set to be >200 days in the top range in its scorecard update for 2023, and now it is about 220 days. To see the impact on its cash flow, although its days of payables have been increased by about 20-30 days, its cash conversion cycle has still risen similarly to over 200 days, the longest in the past twenty years.

Texas Instruments: Cash Conversion Cycle (Calculated and Charted by Waterside Insight with data from company)

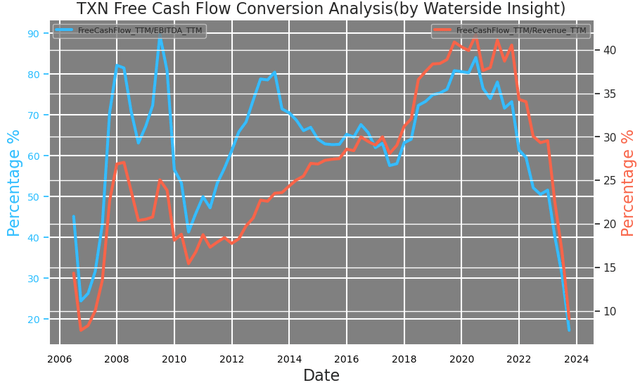

In the same scorecard, Texas Instruments’ free cash flow conversion was set to be about 25-35% of revenue. This ratio is currently at around 10%, and the free cash flow conversion from EBITDA has dropped below 10%. Both are at their historic lows tracing back to before ’08.

Texas Instruments: Free Cash Flow Conversion (Calculated and Charted by Waterside Insight with data from company)

TI set out to spend $3.5 billion in CapEx in 2022 but only ended up with $2.8 billion spent. The company had just broken ground on a new 300-mm semiconductor fabrication plant in Utah by investing $11 billion. This plant is not only its most prized advancement technologically but also a “geopolitically dependable footprint” to bring more production on shore. In 2026, this plant will ship out its new fab, coinciding with its CapEx spending plan to begin to wind down. We believe there is no slowing down on its CapEx as the project has been committed to. If the company spends another $1.1 billion in Q4, which it can easily do, then it will hit the target of its CapEx. But it is stretching thin measured by free cash flow and inventory turnover, even though the management insisted that the inventory buildup was just being “ready for the next upturn”. But as the new wafers coming to the market, supposedly by 2026, this next upturn will need to come before then in order for its current inventory to stay off obsolescence, ideally in 2024.

As TI’s CFO Rafael Lizardi put it, the company does not optimize for depreciation or gross margins but only optimizes for free cash flow. And there is no change in its long-term targets. So to improve its free cash flow, the only viable option left is to increase its top line and net income. Mr. Lizardi explained that the competitive markets in China that could get tougher is only 20% of its revenue, while the other 80% from North America, Europe, and other places where TI will continue to enjoy its competitive advantage. The company provides not only best-in-class production such as the 300-mm product offering, but also in a cost-advantage way with a broad portfolio. The management believes this will play well in markets outside China with the customers, especially the automotive and personal electronics industries. The way the management plans for its product lineup relies on a long-term vision. Its CFO said they started planning for the automotive industry’s current high demand for chips more than ten years ago. He sees that five different sectors in the auto industry will increasingly drive the demand in the long term, such as ADAS, powertrain, infotainment, body electronics, and lighting. So in short, the management plans on riding through the current cycle and aims at holding out for another upturn to come. We think that is the right approach. So long Texas Instruments stays on the cutting-edge product lineup, the demand’s ebbs and flows will work their way back. But for now, investors also need to be patient.

Financial Overview & Valuation

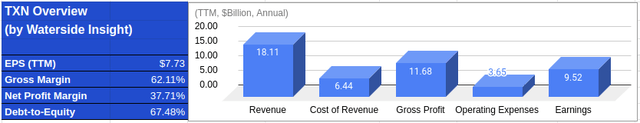

Texas Instruments: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

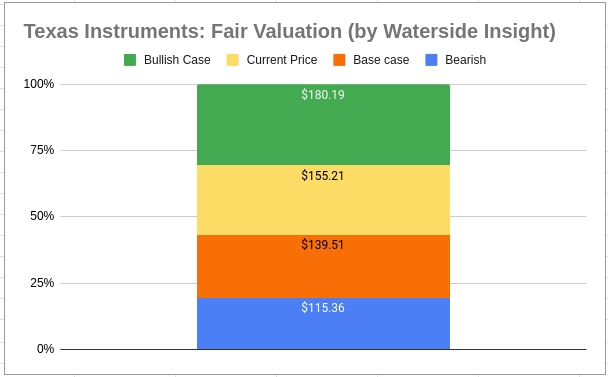

Compared to our previous assessment, the steep decline in free cash flow has come larger and earlier than expected. We originally expected such a decline to happen in 2024. With this change, we also revised our fair valuation. The decline was about 3x more than we expected for 2023, so we revised both 2023 and 2024 expectations. In our base case, the upturn materialized in ’25, and the new wafers came online with a boom in sales in ’26 and beyond; TI was priced at $139.51. In the bullish case, the boom came in ’24 with stronger demand mostly from the developed markets; the company was priced at $180.19. In the bearish case where still some more decline in ’24 and milder recovery in ’25, it was priced at $115.36. The market is still optimistic about TI’s growth trajectory given its latest financial development.

Texas Instruments: Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

Conclusion

In reviewing our previous thesis, the baseline of our concerns over its inventory and CapEx were correct, and our long-term growth picture matches with the plans of Texas Instrument’s management. Although we did not account for how quickly the decline came, we made the right call to not buy five months ago, and investors who held on to their shares got to see more dividends distributed in Q3. The company’s large CapEx to maintain its lead is necessary. Investors who share the management’s long-term vision will need to be patient. Based on our revised assessment, we continue to recommend a hold right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.