Summary:

- American Tower Corporation has a global portfolio with assets on 6 continents, including 200,000 towers and data centers.

- The company expects strong revenue growth due to the increasing demand for data transmission and processing in both 5G and autonomous driving.

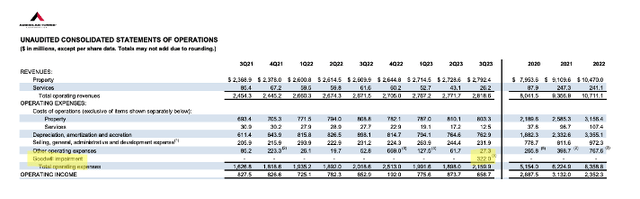

- AMT’s recent results showed positive rent revenue growth, cost management success, and increased liquidity, but there are concerns about collection risk and valuation.

15703083

Dear readers,

American Tower Corporation (NYSE:AMT) is a major cell tower REIT similar to Crown Castle (CCI). I compared both REITs back in February, covered the main differences between the two and concluded that both represented good buying opportunities at the time. More recently, less than a month ago, I published a detailed piece on CCI.

Today, following Q3 2023 results, I want to provide readers with a more detailed review of AMT and show why I think the stock deserves a downgrade to a HOLD despite terrific recent results.

The portfolio

AMT has a global portfolio with assets on 6 continents. This includes about 200,000 towers, of which 43,000 are located in the U.S. In addition to towers, the company also owns data centers which it acquired through the relatively recent CoreSite acquisition.

The company expects to derive major synergies from data centers. In particular, they see a big opportunity for both 5G and data centers in autonomous driving. The idea is that training and operation of autonomous vehicles requires vast amounts of data to be transmitted and processed, which should result in high demand in both AMT’s business lines.

Moreover, data usage per device in AMT’s core markets is expected to grow by a CAGR of up to 18% over the next five years, which should drive strong revenue growth over the medium-term.

The roll-out of 5G is likely to happen in cycles similar to those of 3G and 4G. The cycle generally has three phases and results in two periods of peak investment into infrastructure, bridged together by a phase of moderate activity.

The first phase is all about increasing coverage through upgrading existing infrastructure and likely peaked in 2022 with record industry-wide investment of $40 Billion.

Management sees the first phase winding down today and expects carriers to start harvesting the network efficiency benefits of their investment in phase 2 which, based on experience with 4G cycles, should be characterized by more moderate spending. The expectation is for total spend of $35 Billion in 2023 and likely even less in 2024. In 2025 and beyond investment is expected to re-accelerate again, though I remain cautious of the timing, because management has already pushed back the expected growth from 5G a couple of times. And the current high interest rate environment is quite hostile to new investment, especially for highly leveraged telco carries.

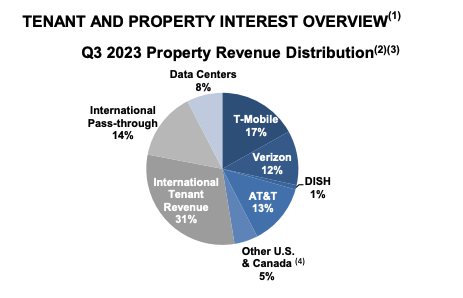

AMT’s tenant mix is more diversified than that of CCI, but is still heavily weighted towards major US telecommunication providers, such as T-Mobile (17%), Verizon (12%) and AT&T (13%).

AMT Supplement

Because AMT has assets abroad, it also has a significant exposure to international carriers. This comes with pros and cons. Telecommunication infrastructure in emerging markets lags behind the US, which means that there is a longer growth runway and also a potential for higher returns (this is also evident from recent results, more on this below). But higher growth comes with higher risk. In particular, collection risk.

AMT has been struggling to get their rent paid in India since the start of this year, as laws aren’t as easily enforceable in emerging markets as they are in the US. Little progress has been made so far, AMT recorded $322 Million in goodwill impairment charges in Q3 and promised to finalize a strategic review of the business by the end of the year.

Recent Results

AMT’s third quarter results were really good.

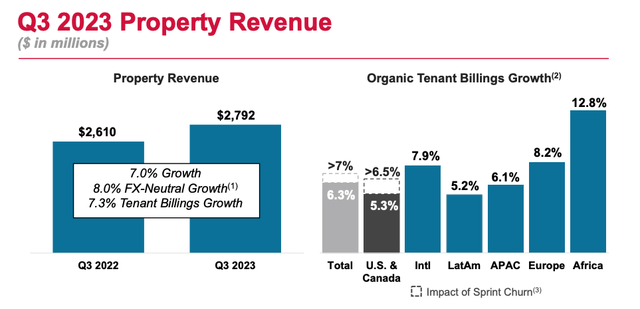

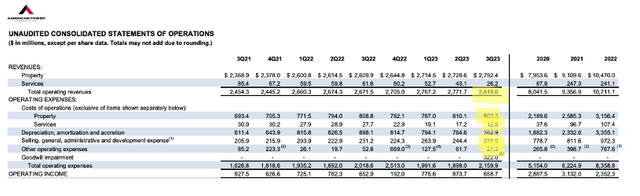

The company saw its rent revenue increase by 6.3% YoY, a third consecutive quarter of 6%+ YoY growth. U.S. & Canada saw the lowest level of growth, partly due to the ongoing Sprint churn, at 5.3% YoY. But this was nicely offset by strong 8.2% YoY growth in Europe and as much as 12.8% YoY in Africa. The data center segment has also done remarkably well, growing their revenues by 9% YoY, well above the initial underwriting expectations.

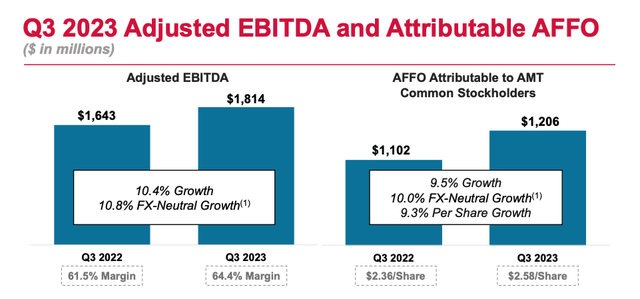

Moreover, management’s declared focus on cost management has paid off. The cash SG&A as a percentage of revenue has declined by 70 bps, resulting in EBITDA margin expansion of 290 bps to 64.4%. Consequently, Adjusted EBITDA and AFFO per share both increase more than revenue by 10.4% YoY and 9.5% YoY, respectively. As a result of good performance and high visibility, management has raised their full year 2023 guidance across nearly all segments.

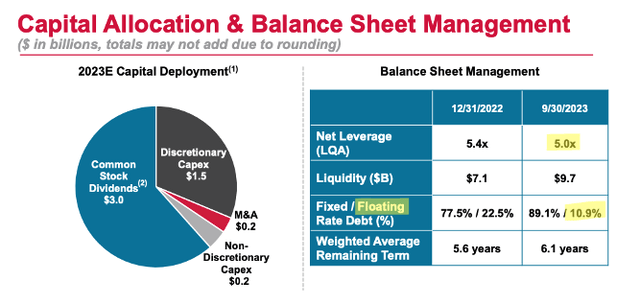

Beyond revenue growth, the REIT has also managed to increase its liquidity and reduce its leverage and floating rate exposure over the first 9 months of the year. Net debt to EBITDA now stands at a reasonable 5x level, floating rate debt exposure has been reduced by $4 Billion to less than 11% and the REIT has raised $1.5 Billion in senior unsecured notes (at an average rate of 5.9%) which it used to repay the outstanding balance on their revolving line of credit.

Valuation

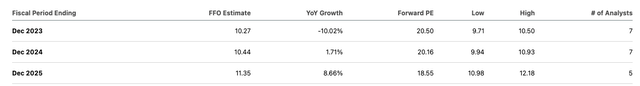

The consensus is for AMT’s FFO to be roughly flat in 2024, mainly as a result of Sprint-churn, and for 8% growth beyond. But since the REIT has a history to pushing back the 5G-related growth, which is likely to be the main growth driver, I’m going to assume a more conservative 3% annual FFO growth in my forecast.

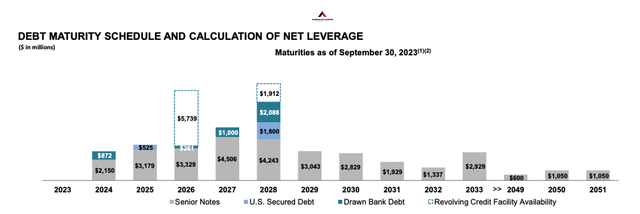

Next year AMT will have to refinance a $872 Million EUR-denominated facility at a current rate of 4.9% and three USD-denominated facilities worth a total of $2.15 Billion at an average current rate of 3.5%.

Assuming that interest rates stay at today’s level, we can use this year’s $1.5 Billion dollar refinancing (at a rate of 5.9%) as a benchmark. Refinancing next year’s debt at this rate will increase interest expense by $45 Million which is about 1% of AMT’s AFFO.

And in 2025, the refinancing impact would only be marginally higher at 1.2% of AFFO. It is therefore evident, that despite a relatively high floating rate exposure and some maturities, AMT’s cash flow will be more dependent on revenue growth as interest expense will likely be quite stable.

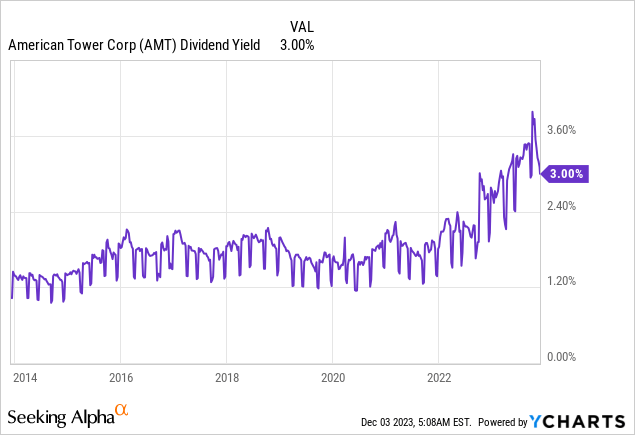

AMT currently pays a 3% dividend yield, which is the highest ever for the stock. The dividend yield is low for a REIT, but has growth at a solid 15%+ CAGR over the past 5 years and is very well covered with a payout ratio of 65%.

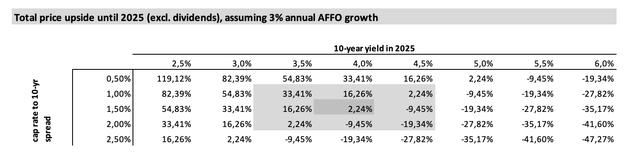

Beyond 3% FFO growth and 3% dividend, further upside will likely only materialize if interest rates drop.

The REIT doesn’t report NOI, but using their latest figures (and ignoring the Indian goodwill impairment), the annualized NOI is close to $7 Billion.

At a share price of $210 per share, AMT therefore trades at an implied cap rate of 5.3%, which is only 80 bps or so above the current 10-year treasury yield and well below CCI’s spread.

That’s a tight spread for a BBB- rated company which is currently experiencing issued with collections in India, the ongoing Sprint-churn and a relatively high floating rate exposure. All things considered, I’d be more comfortable with AMT trading at a 150 bps spread to long-term yields.

Assuming a 150 bps spread and a moderate decline in long-term yields to 4% by the end of 2025, produces upside of only 2%. And with a low dividend yield of just 3%, I don’t see how AMT can reasonably beat the market from these levels. Therefore I downgrade the stock to a HOLD here at $210 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.