Summary:

- American Tower specializes in owning and operating communication real estate, providing essential infrastructure for wireless networks.

- The company is expected to benefit from the double-digit growth of connected mobile devices in the US.

- American Tower has revised its financial outlook for 2023, showing positive growth in adjusted funds from operations and adjusted EBITDA.

- AMT has a strong dividend growth record, with ten consecutive years of raises.

15703083

Overview

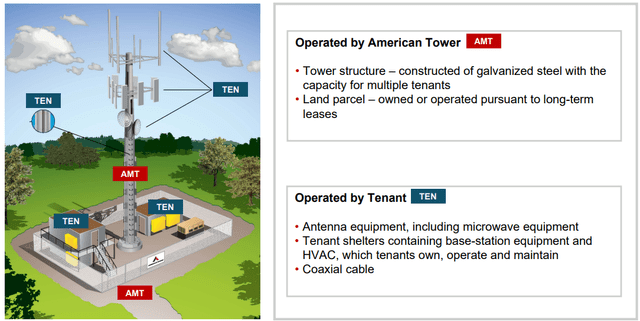

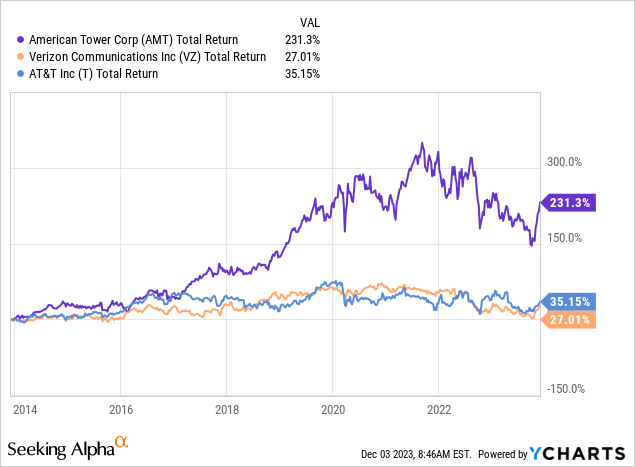

American Tower (NYSE:AMT) has always been a standout REIT in my eyes. This is because I have owned shares of Verizon (VZ) and AT&T (T) for a very long time and have always been severely disappointed with the returns they provide. If you’re unaware of why I’m making the comparison, it’s because AMT specializes in the ownership, operation, and development of multi-tenant communications real estate. Think of the cell towers that millions of mobile phones connect to every single day through providers such as Verizon or AT&T.

In comparison, we can see that AMT has outperformed these two mobile companies in terms of total return over the last decade. While I feel disappointed in the performance of Verizon and AT&T, I feel relieved that AMT offers an alternative form of exposure to telecom that has performed well. AT&T and Verizon are fairly popular within the dividend community as both of these companies have extensive histories of increasing their payouts.

However, I believe that AMT should be included in the mix as they have increased payouts for 10 consecutive years and have a dividend CAGR of 16% over the last 5-year period. Based on the research to follow, I believe this growth will continue into the future.

American Tower boasts a comprehensive global portfolio, encompassing an extensive network of nearly 225,000 communication sites strategically distributed across the world. This extensive reach positions them as a key player in the telecommunications infrastructure sector by offering enhanced connectivity and communication services on a global scale.

A significant portion of AMT’s revenue is derived from leasing their properties. Their primary focus lies in furnishing the essential real estate infrastructure required for contemporary wireless communications networks.

Growth Contributors

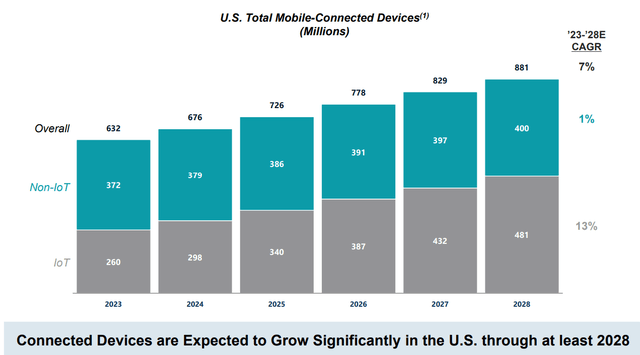

A major catalyst for AMT is the expected growth rate of connected mobile devices in the U.S. The total amount of mobile devices connected is expected to grow at a CAGR (compound annual growth rate) of 7% throughout 2028. This data also goes side-by-side with the projected growth in device usage. The usage, calculated in petabytes, is expected to grow at a CAGR of 20% from 2023-2028. For context, a petabyte is a measurement of one million gigabytes.

The growth will certainly contribute to the traffic to AMT’s towers. There will be an increasing demand and as more of the population continues to use more devices, AMT is set to greatly benefit. In fact, projections show us that by the end of 2024, an estimated 70% of the population will own a mobile phone. That would be a pool of roughly 5.5 billion people that AMT has an exposure to.

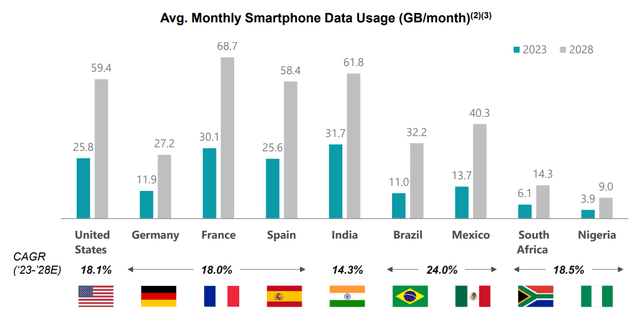

What’s interesting is that this is the projection for the entire world, not just the USA. We can see from the graphic below that the estimated CAGR of smartphone data usage is in the double digits for all regions, with Brazil and Mexico leading the charge with an expected annual growth of 24%.

Growth in countries outside of the US may be much larger because of the increasing affordability of smartphones. That’s right, there are “budget-friendly” smartphone alternatives to the thousand-dollar iPhones that have become the norm. For example, you can get a high-quality smartphone such as the Google Pixel 7a for as low as $279.

Financials

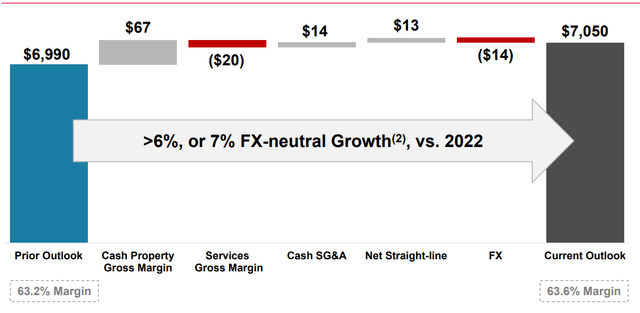

AMT has revised its guidance for 2023 adjusted funds from operations (AFFO) upward, following a third quarter that surpassed expectations. The revised outlook for 2023 now anticipates AFFO per share in the range of $9.72 to $9.85. This revision only represents a minimal 0.3% year-over-year growth. However, AMT has raised its full-year adjusted EBITDA guidance to $7.01 billion to $7.09 billion, indicating a healthy 5.2% increase from the earlier projection of $6.95 billion to $7.03 billion.

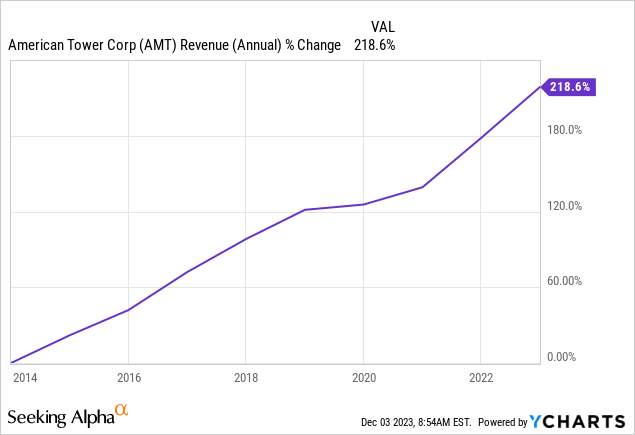

The third quarter results of 2023 saw AFFO per share reaching $2.58, outpacing the average analyst estimate of $2.51. This marked improvement from $2.46 in Q2 and $2.36 in the corresponding quarter of the prior year. Total operating revenues for Q3 amounted to $2.82 billion. I really like the revenue picture here as over the last ten years, we can see the revenue growing substantially. Property revenue witnessed a commendable 7.0% increase, reaching $2,792 million, while adjusted EBITDA registered a substantial 10.4% growth, reaching $1,814 million.

Looking ahead, I stay optimistic about the company’s growth. Management’s ability to consistently increase revenue alongside a growing smartphone market will contribute to future success. When you break away from the financials and research of the growing markets, I look at it with one surface-level question: Over the next decade, will people spend more time glued to their phones? Probably.

Therefore, AMT is a good company to hold exposure to this telecom bet. Rather than bet on specific companies like the previously mentioned Verizon or AT&T, you can take a bet on the sector as a whole by going with AMT instead.

Dividends

As of the latest declared quarterly dividend of $1.62/share, the current dividend yield sits at 3%. This declared dividend also represents a 3.2% raise over the prior dividend of $1.57/share. The dividend growth story here is impressive. This is because they have increased dividends for 10 consecutive years while also having an average dividend CAGR of 16% of the last 5-year period. This growth crushes the sector median growth of an abysmal 0.24%. With a conservative AFFO payout ratio of 62%, the distributions here are safe and have plenty of room for continued growth.

The current yield is actually a bit higher than what the average was. Not only does this indicate undervaluation, but it also indicates that this may be an opportune time to start a position if haven’t already. The average dividend yield over the last four years has been quite low at around a yield of 2.23%. The interest coverage sits at 2.63x compared to the sector median of 1.77x. This ratio is important because it’s a gauge of how well covered a company’s interest on its debt is covered.

Valuation

While AMT is down 2% for the year, it had a recent run-up of over 30% from October to present day. This is following a fall of 27% from the start of the year to the end of September. Even after this run-up, there are several indications that AMT is still undervalued. AMT has historically traded at about 23x AFFO. Currently, the price sits at 21x AFFO which indicates slight undervaluation, even with the recent price run-up.

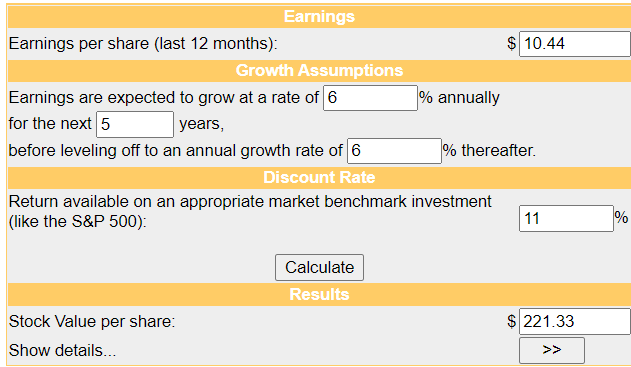

In addition, we can utilize a discounted cash flow model to get a rough estimate of a fair stock value. Using management’s expected EBITDA growth rate of 6%, we can determine that the fair stock value is $221/share. This would represent a modest potential upside of about 5% going into 2024. Combine this with a 3% dividend yield, you are looking at some solid annual growth potential.

Moneychimp

Takeaway

American Tower presents a unique opportunity within the telecom space, particularly when compared to traditional telecom giants such as Verizon and AT&T. The performance trajectory of AMT over the past decade has exceeded that of the mobile carriers and serves as an alternative avenue for exposure to the industry. AMT’s consistent dividend growth, evident in its impressive 10-year streak and a remarkable 16% average compound annual growth rate (CAGR) over the last five years, sets it apart.

Financially, AMT’s upward revision of its 2023 adjusted funds from operations (AFFO) and adjusted EBITDA guidance reflects its strong performance, with a minimal 0.3% year-over-year growth in AFFO per share and a robust 5.2% increase in adjusted EBITDA. The third-quarter results underscore this trend, with AFFO per share surpassing estimates at $2.58 and total operating revenues reaching $2.82 billion.

Despite a recent run-up in its stock price, AMT appears undervalued, trading at 21x AFFO compared to its historical average of 23x. Utilizing a discounted cash flow model, the estimated fair stock value of $221/share implies a potential 5% upside in 2024, complemented by a solid 3% dividend yield.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.