Summary:

- Carnival Corporation’s stock price has doubled this year, far outpacing the S&P 500’s performance.

- Its revenues have almost returned to pre-pandemic levels and the company also reported its first profit since the pandemic in Q3 2023.

- Its guidance for 2024, which is due out with its full-year 2023 results that are expected later this month, should continue to point in the direction of a healthy recovery.

courtneyk/E+ via Getty Images

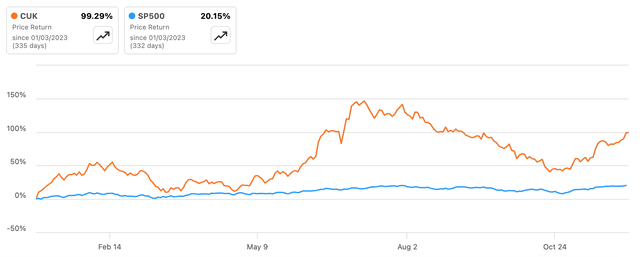

To say that this has been a good year for cruise operator Carnival Corporation (NYSE:CUK) (NYSE:CCL) in the stock market would be an understatement. Its price has almost doubled year-to-date [YTD] (see chart below). Even since I last wrote about it in September, the price has seen a 10.6% uptick, outstripping the S&P 500’s (SP500) 3.3% rise.

Price Return, Carnival Corporation and S&P 500 (Source: Seeking Alpha)

A vastly improved operating environment for the travel sector is, of course, the driving factor behind investor bullishness on Carnival’s stock, which has shown up in its numbers.

At the time I last checked, the company was due for the earnings report for its third quarter (Q3 2023) ending August 31, 2023, earnings report. This was an important update, in so far as the Carnival projected its first profit forecast since the pandemic. With its Q4 2023 and full-year results due a couple of weeks from now, here I take a look back at how it actually performed and whether we can expect continued earnings momentum going forward.

Profitable once again

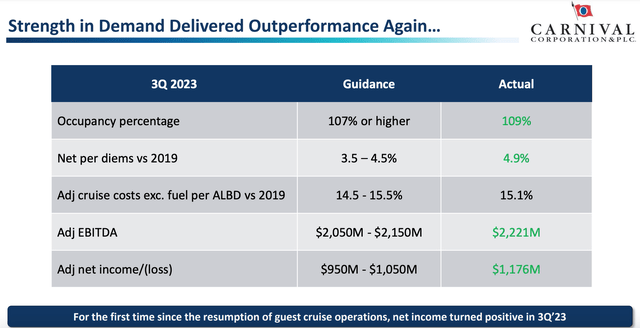

Carnival’s Q3 2023 financials indeed lived up to expectations, and then some, as adjusted profits, both at the EBITDA and the net level, came in even higher than expected (see table below). It even reported a GAAP net profit, with earnings per share of USD 0.79.

The sharp turnaround in operating profit after losses in the first half of the year (H1 2023) is also notable. With an impressive operating margin for the quarter of 23.7%, the operating profit has been high enough to wipe out H1 2023’s losses and result in a profit for the first nine months (9M 2023).

Source: Carnival Corporation

The quarter was buoyed by both improved conditions in general and a rewarding tourist season, which saw occupancy rates of 109%, beating the guidance of 107%. Revenues grew by almost 50% year-on-year (YoY) in Q3 2023, which was also significantly higher than my conservative estimate of a 25% growth, though slightly lower than analysts’ expectations of a 53% rise.

For the first nine months of the year (9M 2023), the trends are broadly the same except that it still reports a net loss, considering that the company was loss making until the first half of 2023. The absolute number though, has shrunk to just USD 26 million (9M 2022: USD 4,495 million). It does have a decent 9.7% operating income margin now, though. This is lower than the teen levels seen pre-pandemic, but it does reflect a good recovery.

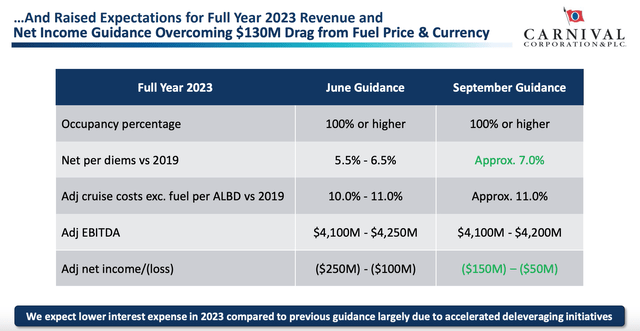

Looking forward

Despite the strong performance so far, however, Carnival slightly reduced its guidance for the upper end of the adjusted EBITDA range for the full year 2023 to USD 4,100-4,200 million from the initial guidance of USD 4,100-4,250 million.

This is related to a lower adjusted EBITDA range of USD 800 to 900 million for Q4 2023, which is lower than the quarterly average figure of USD 1,095 million for 9M 2023.

Source: Carnival Corporation

The company expects to revert to a net loss for the quarter and the full year as well. However, my estimates for its revenue growth are still rather positive. These are based on the assumption that the adjusted EBITDA comes in at the midpoint of the target range and also the adjusted EBITDA margin for the full year 2023 stays at 20.3%, the same as for 9M 2023. This results in revenues of USD 20.5 billion, a 68% increase from 2022.

The market multiples

The revenue projection results in a forward price-to-sales (P/S) of 0.96x. This is lower than my previous estimate of 1.2x, which was based on a more conservative revenue estimate.

Despite the change in number, though, the comparative trend with peers remains unchanged. It’s still higher than that of Norwegian Cruise Line Holdings (NCLH), which is now at 0.87x and remains below the forward P/S of Royal Caribbean Cruises (RCL) at 2.1x. On average, the forward P/S for cruise stocks is at 1.31x, reflecting that Carnival does have some more upside.

Consider 2024 now

Also, it’s worth bearing in mind that the financial year 2023 is already over for the company as of November 30, 2023. So technically, the forward P/S applicable now for it is that for 2024.

CUK’s forward P/S for 2024 is at 0.82x, which is still higher than that for NCLH at 0.8x but also lower than RCL at 1.86x. This results in an average P/S of 1.12x. Both the forward P/S of 2023 and 2024 on average indicate at least 35% upside to Carnival right now.

The forward P/E

There is a catch when considering forward market multiples though. In a break from the past few years, all cruise companies are expected to turn profitable next year. This means that the forward price-to-earnings (P/E) comes into play once again.

For 2024, CUK’s forward P/E is at 17.8x, higher than that for both NCLH and RCL at 13.94x and 12.66x respectively. On average, the forward P/E for 2024 is 13.6x, which indicates around a 15% correction in the price for CUK.

What next?

While the forward P/S and P/E point in different directions, on average, there’s still an upside to the stock of at least around 15%. The case for an upside is also supported by the fact that Carnival still trades at just 30% of its pre-pandemic levels. And this is when its trailing twelve months [TTM] revenues are already close to the same levels as the 2019 highs.

Sure, its earnings will take time to go back to pre-pandemic levels. But now it only appears to be a matter of time before they do, even taking into account the cyclical nature of the tourism business. The results due later this month should point to positive sales and earnings expectations for 2024.

I think at this point, it’s becoming increasingly clear that investors who play the long game will be the ones to come out ahead with Carnival Corporation. Additionally, there’s some short-term upside too. I’m retaining a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CUK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—