Coca-Cola: Digitalization And Category Innovation Drive Growth And Margin Expansion

Summary:

- In 2019, only 30% of Coca-Cola’s total media spending was allocated to digital, but as of year-to-date, this ratio has increased to 60%.

- They persist in investing in innovative products to meet changing consumer demands. Notably, Coke Zero has experienced considerable success.

- 68% of Coca-Cola’s products currently have low or no calories, and their potential risk from GLP-1 drugs is quite low.

George Frey/Getty Images News

Coca-Cola (NYSE:KO) has increased its digital spending as a percentage of total media spending from 30% in 2019 to 60% this year. These digital campaigns and platforms drive margin expansion, and targeted marketing enables them to improve their return on investment. Additionally, Coca-Cola’s ongoing product innovations, such as Coca-Cola Zero, contribute to their topline growth. I am initiating coverage with a “Strong Buy” rating and a fair value of $70 per share.

Digital Initiatives

In 2019, only 30% of Coca-Cola’s total media spending was allocated to digital, but as of year-to-date, this ratio has increased to 60%. Annually, Coca-Cola invests billions of dollars in marketing to promote its diverse brands and product categories. The emphasis on digital initiatives is crucial for improving margins and enhancing the effectiveness of brand promotion.

Firstly, digital campaigns can establish interpersonal connections between consumers and Coca-Cola’s products. For instance, in April, they launched the global campaign ‘A Recipe for Magic,’ aiming to integrate the soda into special moments around the dining table. This campaign is backed by approximately 750 global market influencers, playing a pivotal role in helping the company forge intimate interpersonal relationships with its customers.

Secondly, digital marketing offers a more measurable return on investment compared to traditional advertising. The transition of media spending to digital significantly contributes to improving the company’s profitability.

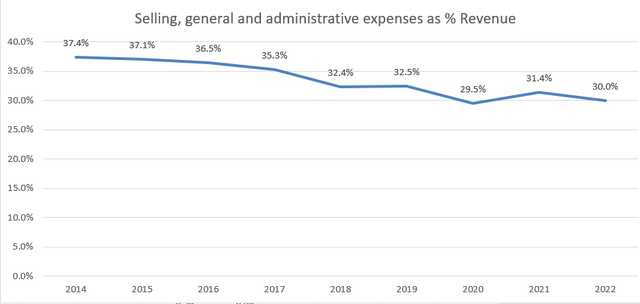

Lastly, Coca-Cola is actively incorporating AI into its digital platforms. As highlighted in their earnings call, the utilization of generative AI enhances their access to insights, market data, research, and trends. Consequently, their SG&A expenses to revenue ratio has been on a declining trend over the past few years. This improvement has played a pivotal role in facilitating margin expansion.

Category Innovation

As disclosed in the earnings call, 68% of Coca-Cola’s products currently have low or no calories, reflecting their commitment to addressing evolving customer preferences. They persist in investing in innovative products to meet changing consumer demands. Notably, Coke Zero has experienced considerable success, with management expressing optimism about its substantial growth potential in the future. They are particularly bullish on its long-term prospects.

I believe that category or product innovation, as well as premiumization, is mission-critical for a consumer staple company.

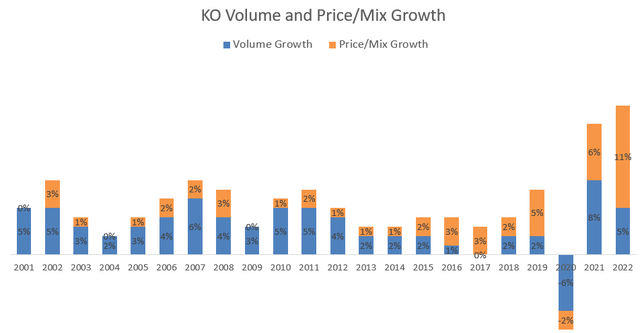

On one hand, innovation and premiumization can enhance their gross margin, given that these innovated categories often command higher prices. As depicted in the chart below, Coca-Cola has consistently achieved robust price/mix growth in recent years. Moreover, the current high inflationary environment is further contributing to their price/mix growth.

On the other hand, innovation and premiumization can revitalize old and established brands. A notable example is the phenomenal reformulation of Coke Zero in recent years. The success of Coke Zero serves as a compelling example of how to evolve and rejuvenate established brands.

Financial Results and Outlook

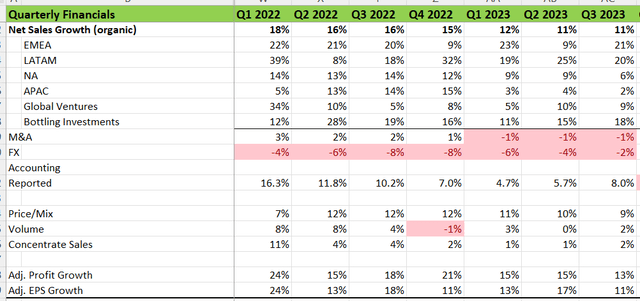

They delivered a robust Q3 FY23 result, with a remarkable 11% organic revenue growth. The price/mix contributed an impressive 9% year-over-year growth for Coca-Cola. Adjusted profit grew by 13%, and EPS was up by 11%.

On the balance sheet, their net debt leverage is 1.5x, well below their long-term target of 2-2.5x. Cash flow from operations increased by 9.7% year over year, driven by strong revenue growth and working capital improvements.

In terms of guidance, they have raised both top-line and bottom-line expectations for FY23. Specifically, they anticipate 10-11% organic revenue growth and comparable EPS growth of 7%-8%. The projected free cash flow is $9.5 billion, with $1.9 billion allocated to capital expenditure. The company plans to continue repurchasing its own shares to fully offset employee stock option dilution.

Overall, Coca-Cola is exhibiting a solid and strong growth rate. Considering their momentum in the past three quarters, they are likely to sustain price/mix growth in the near term, making their FY23 guidance appear realistic.

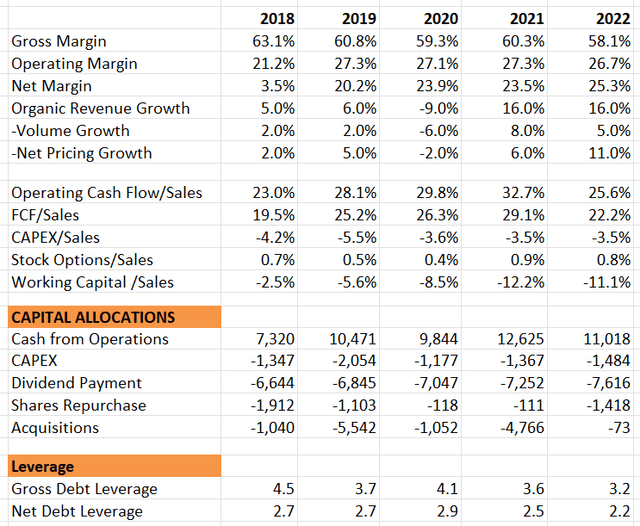

The table below examines their financial results over the past five years, revealing accelerated growth in recent years driven by strong price/mix and volume growth. Their cash flow conversion is robust, and they allocate most capital to dividend payouts, acquisitions, and some share repurchases to offset SBC dilutions.

The balance sheet has consistently been strong, making it highly unlikely for them to face bankruptcy even during a severe global financial crisis.

Valuation

For FY23, I assume a 6% reported revenue growth, comprising 11% organic growth, -4% FX impact, and -1% from divestitures. These growth rates align with their official guidance.

Looking ahead to FY24, I anticipate a moderation in inflation. The company is expected to benefit from a 6% increase in pricing/mix, driven by product innovations. Additionally, a 3% annual volume growth is estimated, consistent with the average figure over the past few years. Post-FY24, the model projects a 5% contribution from price/mix to reflect the normalization of global inflation.

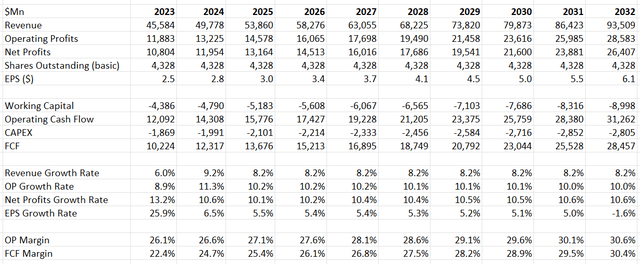

Coca-Cola DCF- Author’s Calculation

On the margin side, I anticipate that their enhanced marketing strategy and product innovation will be key drivers of margin expansion. Simultaneously, they stand to benefit from operating leverage. Consequently, the model projects an annual margin expansion of 50 basis points.

The model utilizes a 10% discount rate, 4% terminal growth, and a 19% tax rate, resulting in an estimated fair value of $70 per share.

Key Risks

Impact of GLP-1 Drug: Anti-obesity GLP-1 drugs are currently experiencing tremendous popularity, with Novo Nordisk (NVO) reporting a 45% growth in their GLP-1 diabetes sales in Q3 FY23. Several companies are entering the GLP-1 market, prompting consideration of potential impacts on soda sales. However, I believe the risk is relatively low for the following reasons.

As mentioned earlier, 68% of Coca-Cola’s products currently have low or no calories, showcasing the company’s ongoing commitment to innovation in healthier product categories. Additionally, according to the CDC, 38.4 million people in the US, or 11.6% of the population, have diabetes. Even under the assumption that all these diabetes patients reduce their soda consumption by 10%, the resulting negative impact on Coca-Cola’s soda revenue would be just 1.2%.

Commodity Inflation: Coca-Cola is guiding that commodity inflation will have a mid-single-digit negative impact on the cost of goods sold in FY23. They are actively hedging a portion of their commodity supplies. While their gross margin may experience fluctuations due to movements in commodity prices, I believe that the global inflationary trend is cooling down, and Coca-Cola should start to benefit from commodity deflation soon.

Conclusion

I admire Coca-Cola’s robust digital marketing strategy and their ongoing product and category innovations that consistently drive both topline and bottom-line growth. Considering the undervalued stock price, I am initiating coverage with a “Strong Buy” rating and a fair value of $70 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.