Summary:

- NextEra Energy reports decreased GAAP net income but increased adjusted earnings in Q3 2023.

- FPL, a subsidiary of NextEra Energy, shows growth with increased net income and customer base.

- NextEra Energy’s stock price rebounds from support levels, indicating a potential market surge.

Justin Paget

NextEra Energy, Inc. (NYSE:NEE), a leader in the energy industry, demonstrated a solid financial performance in Q3 2023. The company reported a decrease in GAAP net income compared to last year’s quarter. However, its adjusted earnings showed a more positive trend, with a significant increase compared to the previous year. This article extends the analysis of the last piece, focusing on NextEra Energy’s financial status based on Q3 2023 earnings. It also examines the technical aspects of the stock price to determine the future trajectory and investment potential. Notably, the stock price appears to have established a bottom at the expected support levels mentioned previously, indicating a potential upward surge.

A Deep Dive into NextEra Energy’s Financial Achievements

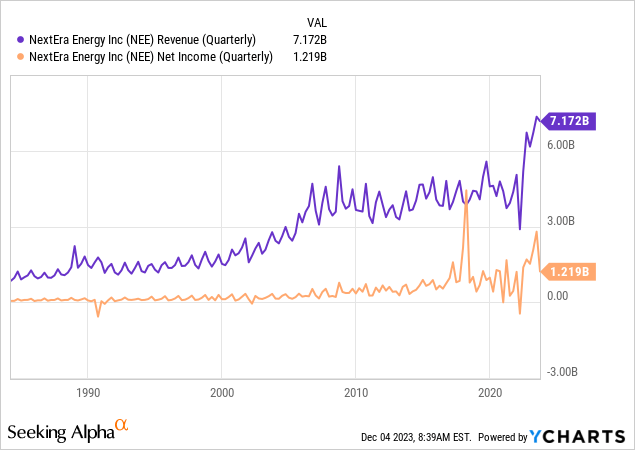

The company reported a GAAP net income of $1.219 billion, a decline from $1,696 million in Q3 2022. However, a more optimistic narrative emerged from the adjusted earnings, which climbed to $1,920 million, or $0.94 per share, an increase from $1,683 million, or $0.85 per share, in the corresponding period in 2022. This reflects a notable adjusted earnings per share growth of about 10.8% across the year’s first three quarters. The chart illustrates NEE’s quarterly revenue and net income, showing that although there was a decrease in net income, NEE still reported a significant revenue of $7.172 billion. It also displays a long-term increasing trend in these financial metrics, underscoring the company’s profitability.

FPL, a principal subsidiary of NextEra Energy and the largest electric utility in Florida, contributed positively with a net income of $1,183 million, an increase from $1,074 million in the previous year’s quarter. This growth is attributed to substantial investments in the business, totaling around $2.6 billion for the quarter. FPL also reported an increased customer base, adding 65,000 more customers, underscoring its expanding market presence and operational effectiveness.

On the other hand, NextEra Energy Resources, another segment, faced a challenging quarter with a GAAP net loss of $230 million, a significant shift from a net income of $655 million in Q3 2022. This included a notable after-tax impairment of approximately $0.9 billion related to NextEra Energy Partners, LP. However, on an adjusted basis, NextEra Energy Resources showed resilience, with earnings of $882 million, up from $729 million in the previous year. The segment marked a historic achievement in renewables and storage, adding around 3,245 megawatts to its project backlog.

Looking ahead, NextEra Energy maintains a confident and stable financial outlook. The company continues to project adjusted earnings per share for 2023 and 2024 to be in the ranges of $2.98 to $3.13 and $3.23 to $3.43, respectively. Furthermore, it anticipates a 6% to 8% growth rate from the 2024 adjusted earnings per share for 2025 and 2026, estimating a range of $3.45 to $3.70 for 2025 and $3.63 to $4.00 for 2026. Additionally, the company aims to sustain a growth rate of around 10% per year in its dividend per share through at least 2024, based on the 2022 figures. This forward-looking strategy reflects NextEra Energy’s strong position in the market, underscored by its commitment to continuous improvement, innovation, and stringent financial management.

Despite mixed results across its segments, NextEra Energy’s recent financial performance demonstrates overall resilience and a promising growth trajectory. The company’s forward-looking strategy, emphasizing sustained earnings growth, expansion in renewable energy, and consistent dividend growth, positions it well in a dynamic energy market. These strategic directions, coupled with its operational effectiveness and expanding market presence, particularly in renewable energy, signal a robust outlook for NextEra Energy’s future financial health and shareholder value.

Examining the Rebound from Solid Support

Recap

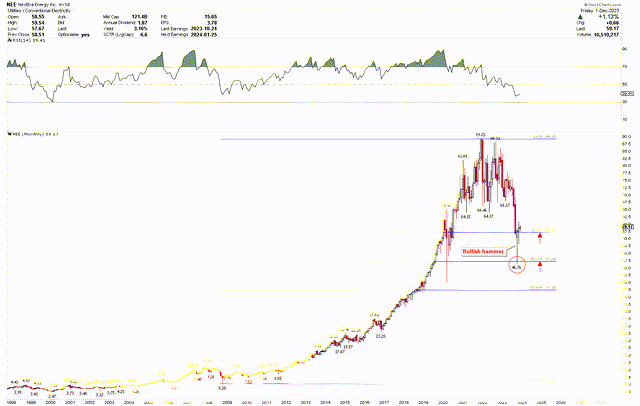

In the previous analysis, the long-term prospects of a stock were examined using yearly and quarterly chart data. The yearly chart revealed an inside candle for 2022, tracing a bullish parabolic surge that began with the 2009 low at $6.83. This surge, spanning 13 years, saw the stock peak at a significant resistance level of $90.60 in 2021, followed by a retracement to seek lower support. The bullish sentiment was further reinforced by the quarterly chart, which showcased a sequence of inside candles, suggesting a build-up of price pressure before an anticipated upward movement. The long-term bullish scenario also gained more credence by applying Fibonacci retracement levels, identifying $58.04 and $47.98 as key supports amid the expected correction. The stock did indeed correct towards these levels, bottoming out at $46.78, which led to a swift price rebound. The previous article explored the potential for a significant correction, projected to present a compelling buying opportunity for NextEra Energy.

NextEra’s Next Move and Investment Prospects

The anticipated drop in NextEra’s stock value found substantial support at the crucial 50% Fibonacci level, marked by $47.26. The stock dipped slightly lower to $46.78 before experiencing a notable recovery. This turnaround manifested as a bullish hammer candlestick on the monthly chart, a positive indicator for traders. Impressively, this bullish hammer concluded above the 38.2% Fibonacci retracement mark at $57.17. This development indicates a strong foundation has been set around these figures, pointing towards a possible upward trend in NextEra’s stock price.

NEE Monthly Chart (stockcharts.com)

Moreover, the RSI has hit levels not seen since the 2009 lows and is now showing signs of recovery. The pronounced tail of the bullish hammer underscores the strength of the price. As per the previous article, the red arrows highlight the expected buying opportunities, with the stock price poised to ascend from these points.

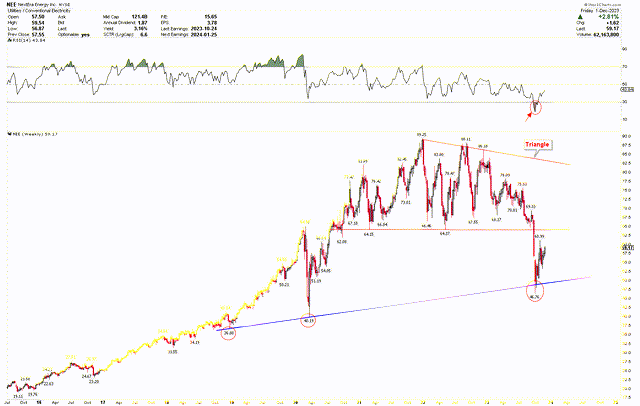

The weekly chart below shows the notable price correction, where the blue trend line indicates support. This trend line has successfully held at $36.80 and $40.19, as marked by the red circles. The vigorous response at these key support levels suggests a potential rally to higher prices. However, the immediate challenge for this rally lies around $64, and the price will probably continue its upward trajectory, potentially reaching new all-time highs. The RSI, recovering from deeply oversold conditions, complements the bullish hammer formation on the monthly chart.

NEE Weekly Chart (stockcharts.com)

The strong price rebound from the 50% Fibonacci retracement level, the support at the blue trend line on the weekly chart, and the market’s oversold state signals that a bottom has likely been formed, paving the way for a market rally. From the previous discussion, it’s clear that historical price patterns are decidedly bullish, and any downward correction is expected to be countered by a strong resurgence and higher prices. Investors may consider buying NextEra Energy shares at the current prices in anticipation of the potential market surge.

Market Risks

The decline in GAAP net income in Q3 2023 highlights the company’s vulnerability to market fluctuations and operational challenges. Despite a rise in adjusted earnings, the net loss reported by NextEra Energy Resources, primarily due to an after-tax impairment, underscores the risks associated with investment decisions and market volatility. While FPL, a key segment, shows promising growth, the overall financial health of NextEra Energy is subject to the fluctuating dynamics of the energy market, regulatory changes, and global economic conditions. These factors can significantly impact the company’s revenue streams and profitability.

NextEra Energy faces external and operational risks, including regulatory changes, particularly in the energy sector, which can impact operating costs and profit margins. The company’s ambitious growth plans in renewables and storage expose it to technological advancements and competition risks. From a technical perspective, NextEra Energy’s stock has shown resilience, as evidenced by the recovery from a significant support level and the formation of a bullish hammer pattern. Yet, if the monthly closing price falls below $46, it would counter the optimistic outlook, signaling a likelihood of additional downward adjustments.

Bottom Line

In conclusion, NextEra Energy has shown a mixed financial performance in Q3 2023, with a decreased GAAP net income but increased adjusted earnings. The company’s principal subsidiary, FPL, has reported growth, while NextEra Energy Resources faced challenges but showed resilience on an adjusted basis. NextEra Energy projects a stable financial outlook with anticipated growth in adjusted earnings per share for the coming years and a commitment to dividend growth.

The technical analysis of NextEra Energy’s stock indicates a potential upward trend. The stock has rebounded from a significant support level, as evidenced by a bullish hammer candlestick and recovery in the RSI, suggesting a solid foundation for future growth. However, the company faces market risks, including volatility in the energy sector, regulatory changes, and global economic conditions, which could impact its financial health and stock performance. Despite these challenges, NextEra Energy’s strategic focus on renewable energy and operational effectiveness positions it well for future success. Investors may consider the present market conditions as a promising opportunity for investment, given the appearance of a bullish hammer at a significant long-term support level. This formation suggests a solid bullish scenario, indicating a potential market surge.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.