Summary:

- Intel’s management team continues to guide for 5 nodes in 4 years plan, reflecting the company’s potential.

- The aggressive implementation of Intel’s vision is starting to see fruition, a stark difference from the past.

- Intel is undervalued as the stock price is not reflecting the company’s progress and future potential yet.

Leon Neal

Introduction

For the past few years, I have been covering Intel (NASDAQ:INTC), and I have consistently given a buy rating on the company. My arguments throughout these times focused on geopolitical progression [source, source] benefiting Intel and the company’s internal progress and execution in an attempt to reach its long-term vision [source, source]. Simply, the geopolitical risks associated with semiconductor foundry focused in Taiwan and South Korea through TSMC (TSM) and Samsung (OTCPK:SSNLF) led to the EU and the US government to incentivize a new western-based competitor, Intel, in the name of national security providing a meaningful tailwind for the company. Along with this trend, Intel was attempting to regain leadership in the industry by achieving 5 nodes in 4 years. Today, I continue to stand by my previous arguments as previous arguments continue to be relevant while there has been further progress in recent months that additionally strengthens my thesis. For the past multiple quarters, numerous data were pointing towards Intel becoming more competitive in both the semiconductor fabrication and fabless industry, yet the company is still valued like the old Intel that had less direction and potential. Therefore, given the impending potential future opportunity, especially with the confirmed Intel 4 launch date, I believe Intel stock is a buy as the company is undervalued.

Intel’s Continued Progress

Intel continues to make progress, which is becoming more evident. On December 14th, Intel announced the release of Intel 4 or Meteor Lake in line with expectations as the management team continued to guide for the launch to happen in the second half of 2023 for the past couple of quarters.

Further, in terms of all of the future nodes including the Intel 4, the management team provided a continued optimistic outlook in the company’s most recent 2023Q3 earnings call. For Intel 4, the management team said that the company “began initial shipments of Meteor Lake on Intel 4, which [the company is] now aggressively ramping on the most productive fleet of EUV tools.” For Intel 3, “the process is tracking to be manufacturing ready by year-end,” and for Intel 20A and 18A, Intel “expect[s] to achieve manufacturing readiness on Intel 20A in the first half of 2024” followed by “expect[ed] manufacturing readiness for Intel 18A in second-half 24.”

Overall, so far, the company’s aggressive 5 nodes in a 4-year plan to “reestablish transistor power and performance leadership” is on track despite some initial negative views by numerous investors. The new management team under CEO Pat Gelsinger has proven and continues to show investors that the company is moving prudently toward its vision. Further, I would like to emphasize that the company’s audacious plan has been on track as guided since 2021 when CEO Pat Gelsinger started to turn around Intel with no significant delays raising alarm regarding the management team’s execution abilities. As such, I believe it is reasonable to expect Intel to continue executing its aggressive goals.

Valuation

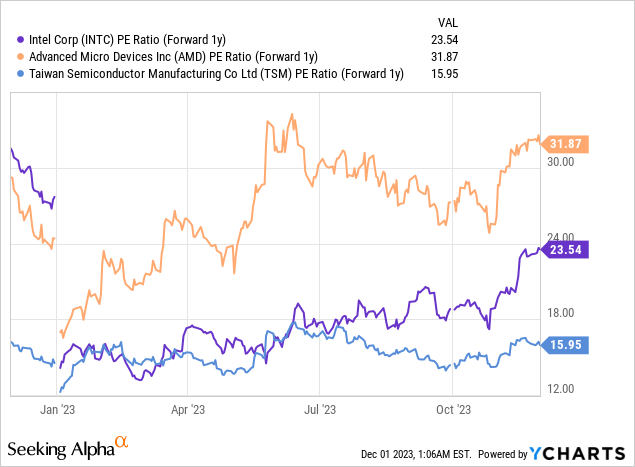

Despite the geopolitical benefits and the company-specific progress that has been happening throughout the past few quarters, the market, in my opinion, is still not giving enough credit to Intel. Compared to its peers, the company’s valuation is low, leaving plentiful room for a potential appreciation as it becomes clearer that Intel will be a competitive player in the industry in the coming months.

As the chart below shows, Intel’s forward price-to-earnings valuation is lower than AMD’s while being higher than TSMC’s.

The forward earnings growth expectations for AMD (AMD), Intel, and TSMC are 16.50%, 99.75%, and 19.10%, respectively. Intel’s year-over-year growth is exceptionally high as a result of a base effect as the company reported a steep decline in earnings in 2023 due to competition, demand, and price cuts. However, the exceptional expected earnings growth is not just a one-time phenomenon as the expectation is that the company will continue growing its bottom line at about 42% in the following year. Thus, relative to Intel’s industry peers, I believe the company is undervalued. Clearly, the company’s bottom line is expected to grow at a faster pace than industry peers for the foreseeable future as the company is on track to unlock a future potential, yet the company’s valuation multiple is not on par with the industry peers. Therefore, as Intel is turning around and nearing the start of its aggressive goal with Intel 4 in the coming weeks, I believe Intel’s valuation is attractive.

Risks

It may be true that the geopolitical conditions are favoring Intel as I mentioned in my previous article, and it may also be true that Intel has been making solid progress for the past few years. Yet, the question of whether Intel will be able to become an industry leader remains along with the question of whether customers who likely have a conflict of interest will choose Intel over companies like Samsung and especially TSMC. Although these concerns and potential risk to my thesis is legitimate, I do not believe it poses a major threat.

First, I do not think it matters if we, as investors, know if Intel will regain industry leadership or not. I do not think my bullish thesis is challenged by the fact that Intel will either win or lose to TSMC or Samsung because for Intel, all they need to do is become competitive. It’s great if the company can regain leadership as the management continues to claim, but even if they don’t, it will likely be enough for Intel’s stock.

Why? The answer to this, in my opinion, is tied to whether competitors will choose Intel over Samsung or TSMC. Not so much for Samsung, but TSMC has an advantage because the company does not have a conflict of interest with its customers. For example, TSMC does not compete with companies like Nvidia (NVDA) and AMD, unlike Intel. Fortunately, geopolitical tensions are on Intel’s side. The US and the EU deeply want to diversify semiconductor supply chains away from Asia closer to their shores. TSMC, Samsung, and Intel, as a result, are all building new fabrication plants in the US, and the political direction will likely bring customers to Intel. We already saw this happen starting in 2021 and 2022 when Qualcomm (QCOM), Amazon (AMZN), and MediaTek became Intel’s customers. Therefore, in this sense, considering the geopolitical trends today, Intel likely won’t have to beat Samsung and Intel to make a meaningful dent in the market. The company will just have to be on par with them as governments pressure companies to diversify in the name of national security. Competing at the level of TSMC and Samsung by no means is an easy task, but compared to the Intel management team’s claim of becoming the industry leader, it gives the company some leeway.

Although I extensively covered the state of the geopolitical tensions in the semiconductor in my previous article, I will leave a quote from this past article to aid in the overall direction the political agendas are evolving in, but for further details, please refer to this article.

U.S. Commerce Secretary said, “I want the United States to be the only country in the world where every company capable of producing leading-edge chips will have a significant R&D and high-volume manufacturing presence.”

The E.U. said “Semiconductors are at the center of strong geostrategic interests, and of the global technological race. For this reason, the Commission proposed the European Chips Act, which strengthens European competitiveness and resilience in this strategic sector.”

In the eyes of global superpowers and politicians, the semiconductor industry seems to be more than economic interest as it has become critical to not only supporting the modern economy, but creating the foundation for innovation, national security, and future growth.

Summary

Intel has been making the right moves for the past multiple quarters since Pat Gelsinger became the CEO. The company’s vision of 5 nodes in 4 years, initially met with skepticism, has continued progressing. In fact, in the recent earnings call, the management team continued to show confidence in the company’s ability to reach this goal creating a future opportunity for Intel to be competitive in both semiconductor fabless and fabrication industries. Further, along with Intel’s excellent performance track record with a future expectation for this to continue, geopolitical interests are creating a tailwind for the company. However, even backed by these positive catalysts, Intel’s valuation does not reflect the company’s situation, progress, and potential. Therefore, I believe Intel is a buy as the company’s stock is undervalued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, INTC, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.