Summary:

- Accenture is a market leader in IT consulting, with the Technology segment representing 63% of its total revenue and the highest growth rate.

- The company partners with various technology providers to help clients adopt emerging technologies, benefiting from their expertise and avoiding in-house development costs.

- Accenture’s Financials and Healthcare segments are expected to drive its revenue growth, with the company positioned as the most competitive IT consulting firm.

- However, with its recent stock price run-up this year, we find the stock overvalued at the moment.

JHVEPhoto

Previously, we conducted an in-depth analysis of Accenture plc (NYSE:ACN), creating a customized business segment map and analyzing the Compound Annual Growth Rate [CAGR] of both Accenture and its competitors across various end markets. Our findings revealed that Accenture outperformed its competitors, boasting the fastest-growing segments. Particularly, we identified Accenture as the market leader in IT consulting, attributing this success to its outstanding brand reputation and overall excellence. We attributed this success to the company’s commitment to robust employee development and satisfaction, ultimately enhancing its ability to deliver superior services to clients.

Despite these strengths, we determined that the company’s stock was overvalued and assigned it a Hold rating. Subsequently, our price target proved in line, and our revenue projections for the company were on point. In this analysis, we will revisit our competitor map for the industry and assess whether Accenture’s current prospects have positively impacted the company’s intrinsic value.

Demand Driven by Emerging Technology

Company Data, Khaveen Investments

|

Revenue Growth % |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

Average |

|

Strategy & Consulting |

0.00% |

30.00% |

7.69% |

-14.29% |

8.33% |

15.38% |

-6.67% |

5.78% |

|

Technology |

6.25% |

29.41% |

9.09% |

8.33% |

15.38% |

26.67% |

7.89% |

14.72% |

|

Operations |

14.29% |

-37.50% |

20.00% |

0.00% |

33.33% |

12.50% |

11.11% |

7.68% |

Source: Company Data, Khaveen Investments

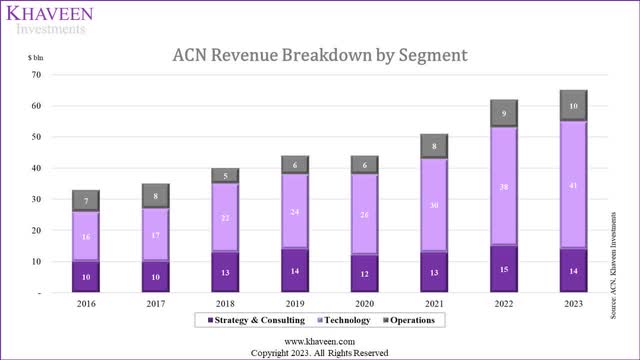

Accenture is an IT consulting firm, but unlike the Big Three consulting firms, its revenue is more aligned to helping businesses adopt new technologies than management consulting. That is not to say that its Strategy & Consulting segment is not large, as it represents 21.5% of its revenue, a bit larger than its Operations segment (15.4%). Strategy & Consulting involves Accenture’s staff providing direct consulting services to the management of Accenture’s client companies, similar to that of the Big Three. The Operations segment involves procuring and sourcing services related to the business functions of a company such as marketing & sales, HR, supply chain, finance and accounting, and others. Both these segments pale in comparison to the largest segment, Technology (63% of total revenue). Not only is it the largest, but it also has the highest 7-year average growth rate at 14.72% vs Strategy & Consulting (5.78%) and Operations (7.68%).

The Technology segment involves Accenture helping businesses adapt to new technologies to improve their business operations and financials. Just as investment firms like Khaveen Investments thoroughly explores emerging technologies such as AI, Cloud, 5G, EV & ADAS, FinTech, AR/VR, Blockchain and many others, Accenture does the same. However, instead of investing in companies that pioneer technologies like investment firms, Accenture partners with them to help their clients adopt these technologies. Accenture mentions in its annual report that its partners include “a broad range of technology providers, including Adobe (ADBE), Alibaba (BABA), Amazon Web Services (AMZN), Blue Yonder, Cisco (CSCO), Databricks, Dell (DELL), Google (GOOG), Hewlett Packard Enterprise (HPE), IBM (IBM) RedHat, Microsoft (MSFT), Oracle (ORCL), Pegasystems (PEGA), Salesforce (CRM), SAP (SAP), ServiceNow (NOW), Snowflake (SNOW), VMware (VMW), Workday (WDAY) and many others.” We believe that this benefits them two-fold.

Firstly, we believe Accenture is able to ride the wave of various technological innovations that are essential for businesses. Understanding the need for these technologies to be adopted swiftly and properly, Accenture acts as an ‘enabler’ for businesses that wish to thrive and have the resources to seek external assistance from firms like Accenture. Secondly, by partnering with technology providers, Accenture does not need to incur costs to develop these technologies in-house itself and additionally would be able to get training from these tech providers themselves. We believe this is the reason why its Technology segment has managed double-digit growth over the years.

“All strategies continue to lead to technology. And companies will need to reinvent every part of their enterprise using tech, data, and AI to optimize operations and accelerate growth. To do so, they must build a digital core. We are continuing to see significant demand in areas like cloud migration and modernization, modern ERP and data and AI, and the emergence of gen AI in particular, all of which represent areas of great opportunity. And it’s still early.” – Julie Sweet, Chair and Chief Executive Officer

According to McKinsey, generative AI could enhance productivity across diverse business functions. Furthermore, AI adoption has allowed 63% of businesses to benefit from revenue increases and 32% from cost savings. We believe the potential market opportunities from new technologies bode well for Accenture and that the company is aligned to capitalize on them.

Financials and Healthcare growth opportunities for Accenture

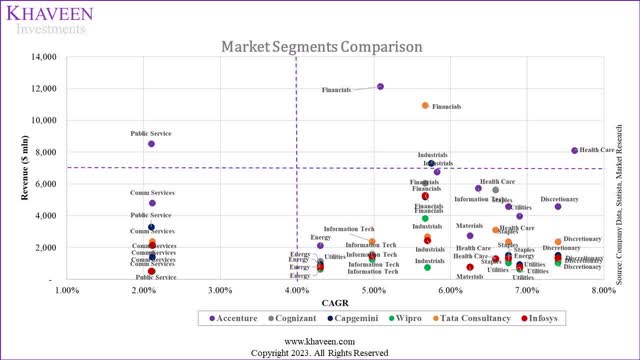

We updated our competitor Four Quadrant map of the IT consulting companies based on their size and CAGR of their business segments by customer end-markets.

Company Data, Statista, Market Research Reports, Khaveen Investments

For comparability, we combined some of Accenture’s business segments, so that all segments are classified by Sectors. This leaves Accenture with 11 segments, which is still the highest, but now on par with Infosys. The other competitors are also quite diversified with Wipro Capgemini and Tata Consultancy having exposure to 9 sectors.

In terms of growth, most segments fall in the right-half of the quadrant, indicating relatively similar growth rates across the segments of all companies. The highest expected growth is in the Discretionary segment with 7.4% growth driven by the rising income of consumers as personal disposable income growth in the US was 9% in H1 2023, with all competitors having exposure to this segment. However, Accenture’s Healthcare segment has specifically the highest growth of all segments (7.6%), as compared to the Healthcare segments of its competitors, due to its relatively larger exposure to Pharmaceuticals, Biotechnology & Life Sciences which has the highest growth in Health Care.

Communication Services has the lowest expected CAGR (2.11%), with all companies having exposure. Communication Services is also weak in terms of size, leading this segment for all companies placed in the bottom left quadrant, which is the worst. Not many competitors have segments with revenue above $7 bln, with only 5 overall. Of these, 3 out of the 5 belong to Accenture, clearly highlighting its size advantage over its competitors.

The best quadrant (top-right) has only 4 segments, with two of those belonging to Accenture. Interestingly, 2 of these are in the Financials sector belonging to Accenture and Tata Consultancy, highlighting not just the size of the market, but also the need for consultancy services in Finance. Financials is the largest segment of all the companies above, except for Capgemini where Financials is the second largest behind Industrials. This ties into our previous AI research where the Financials sector, is expected to have the second-highest productivity impact among all sectors.

Overall, though, this is a clear battle between Accenture and Infosys. Both companies have 2 segments each in the left-half and 9 segments each in the right-half. This indicates that both companies have similar expected growth rates. However, Accenture clearly beats in size. Only 1 out of 11 of Infosys’ (INFY) segments generate more than $3 bln in revenue, whereas 9 out of 11 of Accenture’s segments hit this mark by quite some margin. 3 of Accenture’s segments (Financials, Health Care and Public Service) are above $ 7 bln. As such, we believe Accenture edges out Infosys as the most competitive IT Consulting firm.

We believe the Financials and Healthcare segments of Accenture will lead the bulk of its revenue growth. We believe Accenture has the brand and reputation we previously identified, which will allow it to effectively build in both these highly sensitive segments. However, we see its Financials sector growing slower than its competitors due to it having more customer exposure to Banking (which has the lowest growth in financials). Notwithstanding, Accenture mentioned that it is “partnering with a multinational financial services company on a cloud-based transformation” as well as “helping the defense health agency operate and enhance the Joint Medical Common Operating Picture platform by implementing data synchronization”.

Market Leadership Position Extends

Company Data, Gartner, Khaveen Investments

|

Company Growth % |

2019 |

2020 |

2021 |

2022 |

2023F |

10-year Average |

5-year Average |

5-year Forward Average |

|

Accenture |

5.4% |

2.6% |

14.0% |

21.9% |

4.1% |

8.6% |

9.6% |

5.4% |

|

Tata Consultancy |

4.1% |

-0.7% |

17.1% |

10.6% |

7.9% |

8.4% |

7.8% |

5.8% |

|

Capgemini (OTCPK:CAPMF) |

4.8% |

22.2% |

6.8% |

13.9% |

2.6% |

6.0% |

10.1% |

5.1% |

|

Cognizant Technology (CTSH) |

4.1% |

-0.8% |

11.1% |

5.0% |

0.3% |

8.4% |

3.9% |

5.7% |

|

Wipro (WIT) |

0.8% |

-4.2% |

4.6% |

23.1% |

-1.9% |

4.3% |

4.5% |

5.8% |

|

Infosys |

7.9% |

8.3% |

6.1% |

20.3% |

3.6% |

8.7% |

9.2% |

5.4% |

|

Others |

4.7% |

2.8% |

12.9% |

7.0% |

3.8% |

3.6% |

6.3% |

3.6% |

|

Total Industry |

4.7% |

3.0% |

12.8% |

8.1% |

3.8% |

4.0% |

6.5% |

3.8% |

Source: Company Data, Gartner, Khaveen Investments

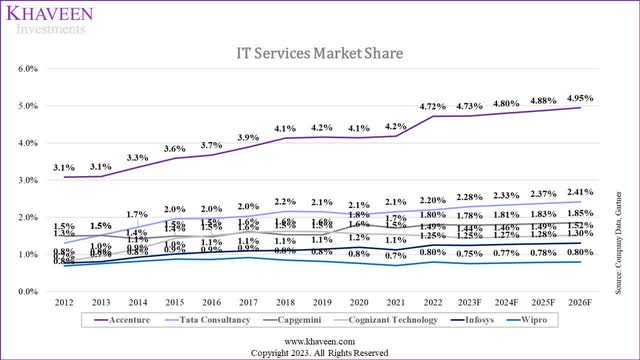

Our previous 2023 forecasted revenue growth rate for Accenture was almost spot on. As such, we continue to use our proprietary four-quadrant competitors’ model to forecast growth rates for all companies in the industry, to determine their market share growth moving forward. As seen, all companies in the industry have had relatively similar growth rates (mid-single) over the 10-year and 5-year historical periods. Capgemini has a much higher 5-year growth rate, but this was skewed due to its acquisition of Altran in 2020.

Infosys has had a slightly higher growth rate in both the 5-year and 10-year periods. We looked into specific competitive advantages Infosys may have over its competitors. We found that many of the technology partners of Infosys have praised and attested to the value they have brought such as Microsoft, Nvidia, and Liberty Global. However, many of these technology providers also work with the other IT Consulting firms above. We also identified numerous awards and rankings placing Infosys among the top IT Consulting firms, but again among the companies we have listed above. Finally, we found that Infosys ranked as one of the Global Top Employers. We find this to be a favorable quality to possess given the service-oriented nature of the industry would depend on the people working for these IT Consulting firms. However, as we previously analyzed, we believe Accenture is also ranked as one of the best-rated employers, and do not see Infosys leading Accenture in this area. Hence, we do not feel it justified to allocate a premium growth rate to Infosys above what our model has forecasted.

As seen in the table above, we forecast Tata Consultancy and Wipro to lead the pack, with the highest growth (5.8%). However, just like the past growth rates of these companies have been similar, our forecasted growth rates are also fairly similar for all companies. From our market share projections, we can see all companies gaining market share, at the expense of the “other” smaller competitors, as the IT Consulting market is expected to grow at 3.8% vs the Top 6 Companies above growing at an average of 5.5%. We believe this could be due to branding advantages that the top companies have, enabling them to attract clients with their past track record and solid reputation.

We expect to see Accenture growing by 5.4% in FY2024 which is just slightly higher than the 2%-5% growth range that management provided. We believe our forecasts are justified, and that actual results could even surprise us on the positive side, as management also reported a record $72.2 bln in new bookings, which is a 12.6% increase compared to 2023 revenues.

Risk: Competition from Foreign Competitors

The company highlighted in its annual report that it “operates in a highly competitive and rapidly changing global marketplace”. Furthermore, the company competes with various foreign competitors and emphasizes the competitive threat of “off-shore IT service providers in lower-cost locations, particularly in India”. For example, half of its top 6 competitors are from India including Wipro, Infosys, and Tata Consultancy.

Verdict

We find Accenture’s business model sustainable due to the exposure to many technological trends that impact business and the economy. Of all competitors, we find Accenture the best positioned in terms of its business segments, as our Four Quadrant Matrix of the industry places its Healthcare and Financials segments as the best, with the Financials Sector also undergoing high technological adoption of AI.

Despite the various technological trends that IT Consulting firms like Accenture can capitalize on, revenue growth still comes in at a moderate pace. While the larger consulting firms like Accenture have an edge over competitors and solidify their lead each year, their growth is not much higher compared to the industry. While the strong brand position and employee satisfaction bode well for the company, which would also translate to better service for clients, we believe it does not necessarily translate to better shareholder value.

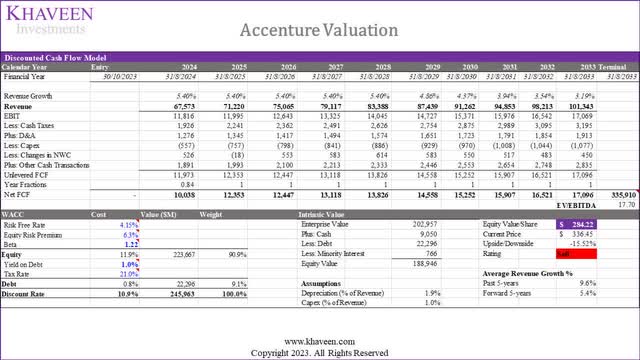

Company Data, Khaveen Investments

After updating our projections and margin estimates, we derived a new DCF valuation as seen below. We assumed a 17.7x EV/EBITDA multiple based on the 5-year historical ratio of Accenture. Its average historical EV/EBITDA is also the highest compared to its top competitors, which has an average of 14.36x. Based on our DCF valuation, we find the company overvalued with a target price of $284.22 which indicates a downside of 15.5% as the company’s stock has had a strong 24% increase YTD.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.