Summary:

- Despite a low valuation rating, Disney could be a compelling investment due to its other positive factors relative to peers.

- Disney’s stock price has declined significantly but could be undervalued considering its revenues and margins.

- The return of CEO Bob Iger and internal restructuring have contributed to Disney’s financial wins and potential for future growth.

- My analyst rating for Disney is a Buy based on its strong future financial estimates in relation to its present low price.

Michael M. Santiago

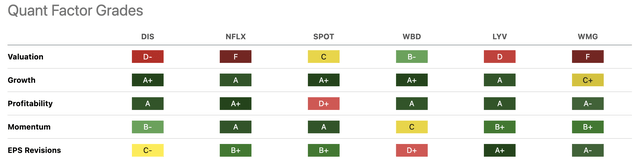

While Disney (NYSE:DIS) may be rated D- on valuation by Seeking Alpha’s Quant Factor Grade system, the company could actually be a compelling investment at the current price, especially considering its other Factor Grades relative to peers.

Seeking Alpha

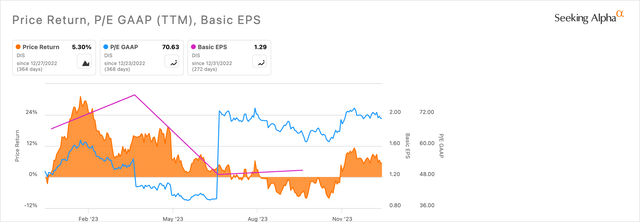

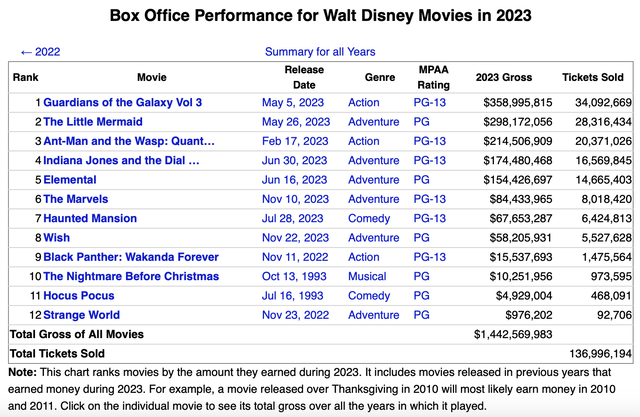

I think this is particularly true when considering the vast difference in the organization’s present GAAP TTM P/E ratio of around 70 versus its GAAP FWD P/E ratio of around 25.

My thesis is that at the current price, despite the momentary unappealing valuation, Disney could be considered an opportunity based on good profitability and growth.

Operations Overview

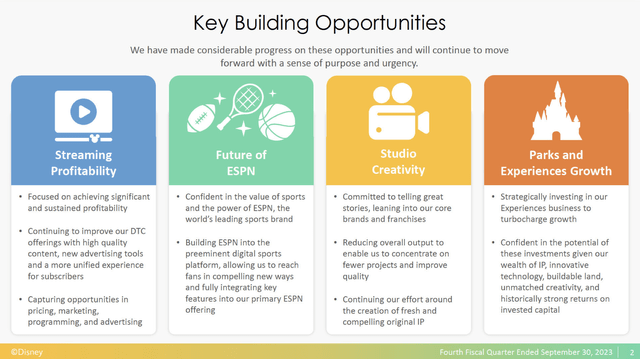

The company has four core operations that contribute to the bulk of its business: streaming, ESPN, studio creations, and theme parks.

Disney Q4 23 Earnings Presentation

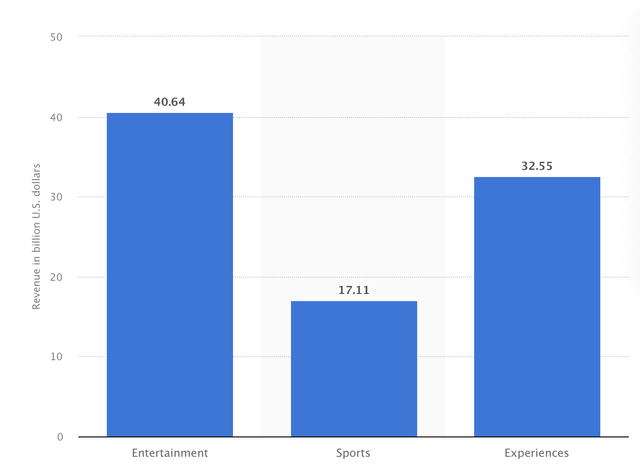

For FY 2023, the highest revenue generator was ‘Entertainment’, encompassing streaming and creative segments. ‘Experiences’ have done particularly well and remain one of the core revenue generators.

Disney’s Revenue of 2023 Operational Segments (Statista)

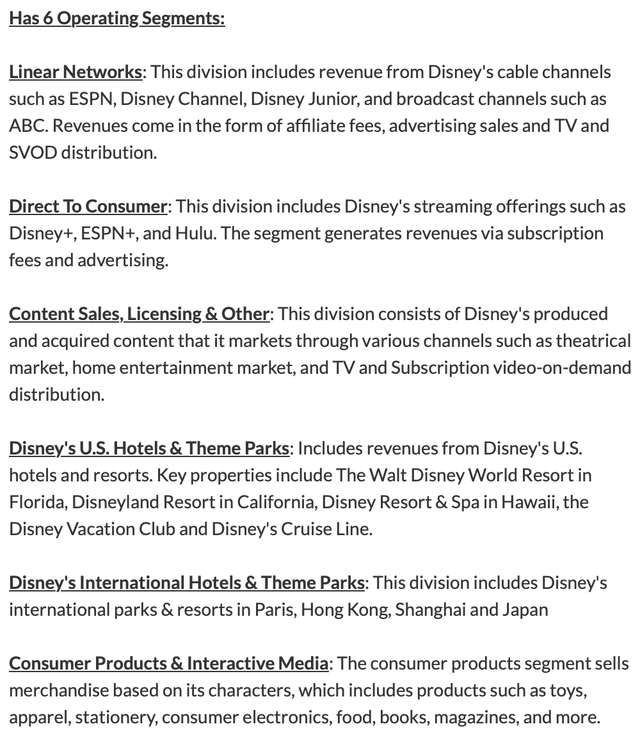

However, there is also a more comprehensive segmental breakdown of Disney into six segments. The first of these segments focuses on cable channels, the second on streaming, the third is content and licensing, the fourth is US hotels and theme parks, the fifth is international hotels and theme parks, and the sixth is merchandise.

Trefis

Price Decline & Peer Analysis

Disney’s stock price is down around 55% since its all-time high after recovering quickly from the pandemic.

Seeking Alpha

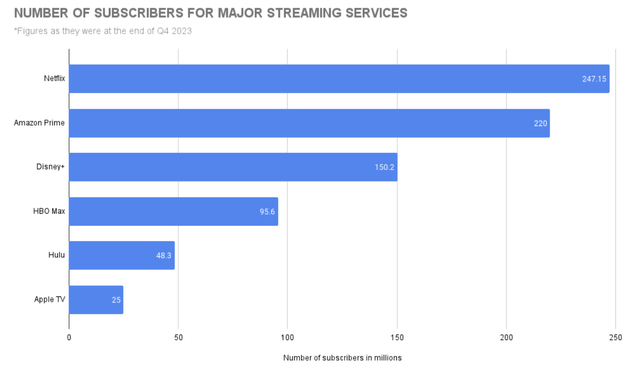

Part of the significant difficulty the company is facing is severe competition from the likes of Netflix (NFLX), Warner Bros. Discovery (WBD), and Amazon’s (AMZN) Prime Video, among others. Amazon’s peer comparison by market cap, a loose corollary for market share, does not do justice to the obvious wide operational focus of Amazon versus its more focused entertainment peers. However, I perceive Amazon’s Prime Video to be the leading threat to Disney’s streaming operations, particularly due to higher quality content at present against Netflix’s leading position in the market.

SellCell

Author, Using Seeking Alpha

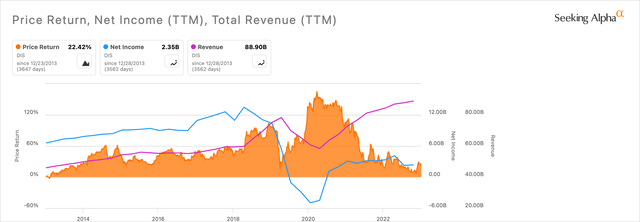

However, I think the price of Disney stock could be considered undervalued right now if we look at how the revenues and margins coincide with the stock price movements:

Author, Using Seeking Alpha

Taking into consideration the relative lag between the increasing revenues and net income against the stock price, it is reasonable to conclude that the price is yet to rise in tandem with these financial successes significantly.

Valuation Discussion

Understanding Disney’s valuation right now is nuanced, as although present multiples look alarming, I have reason to believe the future valuation will be stronger.

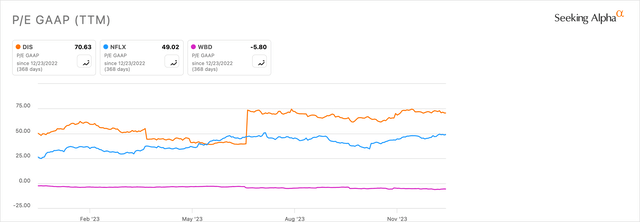

I’d like to look at the standard P/E GAAP TTM ratio of Disney against its main peers, Netflix and Warner Bros. Discovery, leaving out Amazon because of the operational inconsistencies.

Author, Using Seeking Alpha

In the below chart, we can see what caused a dramatic increase in the P/E ratio from around 40 in June 2023 to over 70 in July 2023 was a reduction in basic EPS from $2.26 in April 2023 to $1.23 in July 2023.

Author, Using Seeking Alpha

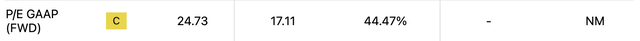

Yet, when I compare the P/E GAAP FWD of Disney and Netflix, the former comes out on top.

Disney (Seeking Alpha)

Netflix (Seeking Alpha)

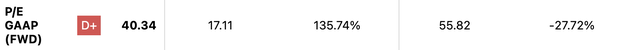

In addition, the PEG ratio of Disney is a B- Quant Factor Grade. This provides considerable hope on the valuation front and, in my opinion, represents the current lag in the Disney share price catching up with estimated earnings growth rates.

Disney (Seeking Alpha)

Considerations Including Q4 Earnings

Disney is experiencing some critical issues right now, which could inhibit its price return prospects and mean the current buying opportunity is less appealing than it looks based on my above analysis. However, Q4 earnings results are promising.

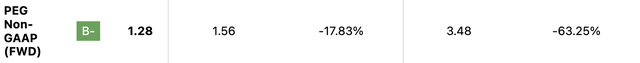

My largest consideration is the difficulty the firm has had in creativity, with most of the revenue coming from legacy content and remakes.

The Numbers

Although the company’s major successes have almost all been legacy remakes, there have been some of these products that have done poorly. For example, many of the titles listed above, including The Little Mermaid, Ant-Man, and Indiana Jones, performed below expectations.

Disney+ also recently experienced an alarming loss of subscribers. It lost 11.7 million subscribers worldwide in the quarter ending 1st July 2023. However, it added 7 million subscribers in Q4 2023. Disney+ now has over 112 million subscribers as of the end of 2023, and while the organization reported an operating loss of $420 million in Q4 for its Direct-to-Consumer segment, the company is doing well here when compared to a $1.406 billion loss in Q4 2022. This signifies some strong forward movement in this segment of the business.

Revenue for the Experiences segment has also increased by 13% compared to the year before in Q4, rising to $8.16 billion. This was driven by growth at Disney Cruise Line, with more cruise days and higher prices, and higher sales at Disney Vacation Club, with particular strength from the new Villas at Disneyland Hotel. Disneyland Resort also had growth from increased attendance and spending. Notably, however, there was a decrease in performance related to Disney World Resort due to the closure of Star Wars: Galactic Starcruiser and decreased hotel rates, bringing in less revenue.

Disney’s sports segment, largely dependent on ESPN, also had positive results in Q4. ESPN revenue rose 1% compared to Q4 2022 to $3.8 billion. ESPN’s operating income also increased by 15% compared to Q4 2022, reaching $953 million. The service now has 26 million paid subscribers, positively indicating growth and market saturation. These strong results were largely driven by growth in ESPN+ subscription revenue, also helped by a retail price increase and lower marketing, programming, and production costs.

Bob Iger has stressed the importance of Disney’s streaming business moving forward, aiming to achieve profitability, focusing on content like Marvel and Star Wars to focus on successful products. The management has also committed to buying the remaining stake in Hulu from Comcast (CMCSA). ESPN is also planning to become a complete direct-to-consumer streaming service. Theme parks and experiences are also going to receive a $60 billion investment over the next decade, and prices have been raised on various tickets and annual passes.

Creative & Leadership Risk

It will be important for the firm to plan strategically for 2026, when Iger’s extended tenure is expected to end. Contrary to the present strategy of focusing on Marvel and Star Wars, I believe the firm could benefit from radical creative innovation, pushing in strong new titles and plots that aim to be better than their legacy peers within Disney to support its streaming segment and keep theme parks and experiences fresh. This is, in my opinion, the only way for the company to stay relevant for many future generations. Although I do see it as an immense challenge, as there is more immediate success with established stories, hiring and attracting the right creative talent could be paramount. Otherwise, the company faces a risk of turning into a legacy and historical monument over the long term.

Balance Sheet Strengths

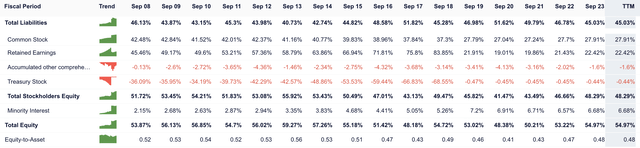

Looking at the company’s long-term total liabilities and equity, the company seems to be in a relatively normal position compared to historically on its balance sheet. While total liabilities have risen from $28.8 billion in 2008 to $92.6 billion in 2023, the percentage of total liabilities as a percentage of total assets has only risen 1.1%.

GuruFocus

As of Q4 2023, the company’s total debt was $46.431 billion, a decrease from $48.369 billion in Q4 2022, and the company’s net debt decreased to $32.249 billion from $36.754 billion in Q4 2022.

These insights significantly contribute to the fact the company is still relatively well-positioned to perform a successful turnaround in 2024 and beyond, led by Bob Iger in a growing business with a stable balance sheet.

A Note on Short-Term Speculation Risk

Activist investors under Nelson Peltz and Trian Fund Management are in a proxy fight with Disney’s board. They are seeking influence in an effort to fulfill short-term profits for shareholders rather than a long-term strategy. This is driving speculation that a sale of Disney’s assets or the spinning off of certain divisions could take place to generate immediate returns. While there is little evidence to support the actuality of this, it remains a short-term risk affecting investor sentiment. My analysis shows that Iger and the management team are driven toward long-term brand, revenue, and margin-building opportunities.

Conclusion

I don’t own Disney shares, but I see a compelling reason to do so. While the valuation on the surface looks bad, and there are operational challenges ahead, I can see an opportunity here if the company continues to operate effectively under Bob Iger’s new leadership.

For example, a continued long-term increase in earnings from the 2020 low, coupled with a share price that keeps going down, could see a natural reversion to normality after a while. For that reason, based on the forward P/E ratio of Disney and its fundamental growth restarting, I think this could be a significant buying opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.