Summary:

- Southwest Airlines has rebounded and grown past 2019 levels, with strong demand for air travel.

- However, higher fuel and labor costs have eaten into the company’s bottom line, causing lower margins compared to competitors.

- Despite being profitable and having a strong balance sheet, at the current price, I’m not a buyer.

4kodiak/iStock Unreleased via Getty Images

Intro

Southwest Airlines (NYSE:LUV) has been the pinnacle of a profitable airliner for the past few decades. Southwest was profitable for 47 consecutive years until the COVID-19 pandemic hit in 2020. The strategy for this profitability is focusing on service while being low-cost, which I have covered in previous writings. As I have discussed before, the business was easily the best performer during the pandemic period, posting the lowest losses and reaching profitability quicker than the competition.

Since the lows of 2020-21, Southwest has rebounded and grown past 2019 levels. Air travel demand is at an all-time high, which Southwest is seeing in the top line. But this year, expenses have eaten into the bottom line. With fuel costing 36% more than in 2019 and four new labor deals struck, Southwest is seeing less on the bottom line. With all the cost pressure and competition booming, it is important to analyze if holding or buying more Southwest shares is a good investment. Although the company is not seeing the great performance of its peers, the business is still turning a profit and has the best balance sheet in the industry. But even so, I am not a buyer at the current price point due to these factors. I am willing to pay a premium for the business, therefore I am willing to buy below 17x earnings.

Demand Is Back, Costs Are Higher

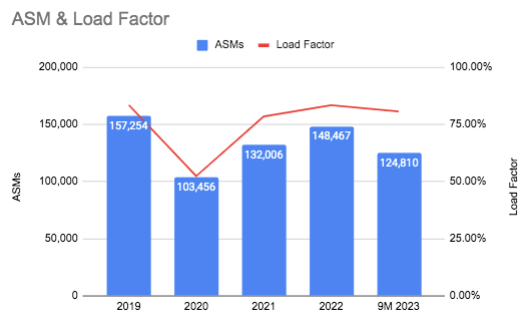

Southwest Airlines has seen very strong demand over the past two years and is just about back to 2019 levels of Available Seat Miles (ASMs), load factor, and trips flown.

Southwest Airlines ASMs & Load Factor (SEC.gov)

Revenue has bounced back to around pre-pandemic levels too, with 2022 posting 94% of the amount of revenue as 2019. This fiscal year is poised to show even better revenue than before the pandemic, with the past nine months’ revenue of 2023 being 15% higher than the same period in 2019. ASMs are also 12% higher than pre-pandemic in the first three quarters of this year. Overall, demand for air travel is back and better than ever.

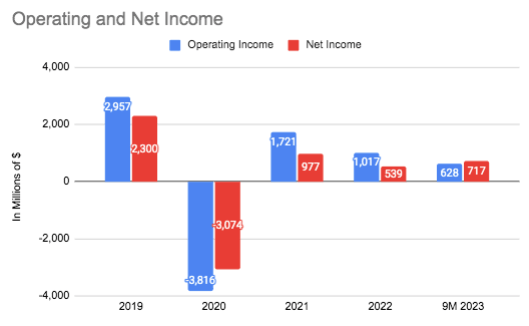

Southwest Airlines Operating & Net Income (SEC.gov)

So why isn’t the bottom line showing the same improvement? Well, in short, costs are way higher than in 2019. Fuel per gallon is 76 cents more expensive, or over 36% pricier than before. While fuel costs may be on a downward trajectory (25 cents cheaper this year than the prior year), labor costs have drastically increased and are not likely to decrease. In fact, labor costs have jumped by 18%, attributable to two labor contract extensions and two bargaining agreements.

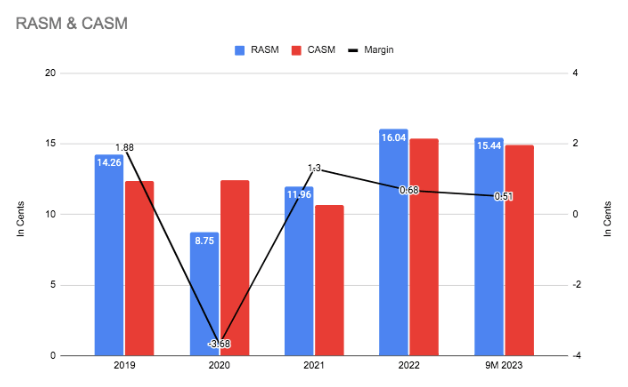

Southwest Airlines RASM & CASM (SEC.gov)

This has caused the margin between revenue per available seat miles (‘RASM’) and cost per available seat miles (‘CASM’) to dwindle. As can be seen, RASM is higher than ever, but Southwest cannot translate this to net income as CASM is also higher than ever. The margin between these two metrics is almost 73% lower now than in 2019, and the fuel and labor costs are the driving forces. This has caused Southwest to have margins way below peers Delta Air Lines (DAL) and American Airlines (AAL), each with margins of 3.09 cents and 1.14 cents. In the past, Southwest has been a leader in margin stability, but these cost increases are concerning, especially when competitors are showing strength.

Even so, Southwest is profitable and is showing strong demand, a markedly different scene than years prior. The business will continue to have growth in the top line and may see some uptick in net income come the end of the year.

As Always, A Healthy Balance Sheet

To top off the higher-than-ever revenues and ASMs, Southwest has maintained one of the best balance sheets in the industry. The company has been able to do this with the low-cost carrier model that has provided profit stability throughout good and bad economies. As of the most recent quarter, Southwest has very ample liquidity, with current and quick ratios of 1.21x and 1.09x. To pair with this is a moderate debt-to-equity of 2.35x. All around, a strong base for the business, per usual.

Overpriced Right Now

I have been a Southwest shareholder for years due to the belief that the airline’s business strategy of being a low-cost carrier focused on service has produced consistent profitability. While some of Southwest’s competitors are currently producing better results, I still believe this company is far superior in many ways to the competition. That being said, at close to $30 a share, I am not a buyer. At this price point, the business is valued at a forward P/E of 21x and a P/BV of 1.73x. I am willing to pay a bit of a premium for a quality balance sheet in this industry, but I think these multiples are too high when factoring in the increased expenses and lower margins at the moment. I was a buyer at the $25 price point and under and did add to my position there when the P/E was around 15-17x. This is in comparison to Delta and American, with forward P/E’s of 6.65x and 4.98x. So Southwest would have to come down in price or see these cost issues subside to pay this much of a premium for the company.

Conclusion

I have held shares of Southwest for over a decade because it is the most stable airliner in a very volatile industry. While margins are being pressured by fuel and labor costs, the business is still making a profit. I am not a seller of this company by any means, but neither a buyer at $30 per share. With the cost pressures aplenty and no real clear sight of easing, I will be buying when the stock hits a multiple of 17x or lower.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.