Summary:

- Tilray Brands, Inc. shares dropped 9.4% after falling short of revenue and GAAP earnings forecasts in its fiscal Q2 2024 financial results.

- The company reported robust growth in its beverage alcohol operations, but overall growth and improvement are not enough to make it a viable prospect for investors.

- Despite growth, Tilray Brands has issues and looks very expensive at this point in time.

halbergman

January 9th was not that pleasant a day for shareholders of cannabis firm Tilray Brands, Inc. (NASDAQ:TLRY). Shares of the company dropped around 9.4% after management reported financial results covering the second quarter of the company’s 2024 fiscal year. Although the business exceeded expectations when it came to adjusted earnings per share, it fell short of forecasts when it came to both revenue and GAAP earnings.

Management did surprise investors by reporting some rather robust growth when it came to the beverage alcohol operations of the company. But outside of that, there wasn’t all that much that was special. We are seeing, in addition to some nice revenue growth, some improvement in the company’s bottom line. But in my view, the growth and improvement seen so far do not yet make the company a viable prospect for anything other than speculative investors.

Not a high-flying quarter

In the last article that I published about Tilray Brands back in August of 2023, I lauded the company’s decision to acquire 8 beer and beverage brands from alcohol giant Anheuser-Busch InBev (BUD) in exchange for $85 million. These were marginal brands that did not move the needle for their prior owner. But for an enterprise like Tilray Brands, which is hoping to grow multiple revenue lines at once, the purchase of brands that are already recognized made a great deal of sense.

Despite my optimism regarding the transaction, I also stated that Tilray Brands still faced some meaningful challenges that made it a risky investment. That led me to reiterate the “Sell” rating I already had on the stock. At the end of the day, that has proven to be a wise decision. While the S&P 500 (SP500) is up 5.8% since the publication of my article, shares of Tilray Brands have generated downside of about 25%.

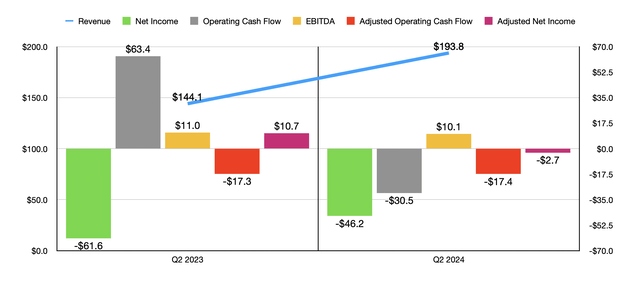

I take no joy in Tilray Brands underperforming the market. Although I personally am not supportive of the recreational cannabis industry, I like to see businesses succeed. Leading up to the earnings release for the business, my hope was that financial performance would come in strong. But for the most part, those hopes fell flat. Let’s take revenue to start with. Sales for the second quarter of the 2024 fiscal year totaled $193.8 million. That’s 34.5% higher than the $144.1 million reported one year earlier. Although this represents a nice increase year-over-year, it actually fell short of analysts’ expectations to the tune of about $1.2 million.

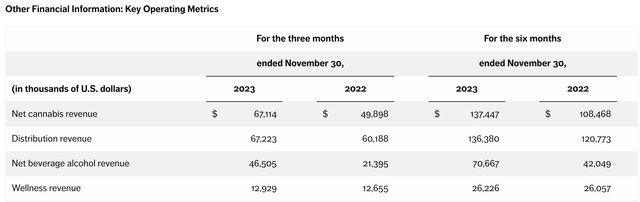

There is a lot to unpack here. For instance, while all segments of the company reported year-over-year growth, the greatest increase in sales came from the beverage alcohol business of the company. Revenue shot up from $21.4 million to $46.5 million. Management did not reveal how much of this growth was driven by the aforementioned purchase. But it’s clear that it had some impact. This size makes the company the 5th largest craft beer brewer in the country. And if the current trend continues, management sees the enterprise becoming a top 12 player when it comes to the beverage/alcohol space, in the nation.

Of course, there were other areas of growth for the company. Most notably was the cannabis business. Revenue jumped from $49.9 million last year to $67.1 million this year. The distribution and wellness businesses also grew, but their increase was marginal by comparison.

On the bottom line, Tilray Brands reported a loss per share accounting to $0.07. That’s better than the $0.11 per share lost in the second quarter of 2023. However, it missed analysts’ expectations by $0.01 on a per share basis. This means that net profits went from negative $61.6 million to negative $46.2 million. On an adjusted basis, the company broke even on a per share basis with a loss of only $2.7 million. That’s far worse than the $10.7 million adjusted profit reported one year earlier. But it exceeded analysts’ expectations by $0.05.

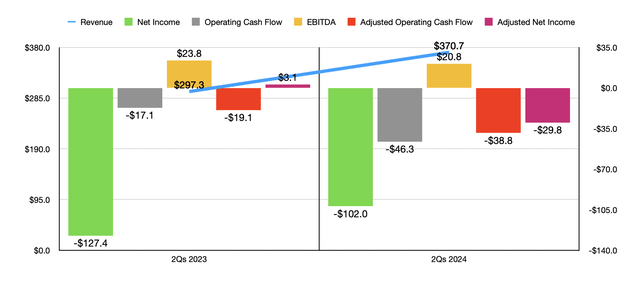

There were, of course, other metrics reported that show a slightly worse side to the company. Operating cash flow, for instance, went from $63.4 million to negative $30.5 million. If we adjust for changes in working capital, it was nearly the same, coming in at negative $17.4 million compared to the negative $17.3 million seen one year earlier. Lastly, EBITDA for the firm went from $11 million to $10 million. In the chart above, you can also see financial performance for the first half of 2024 relative to the same time of the 2023 fiscal year. This shows a mixed picture as well, with revenue and profits improving but other profitability metrics worsening rather substantially.

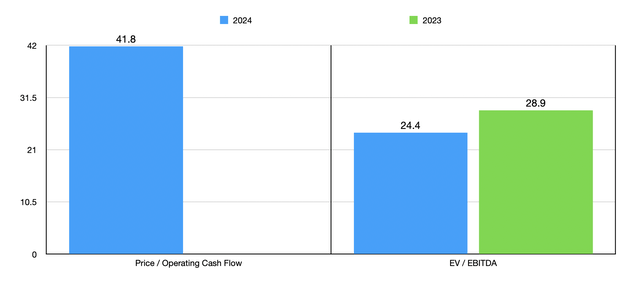

Given some of these readings, it might be difficult to believe that management is being forthright when it comes to some of their claims. In the press release, for instance, the company stated that it still believes it can achieve between $30 million and $35 million in synergies associated with its acquisition last year of rival HEXO. However, it even went a step further, claiming that it has achieved $22 million in annual run rate synergies and $14 million in actual cost savings, in the second quarter alone. The company then went to claim that guidance for this year calls for EBITDA of between $68 million and $78 million. That would compare favorably to the $61.5 million reported for 2023. If we take the midpoint of guidance, that would give us adjusted operating cash flow, according to my estimate, of about $37.3 million for 2024.

In the chart above, you can see how shares are priced on both a forward basis and using data from 2023. If the company was growing at a much more rapid pace, these numbers might be acceptable. But at this rate, it will take the firm far too long to become reasonably priced. That’s especially if they are being honest about how much in savings they have already captured. Of course, they aren’t the only player in the market currently struggling. Rival Canopy Growth Corporation (CGC) is doing even worse.

Using the most recent data, which covers the second quarter of 2024 and that came out in November of last year, Canopy Growth saw its revenue drop 18.3% year-over-year, while its net loss for the quarter totaled CDN$324.8 million. Its shares were also down rather significantly on January 9th, falling about 8.3% as I write this. This was in response to management issuing a private placement to sell $30 million worth of stock (in the form of warrants) at a share price of $4.83. That’s at a 4.2% discount to the $5.04 that shares were trading at on January 8th.

What’s worse than the discount is the fact that half of the warrants, which are exercisable immediately, give the owners the right to purchase said stock at said price for five years, while the other half gives the same five-year time but with a starting point six months from issuance. This means that management is not terribly worried about its share price rising materially over the next few years, which is not confidence-inducing for the company’s investors.

Takeaway

As things stand, I do not find myself all that interested in Tilray Brands from an investment perspective. Even if I were a fan of the cannabis market, the financial data just is not there to support the kind of valuation that we are looking at. A market capitalization of $1.56 billion for a company generating less than $800 million in revenue annually, and that is on track to lose around $200 million for the year if things persist, is just not feasible. Due to this, I have no problem keeping the company rated a “sell” for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!