Summary:

- Amazon’s Q3 2023 earnings show significant growth with net sales and operating income.

- The 2023 yearly candle exhibited a robust bullish trend, laying the groundwork for expected price increases in 2024.

- The breakout of the key level of $146 has opened the doors for further upside potential.

FinkAvenue

Amazon.com, Inc. (NASDAQ:AMZN)’s earnings results for Q3 2023 are a clear demonstration of its sustained growth and strategic expertise. The quarter’s performance reveals a narrative of dynamic expansion and strategically sound decisions, indicating long-term growth prospects. This article builds upon the previous discussion, delving into a technical analysis of Amazon’s stock price to discern its future trajectory. Notably, the stock has breached a crucial threshold and finished 2023 at higher levels, suggesting a robust growth trend for 2024. Bullish hammers in monthly and weekly charts indicate a sustained upward momentum.

A Look at Amazon’s Q3 2023 Earnings

Amazon’s Q3 2023 earnings results reveal a robust performance characterized by significant growth in net sales, operating income, and net income, alongside substantial improvements in free cash flow. The net sales for the quarter stood at $143.1 billion, marking a 13% increase from the $127.1 billion reported in Q3 2022. The company’s sales growth was geographically widespread, with North American segment sales rising 11% to $87.9 billion and International segment sales climbing 16% to $32.1 billion. AWS segments also increased by 12% year-over-year to $23.1 billion.

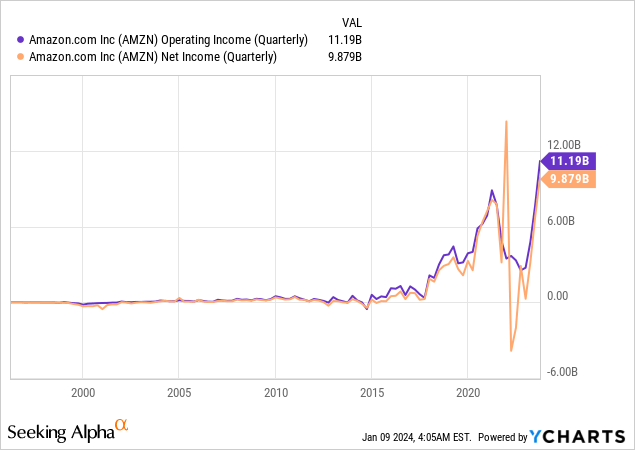

Similarly, the operating income increased substantially to $11.19 billion, compared to $2.5 billion in Q3 2022. This improvement was evident across various segments. The North American segment flipped from an operating loss of $0.4 billion in 2022 to a gain of $4.3 billion. The International segment’s operating loss was significantly reduced to $0.1 billion from $2.5 billion in Q3 2022. AWS’s operating income continued to be a strong contributor, rising to $7.0 billion from $5.4 billion. The net income for the quarter was also remarkable, reaching $9.879 billion, or $0.94 per diluted share, a substantial increase from $2.9 billion, or $0.28 per diluted share, in 2022. The chart below illustrates the robust growth in net income and operating income, highlighting the potential for future profitability of the company.

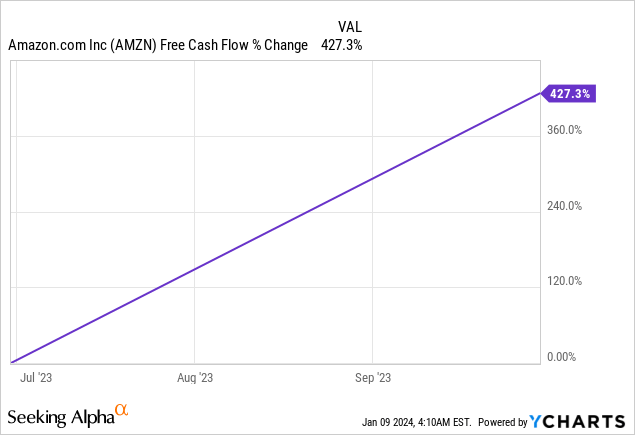

The company’s cash flow metrics also showed impressive improvement. Operating cash flow surged by 81% to $71.7 billion for the trailing twelve months. Free cash flow turned positive, reporting an inflow of $21.4 billion, starkly contrasting the outflow of $19.7 billion in the previous year. The chart below showcases how a revival in Amazon’s e-commerce sector, coupled with steady growth in AWS, has led to a significant boost in the company’s free cash flow. This uptick demonstrates Amazon’s adeptness in handling challenging market scenarios and solidifies its stock as a reliable investment choice.

CEO Andy Jassy attributed this solid performance to several factors. These include improvements in cost-to-serve and delivery speed in the Stores business, stable growth in AWS, robust growth in Advertising revenue, and a substantial rise in overall operating income. Andy Jassy also highlighted the success of the company’s strategic shift to a regional fulfillment network in the U.S., which is exceeding expectations and significantly enhancing delivery speeds for Prime customers.

Amazon is expected to announce Q4 2023 earnings in February 2024. The company expects net sales to range from $160.0 billion to $167.0 billion, representing a growth of 7% to 12% compared to Q4 2022. The company expects its operating income to be $7.0 billion to $11.0 billion, a significant increase from the $2.7 billion reported in Q4 2022. Despite a high price-to-earnings ratio, Amazon’s valuation is supported by the potential for further margin expansion, particularly as the company continues to shift its revenue towards higher-margin businesses.

Amazon’s ventures into Artificial Intelligence (AI), including the launch of Bedrock AI hosting service and its substantial investment in Anthropic AI, position it favorably in the burgeoning AI market. While AI breakthroughs are not a prerequisite for Amazon’s continued success, they represent a significant opportunity for growth. The company’s robust foundation in e-commerce and AWS and its expanding economic moat suggest a strong potential for continued profit growth and stock price appreciation in 2024.

Deciphering Technical Price Movements

Recap

The previous article discussed the bullish price action in Amazon based on the quarterly, monthly, and weekly charts. The long-term price action on the quarterly chart presented a parabolic price move from 2008 lows of $1.73 to record highs of $188.21. The significant correction towards the $81.43 was discussed as the potential bottom for the next price surge. This important bottom was also validated by RSI bottoming at the mid-level. The solid quarterly candles from the $81.43 lows indicated a strong potential for higher prices.

Moreover, this strong move challenged resistance at the critical level of $146 on the monthly chart, which was expected to be broken based on the solid price action from the bottom. The inverted head and shoulders marked this bullish price action pattern at the low of $81.43, further strengthening the bullish outlook. Overall, the previous article discussed the potential of the breakout from the key levels and highlighted the substantial buying opportunity for Amazon.

The Next Move

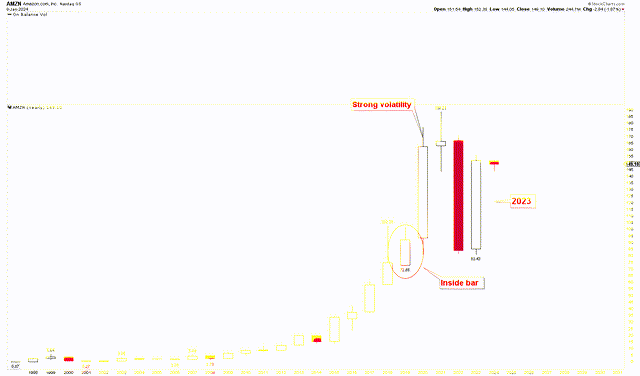

Amazon’s stock price broke the crucial threshold of $146, triggering a robust upward surge, confirming the expectations made in the previous article. This is further corroborated by the yearly chart below, which outlines Amazon’s long-term prospects. The chart reveals significant price fluctuations between 2020 and 2023. This is evident from the solid yearly candle for 2020, the subsequent peak in 2021, and a notable downturn in 2022. The 2020 surge resulted from an inside bar formation in 2019, signaling a period of price consolidation in Amazon’s stock. The breakout from this consolidation in 2020 led to a notable upward momentum in the stock price. However, the substantial downturn in 2022 negated the gains of 2020, underscoring the market’s high volatility. While such volatility indicates large market movements, it also introduces more significant uncertainty.

Nevertheless, the notable rebound in 2023, as depicted by the solid yearly candle that has recouped over 75% of the 2022 correction, suggests that Amazon’s stock is gearing up for a significant upward movement in 2024. This potent surge is anticipated once the stock price surpasses the all-time high of $188.21. If the upward trend begins in 2024, the scale of this shift could be significant, mirroring the substantial price volatility seen from 2020 to 2023.

Amazon Yearly Chart (stockcharts.com)

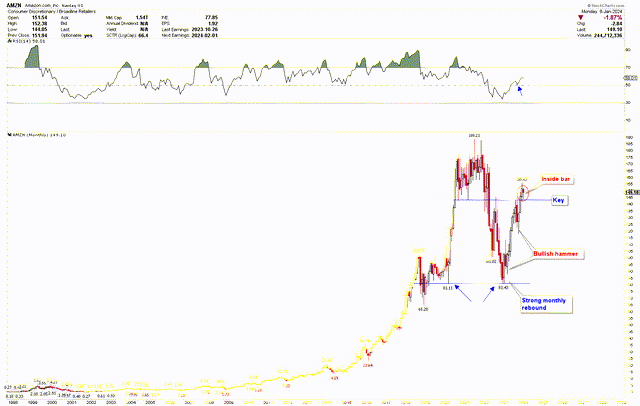

To gain a deeper insight into the robust long-term forecast, the revised monthly chart below highlights that the anticipated critical level was surpassed in November 2023, evidenced by a monthly closing above $146. December 2023 followed an emphatically bullish trend, culminating in a robust year-end close at $151.94. The monthly chart also depicts a mid-level RSI bottom, suggesting that the bullish momentum will likely persist into 2024. The presence of bullish hammer candles in March and October 2023 further reinforces the expectation of this rally advancing to greater heights.

Amazon Monthly Chart (stockcharts.com)

Key Action for Investors

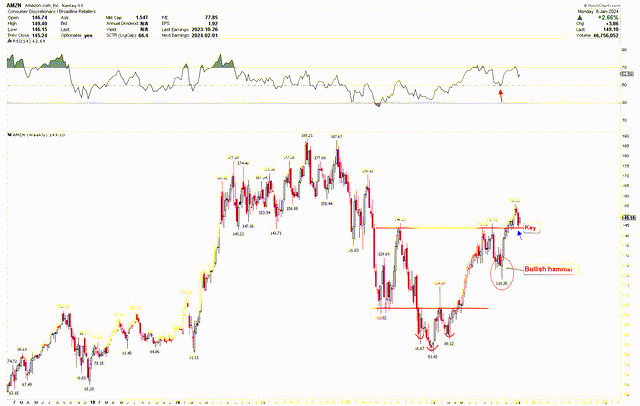

The analysis suggests that Amazon’s stock price is poised for a significant upward trend and could reach new highs in 2024. The weekly chart reveals a short-term bullish pattern, offering insights into potential investment opportunities. Notably, the stock presents a bullish hammer on the weekly chart, mirroring a similar pattern observed on the monthly chart. This bullish hammer has sparked a new rally, as evidenced by consistent strong closes in the weekly charts. Forming an inverted head and shoulders pattern, with the head at $81.43 and shoulders at $85.67 and $88.12, has established a robust bullish price structure, signaling a solid rally into 2024. Furthermore, the appearance of the bullish hammer coincided with the RSI reaching a mid-level, reinforcing the bullish sentiment.

Amazon Weekly Chart (stockcharts.com)

Even though the RSI suggests overbought conditions, the bullish patterns observed on the charts imply that the current rally in Amazon’s stock will likely persist and potentially reach new highs in 2024. If there are any declines in the price, investors might view these as favorable opportunities to invest.

Market Risks

Economic downturns, inflation, or changes in consumer spending patterns can significantly affect Amazon’s sales and profitability. The company’s expansive international presence also exposes it to currency fluctuation risks and differing regional economic conditions. Additionally, Amazon’s high growth expectations make it sensitive to shifts in investor sentiment, which broader economic trends can influence. The e-commerce and cloud computing spaces are intensely competitive. While Amazon is a dominant player, it faces stiff competition from Alibaba Group Holding Limited (BABA), Alphabet Inc. (GOOG), Microsoft Corporation (MSFT), and many smaller yet agile competitors. These rivals are constantly innovating and could potentially erode Amazon’s market share, particularly in emerging markets where Amazon seeks to expand.

As Amazon continues to grow, it increasingly comes under the scrutiny of regulators in various countries. Moreover, Amazon’s future growth is partly predicated on its continued innovation, especially in AI. However, this space is rapidly evolving and highly competitive. Any failure to keep pace with technological advancements or to successfully integrate new technologies into its offerings could hinder Amazon’s ability to maintain its competitive edge. Additionally, disruptions in supply chains, whether due to geopolitical issues, natural disasters, or labor disputes, can impact Amazon’s ability to deliver products efficiently. The company’s increasing reliance on automation and AI also brings operational risks, including potential technical failures or cybersecurity threats.

Bottom Line

In conclusion, Amazon’s Q3 2023 earnings report paints a picture of a company strategically poised for sustained growth in the future. The impressive growth in net sales, operating income, and net income, coupled with substantial improvements in free cash flow, are testaments to Amazon’s robust business model and its capacity to adapt and excel in various market conditions. The technical analysis of Amazon’s stock price further underscores the company’s strong financial footing and growth potential. The breach of the crucial $146 threshold and the bullish indicators in the monthly and weekly charts suggest that Amazon’s stock is on a trajectory of sustained upward momentum. This is further reinforced by bullish hammer candles and the formation of an inverted head and shoulders pattern, pointing towards a potential rally in 2024. Investors may consider buying Amazon shares at the current price and increasing holdings if the stock price declines, positioning themselves to capitalize on the expected upward surge.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.