Summary:

- Chevron investors have underperformed the S&P 500 since my October 2023 update. However, CVX’s November bottom has held firmly.

- Concerns over the dispute between Guyana and Venezuela may dampen CVX’s valuation re-rating in the near term. However, I view the weakness as an opportunity for investors to buy.

- Chevron remains well-positioned to leverage its capabilities and benefit from medium-term production growth in upstream, driving margin accretion further.

- The company is also confident of delivering its capital allocation framework even with lower energy prices.

- I argue why the recent Guyana fears are overstated, allowing opportunistic investors to buy more shares before the cyclical recovery takes CVX higher.

Mario Tama

Chevron Corporation (NYSE:CVX) investors have underperformed the S&P 500 (SPX) (SPY) since my previous update in October 2023. I urged investors to maintain a bullish posture on CVX, notwithstanding the near-term earnings dilution impact due to its recent Hess Corporation (HES) acquisition. Although the acquisition is undergoing regulatory review, the market has likely reflected the near-term headwinds that saw CVX fall toward the $140 level in mid-November. While CVX consolidated constructively, as dip buyers likely gleaned an attractive opportunity, the heightened dispute between Guyana and Venezuela has likely raised the execution risks over its production in the region. Coupled with Hess Corporation’s exposure, the market could be concerned whether the uncertainties could dampen CVX’s upward valuation re-rating in the medium term.

However, while the near-term caution is justified, Chevron investors must be prepared to ride it out. Why? Exxon Mobil (XOM) had already cautioned that the “resolution of the dispute over Guyana’s Essequibo region may take a couple of years.” In addition, Chevron highlighted its confidence that the disagreements “are not expected to escalate into a military conflict.” Sure, bearish investors might point out that Venezuela recently deployed troops to its “eastern Caribbean coast,” elevating the temperature in its dispute with Guyana.

However, with the downward de-rating in late October, as Chevron reported a sharp decline in its operating performance, I assessed that it has not caused holders to capitulate further. Consequently, it indicates that the market seems confident enough as buying sentiments have remained robust. Chevron is still optimistic about reallocating its focus on upstream production growth to drive its margins higher.

The leading oil and gas integrated company stressed that its portfolio “is moving back towards an 80-20 or 85-15 weighting between upstream and downstream.” As a result, Chevron is leveraging its ability and assets to drive growth, even as energy futures have likely peaked in 2022. With Chevron and its leading peers seeing price levels moving back to mid-cycle zones, Chevron needs to pursue higher margin opportunities in upstream. Accordingly, the company anticipates that the “returns in the upstream sector are likely to be structurally higher than in the downstream.”

I gleaned that the energy markets have struggled for momentum lately, particularly in crude oil (CL1:COM) (CO1:COM). As a result, WTI crude remains close to the low $70 level, which it last saw in June 2023. Saudi Arabia’s recent decision to “reduce the selling price of its flagship Arab Light crude” to Asian customers was attributed to this week’s volatility. However, WTI crude buyers have not given up the critical $70 support level convincingly, underscoring my observation that crude oil remains firmly in a medium-term uptrend.

Furthermore, Chevron’s ability to drive production growth should mitigate medium-term volatility in the energy markets. Chevron also expects to maintain its robust capital allocation policies with the range of $10B to $20B for share repurchases. Management stressed that “Chevron can sustain these repurchases in a lower price environment.”

With CVX trading at a forward EBITDA multiple of 5.6x, it isn’t priced at a premium to the broad market. However, Chevron’s market leadership suggests it’s trading at a premium against its peers, with a valuation grade of “D+.” As a result, the market likely expects Chevron to continue executing well to deserve its relative premium. However, with the recent de-rating as it bottomed out in November 2023 at the $140 level, could the worst be over?

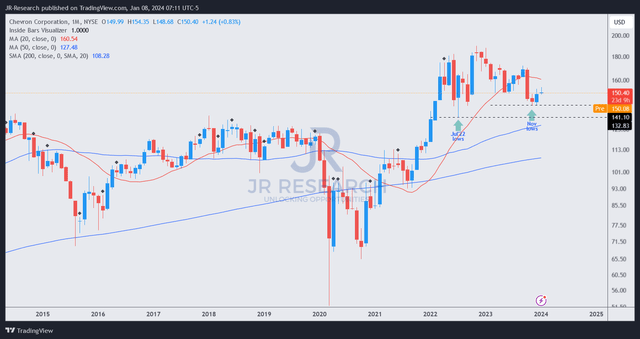

CVX price chart (monthly, long-term) (TradingView)

CVX’s long-term price action suggests an uptrend continuation structure, predicated on the bear trap (false downside breakdown) at its November 2023 lows.

Therefore, I don’t quite understand why investors who don’t assess investor psychology as a fundamental aspect of their analytical framework were so concerned with the Guyana challenges. I believe management has already considered the political uncertainties, given the involvement of Exxon and China National Offshore Oil Corporation or CNOOC.

CVX’s buying sentiments over the past two months corroborate that the fears were overstated, as the uptrend continuation remains intact.

As a result, I remain bullish on CVX and view the recent weakness as a fantastic opportunity for investors to benefit from the cyclical recovery of CVX as it moves into its mid-cycle phase.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!