Summary:

- It is apparent that there is no escaping the ongoing cord cutting observed in multiple cable companies, with Comcast reporting impacted Media and advertising top/bottom lines.

- CMCSA also records a somewhat bloated Debt to EBITDA ratio of 2.44x, compared to its FY2017 ratio of 2.14x, though comfortably between the Entertainment/Telecom sector mean ratios.

- While the macroeconomic outlook has lifted, it appears that market sentiments may remain mixed for so long that its debts are elevated and cable performance impacted.

- However, we believe that CMCSA’s intermediate-term prospects may lift drastically, with us standing by our previous Hulu valuation of $45B and $8.61B paid by Disney.

- The stock’s depressed valuations may be a great gift for investors looking for dual pronged (prospective) returns of capital appreciation and dividend income.

wildpixel

We previously covered Comcast (NASDAQ:CMCSA) in October 2023, discussing its bright prospects as its Hulu stake might very well be worth $15B upon reassessment, with the additional liquidity likely allowing the management to either deleverage or pursue growth opportunities.

Combined with the stock’s inherent undervaluation and the excellent profitability, we had rated the stock as a Buy then.

In this article, we shall discuss why we are maintaining our Buy rating for the CMCSA stock, thanks its moderating debt to EBITDA ratio and excellent shareholder returns thus far.

Its other segments continue to be highly profitable on a YoY basis, implying its ability to weather the slow but inevitable cord cutting and unprofitable streaming in the intermediate term, before things normalize.

As a result of the highly attractive risk/ reward ratio at current levels, we maintain our Buy rating for value and income-oriented investors.

The CMCSA Investment Thesis Remains Highly Bullish

For now, CMCSA has reported a double beat FQ3’23 earnings call, with revenues of $30.11B (-1.3% QoQ/ +0.9% YoY), adj EBITDA of $9.96B (-2.7% QoQ/ +5% YoY), and adj EPS of $1.08 (-4.4% QoQ/ +12.5% YoY).

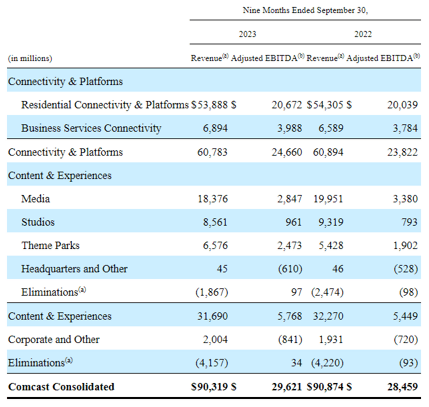

CMCSA Segment Performance

Seeking Alpha

Much of CMCSA’s profit tailwinds are attributed to the outperformance observed in most of its segments, except for the Media segment naturally.

It is apparent that there is no escaping the ongoing cord cutting observed in multiple cable companies, with CMCSA similarly reporting impacted Media revenues of $18.37B (-7.9% YoY) and adj EBITDA of $2.84B over the past nine months (-15.9% YoY).

Most of the headwind is attributed to the moderating domestic advertising revenues of $5.96B (-20.8% YoY) over the past nine months, as more media companies introduce ad-supported streaming tiers.

The previous SAG-AFTRA/ WGA strikes have also driven advertisers to unaffiliated platforms, such as Alphabet’s (GOOG) YouTube, with it recording impressive advertising revenue growth of $7.95B in the latest quarter (+3.7% QoQ/ +12.4% YoY).

In contrast, CMCSA’s D2C segment, Peacock, has yet to achieve break even with adj EBITDA loss of -$565M (+13.2% QoQ/ +7.9% YoY) despite the growing top-line to $830M (+1.2% QoQ/ +6.4% YoY), with an underwhelming adj EBITDA margins of -68% (+11.3 points QoQ/ +53.3 YoY).

This is compared to the streaming leader, Netflix (NFLX) at 23.4% (+0.1 points QoQ/ +3.1 YoY) in the latest quarter.

Therefore, while CMCSA’s other segments continue to be highly profitable on a YoY basis, implying its ability to weather the slow but inevitable cord cutting in the intermediate term, we believe that its Media prospects may remain mixed in the intermediate term.

On the one hand, CMCSA still reports elevated long-term debts of $94.35B (inline QoQ/ -1.2% YoY) by the latest quarter, with $4.24B in annualized interest expenses (+6.2% QoQ/ +10.4% YoY) and $11.1B of debt maturing through FY2025.

On the other hand, these debts come with a long-term weighted-average time to maturity of approximately 17 years, significantly aided by the fact that 93% are at fixed interest rate of 3.59% as of December 31, 2022.

Then again, CMCSA records a somewhat bloated Debt to EBITDA ratio of 2.44x, compared to its FY2017 ratio of 2.14x, though comfortably between the Entertainment sector mean ratio of 2.2x and Telecom sector mean ratio of 2.55x.

The latest ratio is based on the FQ3’23 debt level of $97.3B and annualized adj EBITDA generation of $39.84B (-2.7% QoQ/ +4.9% YoY). Readers must also note the FY2017 ratio is highly relevant, since it is indicative of the health of its balance sheet before the all-cash acquisition of Sky Plc for $38.8B in October 2018.

As a result, while the macroeconomic outlook has lifted thanks to the cooling inflation and the (potential) Fed pivot from Q1’24 onwards, it appears that market sentiments may remain mixed for so long that its debts are elevated and profitability impacted.

However, we believe that CMCSA’s intermediate-term prospects may lift drastically, with it already receiving the base sum of $8.61B from Disney (DIS) for the one-third stake in Hulu, with a total of $15B very likely based on the projections in our previous article.

Readers must also note that the management has raised the prices of its services from December 2023 onwards, with FQ4’23 likely to bring forth improved top/ bottom line performance and healthier balance sheet.

If anything, CMCSA also reports a robust Free Cash Flow of $15.74B over the last twelve months (-11.3% sequentially), with the company more than able to cover its annualized dividend obligations of $4.75B while retiring 236M of shares over the same time period, or 469M since FY2019.

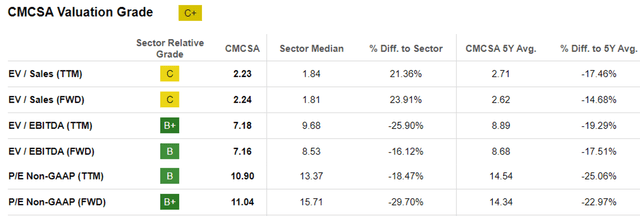

CMCSA Valuations

Assuming that CMCSA is able to consistently deleverage below the sector means and its FY2017 ratio, we may also see Mr. Market slowly rerate the stock’s valuations nearer to its historical P/E means of over 18x (prior the expensive acquisition).

This also means that CMCSA is inherently undervalued here, based on its FWD EV/ EBITDA valuation of 7.16x and FWD P/E valuation of 11.04x, compared to its 1Y mean of 7.22x/ 10.81x, 3Y pre-pandemic mean of 8.18x/ 15.71x, and the sector median of 8.53x/ 15.71x, respectively.

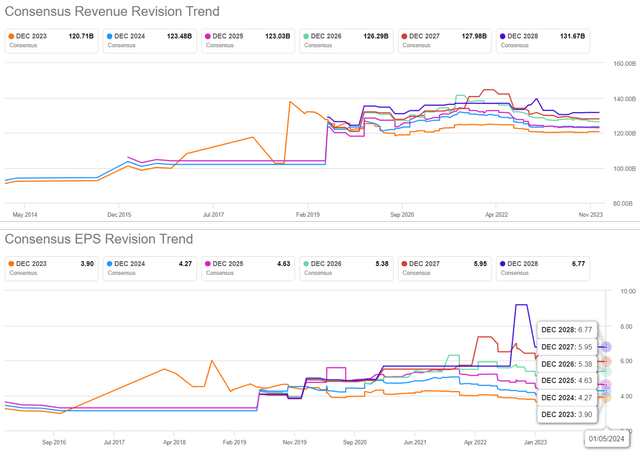

The Consensus Forward Estimates

Most importantly, readers must note CMCSA’s fairly consistent top and bottom line growth thus far, at a CAGR of +7.1% and +13.1% between FY2016 and FY2022, respectively, with the consensus still expecting a somewhat decent expansion at a CAGR of +1% and +10.2% through FY2026, respectively.

With its profitability still growing, we believe that the stock’s depressed valuations are unwarranted, with an upward rerating likely to occur once its balance sheet improves.

This possibility may also be aided by the eventual bottoming of CMCSA’s cable networks’ headwinds and improvement in its streaming top/ bottom lines over the next few years, well balanced by the excellent performance reported by the other segments thus far.

So, Is CMCSA Stock A Buy, Sell, or Hold?

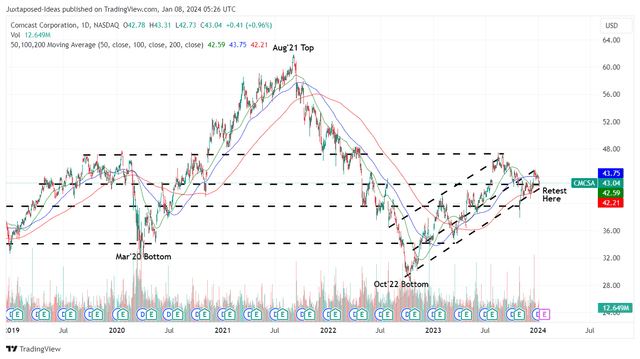

CMCSA 5Y Stock Price

For now, assuming that CMCSA records a similar FQ4’23 adj EPS as that of FQ3’23, we may see the company report $4.21 in FY2023 adj EPS (+15.6% YoY). Combined with the impacted FWD P/E valuation of 11.04x, it appears that the stock is trading near its fair value of $46.40.

However, we believe that these depressed valuations offer an attractive dual pronged (prospective) returns of capital appreciation and dividend income.

This is based on the +96% in upside potential to our long-term price target of $84.30, attributed to the eventual rerating in CMCSA’s P/E valuation to pre-pandemic levels of 15.7x and the consensus FY2026 adj EPS estimates of $5.37

Readers may also want to note the stock’s consistently higher highs and higher lows since the October 2022 bottom, implying the increased bullish support for its reversal.

This is on top of CMCSA’s expanded forward dividend yield of 2.70%, compared to its 4Y average of 2.30% and sector median of 3.14%.

Its dividend investment thesis remains robust as well, with an improving TTM Dividend Coverage Ratio of 3.35x and TTM Interest Coverage Ratio of 5.78x, compared to its 4Y historical average of 3.20x/ 4.89x and the sector median of 2.16x/ 3.96x, respectively.

As a result of the highly attractive risk/ reward ratio at current levels, we maintain our CMCSA Buy rating for value and income-oriented investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.