Summary:

- Microsoft’s finally finalized buyout of Activision Blizzard marks a significant reorientation towards vertical integration in the gaming sector, positioning Microsoft as the third-largest gaming company globally.

- The acquisition enhances Microsoft’s gaming portfolio with high-caliber franchises and bolsters its competitive stance in a market forecasted to grow to $665 billion by 2030.

- Microsoft’s gaming division is poised to be a significant growth driver, potentially adding approximately $406 billion to the company’s market capitalization.

- New developments from CES and a new Xbox offer catalysts for the company to realize this.

Ivan Pantic/E+ via Getty Images

Investment Thesis: Microsoft 2024 Outlook -Gaming Is Under-appreciated

Microsoft (NASDAQ:MSFT)’s finally finalized buyout of Activision Blizzard, pegged at $68.7 billion, marks a launch point in the technology giant’s gaming strategy, presenting what I believe to be a compelling, underappreciated investment thesis for 2024 & going forward. This acquisition, which secured Microsoft approximately 8.3% of the global gaming market share, is not just an expansion but a significant reorientation towards vertical integration in the gaming sector providing huge benefits to Microsoft. The acquisition bolsters Microsoft’s gaming portfolio with high-caliber franchises, enhancing its competitive stance in a market forecasted to grow to $665 billion by 2030.

The optimistic outlook is not perfect, however. Global gaming is only projected to grow only 2.5% in 2024. With this heightened competition from resilient competitors like Sony, highlight an extremely competitive market landscape.

Even with this I remain bullish, and think this is an underappreciated part of the Microsoft story. I believe their gaming division is poised to be a significant growth driver, with its valuation potentially adding approximately ~$406 billion to the company’s market capitalization. As the gaming industry continues to evolve, Microsoft’s adaptive strategies & innovative approaches will be key to harnessing the full potential of its gaming division in 2024 and beyond. I’m bullish on the company and the stock. I think it’s a strong buy.

Background: Microsoft’s Acquisition of Activision Blizzard

Microsoft’s acquisition of Activision Blizzard (first announced in January of 2022), valued at $68.7 billion, is a transformative move for its gaming division, catapulting the company into a powerful position within the video game software publishing industry. This deal, which gives Microsoft an estimated additional 8.3% market share in the gaming industry, is a significant step towards vertical integration in the gaming sector.

While I wrote about Microsoft recently, I totally missed the upside potential here (and with recent updates -see below- I believe this make this a great time to dive in).

By acquiring Activision Blizzard, Microsoft has significantly expanded its gaming studio portfolio. This encompasses a range of developers under Activision Blizzard, including Activision Publishing, Blizzard Entertainment, and King, the creator of the hit mobile game Candy Crush. The acquisition also includes rights to prominent franchises like Overwatch, Tony Hawk’s Pro Skater, Starcraft, Crash Bandicoot, and the immensely popular Call of Duty.

The acquisition also has broader implications, such as the potential impact on Xbox Game Pass. Analysts anticipate that this move will bolster the Game Pass library with a vast back catalog and future releases from Activision Blizzard, thereby potentially increasing its attractiveness and subscriber base.

The deal faced regulatory (antitrust) headwinds but closed on October 13th last year. This delay resulted in a delay in integration of the two firms but now the merger is back on plan. In essence, however, Microsoft has only in the last quarter started to realize the benefits (we saw this come to the surface at CES this month).

Key Updates for 2024 (What’s New To Start The New Year?)

With the kickoff of 2024, Microsoft has doubled down to enhancing the gaming landscape. The introduction of next-generation Windows 11 gaming PCs, unveiled at CES and developed in collaboration with various PC partners, marks a substantial step forward in gaming technology. Microsoft’s partner PCs feature cutting-edge advancements, including the latest Nvidia GeForce RTX 40 Series GPUs with DLSS 3.5 technology and Nvidia Advanced Optimus, providing a significant boost in performance and AI-powered graphic capabilities. What’s key about this is this is the first major gaming PC announcement since the Activision acquisition closed. Remember, they could not integrate Activision while the deal was pending antitrust review, so this is one of the first product launches with the acquisition under one roof.

Similarly, Microsoft is planning a significant refresh for its Xbox Series X console in 2024. Codenamed Brooklin, Microsoft is expected to feature an all-new design, along with doubling the console’s storage capacity to 2 TB, along with improving wireless and Bluetooth capabilities. The refreshed console aims to provide an enhanced gaming experience, aligning with the latest design trends and promising a more sustainable gaming solution. To emphasize again: this will be the first major console refresh with Activision under the same roof. This is likely where we will see the first synergies to the console division.

Finally, Activision’s former CEO, Bobby Kotick, left the company on December 29th. This is significant because this marks the beginning of the official Microsoft integration (and when we should start to see talent synergies from this acquisition). For example, once Mr. Kotick left, most of the remaining leadership from Activision started to report to Matt Booty President, Microsoft Game Content and Studios. Booty was recently promoted to his position in October once the deal closed.

Now That the Deal is Closed, What is the Potential Upside?

The closure of Microsoft’s acquisition of Activision Blizzard, finalized in October, marks the beginning of a pivotal moment for Microsoft’s expansion in the gaming sector. This positions Microsoft as the third-largest gaming company globally, trailing only behind Sony and Tencent.

With the gaming market forecasted to grow to over $655 billion by 2030, Microsoft’s expanded capabilities and resources place it in a strong position to capitalize on this growth.

As a reminder, the deal faced significant regulatory scrutiny due to its potential impact on the cloud gaming market. With this, Microsoft agreed to sell the streaming rights of Activision’s games to Ubisoft Entertainment, ensuring the availability of these titles on non-Windows operating systems for 15 years (this is another cash flow opportunity). This concession was key to satisfying antitrust regulators’ concerns and securing approval for the deal. So while Microsoft will not be able to use these games as a sole source marketing campaign (yet) to sell more hardware sales (like the new Xbox or new gaming PCs), I am sure there will be new and exclusive features only available on the Microsoft hosted versions of Activision titles.

Microsoft’s internal documents have indicated an ambitious target for its gaming revenue, aiming to reach $36 billion by 2030. However, I believe the figure may seem conservative given the rapid expansion of the gaming industry and Microsoft’s strengthened position post-acquisition (see Valuation below).

Valuation (What’s all this worth)

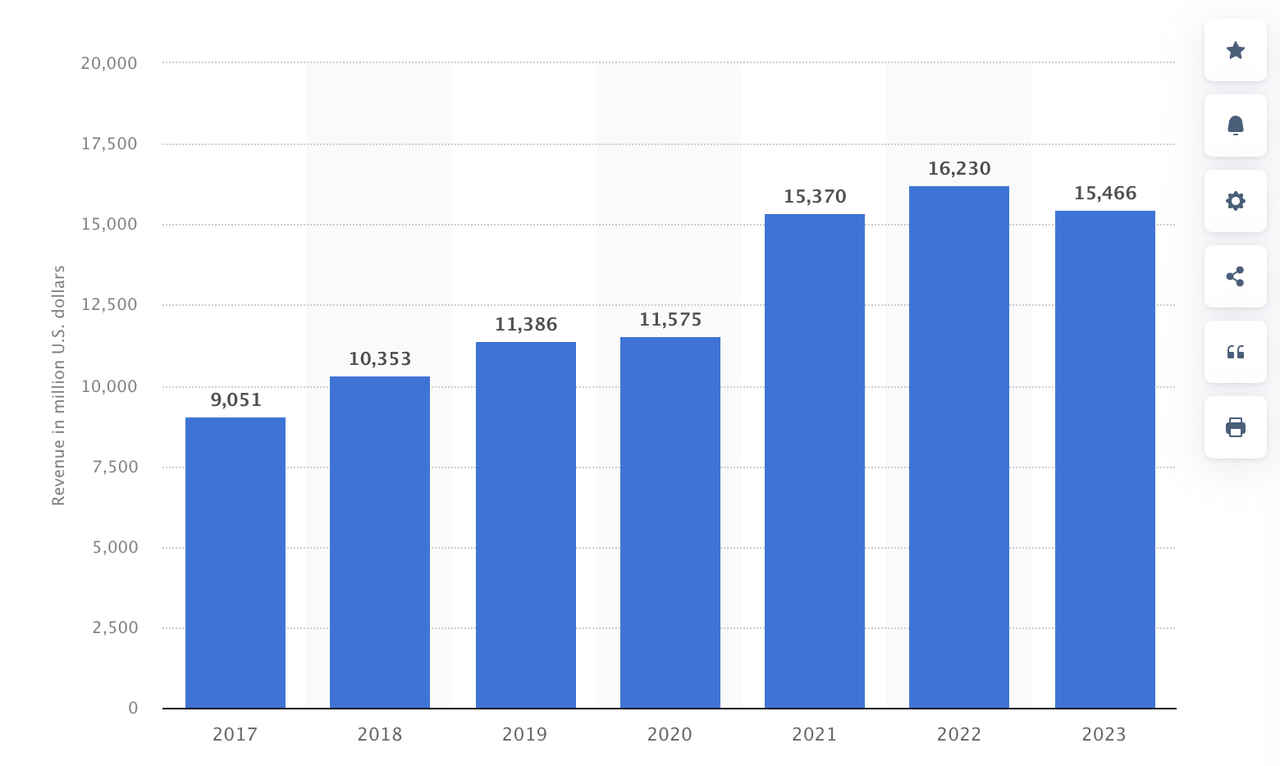

In my opinion, there are a couple ways to value Microsoft’s gaming division, particularly in the wake of its Activision Blizzard acquisition. Microsoft’s gaming revenue for the fiscal year 2023 was $15.47 billion, a slight decrease from the previous year. However, the acquisition of Activision Blizzard, valued at $68.7 billion, significantly enhances Microsoft’s position in the gaming market, particularly in mobile gaming.

Taking this revenue and applying the company-wide price to sales (11.76) to it gives us a division (forward) market cap valuation of $181.92 billion.

Microsoft Annual Gaming Revenue (Statista)

However, this does not consider the incremental revenue that Activision will provide. Keep in mind that the gaming market is expected to grow from $249.55 billion in 2022 (last full year of Activision being an independent company) to $665.77 billion in 2030. Taking the spread (or growth) here, we get a market expansion of $416.22 billion. Assuming that Microsoft maintains the same 8.3% market share Activision has (I think this could even increase this year with the new console allowing them to be a catalyst to gain more market share), this implies $34.54 billion in new annual revenue.

Considering this, and applying the forward price-to-sales multiple of 11.76 to the projected gaming revenue, we can estimate a potential valuation bump to Microsoft of approximately $406.26 billion from Microsoft’s gaming division alone. This implies 14.2% upside to Microsoft’s market cap (assuming no share buybacks which they will likely have). Share buybacks will only increase the upside potential here in my opinion.

While this estimate is for 2030 revenue, I think this is a conservative estimate in that it does not include the revenue Activision brings in now, no new market share like I think will happen, and no new incremental hardware sales from Xbox because it has an even better suite of games on it because of the acquisition.

Risks to Thesis

Unfortunately, the broader gaming market is experiencing turbulence. Some analysts estimate that the market in 2024 will only book 2.5% growth. They’re attributing the modest growth to a weaker gaming title release slate compared to previous years and macroeconomic pressures.

In this case, I’m not particularly worried. As I mentioned earlier (and this is key), reports have come out that Microsoft could launch their new Xbox X console. This console will likely cause a hardware upgrade cycle boost and with its new game sales. There is even a scenario where Activision (under Microsoft) gains market share (from the 8.3%) as people use the new Xbox as a catalyst to buy more Activision games.

Takeaway

Microsoft’s strategic maneuvers in the gaming industry, through the acquisition of Activision Blizzard, represent a significant growth opportunity that I think will come into view in 2024.

While the gaming industry’s growth rate, predicted to be modest this year in comparison to previous years, gives me pause, I think Microsoft has a unique trick up their sleeve with respect to their new Xbox rollout.

With a potential marginal market valuation of approximately $406 billion from the gaming division alone, it stands as an underappreciated asset within Microsoft’s diverse portfolio. I like where the company is going, leveraging its bleeding edge tech in other places I have written on (like AI and with Bing) to dominate a new market: gaming. I think the stock is a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noahs' Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.