Acuity Brands: Likely At Fair Value Following Q1 Earnings Pop

Summary:

- Acuity Brands reported its Q1 earnings which beat expectations.

- Despite a decline in sales, pricing initiatives have supported expanding margins.

- AYI benefits from solid fundamentals, although we believe the recent rally has already captured many of the positives in the outlook.

buzbuzzer

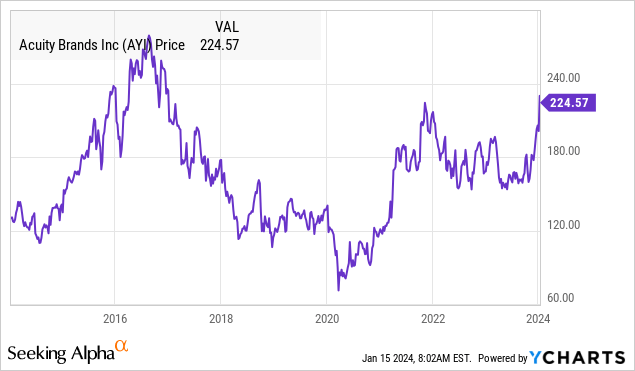

Acuity Brands, Inc.’s (NYSE:AYI) latest quarterly earnings beat expectations sending shares to a seven-year high. The North American leader in lighting and building management solutions has moved past the headwinds of supply chain disruptions that defined 2022 while benefiting from otherwise resilient economic conditions.

Indeed, the story here is impressive execution with a combination of pricing initiatives and efficiency improvements driving margin expansion. We like AYI for its combination of quality fundamentals supportive of a positive outlook.

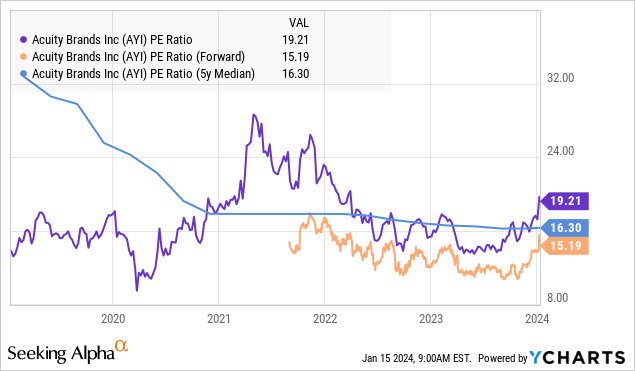

That being said, we also have reasons to believe the upside for the stock may be limited from the current level in the near term. Valuation multiples have returned to the upper range of the company’s long-term average while the backdrop for otherwise soft growth works to dim any exuberance. We expect shares to consolidate recent gains through the next several quarters.

AYI Earnings Recap

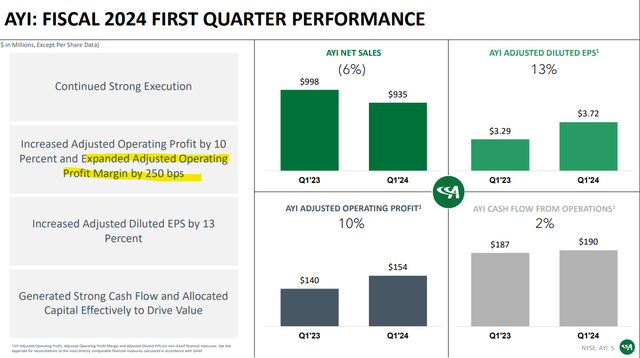

AYI reported fiscal 2024 Q1 EPS of $3.72, well ahead of the $3.23 consensus estimate, and up 13% year-over-year. On the other hand, revenue of $935 million came in line with the market forecast, representing a decline of -6% y/y.

The context here considers an exceptionally strong adjusted gross margin that reached 45.8% compared to 41.7% in the period last year. Easing inflationary cost pressures as well as the impact of higher average pricing in a shifting sales mix across the brand portfolio toward more value-added categories added to the earnings strength.

Separately, a new state-of-the-art production line with higher capacity incorporating lower energy usage contributed to the adjusted operating margin that reached 16.5%, up 250 basis points from Q1 fiscal 2023.

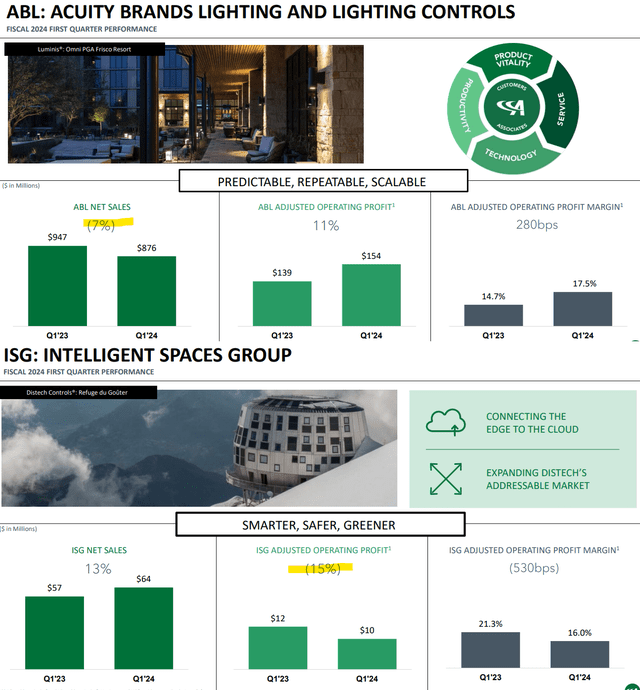

So while the headline metrics are solid, we want to highlight an apparent divergence within the core operating segments.

The bulk of the business comes from the Acuity Brands Lighting [ABL] group where net sales declined by -7% y/y. Management explains some of that weakness against a particularly strong comparison period last year while focusing on the margin gains. This was partially offset by the 13% increase in net sales from the smaller Intelligent Spaces Group [ISG] segment even as that segment’s opening profit declined.

ABL covers lighting products that are typically installed in new developments between residential, commercial, and industrial applications. ISG captures more of the “tech” side of the business including software management tools and controller solutions for lighting management.

As we see it, the ABL operation is dealing with softer volumes reflecting the product level exposure to high-level macro themes between softer industrial production and weaker levels of new construction activity.

Simply put, Acuity Brands has done a good job of managing these market conditions, but those steps in financial engineering can only go far enough if the demand momentum is missing.

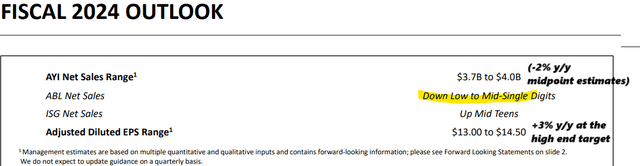

That view follows through with the current management guidance, projecting net sales between $3.7 and $4.0 billion for the year, down about -2% y/y at the midpoint. This is considered a continuation of the Q1 trends with ABL net sales down in the “low to mid-single digits” balanced by a stronger performance in ISG. The target for adjusted EPS is between $13.00 and $14.50 for the year, compared to $14.05 in 2023.

During the earnings conference call, management projected confidence while alluding to a possible revision of these same estimates at the midyear update following Q2 results.

Finally, we can bring up that Acuity Brands ended the quarter with $513 million in cash and cash equivalents against $496 million in total long-term financial debt. With more than $663 million in adjusted EBITDA over the trailing twelve months, we view the rock-solid balance sheet as a strong point in the company’s investment profile.

What’s Next For AYI?

There’s a lot to like about Acuity Brands that is well positioned to consolidate its market share with steady growth over the long run. At the same time, we sense that the breathtaking rally in recent months, up more than 40% just since October, has already incorporated many of the positives in its outlook.

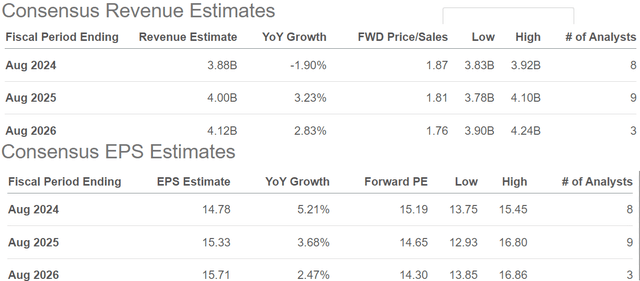

Notably, the latest quarterly report was good enough that it drove a wave of revisions higher to the current 2024 consensus EPS estimate of $14.78, already above management’s guidance range. That being said, the market forecasts for revenue growth to average just around 3% annually through 2026 fail to inspire much confidence.

From a top-down perspective, the main operating drivers for the company continue to be the level of new construction activity and major real estate development. While the U.S. economy appears to be on firm footing, there is also an expectation that these areas will remain subdued for the foreseeable future, regardless of marginal changes to interest rates.

What we can say here is that expectations for AYI are now high which makes the next stage of the rally more difficult to justify.

What we have here is a stock that isn’t quite a “growth” name and doesn’t offer much in terms of compelling value trading at a 15x forward P/E multiple. That metric has averaged around 16x over the last 5 years, but that includes the post-pandemic era peak above 20x. The main difference between Acuity Brands today and in 2021 is that revenue growth was a much stronger 15% into fiscal 2022.

Final Thoughts

We rate AYI as a hold with a sense that a ~15x earnings multiple is fair for the stock under current circumstances.

On the upside, we would like to see growth re-accelerate beyond the low single-digit range to support a higher valuation. There is also a question of how much more room there is for the gross and operating margin to expand organically from what are already historically strong levels.

In terms of risks, weaker-than-expected results through the next few quarters would force a reassessment of the long-term earnings outlook and open the door for a deeper correction. Acuity Brands also remains exposed to macro trends with the potential for deterioration of economic activities undermining demand for lighting solutions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.