Summary:

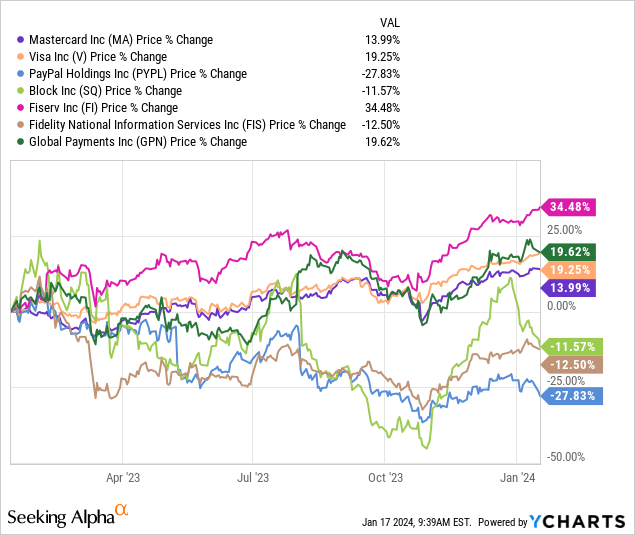

- After turning bullish on the stock a year ago, Mastercard Incorporated has become one of the best-performing companies within its peer group.

- As sell-side analysts remain extremely optimistic, Mastercard share price upside over the coming year appears limited.

- Record high margins have played a key role in Mastercard’s performance over the past year, but are unlikely to provide a tailwind in 2024.

jbk_photography

Perhaps not surprisingly, Mastercard Incorporated (NYSE:MA) was among the best performing stocks within the electronic payments space over the past year, alongside the usual suspect Visa (NYSE:V) and the unexpected winner – Fiserv (NYSE:FI).

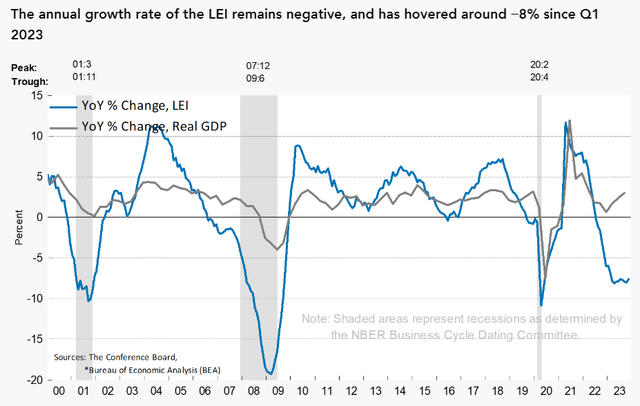

About a year ago, I also turned bullish on Mastercard, even though a recession in 2023 was a highly likely scenario that did not materialize. The odds of a major economic slowdown are even higher in 2024, as leading economic indicators have continued to deteriorate and the inverted yield curve is finally steepening.

Having said that, I remain optimistic on Mastercard’s business model over the long run and I see no reason for the stock to underperform its broader peer group.

In the more immediate future, however, 2024 is likely to be far less supportive for Mastercard’s operations. On top of that, the stock is now pricing in MA’s record-high profitability to be sustained, which is not an unreasonable scenario, but it also limits potential upside.

Less Supportive Environment

After MA staying relatively flat through the 2021 and 2022 period, the stock had a very strong 2023 on the back of a number of macroeconomic tailwinds and renewed business momentum.

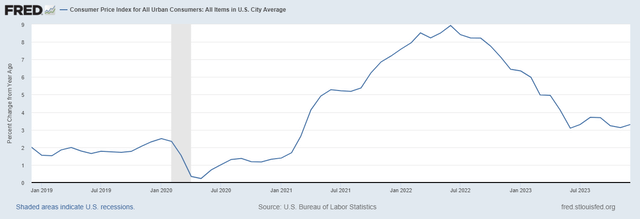

Elevated inflation during 2022 was a significant one that has driven nominal value of retail sales to record highs.

Thus, Mastercard’s gross dollar volume enjoyed a very strong 2023 with volumes outside of the U.S. increasing by 13% and high margin cross-border volumes improving 21%.

Gross Dollar Volume, or GDV, increased by 11% year-over-year on a local currency basis. In the U.S., GDV increased by 5%, with credit growth of 7% and debit growth of 4%. Outside of the U.S., volume increased 13%, with credit growth of 13% and debit growth of 14%. Sequentially, the debit growth rate was primarily impacted by the lapping of the NatWest portfolio migration in the U.K.

Overall, cross-border volume increased 21% globally for the quarter on a local currency basis, reflecting continued strong growth in both travel and non-travel-related cross-border spending.

Source: Mastercard Q3 2023 Earnings Transcript (emphasis added).

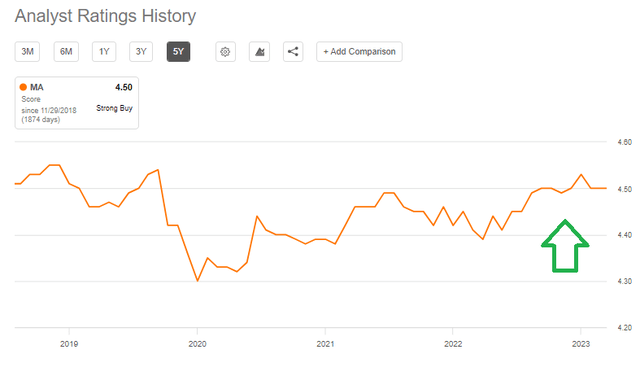

Over the past year or so, the stock has also experienced notable upgrades from sell-side analysts, and the consensus rating on the company is now at one of its highest levels for the past 5-year period.

Even though such rapid increases in the consensus view are done for a good reason, they also bring significant short-term risks for the share price due to the excessive optimism.

Lastly, Mastercard’s management was also more aggressive than usual over the past few years when it comes to expanding the business through M&A activity. During 2020-2021 period, the company has completed a number of large deals:

- Corporate Services business of Nets Denmark A/S (“Nets”) for €3.0 billion (approximately $3.6 billion as of the date of acquisition)

- 100% equity interest in Ekata, Inc. (“Ekata”) for cash consideration of $861 million

- Finicity Corporation (“Finicity”), an open-banking provider, headquartered in Salt Lake City, Utah for cash consideration of $809 million.

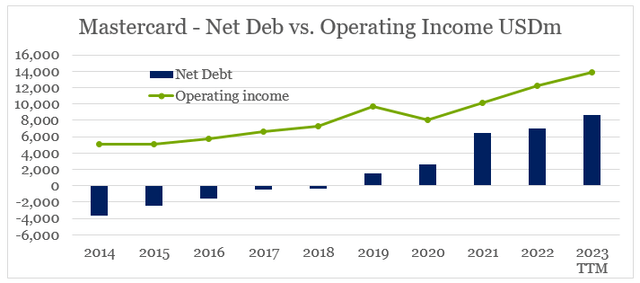

As a result, net debt now stands at nearly $9bn, up from a negative $350m in fiscal year 2018. Although this large increase is hardly a problem for the stable and highly profitable business model of Mastercard, the company is unlikely to sustain this aggressive M&A approach going forward.

prepared by the author, using data from SEC Filings

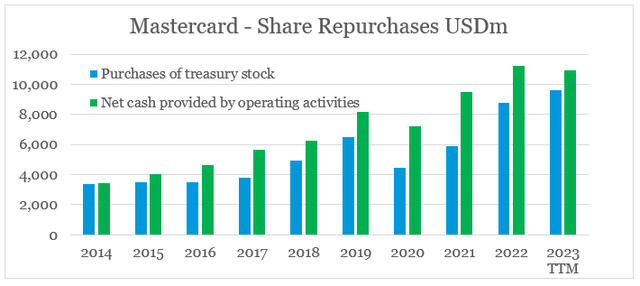

After the completion of the aforementioned deals, Mastercard’s management has shifted its attention to share repurchases, which are on track to reach $10bn annually. Over time, the amount spent on share buybacks usually tracks the company’s cash flow from operations, already showing signs of slowdown in 2023.

prepared by the author, using data from SEC Filings

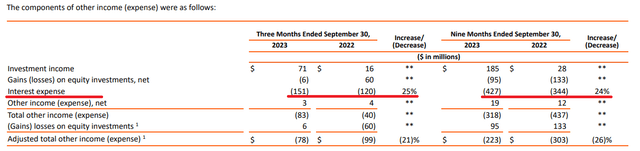

In addition to the higher debt load we saw above, the recent increase in interest rates would put further pressure on Mastercard’s ability to grow inorganically and repurchase shares at the current rate. As we saw during the last reported quarter, interest expense has grown nearly 25% for the first 9-month period of 2023 and will likely reach $600m for the full fiscal year.

Have Margins Peaked Already?

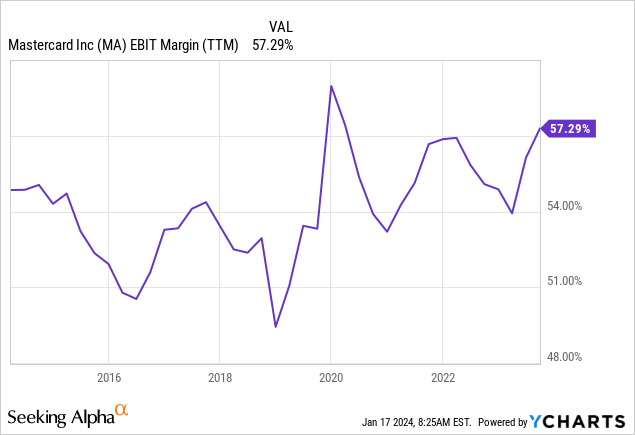

Everything mentioned so far has been a tailwind for Mastercard’s top line and earnings growth in recent years, but going forward, share price returns would face yet another limiting factor – a peak in margins.

Following the pandemic, Mastercard’s operating margin has been consistently higher than the company’s historical average and currently stands at one of its highest levels on record.

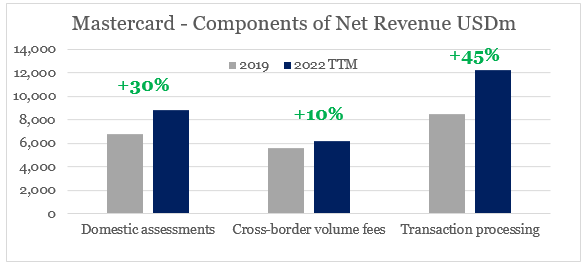

This increase has been largely driven by economies of scale as Mastercard grew significantly in recent years. Last year, I showed just how much each of the company’s different segments increased in size to the pre-pandemic period highlighted the massive increase in domestic assessments and transaction processing revenues of 30% and 45%, respectively.

prepared by the author, using data from SEC Filings

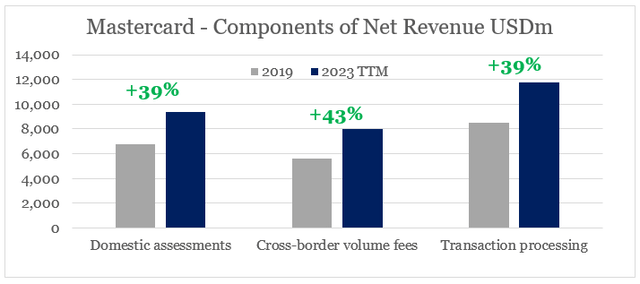

One year later, and as of the end of the third quarter of 2023, we now see a massive increase in the cross-border volume fees as well.

prepared by the author, using data from SEC Filings

However, Mastercard’s cross-border volumes are already showing signs of weakness, as the company is lapping the strong recovery experienced last year.

Overall, cross-border volume increased 21% globally for the quarter on a local currency basis, reflecting continued strong growth in both travel and non-travel-related cross-border spending. While this is sequentially lower versus Q2, this is due to tougher comps as we lapped the cross-border travel recovery from last year.

Source: Mastercard Q3 2023 Earnings Transcript.

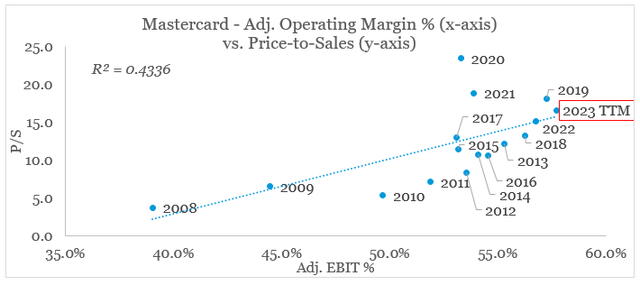

With operating margins at record high, it comes as no surprise that Mastercard’s stock now trades at one of its highest sales multiples since the company’s IPO. Over time, there’s a relatively strong relationship between the two variables, and the current P/S ratio of nearly 17 is in-line with the margins achieved over the past 12-month period.

prepared by the author, using data from SEC Filings and Seeking Alpha

Thus a further upward repricing in MA’s multiples appears highly unlikely, unless the company manages to improve its margins beyond the already record-high levels. This is certainly a possible scenario in the short term, but an unlikely one for anyone with longer investment horizons.

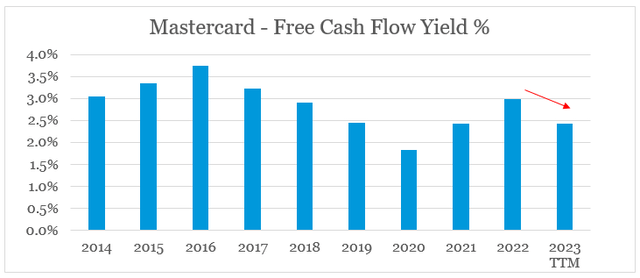

Over the past year or so, Mastercard’s free cash flow yield also noted a large drop and now stands below 2.5%, which in a higher rate environment holds certain risks for a company of its size.

prepared by the author, using data from SEC Filings

Conclusion

Mastercard Incorporated remains as one of my top picks within the electronic payments space, but the strong performance over the past year has left little upside for 2024. The highly supportive macroeconomic environment is likely to change over the coming year. Shareholders should also be mindful of certain capital allocation decisions and the optimistic business fundamentals currently being priced in.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for similarly well-positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

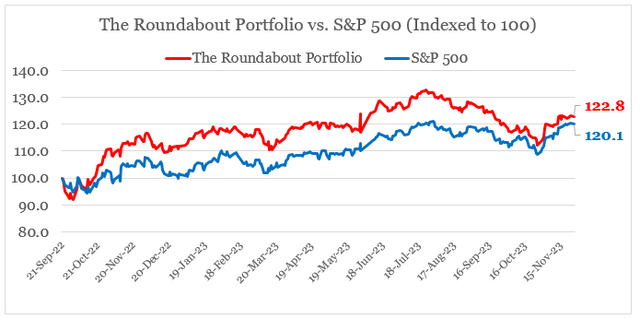

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.