Exxon Vs. Saudi Aramco: Buy American For Energy’s Future

Summary:

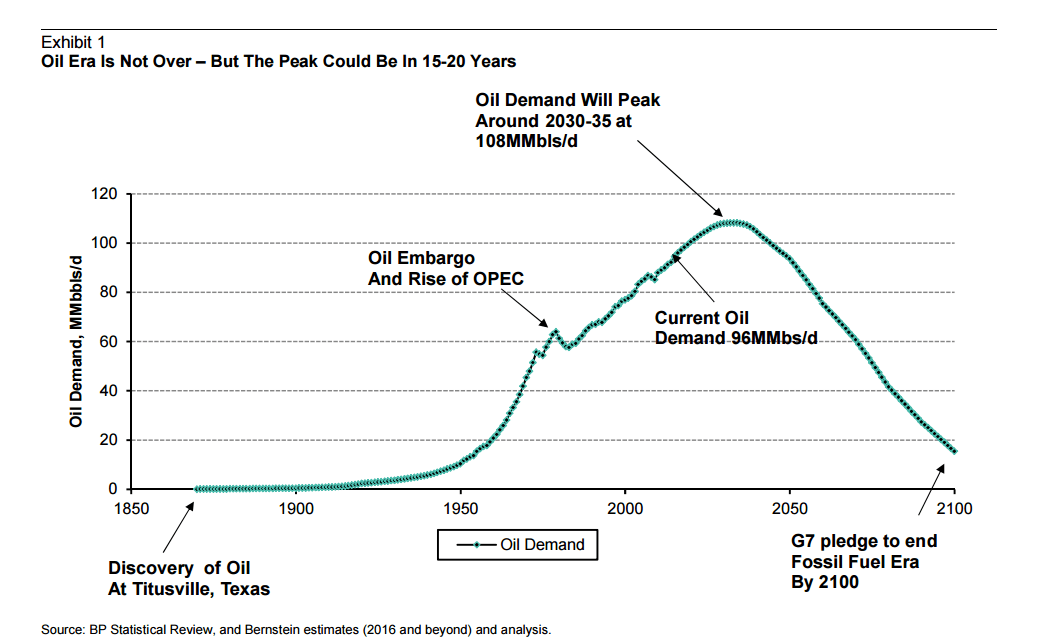

- Exxon and Saudi Aramco resist efforts to reduce emissions and reliance on fossil fuels, believing peak oil demand is still in the future.

- Exxon’s upstream strategy and focus on profitability make it well-positioned to dominate the energy sector’s final chapter.

- Geopolitical risks, such as attacks on oil production, pose a threat to Saudi Aramco, while Exxon’s culture and economic advantage make it a stronger contender.

imaginima

Nationalized industries are notorious for their inability to operate at a profit. –J. Paul Getty

The transition from a carbon-based economy to one based on renewables is underway, but it is also incredibly contentious. It should not surprise folks that the world’s formerly most powerful industry resisted external efforts to endanger its viability. No firm symbolized that resistance more than Exxon. While it angered activists, its contrarian upstream strategy makes it an excellent candidate to dominate the iconic Energy sector’s final chapter.

I cover no other sectors that earn as much animosity from both sides as the Energy business. If you’ve followed my research, you know that I view widespread hyperbolic perceptions as a significant way to potentially identify alpha opportunities.

The reason is that the public narrative and much of the information about the future of the oil industry is biased in one way or another. It’s not always as simple as ‘the truth is somewhere in between both extremes’, but assuming that can be a useful analytical device. So, before I get too far into this article, I will state two core beliefs that underpin Energy sector analysis, and even these baseline items will infuriate some.

- Fossil fuel consumption is a significant driver of climate change, and it must be alleviated dramatically to prevent disastrous consequences.

- Peak oil demand has not yet been reached. Despite the noble goals of climate change activists, there needs to be continued investment in upstream fossil fuel activities to promote economic stability.

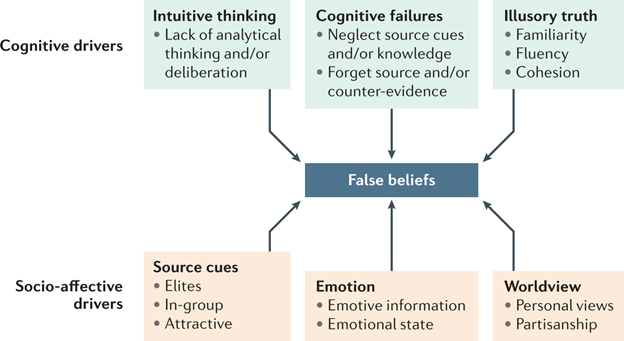

Most people are so tribal about this issue that they can’t accept these two items as mutually accurate. From an evolutionary standpoint, this is easy to understand. It is more advantageous to be in a group to ensure survival than it is to be right.

Ecker, U.K.H., Lewandowsky, S., Cook, J. et al. The psychological drivers of misinformation belief and its resistance to correction. Nat Rev Psychol 1, 13–29 (2022).

When we engage in tribal thinking, it literally prevents us from using the most sophisticated parts of our brains. And this isn’t any less true for intelligent people. Indeed, when they perceive their group as being threatened by rhetoric or a belief that seems to contradict the beliefs of their self-assigned group, their logic shuts down even more than their less mentally capable group members.

Exxon Mobil (NYSE:XOM) and Saudi Aramco (ARMCO) have taken a bit more of an aggressive stance against the state’s efforts to rein in the activities of the energy industry to reduce emissions and reliance on fossil fuels. For example, unlike many peers, leadership at both firms has expressed the belief that peak oil is much further away than others have stated. This diverges from many government goals, but I think they have made the case convincingly.

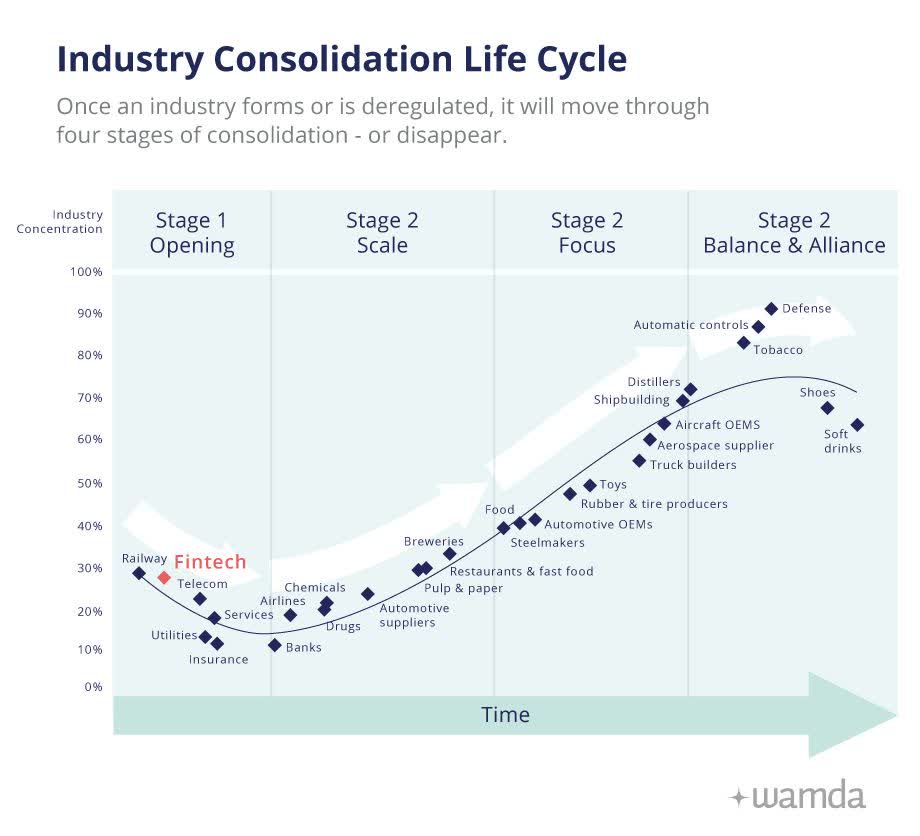

AT Kearny

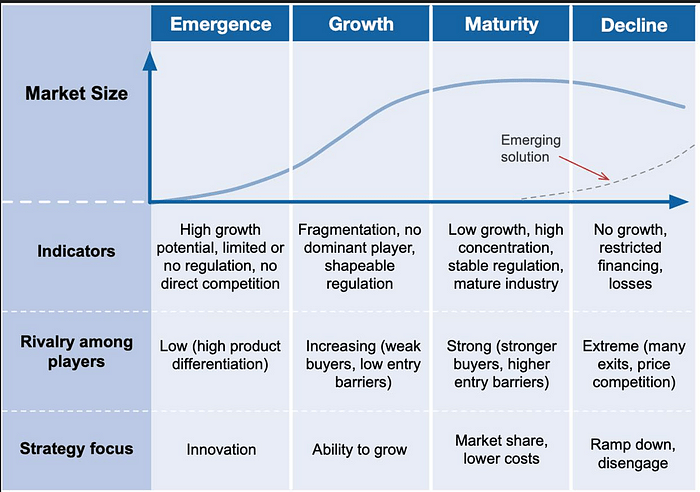

In a way, the future viability of major oil companies and the geopolitical blocs whose interests some of them represent comes down to the question of when peak oil demand is. If, like Exxon and Saudi Aramco postulate, peak oil is still well in the future, then the firms who have maintained upstream investment and a Spartan focus on resilient profitability through cycles should have a distinct advantage over firms that do not.

Vishal Gupta

Where exactly we are in the industry consolidation life cycle is essential for who will win the oil game. As you can see, consolidation picks up in the last stage of an industry. So it is eat or be eaten for large firms. If demand has not peaked, then the aggressive upstream expansion will be particularly valuable for Exxon as price competition also becomes essential during the twilight of an industry.

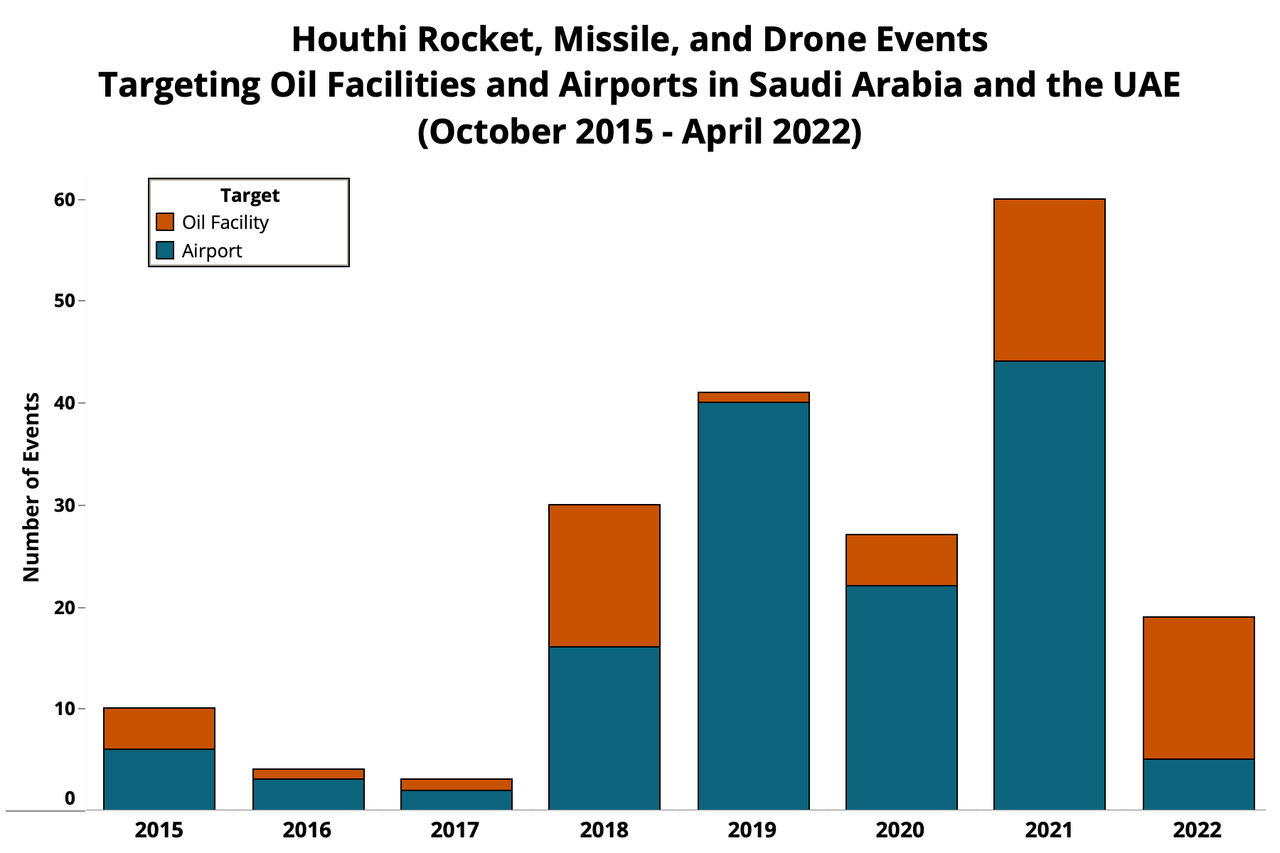

Furthermore, oil assets are always subject to geopolitical risk, and much of Aramco’s infrastructure is targeted by copious amounts of Iranian ballistic missiles. While a regional conflagration remains a low-probability scenario, its odds certainly increase as the Gaza War festers and tears at a new Middle East economic consensus.

It is not hypothetical that an attack by Iran or its proxies could knock out a significant portion of Saudi oil production and mess things up for Aramco shareholders. In 2019, an attack by Iranian proxies knocked out half of Saudi Arabia’s oil output. This was one of many attacks, as you can see below. The ensuing production shutdown of around 6 million barrels a day was equivalent to 5% of the world’s total oil supply.

ACLE Data: Beyond Riyadh: Houthi Cross-Border Aerial Warfare 2015-2022

Recent escalations by Iran with neighbors don’t bode well for the world, avoiding a repeat of this overlooked event, perhaps a far more acute iteration. Furthermore, retaliating in a way that spiked the global oil price may be particularly enticing as a way of responding to American strikes in an asymmetric fashion that exacts a real cost on US interests. Saudi defenses proved woefully inadequate in the last round of attacks, so there’s a precedent of success for the cornered Houthis.

After all, the Hamas attacks and the subsequent coalition that is opposing the Western-Israeli block are trying to undermine the new economic consensus in the Middle East led by Saudi Arabia, and thus, drawing it directly into a conflict could serve Iranian/Houthi interests quite well.

Aside from the geopolitical risks, I believe that Exxon and Saudi Aramco are correct about peak oil being some years off. Exxon’s strategy in dominating this future landscape is frankly more viable. Exxon may have been late to the decarbonization party, but now that it is here, it is setting an example in many ways.

This unique mix of premier upstream assets relatively insulated from potential conflict, and the interests of shareholders driving their corporate strategy instead of Mohammed bin Salman should be a distinct advantage in the effort to dominate the closing chapter of humanity’s reliance on fossil fuels. Saudi Aramco is a storied company with fantastic assets, but at the end of the day, it ultimately answers to a man who locked his family in the Ritz Carlton and shook them down for tens of billions of dollars. Should the royal intrigue turn the other way, it could also prove problematic for the company.

BP Statistical Estimates

I have pointed out before that I think climate goals align a lot more with Exxon’s established culture of ruthlessly cutting fat than hyperbolic media narratives would indicate. Furthermore, Exxon has already made some big moves in Lithium and other respectable low-carbon energy initiatives. The activist board members should be an asset. While the Saudis are also attempting green projects, I have more confidence in Exxon’s efforts.

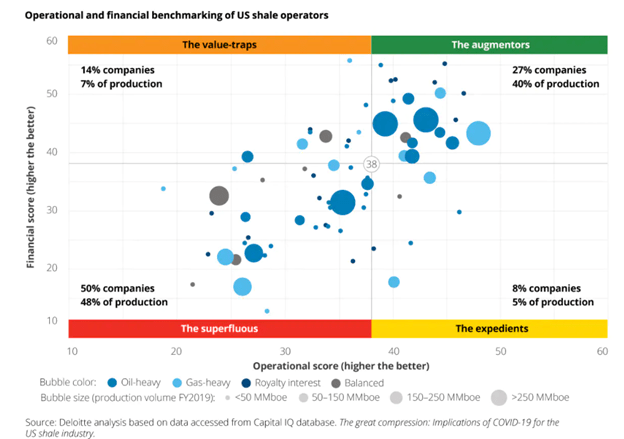

The Death of a Shalesman: Why Exxon Is Ready To Tango With The Gulf and Saudis

The old battle between OPEC and America’s shale producers to influence the price of oil has primarily evaporated and dawned an age where shale producers use their incredible technology in a much more disciplined fashion. The initial days of the shale industry were marked by cowboy roughneck exploits and disreputable operators that burned a lot of capital.

Deloitte

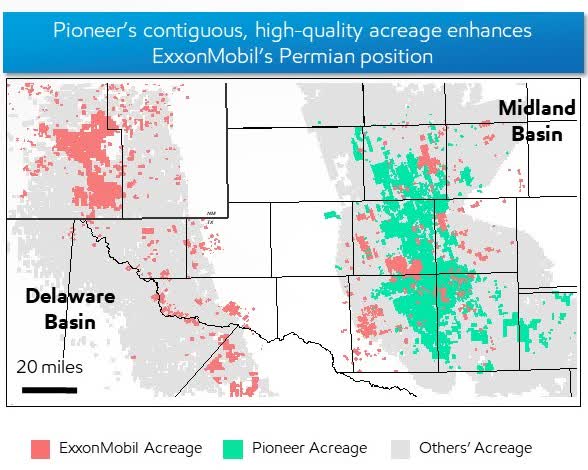

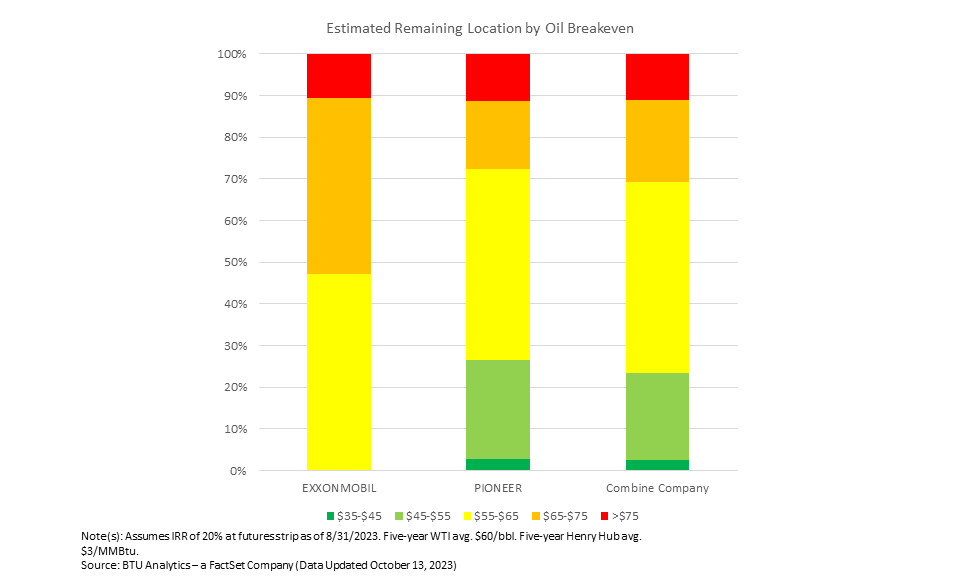

But investors tend to learn their lesson by getting burned better than any other way. After the fiasco that befell many investors at the behest of unscrupulous operators, the market not only purged such behavior, but the American Supermajors have now co-opted the incredible power of shale production. Exxon merged with Pioneer Resources Corporation, doubling its production capacity in the lucrative Permian Basin. Chevron merged with Hess, which will also boost its shale muscle.

Exxon Mobil

This sets up a distinctly different dynamic than in the past. The continued consolidation of America’s energy industry and the fact that America produced more oil than any country ever has in 2023 means that pound-for-pound, Exxon is increasingly starting to trounce Aramco on oil economics.

The breakeven oil prices for the American super majors keep falling, and Exxon’s continued upstream investment in places like Guyana ensures that this will continue to be the case. And again, this all bodes well for Exxon’s ability to outcompete Aramco on price over the long haul. If oil demand is less robust, both firms may have overinvested, but Exxon is more diversified.

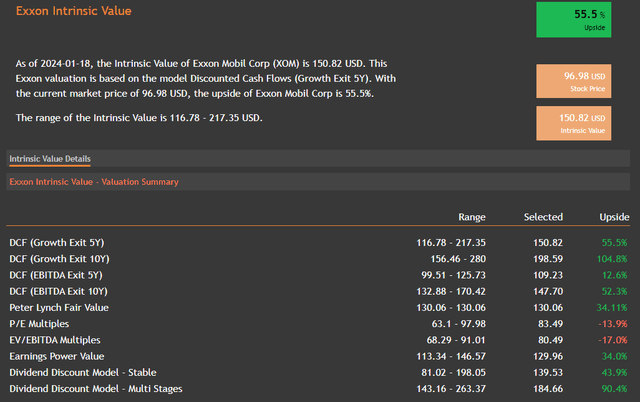

ValueInvesting.io

Another significant advantage in Exxon’s corner is valuation. The firm is undervalued by most measures, including those that measure intrinsic value based on future dividend payments. It’s always lovely when cash flow-based and dividend-based intrinsic value measures align. Another Seeking Alpha contributor did an excellent job outlining why Saudi Aramco is relatively overvalued.

Risks and Where I Could Be Wrong

One of the primary risks in public perception is the increasing regulatory risk that the US Energy complex will face in the second term of the Biden administration. Indeed, the Republicans have made regulatory relief for the Energy sector one of their primary policy issues. However, despite a public perception bolstered by partisan political incentives, the Energy sector has done amazingly well during the Biden administration so far.

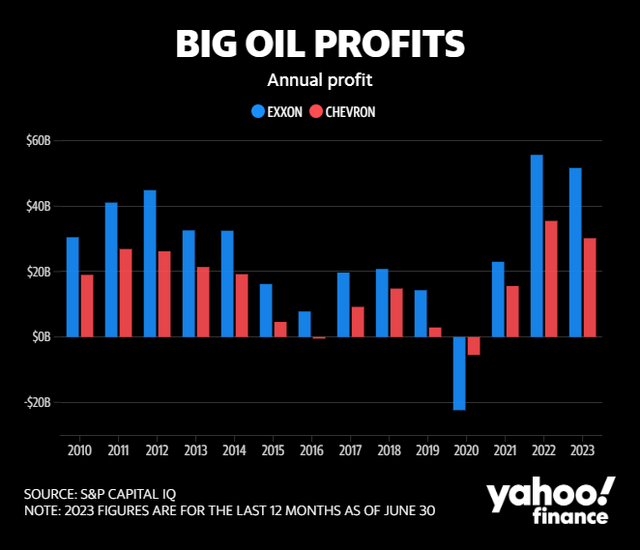

Yahoo Finance

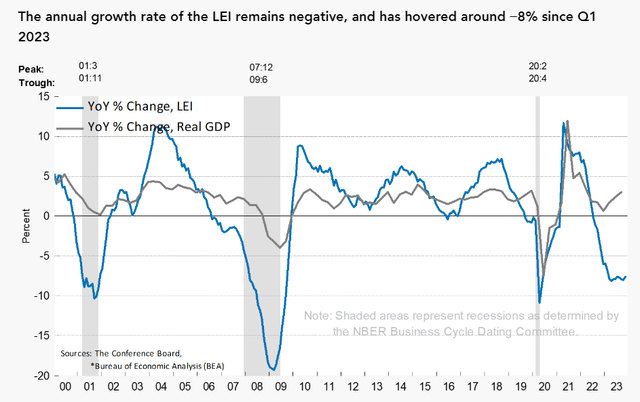

One of the most significant risks to my bullish outlook for Exxon over Saudi Aramco is that peak oil has already occurred or is very close to occurring. However, in this event, both companies would be severely disadvantaged. Of course, oil is cyclical, and a recession would most likely dramatically curtail Energy earnings. But for now, US Energy earnings are likely to outperform quarterly expectations. There is certainly no shortage of indicators foretelling recession, though.

The Conference Board

Geopolitical risks are a concern for Exxon as well. For example, Venezuela recently threatened military action in Guyana. However, this is a much less acute geopolitical risk than that faced by Saudi Aramco. Venezuelans aren’t going to rain missiles down on our vital American refinery capacity. But any of the following risks could cause a recession that hurts oil profits:

- Geopolitical risks in Ukraine, the Middle East, and Taiwan

- Credit event (Junk bond spreads rising).

- Political Risk and Fiscal Situation.

- Commercial Real Estate.

- Reignition of the banking crisis.

- The lag effect of high rates/Fed policy error.

Also, as we enter an election year and the climate change debate heats up, there is always a chance that reputational damage or activist policy could seriously impair the financial viability of the US oil majors. This is one area where Aramco has a decided advantage. As a national asset in an effective dictatorship, it doesn’t have to worry about domestic political obstacles or the whims of public opinion.

Conclusion: Exxon’s Culture Is More Aligned With Climate Goals Than You Think

Just as Energy’s performance during the Biden administration defies popular perceptions, many who see Exxon Mobil as the bane of climate goals may be taking a rather myopic and uninformed perspective. Exxon Mobil is notorious for a culture of ruthless cost-cutting and efficiency that is entirely congruent with most climate goals. Similarly, the Biden administration doesn’t want to see the US edge in the competition for global energy dominance eroded, as this has become a strategic plane of competition with adversaries.

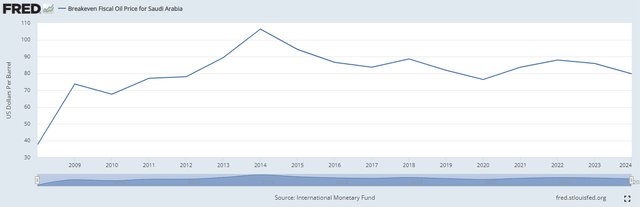

FRED

Of course, one of the main advantages I see for Exxon is the current geopolitical situation. If there is a conflagration in the Middle East, it will benefit Exxon because of higher prices. It will adversely affect Aramco because of the potential of knocking out a significant chunk of output or even all of it. Saudi breakeven costs are more than twice as high as Exxon’s, and the culture of the Saudi administration is known for bizarre political incentives and corruption that can interfere with the directives of Aramco’s energy experts.

FactSet

The economics for Exxon are just far better. Not only does the Pioneer merger give them a lot of flexibility to make hay when prices are high, but it also brings their breakeven per barrel production cost to less than $35 a barrel. This is less than half of what it takes for the Saudis to break even on a barrel of oil, which is about $80. Ultimately, this inherent economic advantage will likely allow Exxon to dominate the latter stages of humanity’s reliance on fossil fuels as it matures and consolidates along with the rising decarbonization imperatives of the state.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.